Market Summary

ABNB Alerts

ABNB Stock Price

ABNB RSI Chart

ABNB Valuation

ABNB Price/Sales (Trailing)

ABNB Profitability

ABNB Fundamentals

ABNB Revenue

ABNB Earnings

Breaking Down ABNB Revenue

Last 7 days

-0.5%

Last 30 days

-8.0%

Last 90 days

-4.5%

Trailing 12 Months

30.2%

How does ABNB drawdown profile look like?

ABNB Financial Health

ABNB Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 10.2B | 0 | 0 | 0 |

| 2023 | 8.7B | 9.1B | 9.6B | 9.9B |

| 2022 | 6.6B | 7.4B | 8.0B | 8.4B |

| 2021 | 3.4B | 4.4B | 5.3B | 6.0B |

| 2020 | 4.4B | 4.1B | 3.7B | 3.4B |

| 2019 | 0 | 0 | 0 | 4.8B |

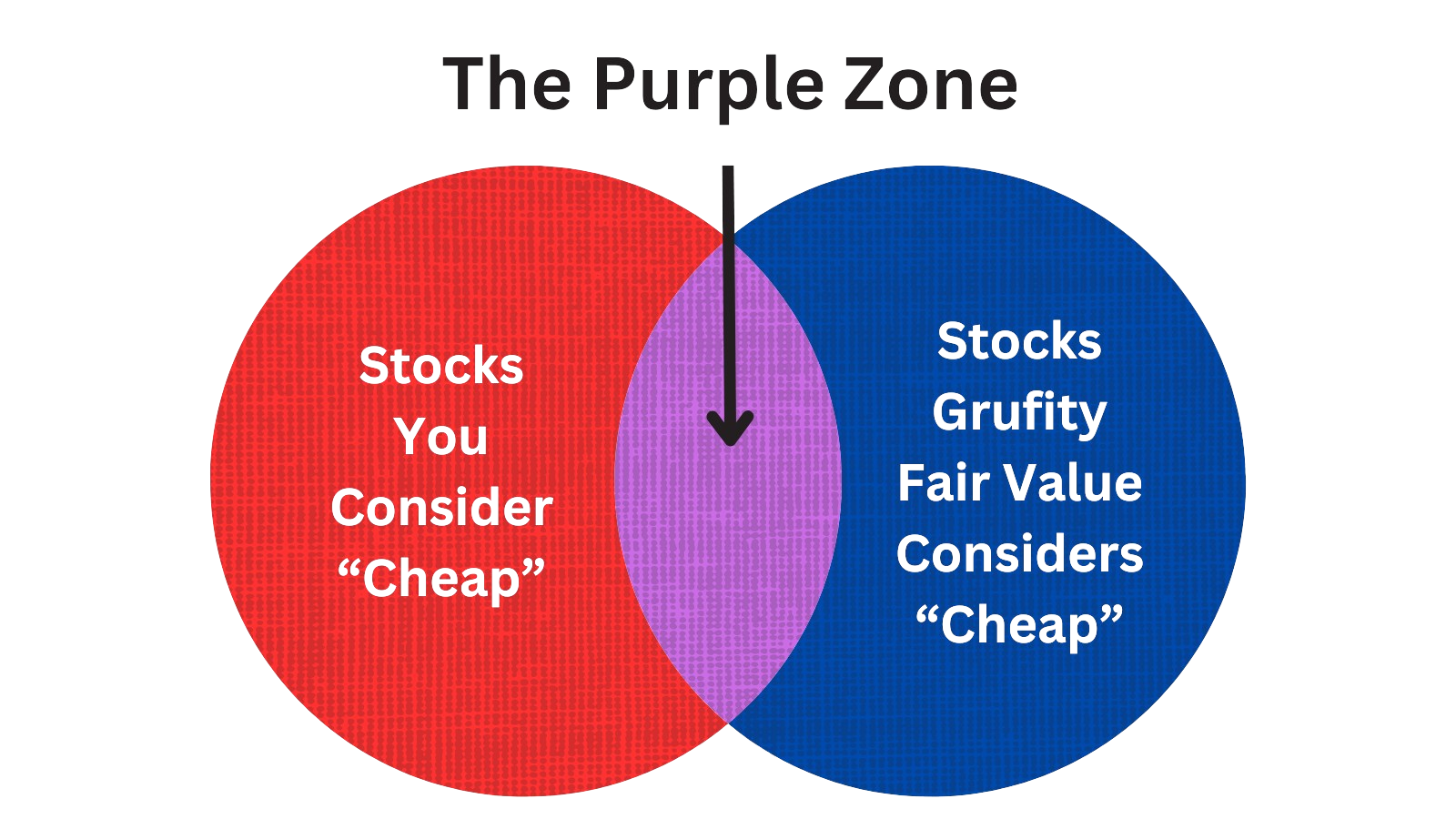

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Airbnb, Inc.

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 14, 2024 | balogh aristotle n | sold | -89,640 | 149 | -600 | chief technology officer |

| May 07, 2024 | balogh aristotle n | sold | -97,200 | 162 | -600 | chief technology officer |

| Apr 30, 2024 | balogh aristotle n | sold | -96,612 | 161 | -600 | chief technology officer |

| Apr 23, 2024 | balogh aristotle n | sold | -94,344 | 157 | -600 | chief technology officer |

| Apr 16, 2024 | balogh aristotle n | sold | -93,498 | 155 | -600 | chief technology officer |

| Apr 09, 2024 | balogh aristotle n | sold | -96,930 | 161 | -600 | chief technology officer |

| Apr 05, 2024 | mertz elinor | acquired | - | - | 46,534 | chief financial officer |

| Apr 05, 2024 | blecharczyk nathan | acquired | - | - | 30,247 | chief strategy officer |

| Apr 05, 2024 | balogh aristotle n | acquired | - | - | 79,773 | chief technology officer |

| Apr 05, 2024 | bernstein david c | acquired | - | - | 9,307 | chief accounting officer |

Which funds bought or sold ABNB recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 17, 2024 | VIMA LLC | added | 96.3 | 31,934 | 61,340 | 0.05% |

| May 17, 2024 | Aspect Partners, LLC | added | 11.76 | 2,460 | 9,403 | 0.01% |

| May 17, 2024 | Advisory Resource Group | reduced | -9.17 | 118,393 | 1,295,600 | 0.30% |

| May 17, 2024 | Plato Investment Management Ltd | added | 845 | 1,977,650 | 2,166,750 | 0.22% |

| May 16, 2024 | Meiji Yasuda Life Insurance Co | reduced | -30.29 | -106,819 | 580,824 | 0.01% |

| May 16, 2024 | COMERICA BANK | sold off | -100 | -1,796 | - | -% |

| May 16, 2024 | SWEENEY & MICHEL, LLC | new | - | 291,346 | 291,346 | 0.13% |

| May 16, 2024 | JANE STREET GROUP, LLC | new | - | 538,101 | 538,101 | -% |

| May 16, 2024 | Creekmur Asset Management LLC | reduced | -36.56 | -13,348 | 44,375 | 0.01% |

| May 16, 2024 | JANE STREET GROUP, LLC | added | 31.96 | 15,146,600 | 40,435,800 | 0.01% |

Are Funds Buying or Selling ABNB?

ABNB Alerts

Unveiling Airbnb, Inc.'s Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 14, 2024 | sc us (ttgp), ltd. | 0.9% | 3,875,044 | SC 13G/A | |

| Feb 13, 2024 | blecharczyk nathan | 11.8% | 58,224,127 | SC 13G/A | |

| Feb 13, 2024 | chesky brian | 14.0% | 70,146,784 | SC 13G/A | |

| Feb 13, 2024 | gebbia joseph | 9.7% | 47,101,780 | SC 13G/A | |

| Feb 13, 2024 | vanguard group inc | 7.71% | 33,533,296 | SC 13G/A | |

| Feb 09, 2024 | fmr llc | - | 0 | SC 13G/A | |

| Jan 29, 2024 | blackrock inc. | 6.1% | 26,580,286 | SC 13G | |

| Feb 14, 2023 | sc us (ttgp), ltd. | 0% | 0 | SC 13G/A | |

| Feb 13, 2023 | blecharczyk nathan | 13.1% | 60,105,531 | SC 13G/A | |

| Feb 13, 2023 | chesky brian | 16.0% | 76,073,075 | SC 13G/A |

Recent SEC filings of Airbnb, Inc.

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 16, 2024 | 4 | Insider Trading | |

| May 14, 2024 | 144 | Notice of Insider Sale Intent | |

| May 09, 2024 | 4 | Insider Trading | |

| May 08, 2024 | 10-Q | Quarterly Report | |

| May 08, 2024 | 8-K | Current Report | |

| May 07, 2024 | 144 | Notice of Insider Sale Intent | |

| May 02, 2024 | 4 | Insider Trading | |

| May 01, 2024 | 144 | Notice of Insider Sale Intent | |

| Apr 30, 2024 | 144 | Notice of Insider Sale Intent | |

| Apr 25, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to Airbnb, Inc.)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

BKNG | 125.8B | 22.0B | 7.68% | 33.35% | 26.22 | 5.72 | 21.07% | 19.26% |

ABNB | 92.9B | 10.2B | -8.05% | 30.17% | 18.81 | 9.07 | 17.60% | 143.42% |

DKNG | 38.3B | 4.1B | 4.69% | - | -69.94 | 9.41 | 57.00% | 58.12% |

RCL | 36.5B | 14.7B | 10.91% | 77.12% | 17.35 | 2.48 | 38.21% | 303.01% |

CCL | 16.8B | 22.6B | 6.30% | 33.07% | 41.6 | 0.75 | 77.46% | 108.27% |

MGM | 12.9B | 16.7B | -2.36% | -4.42% | 14.42 | 0.77 | 17.87% | -54.40% |

| MID-CAP | ||||||||

HAS | 8.4B | 4.8B | 9.65% | -3.05% | -5.94 | 1.76 | -16.42% | -1272.21% |

NCLH | 6.7B | 8.9B | -12.71% | 8.26% | 19.68 | 0.76 | 76.51% | 123.70% |

MAT | 6.4B | 5.4B | 3.10% | -2.10% | 21.89 | 1.18 | 4.38% | 9.98% |

PENN | 2.4B | 6.3B | -2.09% | -36.37% | -2.17 | 0.39 | -3.29% | -263.41% |

| SMALL-CAP | ||||||||

PTON | 1.4B | 2.7B | 27.18% | -46.53% | -1.89 | 0.54 | -4.86% | 66.45% |

ACEL | 846.7M | 1.2B | -10.37% | 7.10% | 19.31 | 0.72 | 10.59% | -35.05% |

AGS | 456.1M | 369.3M | 31.96% | 99.65% | 89.31 | 1.23 | 15.51% | 20.88% |

CLAR | 265.0M | 257.9M | 15.72% | -20.37% | 26.14 | 1.03 | -16.24% | 113.80% |

CNTY | 90.2M | 577.7M | -6.37% | -58.53% | -2.23 | 0.16 | 32.52% | -721.63% |

Airbnb, Inc. News

Airbnb, Inc. Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | ||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 |

| Revenue | -3.4% | 2,142 | 2,218 | 3,397 | 2,484 | 1,818 | 1,902 | 2,884 | 2,104 | 1,509 | 1,532 | 2,237 | 1,335 | 887 | 859 | 1,342 | 335 | 842 | - |

| Cost Of Revenue | 25.0% | 480 | 384 | 459 | 432 | 428 | 345 | 401 | 390 | 363 | 295 | 312 | 294 | 255 | 210 | 227 | 161 | 278 | - |

| Costs and Expenses | -24.8% | 2,041 | 2,714 | 1,901 | 1,961 | 1,823 | 1,667 | 1,681 | 1,735 | 1,514 | 1,457 | 1,385 | 1,386 | 1,334 | 3,959 | 924 | 918 | 1,167 | - |

| S&GA Expenses | 21.2% | 514 | 424 | 403 | 486 | 450 | 408 | 384 | 379 | 345 | 351 | 291 | 315 | 229 | 629 | 113 | 115 | 317 | - |

| R&D Expenses | 10.0% | 475 | 432 | 419 | 451 | 420 | 398 | 366 | 375 | 363 | 368 | 344 | 350 | 363 | 2,062 | 214 | 218 | 259 | - |

| EBITDA Margin | 4.2% | 0.23* | 0.22* | 0.29* | 0.27* | 0.24* | 0.24* | 0.22* | 0.18* | 0.13* | -0.04* | -0.80* | -1.08* | -1.55* | -1.35* | -0.11* | -0.10* | -0.09* | -0.08* |

| Interest Expenses | -100.0% | - | 53.00 | 1.00 | - | 1.00 | - | 2.00 | 3.00 | 3.00 | 2.00 | 3.00 | 2.00 | 43.00 | 52.00 | 51.00 | 24.00 | 2.00 | - |

| Income Taxes | 341.7% | 29.00 | -12.00 | -2,695 | 26.00 | 13.00 | 25.00 | 56.00 | 4.00 | 11.00 | 18.00 | 17.00 | 11.00 | 6.00 | -104 | 88.00 | -63.81 | -16.48 | - |

| Earnings Before Taxes | 176.5% | 293 | -383 | 1,679 | 676 | 130 | 344 | 1,270 | 383 | -8.00 | 72.00 | 850 | -56.98 | -1,165 | -3,992 | 307 | -639 | -357 | - |

| EBT Margin | 4.3% | 0.22* | 0.21* | 0.29* | 0.27* | 0.24* | 0.24* | 0.21* | 0.18* | 0.13* | -0.05* | -0.82* | -1.11* | -1.60* | -1.39* | -0.11* | -0.10* | -0.09* | -0.09* |

| Net Income | 175.6% | 264 | -349 | 4,374 | 650 | 117 | 319 | 1,214 | 379 | -19.00 | 55.00 | 834 | -68.22 | -1,172 | -3,888 | 219 | -575 | -340 | - |

| Net Income Margin | -0.2% | 0.48* | 0.48* | 0.57* | 0.25* | 0.23* | 0.23* | 0.20* | 0.17* | 0.12* | -0.06* | -0.81* | -1.11* | -1.58* | -1.36* | -0.18* | -0.16* | -0.15* | -0.14* |

| Free Cashflow | 2952.4% | 1,923 | 63.00 | 1,310 | 900 | 1,581 | 455 | 958 | 796 | 1,196 | 378 | 529 | 782 | 599 | -256 | 328 | -262 | -585 | - |

| Balance Sheet | (In Millions) | ||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 |

| Assets | 18.9% | 24,537 | 20,645 | 21,439 | 21,188 | 20,018 | 16,038 | 16,077 | 19,059 | 17,068 | 13,708 | 13,582 | 15,485 | 12,339 | 10,491 |

| Current Assets | 23.5% | 20,393 | 16,509 | 17,523 | 20,052 | 18,869 | 14,861 | 14,867 | 17,826 | 15,761 | 12,386 | 12,221 | 14,096 | 10,927 | 8,916 |

| Cash Equivalents | 140.5% | 16,529 | 6,874 | 8,175 | 7,905 | 8,166 | 7,378 | 12,259 | 15,242 | 12,939 | 9,727 | 9,873 | 11,945 | 8,486 | 7,668 |

| Net PPE | 6.9% | 171 | 160 | 147 | 132 | 122 | 121 | 118 | 118 | 143 | 157 | 174 | 193 | 211 | 270 |

| Goodwill | - | - | - | - | - | - | 650 | 647 | 649 | 652 | 653 | 654 | 655 | 654 | 656 |

| Liabilities | 33.3% | 16,641 | 12,480 | 12,316 | 16,129 | 14,727 | 10,478 | 10,536 | 13,814 | 12,331 | 8,933 | 9,133 | 12,092 | 9,180 | 7,590 |

| Current Liabilities | 42.1% | 14,139 | 9,950 | 9,821 | 13,624 | 12,212 | 7,978 | 8,015 | 11,287 | 9,774 | 6,359 | 6,559 | 9,496 | 6,573 | 5,140 |

| Long Term Debt | 0.1% | 1,992 | 1,991 | 1,990 | 2,000 | 1,988 | 1,987 | 1,986 | 1,985 | 1,984 | 1,983 | 1,981 | 1,980 | 1,979 | 1,816 |

| LT Debt, Non Current | -100.0% | - | 1,991 | 1,990 | 2,000 | 1,988 | 1,987 | 1,986 | 1,985 | 1,984 | 1,983 | 1,981 | 1,980 | 1,979 | 1,816 |

| Shareholder's Equity | -3.3% | 7,896 | 8,165 | 9,123 | 5,059 | 5,291 | 5,560 | 5,540 | 5,245 | 4,737 | 4,775 | 4,449 | 3,393 | 3,159 | 2,901 |

| Retained Earnings | -14.3% | -3,914 | -3,425 | -2,324 | -6,198 | -6,341 | -5,965 | -5,783 | -5,997 | -6,376 | -6,358 | -6,412 | -7,246 | -7,177 | -6,005 |

| Additional Paid-In Capital | 1.5% | 11,819 | 11,639 | 11,452 | 11,290 | 11,662 | 11,557 | 11,365 | 11,267 | 11,126 | 11,140 | 10,864 | 10,639 | 10,339 | 8,905 |

| Shares Outstanding | 0.2% | 638 | 637 | 636 | 635 | 634 | 637 | 639 | 637 | 635 | 616 | 611 | 612 | 601 | 284 |

| Float | - | - | - | - | 52,800 | - | - | - | 35,100 | - | - | - | 50,300 | - | - |

| Cashflow (Quarterly) | (In Millions) | ||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 |

| Cashflow From Operations | 2952.4% | 1,923 | 63.00 | 1,325 | 909 | 1,587 | 463 | 964 | 801 | 1,202 | 382 | 535 | 790 | 606 | -249 | 336 | -256 | -569 | - |

| Share Based Compensation | 1.7% | 295 | 290 | 286 | 304 | 240 | 254 | 234 | 247 | 195 | 226 | 211 | 233 | 229 | 2,894 | 29.00 | 38.00 | 42.00 | - |

| Cashflow From Investing | 82.3% | -84.00 | -475 | -364 | -20.00 | -183 | -143 | -56.00 | 368 | -197 | -329 | -175 | 326 | -1,172 | 896 | -237 | -581 | 2.00 | - |

| Cashflow From Financing | 282.2% | 2,134 | -1,171 | -3,712 | 167 | 2,286 | -764 | -3,574 | 1,445 | 2,204 | -147 | -2,327 | 2,328 | 1,456 | 1,877 | -1,029 | 2,543 | -339 | - |

| Buy Backs | 0.1% | 753 | 752 | 500 | 507 | 493 | 500 | 1,000 | - | - | - | - | - | - | - | - | - | - | - |

ABNB Income Statement

2024-03-31Condensed Consolidated Statements of Operations - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Revenues [Abstract] | ||

| Revenue | $ 2,142 | $ 1,818 |

| Costs and expenses: | ||

| Cost of revenue | 480 | 428 |

| Operations and support | 285 | 282 |

| Product development | 475 | 420 |

| Sales and marketing | 514 | 450 |

| General and administrative | 287 | 243 |

| Total costs and expenses | 2,041 | 1,823 |

| Income (loss) from operations | 101 | (5) |

| Interest income | 202 | 146 |

| Other expense, net | (10) | (11) |

| Income before income taxes | 293 | 130 |

| Provision for income taxes | 29 | 13 |

| Net income | $ 264 | $ 117 |

| Net income per share attributable to Class A and Class B common stockholders: | ||

| Net income per share attributable to Class A and Class B common stockholders, basic (in USD per share) | $ 0.41 | $ 0.18 |

| Net income per share attributable to Class A and Class B common stockholders, diluted (in USD per share) | $ 0.41 | $ 0.18 |

| Weighted-average shares used in computing net income per share attributable to Class A and Class B common stockholders: | ||

| Weighted-average shares used in computing net income per share attributable to Class A and Class B common stockholders, basic (in shares) | 638 | 634 |

| Weighted-average shares used in computing net income per share attributable to Class A and Class B common stockholders, diluted (in shares) | 654 | 670 |

ABNB Balance Sheet

2024-03-31Condensed Consolidated Balance Sheets - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 7,829 | $ 6,874 |

| Short-term investments (including assets reported at fair value of $2,507 and $2,524, respectively) | 3,264 | 3,197 |

| Funds receivable and amounts held on behalf of customers | 8,737 | 5,869 |

| Prepaids and other current assets (including customer receivables of $249 and $212 and allowances of $44 and $37, respectively) | 563 | 569 |

| Total current assets | 20,393 | 16,509 |

| Deferred tax assets, net | 2,886 | 2,881 |

| Goodwill and intangible assets, net | 786 | 792 |

| Other assets, noncurrent | 472 | 463 |

| Total assets | 24,537 | 20,645 |

| Current liabilities: | ||

| Accrued expenses, accounts payable, and other current liabilities | 2,968 | 2,654 |

| Funds payable and amounts payable to customers | 8,737 | 5,869 |

| Unearned fees | 2,434 | 1,427 |

| Total current liabilities | 14,139 | 9,950 |

| Long-term debt | 1,992 | 1,991 |

| Other liabilities, noncurrent | 510 | 539 |

| Total liabilities | 16,641 | 12,480 |

| Commitments and contingencies (Note 9) | ||

| Stockholders’ equity: | ||

| Common stock | 0 | 0 |

| Additional paid-in capital | 11,819 | 11,639 |

| Accumulated other comprehensive loss | (9) | (49) |

| Accumulated deficit | (3,914) | (3,425) |

| Total stockholders’ equity | 7,896 | 8,165 |

| Total liabilities and stockholders’ equity | $ 24,537 | $ 20,645 |

| CEO | Mr. Brian Chesky |

|---|---|

| WEBSITE | airbnb.com |

| INDUSTRY | Leisure |

| EMPLOYEES | 6811 |