Market Summary

BXP Stock Price

BXP RSI Chart

BXP Valuation

BXP Price/Sales (Trailing)

BXP Profitability

BXP Fundamentals

BXP Revenue

BXP Earnings

Breaking Down BXP Revenue

Last 7 days

2.8%

Last 30 days

9.1%

Last 90 days

-6.2%

Trailing 12 Months

28.1%

How does BXP drawdown profile look like?

BXP Financial Health

BXP Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 3.3B | 0 | 0 | 0 |

| 2023 | 3.2B | 3.2B | 3.2B | 3.3B |

| 2022 | 2.9B | 3.0B | 3.0B | 3.1B |

| 2021 | 2.7B | 2.8B | 2.8B | 2.9B |

| 2020 | 3.0B | 2.9B | 2.9B | 2.8B |

| 2019 | 2.8B | 2.9B | 2.9B | 3.0B |

| 2018 | 2.6B | 2.6B | 2.7B | 2.7B |

| 2017 | 2.5B | 2.6B | 2.6B | 2.6B |

| 2016 | 2.5B | 2.5B | 2.5B | 2.6B |

| 2015 | 2.4B | 2.5B | 2.5B | 2.5B |

| 2014 | 2.2B | 2.3B | 2.4B | 2.4B |

| 2013 | 1.9B | 1.9B | 2.0B | 2.1B |

| 2012 | 1.8B | 1.8B | 1.8B | 1.8B |

| 2011 | 1.6B | 1.6B | 1.7B | 1.8B |

| 2010 | 1.5B | 1.5B | 1.5B | 1.6B |

| 2009 | 1.5B | 1.5B | 1.5B | 1.5B |

| 2008 | 0 | 1.5B | 1.5B | 1.5B |

| 2007 | 0 | 0 | 0 | 1.5B |

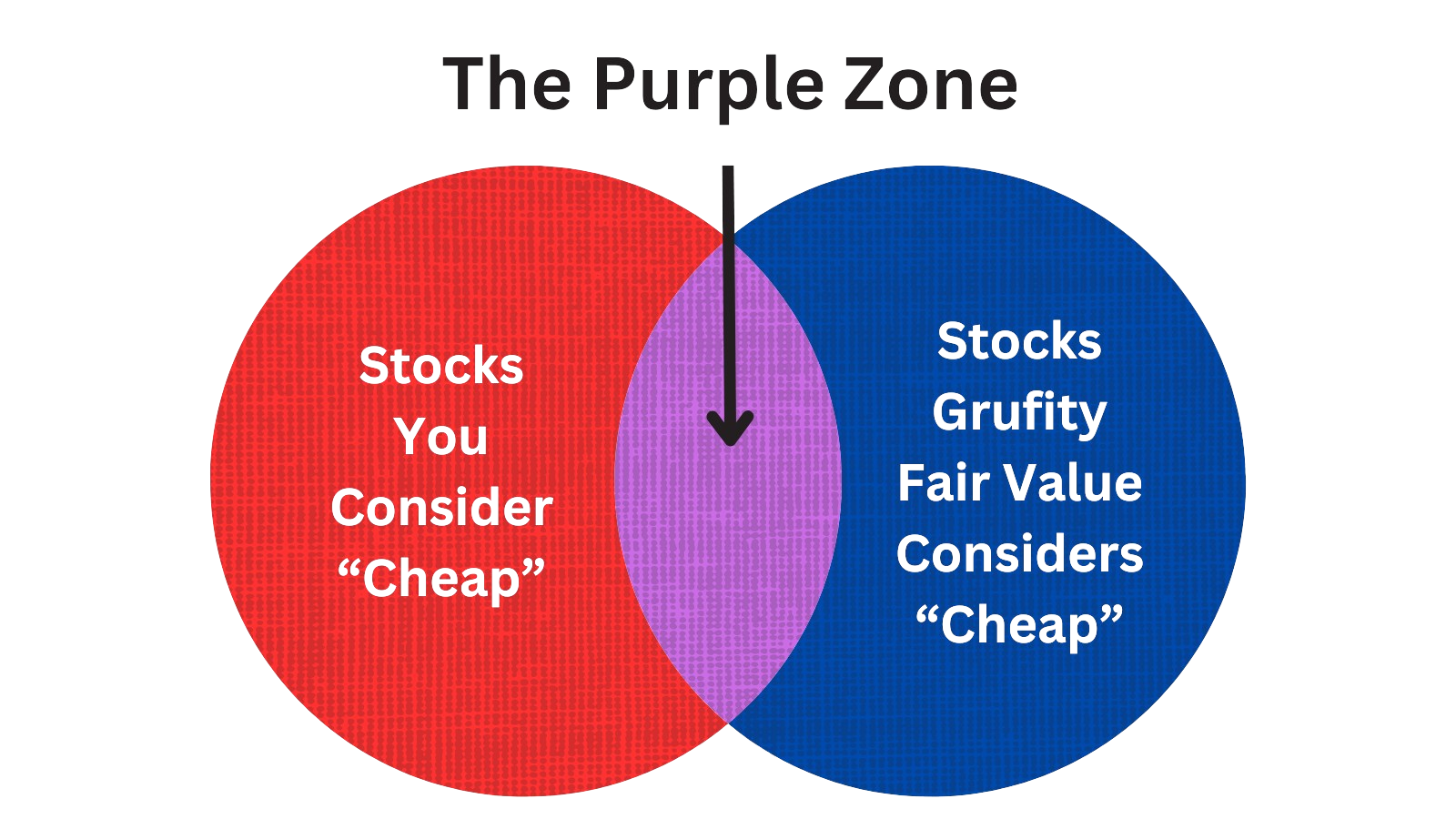

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Boston Properties Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Mar 06, 2024 | ritchey raymond a | acquired | - | - | 14,150 | senior evp |

| Mar 06, 2024 | ritchey raymond a | sold | -889,149 | 62.8374 | -14,150 | senior evp |

| Mar 04, 2024 | ritchey raymond a | acquired | - | - | 14,150 | senior evp |

| Feb 29, 2024 | kevorkian eric g | gifted | - | - | -100 | svp, clo and secretary |

| Feb 02, 2024 | labelle michael e | acquired | - | - | 9,813 | evp and cfo |

| Jan 15, 2024 | labelle michael e | sold (taxes) | -22,876 | 69.96 | -327 | evp and cfo |

| Jan 15, 2024 | kevorkian eric g | sold (taxes) | -6,156 | 69.96 | -88.00 | svp, clo and secretary |

| Jan 15, 2024 | spann hilary j. | sold (taxes) | -70,030 | 69.96 | -1,001 | executive vice president |

| Sep 11, 2023 | kevorkian eric g | sold | -66,430 | 66.43 | -1,000 | svp, clo and secretary |

| Sep 11, 2023 | kevorkian eric g | acquired | - | - | 1,000 | svp, clo and secretary |

Which funds bought or sold BXP recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 17, 2024 | Plato Investment Management Ltd | new | - | 278,155 | 278,155 | 0.03% |

| May 16, 2024 | EJF Capital LLC | new | - | 228,585 | 228,585 | 0.16% |

| May 16, 2024 | LBP AM SA | reduced | -68.6 | -2,502,840 | 1,033,660 | 0.04% |

| May 16, 2024 | JANE STREET GROUP, LLC | reduced | -97.43 | -11,849,900 | 290,630 | -% |

| May 16, 2024 | Redwood Investment Management, LLC | reduced | -7.44 | -341,000 | 2,114,000 | 0.20% |

| May 16, 2024 | CALIFORNIA STATE TEACHERS RETIREMENT SYSTEM | added | 1.79 | -920,177 | 16,572,200 | 0.02% |

| May 16, 2024 | Beacon Capital Management, LLC | sold off | -100 | -15,465 | - | -% |

| May 16, 2024 | Tidal Investments LLC | new | - | 290,238 | 290,238 | -% |

| May 15, 2024 | Employees Retirement System of Texas | unchanged | - | -291,000 | 3,919,000 | 0.04% |

| May 15, 2024 | PUBLIC EMPLOYEES RETIREMENT SYSTEM OF OHIO | reduced | -2.51 | -1,773,880 | 17,385,200 | 0.07% |

Are Funds Buying or Selling BXP?

Unveiling Boston Properties Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 14.94% | 23,446,379 | SC 13G/A | |

| Jan 30, 2024 | state street corp | 7.73% | 12,135,782 | SC 13G/A | |

| Jan 23, 2024 | blackrock inc. | 11.8% | 18,575,604 | SC 13G/A | |

| Feb 14, 2023 | norges bank | 8.10% | 12,695,570 | SC 13G/A | |

| Feb 14, 2023 | tci fund management ltd | 0% | 0 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 15.05% | 23,591,706 | SC 13G/A | |

| Feb 06, 2023 | state street corp | 7.10% | 11,123,759 | SC 13G/A | |

| Jan 26, 2023 | blackrock inc. | 11.6% | 18,146,691 | SC 13G/A | |

| Jan 20, 2023 | blackrock inc. | 11.6% | 18,146,691 | SC 13G | |

| Feb 14, 2022 | tci fund management ltd | 7.96% | 12,458,851 | SC 13G/A |

Recent SEC filings of Boston Properties Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 10, 2024 | 10-Q | Quarterly Report | |

| Apr 30, 2024 | 8-K | Current Report | |

| Apr 16, 2024 | ARS | ARS | |

| Apr 12, 2024 | DEF 14A | DEF 14A | |

| Apr 12, 2024 | DEFA14A | DEFA14A | |

| Apr 01, 2024 | 4 | Insider Trading | |

| Apr 01, 2024 | 4 | Insider Trading | |

| Apr 01, 2024 | 4 | Insider Trading | |

| Apr 01, 2024 | 4 | Insider Trading | |

| Apr 01, 2024 | 4 | Insider Trading |

Peers (Alternatives to Boston Properties Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

AMT | 90.9B | 11.2B | 13.13% | 1.87% | 46.04 | 8.11 | 3.63% | 50.79% |

CCI | 44.7B | 6.8B | 10.57% | -9.74% | 32.06 | 6.53 | -2.39% | -16.60% |

AVB | 28.3B | 2.8B | 9.91% | 13.04% | 29.6 | 10.08 | 5.72% | -6.47% |

ARE | 21.7B | 3.0B | 6.63% | 6.21% | 110.61 | 7.35 | 10.44% | -73.79% |

AMH | 13.5B | - | 6.12% | 9.11% | 31.9 | 8.3 | 8.93% | 11.87% |

REG | 11.3B | 1.4B | 6.30% | 4.57% | 30.12 | 8.22 | 10.48% | -2.93% |

BXP | 9.9B | 3.3B | 9.08% | 28.09% | 51.64 | 3 | 4.82% | -75.15% |

| MID-CAP | ||||||||

FRT | 8.5B | 1.2B | 5.40% | 14.57% | 35.59 | 7.38 | 5.48% | -38.69% |

SLG | 3.4B | 892.3M | 6.62% | 140.10% | -6.71 | 3.85 | -5.33% | -307.54% |

MAC | 3.4B | 878.0M | 1.11% | 67.10% | -9.8 | 3.82 | 2.35% | -290.60% |

| SMALL-CAP | ||||||||

AAT | 1.4B | 444.1M | 12.17% | 21.82% | 20.36 | 3.15 | 3.54% | 8.91% |

AIV | 1.2B | 198.2M | 6.70% | -0.84% | -7.55 | 6.02 | -43.33% | -308.08% |

MFA | 1.1B | 650.2M | 7.51% | 2.13% | 36.77 | 1.73 | 27.93% | 140.31% |

NYMT | 572.0M | 285.4M | -8.06% | -36.92% | -4.15 | 2 | 11.05% | 83.70% |

IVR | 459.4M | 277.2M | 15.74% | -12.95% | -56.03 | 1.66 | 25.89% | 94.64% |

Boston Properties Inc News

Boston Properties Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 1.3% | 839 | 829 | 824 | 817 | 803 | 790 | 791 | 774 | 754 | 731 | 730 | 714 | 714 | 665 | 693 | 655 | 753 | 758 | 744 | 734 | 726 |

| Costs and Expenses | 4.7% | 594 | 567 | 553 | 551 | 569 | 529 | 519 | 502 | 500 | 478 | 481 | 476 | 485 | 460 | 459 | 461 | 481 | 483 | 474 | 482 | 476 |

| Operating Expenses | -100.0% | - | 57.00 | 65.00 | 61.00 | 57.00 | 55.00 | 53.00 | 45.00 | 46.00 | 44.00 | 40.00 | 37.00 | 37.00 | 38.00 | 38.00 | 34.00 | 35.00 | 34.00 | 29.00 | 30.00 | 30.00 |

| S&GA Expenses | -100.0% | - | 39.00 | 31.00 | 44.00 | 56.00 | 36.00 | 33.00 | 35.00 | 43.00 | 34.00 | 35.00 | 38.00 | 45.00 | 31.00 | 28.00 | 38.00 | 36.00 | 33.00 | 31.00 | 35.00 | 42.00 |

| Interest Expenses | 4.4% | 162 | 155 | 148 | 142 | 134 | 120 | 112 | 104 | 101 | 103 | 106 | 106 | 108 | 112 | 111 | 107 | 102 | 103 | 106 | 102 | 101 |

| Net Income | -33.4% | 80.00 | 120 | -111 | 104 | 78.00 | 112 | 361 | 223 | 143 | 185 | 108 | 112 | 101 | 11.00 | 92.00 | 269 | 500 | 141 | 110 | 167 | 101 |

| Net Income Margin | -0.1% | 0.06* | 0.06* | 0.06* | 0.20* | 0.25* | 0.27* | 0.30* | 0.22* | 0.19* | 0.17* | 0.12* | 0.11* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -49.0% | 198 | 387 | 301 | 379 | 234 | 370 | 296 | 397 | 219 | 346 | 226 | 408 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -1.9% | 25,526 | 26,026 | 24,739 | 25,342 | 24,625 | 24,208 | 23,727 | 23,266 | 22,476 | 22,365 | 22,849 | 22,059 | 22,214 | 22,858 | 22,959 | 23,001 | 21,830 | 21,285 | 21,289 | 21,268 | 20,502 |

| Cash Equivalents | -54.2% | 702 | 1,531 | 883 | 1,582 | 919 | 690 | 376 | 456 | 436 | 453 | 1,003 | 557 | 697 | 1,669 | 1,715 | 1,691 | 661 | 645 | 751 | 1,087 | 360 |

| Liabilities | -3.3% | 17,240 | 17,834 | 16,699 | 17,049 | 16,313 | 15,837 | 15,327 | 15,116 | 14,423 | 14,322 | 14,785 | 13,960 | 14,085 | 14,512 | 14,459 | 14,448 | 13,403 | 13,262 | 13,286 | 13,248 | 12,331 |

| Shareholder's Equity | 40.9% | 8,278 | 5,877 | 5,788 | 8,287 | 8,306 | 6,133 | 8,393 | 8,143 | 8,042 | 8,033 | 8,055 | 8,090 | 8,121 | 8,340 | 8,495 | 8,547 | 8,421 | 8,014 | 7,996 | 8,021 | 8,170 |

| Retained Earnings | -9.1% | -890 | -816 | -782 | -516 | -467 | -391 | -359 | -567 | -636 | -625 | -657 | -612 | -570 | -509 | -364 | -302 | -416 | -760 | -749 | -710 | -728 |

| Additional Paid-In Capital | 0.6% | 6,753 | 6,715 | 6,569 | 6,561 | 6,549 | 6,539 | 6,532 | 6,525 | 6,510 | 6,498 | 6,416 | 6,406 | 6,393 | 6,357 | 6,348 | 6,341 | 6,321 | 6,295 | 6,275 | 6,279 | 6,415 |

| Shares Outstanding | 0.1% | 157 | 157 | 157 | 157 | 157 | 157 | 157 | 157 | 157 | 156 | 156 | 156 | - | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | 9,013 | - | - | - | 13,917 | - | - | - | 17,852 | - | - | - | 14,037 | - | - | - | 19,902 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -49.0% | 198 | 387 | 301 | 379 | 234 | 370 | 296 | 397 | 219 | 346 | 226 | 408 | 152 | 374 | 228 | 379 | 175 | 361 | 254 | 358 | 207 |

| Share Based Compensation | 294.9% | 19.00 | 5.00 | 5.00 | 15.00 | 26.00 | 8.00 | 8.00 | 15.00 | 21.00 | 8.00 | 9.00 | 14.00 | 20.00 | 8.00 | 8.00 | 10.00 | 18.00 | 8.00 | 8.00 | 10.00 | 15.00 |

| Cashflow From Investing | 9.9% | -286 | -318 | -320 | -269 | -285 | -289 | -333 | -828 | -151 | -41.59 | -434 | -321 | -242 | -225 | -267 | -46.73 | -73.79 | -278 | -408 | -104 | -223 |

| Cashflow From Financing | -223.4% | -756 | 613 | -678 | 554 | 279 | 208 | -16.68 | 452 | -86.97 | -885 | 653 | -398 | -679 | -194 | -187 | 801 | 65.00 | -195 | -203 | 477 | -190 |

| Dividend Payments | -100.0% | - | 173 | 172 | 172 | 171 | 172 | 172 | 171 | 170 | 170 | 170 | 172 | 172 | 172 | 172 | 172 | 172 | 167 | 167 | 167 | 166 |

BXP Income Statement

2024-03-31Consolidated Statements Of Operations - USD ($) shares in Thousands, $ in Thousands | 3 Months Ended | |||

|---|---|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |||

| Revenue | ||||

| Lease | $ 788,590 | $ 756,875 | ||

| Total revenue | 839,439 | 803,200 | ||

| Expenses | ||||

| Rental | 314,157 | 291,308 | ||

| General and administrative | 50,018 | 55,802 | ||

| Transaction costs | 513 | 911 | ||

| Depreciation and amortization | 218,716 | 208,734 | ||

| Total expenses | 593,712 | 568,661 | ||

| Other income (expense) | ||||

| Income (loss) from unconsolidated joint ventures | 19,186 | (7,569) | ||

| Interest and other income (loss) | 14,529 | 10,941 | ||

| Gains from investments in securities | 2,272 | 1,665 | ||

| Unrealized gain on non-real estate investments | 396 | 259 | ||

| Impairment loss | (13,615) | 0 | ||

| Interest expense | (161,891) | (134,207) | ||

| Net Income (loss) | 106,604 | 105,628 | ||

| Net income attributable to noncontrolling interests | ||||

| Noncontrolling interests in property partnerships | (17,221) | (18,660) | ||

| Noncontrolling interest - common units of the Operating Partnership | (9,500) | (9,078) | ||

| Net income attributable to Boston Properties, Inc. | 79,883 | 77,890 | ||

| Net income attributable to the Company | $ 79,883 | $ 77,890 | ||

| Basic earnings per common share / unit attributable to the Company common shareholders / unitholders | ||||

| Earnings Per Share After Allocation of Undistributed Earnings to Participating Securities Basic (dollars per share) | $ 0.51 | $ 0.50 | ||

| Weighted average number of common shares / units outstanding (in shares / units) | 156,983 | 156,803 | ||

| Diluted earnings per common share / unit attributable to the Company common shareholders / unitholders | ||||

| Diluted Earnings: Net income, Per Share Amount (in dollars per share / unit) | $ 0.51 | $ 0.50 | ||

| Weighted average number of common and common equivalent shares / units outstanding (in shares / units) | 157,132 | 157,043 | ||

| Boston Properties Limited Partnership | ||||

| Revenue | ||||

| Lease | $ 788,590 | $ 756,875 | ||

| Total revenue | 839,439 | 803,200 | ||

| Expenses | ||||

| Rental | 314,157 | 291,308 | ||

| General and administrative | 50,018 | 55,802 | ||

| Transaction costs | 513 | 911 | ||

| Depreciation and amortization | 217,019 | 206,872 | ||

| Total expenses | 592,015 | 566,799 | ||

| Other income (expense) | ||||

| Income (loss) from unconsolidated joint ventures | 19,186 | (7,569) | ||

| Interest and other income (loss) | 14,529 | 10,941 | ||

| Gains from investments in securities | 2,272 | 1,665 | ||

| Unrealized gain on non-real estate investments | 396 | 259 | ||

| Impairment loss | (13,615) | 0 | ||

| Interest expense | (161,891) | (134,207) | ||

| Net Income (loss) | 108,301 | 107,490 | ||

| Net income attributable to noncontrolling interests | ||||

| Noncontrolling interests in property partnerships | (17,221) | (18,660) | ||

| Net income attributable to Boston Properties, Inc. | 91,080 | 88,830 | ||

| Net income attributable to the Company | $ 91,080 | $ 88,830 | ||

| Basic earnings per common share / unit attributable to the Company common shareholders / unitholders | ||||

| Earnings Per Share After Allocation of Undistributed Earnings to Participating Securities Basic (dollars per share) | $ 0.52 | $ 0.51 | ||

| Weighted average number of common shares / units outstanding (in shares / units) | 175,255 | 174,652 | ||

| Diluted earnings per common share / unit attributable to the Company common shareholders / unitholders | ||||

| Diluted Earnings: Net income, Per Share Amount (in dollars per share / unit) | $ 0.52 | $ 0.51 | ||

| Weighted average number of common and common equivalent shares / units outstanding (in shares / units) | 175,404 | 174,892 | ||

| Parking and Other [Member] | ||||

| Revenue | ||||

| Other revenue | $ 32,216 | $ 24,009 | ||

| Parking and Other [Member] | Boston Properties Limited Partnership | ||||

| Revenue | ||||

| Other revenue | 32,216 | 24,009 | ||

| Hotel [Member] | ||||

| Revenue | ||||

| Other revenue | [1] | 8,186 | 8,101 | |

| Expenses | ||||

| Operating expense | 6,015 | 6,671 | ||

| Hotel [Member] | Boston Properties Limited Partnership | ||||

| Revenue | ||||

| Other revenue | 8,186 | 8,101 | ||

| Expenses | ||||

| Operating expense | 6,015 | 6,671 | ||

| Management Service [Member] | ||||

| Revenue | ||||

| Other revenue | 6,154 | 8,980 | ||

| Management Service [Member] | Boston Properties Limited Partnership | ||||

| Revenue | ||||

| Other revenue | 6,154 | 8,980 | ||

| Real Estate, Other [Member] | ||||

| Revenue | ||||

| Other revenue | 4,293 | 5,235 | ||

| Expenses | ||||

| Operating expense | 4,293 | 5,235 | ||

| Real Estate, Other [Member] | Boston Properties Limited Partnership | ||||

| Revenue | ||||

| Other revenue | 4,293 | 5,235 | ||

| Expenses | ||||

| Operating expense | $ 4,293 | $ 5,235 | ||

| ||||

BXP Balance Sheet

2024-03-31Consolidated Balance Sheets - USD ($) $ in Thousands | Mar. 31, 2024 | Dec. 31, 2023 | ||

|---|---|---|---|---|

| ASSETS | ||||

| Real estate, at cost (amounts related to variable interest entities (“VIEs”) of $7,376,175 and $7,054,075 at March 31, 2024 and December 31, 2023, respectively) | $ 27,063,048 | $ 26,749,209 | ||

| Right of use assets - finance leases (amounts related to VIEs of $21,000 and $21,000 at March 31, 2024 and December 31, 2023, respectively) | 401,486 | 401,680 | ||

| Right of use assets - operating leases (amounts related to VIEs of $154,217 and $158,885 at March 31, 2024 and December 31, 2023, respectively) | [1] | 344,255 | 324,298 | |

| Less: accumulated depreciation (amounts related to VIEs of $(1,538,940) and $(1,501,483) at March 31, 2024 and December 31, 2023, respectively) | (7,040,501) | (6,881,728) | ||

| Total real estate | 20,768,288 | 20,593,459 | ||

| Cash and cash equivalents (amounts related to VIEs of $298,548 and $245,317 at March 31, 2024 and December 31, 2023, respectively) | 701,695 | 1,531,477 | ||

| Cash held in escrows (amounts related to VIEs of $4,839 and $22,160 at March 31, 2024 and December 31, 2023, respectively) | 64,939 | 81,090 | ||

| Investments in securities | 37,184 | 36,337 | ||

| Tenant and other receivables, net (amounts related to VIEs of $27,792 and $27,987 at March 31, 2024 and December 31, 2023, respectively) | 94,115 | 122,407 | ||

| Note receivable, net | 2,274 | 1,714 | ||

| Sales-type lease receivable, net | 13,943 | 13,704 | ||

| Accrued rental income, net (amounts related to VIEs of $409,628 and $401,159 at March 31, 2024 and December 31, 2023, respectively) | 1,390,217 | 1,355,212 | ||

| Deferred charges, net (amounts related to VIEs of $194,489 and $175,383 at March 31, 2024 and December 31, 2023, respectively) | 818,424 | 760,421 | ||

| Prepaid expenses and other assets (amounts related to VIEs of $45,672 and $11,824 at March 31, 2024 and December 31, 2023, respectively) | 146,286 | 64,230 | ||

| Investments in unconsolidated joint ventures | 1,399,824 | 1,377,319 | ||

| Total assets | 25,525,978 | 26,026,149 | ||

| Liabilities: | ||||

| Mortgage notes payable, net (amounts related to VIEs of $3,278,396 and $3,277,185 at March 31, 2024 and December 31, 2023, respectively) | 4,368,367 | 4,166,379 | ||

| Unsecured senior notes, net | 9,794,527 | 10,491,617 | ||

| Unsecured line of credit | 0 | 0 | ||

| Unsecured term loan, net | 1,199,430 | 1,198,301 | ||

| Lease liabilities - finance leases (amounts related to VIEs of $20,831 and $20,794 at March 31, 2024 and December 31, 2023, respectively) | 415,888 | 417,961 | ||

| Lease liabilities - operating leases (amounts related to VIEs of $148,706 and $145,826 at March 31, 2024 and December 31, 2023, respectively) | 377,667 | 350,391 | ||

| Accounts payable and accrued expenses (amounts related to VIEs of $112,385 and $59,667 at March 31, 2024 and December 31, 2023, respectively) | 374,681 | 458,329 | ||

| Dividends and distributions payable | 172,154 | 171,176 | ||

| Accrued interest payable | 119,573 | 133,684 | ||

| Other liabilities (amounts related to VIEs of $105,786 and $115,275 at March 31, 2024 and December 31, 2023, respectively) | 417,978 | 445,947 | ||

| Total liabilities | 17,240,265 | 17,833,785 | ||

| Redeemable deferred stock units— 124,656 and 119,471 units outstanding at redemption value at March 31, 2024 and December 31, 2023, respectively | $ 8,141 | $ 8,383 | ||

| Excess stock, shares outstanding | 0 | 0 | ||

| Excess stock, shares issued | 0 | 0 | ||

| Preferred stock / units, shares / units issued (in shares / units) | 0 | 0 | ||

| Preferred stock / units, shares / units outstanding (in shares / units) | 0 | 0 | ||

| Equity / Capital: | ||||

| Excess stock, $0.01 par value, 150,000,000 shares authorized, none issued or outstanding | $ 0 | $ 0 | ||

| Preferred stock, $0.01 par value, 50,000,000 shares authorized, none issued or outstanding | 0 | 0 | ||

| Common stock, $0.01 par value, 250,000,000 shares authorized, 157,128,071 and 157,019,766 issued and 157,049,171 and 156,940,866 outstanding at March 31, 2024 and December 31, 2023, respectively | 1,570 | 1,569 | ||

| Additional paid-in capital | 6,752,648 | 6,715,149 | ||

| Dividends in excess of earnings | $ (890,177) | $ (816,152) | ||

| Treasury common stock at cost, shares | 78,900 | 78,900 | ||

| Treasury common stock at cost, 78,900 shares at March 31, 2024 and December 31, 2023 | $ (2,722) | $ (2,722) | ||

| Accumulated other comprehensive loss | (3,620) | (21,147) | ||

| Total stockholders' equity attributable to Boston Properties, Inc. | 5,857,699 | 5,876,697 | ||

| Noncontrolling interests: | ||||

| Common units of the Operating Partnership | 684,969 | 666,580 | ||

| Property partnerships | 1,734,904 | 1,640,704 | ||

| Total equity / capital | 8,277,572 | 8,183,981 | ||

| Total liabilities and equity / capital | 25,525,978 | 26,026,149 | ||

| Related Party | ||||

| ASSETS | ||||

| Related party note receivable, net | 88,789 | 88,779 | ||

| Variable Interest Entity, Primary Beneficiary [Member] | ||||

| ASSETS | ||||

| Real estate, at cost (amounts related to variable interest entities (“VIEs”) of $7,376,175 and $7,054,075 at March 31, 2024 and December 31, 2023, respectively) | 7,376,175 | 7,054,075 | ||

| Right of use assets - finance leases (amounts related to VIEs of $21,000 and $21,000 at March 31, 2024 and December 31, 2023, respectively) | 21,000 | 21,000 | ||

| Right of use assets - operating leases (amounts related to VIEs of $154,217 and $158,885 at March 31, 2024 and December 31, 2023, respectively) | 154,217 | 158,885 | ||

| Less: accumulated depreciation (amounts related to VIEs of $(1,538,940) and $(1,501,483) at March 31, 2024 and December 31, 2023, respectively) | (1,538,940) | (1,501,483) | ||

| Cash and cash equivalents (amounts related to VIEs of $298,548 and $245,317 at March 31, 2024 and December 31, 2023, respectively) | 298,548 | 245,317 | ||

| Cash held in escrows (amounts related to VIEs of $4,839 and $22,160 at March 31, 2024 and December 31, 2023, respectively) | 4,839 | 22,160 | ||

| Tenant and other receivables, net (amounts related to VIEs of $27,792 and $27,987 at March 31, 2024 and December 31, 2023, respectively) | 27,792 | 27,987 | ||

| Accrued rental income, net (amounts related to VIEs of $409,628 and $401,159 at March 31, 2024 and December 31, 2023, respectively) | 409,628 | 401,159 | ||

| Deferred charges, net (amounts related to VIEs of $194,489 and $175,383 at March 31, 2024 and December 31, 2023, respectively) | 194,489 | 175,383 | ||

| Prepaid expenses and other assets (amounts related to VIEs of $45,672 and $11,824 at March 31, 2024 and December 31, 2023, respectively) | 45,672 | 11,824 | ||

| Liabilities: | ||||

| Mortgage notes payable, net (amounts related to VIEs of $3,278,396 and $3,277,185 at March 31, 2024 and December 31, 2023, respectively) | 3,278,396 | 3,277,185 | ||

| Lease liabilities - finance leases (amounts related to VIEs of $20,831 and $20,794 at March 31, 2024 and December 31, 2023, respectively) | 20,831 | 20,794 | ||

| Lease liabilities - operating leases (amounts related to VIEs of $148,706 and $145,826 at March 31, 2024 and December 31, 2023, respectively) | 148,706 | 145,826 | ||

| Accounts payable and accrued expenses (amounts related to VIEs of $112,385 and $59,667 at March 31, 2024 and December 31, 2023, respectively) | 112,385 | 59,667 | ||

| Other liabilities (amounts related to VIEs of $105,786 and $115,275 at March 31, 2024 and December 31, 2023, respectively) | 105,786 | 115,275 | ||

| Boston Properties Limited Partnership | ||||

| ASSETS | ||||

| Real estate, at cost (amounts related to variable interest entities (“VIEs”) of $7,376,175 and $7,054,075 at March 31, 2024 and December 31, 2023, respectively) | 26,696,783 | 26,382,944 | ||

| Right of use assets - finance leases (amounts related to VIEs of $21,000 and $21,000 at March 31, 2024 and December 31, 2023, respectively) | 401,486 | 401,680 | ||

| Right of use assets - operating leases (amounts related to VIEs of $154,217 and $158,885 at March 31, 2024 and December 31, 2023, respectively) | [1] | 344,255 | 324,298 | |

| Less: accumulated depreciation (amounts related to VIEs of $(1,538,940) and $(1,501,483) at March 31, 2024 and December 31, 2023, respectively) | (6,915,437) | (6,758,361) | ||

| Total real estate | 20,527,087 | 20,350,561 | ||

| Cash and cash equivalents (amounts related to VIEs of $298,548 and $245,317 at March 31, 2024 and December 31, 2023, respectively) | 701,695 | 1,531,477 | ||

| Cash held in escrows (amounts related to VIEs of $4,839 and $22,160 at March 31, 2024 and December 31, 2023, respectively) | 64,939 | 81,090 | ||

| Investments in securities | 37,184 | 36,337 | ||

| Tenant and other receivables, net (amounts related to VIEs of $27,792 and $27,987 at March 31, 2024 and December 31, 2023, respectively) | 94,115 | 122,407 | ||

| Note receivable, net | 2,274 | 1,714 | ||

| Sales-type lease receivable, net | 13,943 | 13,704 | ||

| Accrued rental income, net (amounts related to VIEs of $409,628 and $401,159 at March 31, 2024 and December 31, 2023, respectively) | 1,390,217 | 1,355,212 | ||

| Deferred charges, net (amounts related to VIEs of $194,489 and $175,383 at March 31, 2024 and December 31, 2023, respectively) | 818,424 | 760,421 | ||

| Prepaid expenses and other assets (amounts related to VIEs of $45,672 and $11,824 at March 31, 2024 and December 31, 2023, respectively) | 146,286 | 64,230 | ||

| Investments in unconsolidated joint ventures | 1,399,824 | 1,377,319 | ||

| Total assets | 25,284,777 | 25,783,251 | ||

| Liabilities: | ||||

| Mortgage notes payable, net (amounts related to VIEs of $3,278,396 and $3,277,185 at March 31, 2024 and December 31, 2023, respectively) | 4,368,367 | 4,166,379 | ||

| Unsecured senior notes, net | 9,794,527 | 10,491,617 | ||

| Unsecured line of credit | 0 | 0 | ||

| Unsecured term loan, net | 1,199,430 | 1,198,301 | ||

| Lease liabilities - finance leases (amounts related to VIEs of $20,831 and $20,794 at March 31, 2024 and December 31, 2023, respectively) | 415,888 | 417,961 | ||

| Lease liabilities - operating leases (amounts related to VIEs of $148,706 and $145,826 at March 31, 2024 and December 31, 2023, respectively) | 377,667 | 350,391 | ||

| Accounts payable and accrued expenses (amounts related to VIEs of $112,385 and $59,667 at March 31, 2024 and December 31, 2023, respectively) | 374,681 | 458,329 | ||

| Dividends and distributions payable | 172,154 | 171,176 | ||

| Accrued interest payable | 119,573 | 133,684 | ||

| Other liabilities (amounts related to VIEs of $105,786 and $115,275 at March 31, 2024 and December 31, 2023, respectively) | 417,978 | 445,947 | ||

| Total liabilities | 17,240,265 | 17,833,785 | ||

| Redeemable deferred stock units— 124,656 and 119,471 units outstanding at redemption value at March 31, 2024 and December 31, 2023, respectively | 8,141 | 8,383 | ||

| Noncontrolling interest: | ||||

| Redeemable partnership units— 16,492,171 and 16,508,277 common units and 2,666,636 and 2,065,861 long term incentive units outstanding at redemption value at March 31, 2024 and December 31, 2023, respectively | 1,300,409 | 1,347,575 | ||

| Equity / Capital: | ||||

| Boston Properties Limited Partnership partners’ capital— 1,762,080 and 1,755,150 general partner units and 155,287,091 and 155,185,716 limited partner units outstanding at March 31, 2024 and December 31, 2023, respectively | 5,004,678 | 4,973,951 | ||

| Accumulated other comprehensive loss | (3,620) | (21,147) | ||

| Total partners’ capital | 5,001,058 | 4,952,804 | ||

| Noncontrolling interests in property partnerships | 1,734,904 | 1,640,704 | ||

| Noncontrolling interests: | ||||

| Total equity / capital | 6,735,962 | 6,593,508 | ||

| Total liabilities and equity / capital | 25,284,777 | 25,783,251 | ||

| Boston Properties Limited Partnership | Related Party | ||||

| ASSETS | ||||

| Related party note receivable, net | 88,789 | 88,779 | ||

| Boston Properties Limited Partnership | Variable Interest Entity, Primary Beneficiary [Member] | ||||

| ASSETS | ||||

| Real estate, at cost (amounts related to variable interest entities (“VIEs”) of $7,376,175 and $7,054,075 at March 31, 2024 and December 31, 2023, respectively) | 7,376,175 | 7,054,075 | ||

| Right of use assets - finance leases (amounts related to VIEs of $21,000 and $21,000 at March 31, 2024 and December 31, 2023, respectively) | 21,000 | 21,000 | ||

| Right of use assets - operating leases (amounts related to VIEs of $154,217 and $158,885 at March 31, 2024 and December 31, 2023, respectively) | 154,217 | 158,885 | ||

| Less: accumulated depreciation (amounts related to VIEs of $(1,538,940) and $(1,501,483) at March 31, 2024 and December 31, 2023, respectively) | (1,538,940) | (1,501,483) | ||

| Cash and cash equivalents (amounts related to VIEs of $298,548 and $245,317 at March 31, 2024 and December 31, 2023, respectively) | 298,548 | 245,317 | ||

| Cash held in escrows (amounts related to VIEs of $4,839 and $22,160 at March 31, 2024 and December 31, 2023, respectively) | 4,839 | 22,160 | ||

| Tenant and other receivables, net (amounts related to VIEs of $27,792 and $27,987 at March 31, 2024 and December 31, 2023, respectively) | 27,792 | 27,987 | ||

| Accrued rental income, net (amounts related to VIEs of $409,628 and $401,159 at March 31, 2024 and December 31, 2023, respectively) | 409,628 | 401,159 | ||

| Deferred charges, net (amounts related to VIEs of $194,489 and $175,383 at March 31, 2024 and December 31, 2023, respectively) | 194,489 | 175,383 | ||

| Prepaid expenses and other assets (amounts related to VIEs of $45,672 and $11,824 at March 31, 2024 and December 31, 2023, respectively) | 45,672 | 11,824 | ||

| Liabilities: | ||||

| Mortgage notes payable, net (amounts related to VIEs of $3,278,396 and $3,277,185 at March 31, 2024 and December 31, 2023, respectively) | 3,278,396 | 3,277,185 | ||

| Lease liabilities - finance leases (amounts related to VIEs of $20,831 and $20,794 at March 31, 2024 and December 31, 2023, respectively) | 20,831 | 20,794 | ||

| Lease liabilities - operating leases (amounts related to VIEs of $148,706 and $145,826 at March 31, 2024 and December 31, 2023, respectively) | 148,706 | 145,826 | ||

| Accounts payable and accrued expenses (amounts related to VIEs of $112,385 and $59,667 at March 31, 2024 and December 31, 2023, respectively) | 112,385 | 59,667 | ||

| Other liabilities (amounts related to VIEs of $105,786 and $115,275 at March 31, 2024 and December 31, 2023, respectively) | $ 105,786 | $ 115,275 | ||

| ||||

| CEO | Mr. Owen David Thomas |

|---|---|

| WEBSITE | bxp.com |

| INDUSTRY | REIT Mortgage |

| EMPLOYEES | 780 |