Market Summary

CAT Stock Price

CAT RSI Chart

CAT Valuation

CAT Price/Sales (Trailing)

CAT Profitability

CAT Fundamentals

CAT Revenue

CAT Earnings

Breaking Down CAT Revenue

52 Week Range

Last 7 days

4.9%

Last 30 days

-5.4%

Last 90 days

10.9%

Trailing 12 Months

65.1%

How does CAT drawdown profile look like?

CAT Financial Health

CAT Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 67.0B | 0 | 0 | 0 |

| 2023 | 61.7B | 64.8B | 66.6B | 67.1B |

| 2022 | 52.7B | 54.0B | 56.6B | 59.4B |

| 2021 | 43.0B | 45.9B | 48.4B | 51.0B |

| 2020 | 51.0B | 46.5B | 43.7B | 41.7B |

| 2019 | 55.3B | 55.8B | 55.0B | 53.8B |

| 2018 | 48.5B | 51.2B | 53.3B | 54.7B |

| 2017 | 38.9B | 39.9B | 42.1B | 45.5B |

| 2016 | 43.8B | 41.8B | 40.0B | 38.5B |

| 2015 | 54.6B | 52.8B | 50.2B | 47.0B |

| 2014 | 55.7B | 55.2B | 55.3B | 55.2B |

| 2013 | 63.1B | 60.4B | 57.3B | 55.7B |

| 2012 | 63.2B | 66.3B | 67.0B | 65.9B |

| 2011 | 47.3B | 51.1B | 55.7B | 60.1B |

| 2010 | 31.4B | 33.8B | 37.7B | 42.6B |

| 2009 | 48.8B | 43.1B | 37.4B | 32.4B |

| 2008 | 0 | 47.1B | 49.2B | 51.3B |

| 2007 | 0 | 0 | 0 | 45.0B |

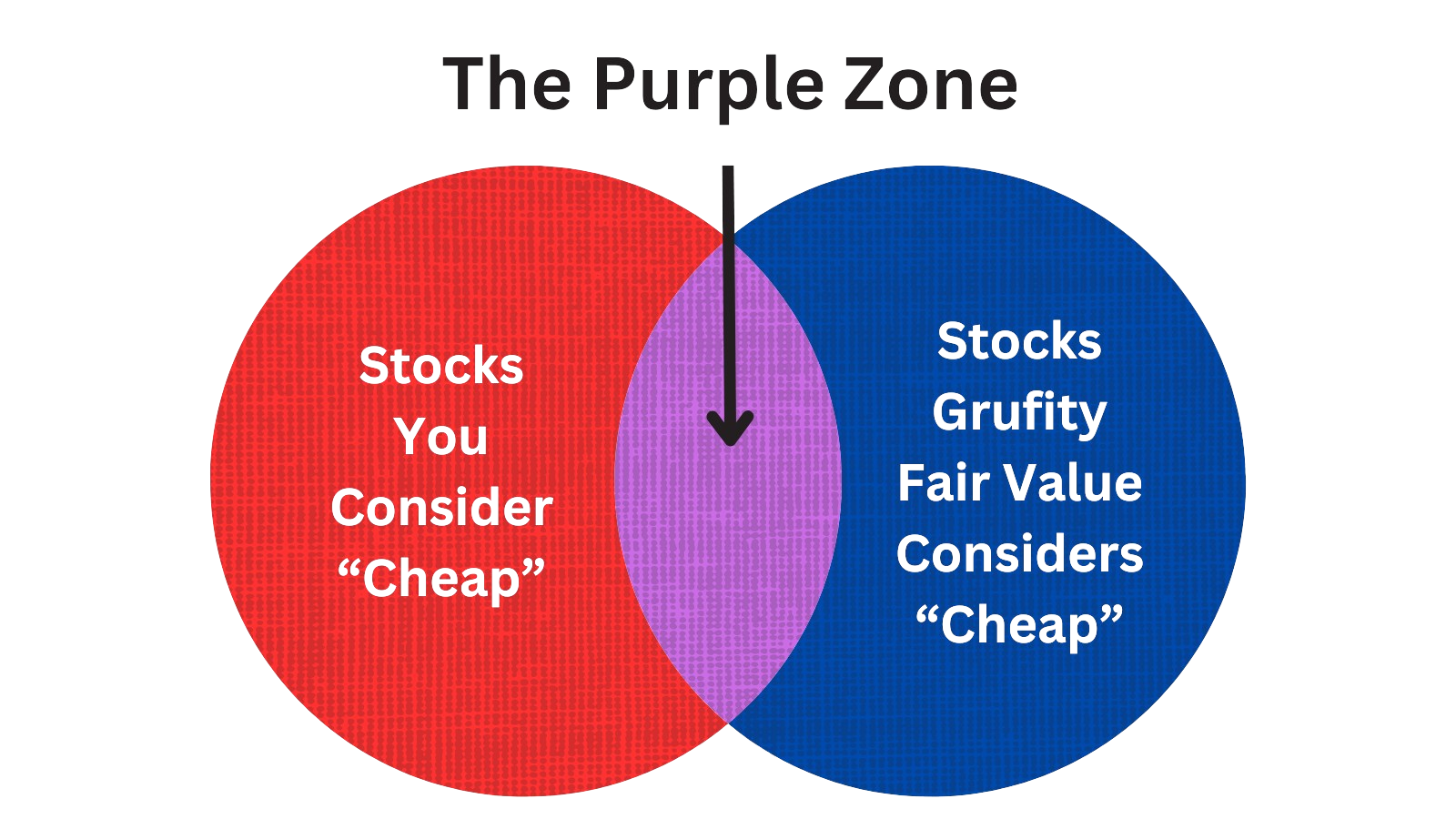

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Caterpillar Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 03, 2024 | maclennan david | bought | 168,695 | 337 | 500 | - |

| Apr 29, 2024 | schwab susan c | back to issuer | -4,498,230 | 349 | -12,881 | - |

| Apr 01, 2024 | owens derek | sold (taxes) | -26,300 | 365 | -72.00 | clo & general counsel |

| Mar 07, 2024 | bonfield andrew r j | sold (taxes) | -7,744,210 | 340 | -22,751 | chief financial officer |

| Mar 07, 2024 | bonfield andrew r j | acquired | 6,173,150 | 208 | 29,579 | chief financial officer |

| Mar 04, 2024 | creed joseph e | acquired | - | - | 5,168 | chief operating officer |

| Mar 04, 2024 | schaupp william e | acquired | - | - | 229 | chief accounting officer |

| Mar 04, 2024 | fassino anthony d. | acquired | - | - | 2,731 | group president |

| Mar 04, 2024 | umpleby iii donald j | acquired | - | - | 12,181 | chief executive officer |

| Mar 04, 2024 | kaiser jason | acquired | - | - | 2,731 | group president |

Which funds bought or sold CAT recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 08, 2024 | AVANTAX ADVISORY SERVICES, INC. | added | 12.68 | 3,659,510 | 12,890,700 | 0.11% |

| May 08, 2024 | Heritage Wealth Advisors | reduced | -1.62 | 168,444 | 936,595 | 0.04% |

| May 08, 2024 | Hills Bank & Trust Co | added | 72.21 | 231,744 | 436,052 | 0.04% |

| May 08, 2024 | GREAT LAKES ADVISORS, LLC | reduced | -7.16 | 15,369,100 | 117,430,000 | 1.00% |

| May 08, 2024 | ACORN FINANCIAL ADVISORY SERVICES INC /ADV | sold off | -100 | -382,261 | - | -% |

| May 08, 2024 | J. W. Coons Advisors, LLC | unchanged | - | 253,321 | 1,311,820 | 0.30% |

| May 08, 2024 | Columbia Asset Management | unchanged | - | - | 5,546,000 | 1.12% |

| May 08, 2024 | One Capital Management, LLC | new | - | 223,522 | 223,522 | 0.01% |

| May 08, 2024 | DEARBORN PARTNERS LLC | reduced | -1.6 | 2,627,620 | 14,595,300 | 0.63% |

| May 08, 2024 | Crestwood Advisors Group, LLC | added | 9.01 | 2,037,690 | 7,842,930 | 0.17% |

Are Funds Buying or Selling CAT?

Unveiling Caterpillar Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 9.50% | 48,352,179 | SC 13G/A | |

| Feb 12, 2024 | blackrock inc. | 6.6% | 33,509,816 | SC 13G/A | |

| Feb 09, 2024 | capital world investors | 5.8% | 29,445,081 | SC 13G/A | |

| Jan 30, 2024 | state street corp | 7.41% | 37,741,566 | SC 13G/A | |

| Feb 13, 2023 | capital world investors | 5.6% | 29,381,792 | SC 13G | |

| Feb 09, 2023 | state street corp | 7.66% | 39,841,238 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 9.36% | 48,701,582 | SC 13G/A | |

| Jan 31, 2023 | blackrock inc. | 7.0% | 36,459,646 | SC 13G/A | |

| Feb 11, 2022 | state street corp | 7.59% | 41,036,149 | SC 13G/A | |

| Feb 09, 2022 | vanguard group inc | 8.79% | 47,559,902 | SC 13G/A |

Recent SEC filings of Caterpillar Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 08, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4/A | Insider Trading | |

| May 06, 2024 | 4 | Insider Trading | |

| May 02, 2024 | 4 | Insider Trading | |

| May 01, 2024 | 10-Q | Quarterly Report | |

| Apr 30, 2024 | 144 | Notice of Insider Sale Intent | |

| Apr 30, 2024 | 4 | Insider Trading | |

| Apr 29, 2024 | DEFA14A | DEFA14A | |

| Apr 29, 2024 | DEF 14A | DEF 14A | |

| Apr 29, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to Caterpillar Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

GE | 183.3B | 69.5B | 8.41% | 68.26% | 52.22 | 2.64 | 16.04% | -60.91% |

CAT | 173.7B | 67.0B | -5.39% | 65.06% | 15.45 | 2.59 | 8.59% | 58.17% |

CMI | 40.3B | 34.0B | -2.46% | 36.67% | 19.54 | 1.18 | 12.85% | -19.64% |

AME | 39.3B | 6.7B | -6.23% | 17.43% | 29.83 | 5.84 | 7.11% | 10.53% |

ACM | 12.6B | 15.3B | -3.58% | 15.85% | -915.55 | 0.82 | 13.36% | -103.70% |

| MID-CAP | ||||||||

APG | 10.3B | 6.9B | -4.99% | 68.04% | 59.94 | 1.49 | 3.19% | 62.26% |

FLR | 6.7B | 15.5B | -5.91% | 44.99% | 21.94 | 0.43 | 7.53% | 3145.00% |

FLS | 6.5B | 4.4B | 3.46% | 38.34% | 27.74 | 1.47 | 17.31% | 1.26% |

ACA | 4.3B | 2.4B | 5.37% | 27.66% | 30.01 | 1.82 | 4.48% | -49.27% |

ALG | 2.4B | 1.7B | -10.94% | 9.35% | 17.71 | 1.4 | 8.96% | 15.52% |

| SMALL-CAP | ||||||||

AMRC | 1.5B | 1.4B | 15.88% | -32.78% | 25.02 | 1.04 | -13.54% | -25.70% |

AGX | 894.9M | 573.3M | 32.71% | 64.84% | 27.66 | 1.56 | 26.00% | -2.24% |

NKLA | 786.8M | 35.8M | -42.00% | -27.50% | -0.83 | 21.95 | -27.93% | -18.06% |

AMSC | 424.5M | 135.4M | 5.42% | 218.20% | -25.88 | 3.14 | -25.90% | 65.37% |

ADES | 257.3M | 100.1M | 12.78% | 412.84% | -31.53 | 2.57 | 2.80% | 39.07% |

Caterpillar Inc News

Caterpillar Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -7.4% | 15,799 | 17,070 | 16,810 | 17,318 | 15,862 | 16,597 | 14,994 | 14,247 | 13,589 | 13,798 | 12,397 | 12,889 | 11,887 | 11,235 | 9,881 | 9,997 | 10,635 | 13,144 | 12,758 | 14,432 | 13,466 |

| Cost Of Revenue | -12.3% | 9,662 | 11,016 | 10,583 | 11,065 | 10,103 | 11,614 | 10,202 | 9,975 | 9,559 | 10,003 | 8,617 | 8,881 | 8,012 | 7,784 | 6,919 | 7,113 | 7,266 | 9,117 | 8,569 | 9,941 | 9,003 |

| Costs and Expenses | -11.9% | 12,280 | 13,936 | 13,361 | 13,666 | 13,131 | 14,917 | 12,569 | 12,303 | 11,734 | 12,187 | 10,733 | 11,100 | 10,073 | 9,855 | 8,896 | 9,213 | 9,231 | 11,294 | 10,738 | 12,219 | 11,259 |

| Operating Expenses | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 11,294 | 10,738 | 12,219 | 11,259 |

| S&GA Expenses | -10.2% | 1,577 | 1,756 | 1,624 | 1,528 | 1,463 | 1,479 | 1,401 | 1,425 | 1,346 | 1,422 | 1,340 | 1,364 | 1,239 | 1,216 | 1,126 | 1,179 | 1,121 | 1,283 | 1,251 | 1,309 | 1,319 |

| R&D Expenses | -6.1% | 520 | 554 | 554 | 528 | 472 | 401 | 476 | 480 | 457 | 439 | 427 | 446 | 374 | 374 | 344 | 341 | 356 | 386 | 431 | 441 | 435 |

| EBITDA Margin | 6.0% | 0.24* | 0.23* | 0.21* | 0.20* | 0.19* | 0.18* | 0.20* | 0.20* | 0.20* | 0.21* | 0.19* | 0.18* | 0.16* | 0.15* | 0.16* | 0.17* | 0.19* | 0.19* | 0.19* | 0.19* | 0.19* |

| Income Taxes | 17.2% | 688 | 587 | 734 | 752 | 708 | 644 | 527 | 427 | 469 | 429 | 368 | 470 | 475 | 167 | 187 | 227 | 425 | 276 | 518 | 565 | 387 |

| Earnings Before Taxes | 8.7% | 3,532 | 3,249 | 3,515 | 3,652 | 2,634 | 2,099 | 2,558 | 2,096 | 1,999 | 2,562 | 1,775 | 1,870 | 1,997 | 941 | 863 | 678 | 1,513 | 1,365 | 2,005 | 2,178 | 2,264 |

| EBT Margin | 7.0% | 0.21* | 0.19* | 0.18* | 0.17* | 0.15* | 0.15* | 0.16* | 0.16* | 0.16* | 0.16* | 0.14* | 0.12* | 0.10* | 0.10* | 0.10* | 0.12* | 0.14* | 0.15* | 0.14* | 0.14* | 0.14* |

| Net Income | 6.8% | 2,854 | 2,673 | 2,793 | 2,924 | 1,942 | 1,454 | 2,040 | 1,673 | 1,537 | 2,120 | 1,428 | 1,414 | 1,531 | 780 | 671 | 459 | 1,093 | 1,098 | 1,494 | 1,620 | 1,881 |

| Net Income Margin | 8.9% | 0.17* | 0.15* | 0.14* | 0.13* | 0.12* | 0.11* | 0.13* | 0.13* | 0.12* | 0.13* | 0.11* | 0.10* | 0.08* | 0.07* | 0.08* | 0.09* | 0.10* | 0.11* | 0.11* | 0.11* | 0.12* |

| Free Cashflow | -55.2% | 1,552 | 3,467 | 3,682 | 2,988 | 1,151 | 2,311 | 2,199 | 1,993 | -33.00 | 992 | 1,486 | 1,951 | 1,676 | 1,780 | 1,520 | 1,224 | 825 | 2,101 | 525 | 2,387 | 843 |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -4.3% | 83,741 | 87,476 | 86,791 | 85,427 | 83,649 | 81,943 | 80,907 | 81,107 | 82,276 | 82,793 | 80,784 | 81,697 | 80,729 | 78,324 | 76,741 | 76,566 | 75,894 | 78,453 | 77,993 | 79,187 | 78,726 |

| Current Assets | -7.0% | 43,664 | 46,949 | 48,005 | 47,000 | 45,660 | 43,785 | 42,577 | 41,982 | 42,570 | 43,455 | 41,893 | 42,946 | 42,581 | 39,464 | 38,534 | 37,862 | 37,586 | 39,193 | 39,160 | 39,789 | 39,126 |

| Cash Equivalents | -28.8% | 4,965 | 6,978 | 6,545 | 7,387 | 6,789 | 7,004 | 6,355 | 6,023 | 6,532 | 9,263 | 9,449 | 10,842 | 11,351 | 9,366 | 9,319 | 8,791 | 7,130 | 8,292 | 7,936 | 7,459 | 7,158 |

| Inventory | 2.3% | 16,953 | 16,565 | 17,580 | 17,746 | 17,633 | 16,270 | 16,860 | 15,881 | 15,038 | 14,038 | 13,666 | 12,672 | 12,149 | 11,402 | 11,453 | 11,371 | 11,748 | 11,266 | 12,180 | 12,007 | 12,340 |

| Net PPE | -1.1% | 12,538 | 12,680 | 12,287 | 12,124 | 11,973 | 12,028 | 11,643 | 11,744 | 11,932 | 12,090 | 11,904 | 12,014 | 12,132 | 12,401 | 12,232 | 12,357 | 12,488 | 12,904 | 12,842 | 13,172 | 13,259 |

| Goodwill | -0.6% | 5,277 | 5,308 | 5,268 | 5,293 | 5,309 | 5,288 | 6,092 | 6,195 | 6,293 | 6,324 | 6,353 | 6,372 | 6,343 | 6,394 | 6,304 | 6,192 | 6,140 | 6,196 | 6,142 | 6,211 | 6,191 |

| Liabilities | -2.8% | 66,096 | 67,973 | 66,284 | 67,171 | 65,479 | 66,052 | 65,285 | 65,348 | 65,179 | 66,277 | 64,089 | 64,817 | 64,112 | 62,946 | 61,747 | 62,789 | 61,655 | 63,824 | 63,000 | 64,309 | 63,248 |

| Current Liabilities | -6.8% | 32,371 | 34,728 | 33,124 | 35,314 | 31,842 | 31,531 | 30,202 | 28,963 | 29,532 | 29,847 | 25,976 | 27,508 | 26,578 | 25,717 | 24,978 | 25,231 | 26,516 | 26,621 | 27,201 | 27,735 | 27,388 |

| Short Term Borrowings | -100.0% | - | 4,643 | - | - | - | 5,957 | - | - | - | 5,404 | - | - | - | 2,015 | - | - | - | 5,166 | - | - | - |

| Shareholder's Equity | -9.5% | 17,645 | 19,503 | 20,507 | 18,256 | 18,170 | 15,891 | 15,622 | 15,759 | 17,097 | 16,516 | 16,695 | 16,880 | 16,617 | 15,378 | 14,994 | 13,777 | 14,239 | 14,629 | 14,993 | 14,878 | 15,478 |

| Retained Earnings | 5.6% | 54,108 | 51,250 | 49,888 | 47,094 | 45,457 | 43,514 | 43,304 | 41,263 | 40,820 | 39,282 | 38,361 | 36,934 | 36,697 | 35,167 | 35,508 | 34,841 | 35,504 | 34,437 | 34,477 | 32,981 | 32,435 |

| Shares Outstanding | -3.3% | 494 | 511 | 510 | 513 | 516 | 527 | 525 | 531 | 535 | 544 | 544 | 547 | 546 | 544 | 542 | 545 | 547 | 562 | 565 | 570 | 572 |

| Minority Interest | -33.3% | 6.00 | 9.00 | 18.00 | 21.00 | 21.00 | 22.00 | 31.00 | 32.00 | 32.00 | 32.00 | 30.00 | 47.00 | 44.00 | 47.00 | 45.00 | 43.00 | 42.00 | 41.00 | 41.00 | 41.00 | 41.00 |

| Float | - | - | - | - | 125,000 | - | - | - | 94,700 | - | - | - | 118,100 | - | - | - | 67,900 | - | - | - | 76,800 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -48.7% | 2,052 | 4,003 | 4,060 | 3,249 | 1,573 | 2,739 | 2,481 | 2,233 | 313 | 1,412 | 1,740 | 2,118 | 1,928 | 2,072 | 1,734 | 1,391 | 1,130 | 2,434 | 769 | 2,588 | 1,121 |

| Share Based Compensation | - | - | - | - | - | 44.00 | - | 55.00 | 67.00 | 40.00 | - | 58.00 | 69.00 | 42.00 | - | 55.00 | 67.00 | 47.00 | - | 57.00 | 68.00 | 45.00 |

| Cashflow From Investing | 272.9% | 958 | -554 | -3,435 | -1,199 | -683 | -843 | 190 | -575 | -1,313 | -992 | -375 | -1,240 | -477 | -526 | -216 | -530 | -213 | -574 | -275 | -898 | -181 |

| Cashflow From Financing | -64.9% | -5,000 | -3,033 | -1,400 | -1,393 | -1,106 | -1,123 | -2,267 | -2,176 | -1,715 | -586 | -2,746 | -1,402 | 546 | -1,542 | -1,000 | 786 | -1,999 | -1,507 | 20.00 | -1,376 | -1,675 |

| Dividend Payments | -2.1% | 648 | 662 | 663 | 618 | 620 | 620 | 633 | 592 | 595 | 599 | 607 | 564 | 562 | 560 | 558 | 558 | 567 | 568 | 578 | 492 | 494 |

| Buy Backs | 61.1% | 4,455 | 2,766 | 380 | 1,429 | 400 | 921 | 1,385 | 1,104 | 820 | 1,046 | 1,371 | 251 | - | - | - | 87.00 | 1,043 | 730 | 1,300 | 1,300 | 751 |

CAT Income Statement

2024-03-31Consolidated Statement of Results of Operations - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |||||

|---|---|---|---|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |||||

| Sales and revenues: | ||||||

| Total sales and revenues | $ 15,799 | $ 15,862 | ||||

| Operating costs: | ||||||

| Cost of goods sold | 9,662 | 10,103 | ||||

| Selling, general and administrative expenses | 1,577 | 1,463 | ||||

| Research and development expenses | 520 | 472 | ||||

| Other operating (income) expenses | 223 | 876 | ||||

| Total operating costs | 12,280 | 13,131 | ||||

| Operating profit | 3,519 | 2,731 | ||||

| Other income (expense) | 156 | 32 | ||||

| Consolidated profit before taxes | 3,532 | 2,634 | ||||

| Provision (benefit) for income taxes | 688 | 708 | ||||

| Profit of consolidated companies | 2,844 | 1,926 | ||||

| Equity in profit (loss) of unconsolidated affiliated companies | 10 | 16 | ||||

| Profit of consolidated and affiliated companies | 2,854 | 1,942 | ||||

| Less: Profit (loss) attributable to noncontrolling interests | (2) | (1) | ||||

| Profit | [1] | $ 2,856 | $ 1,943 | |||

| Profit per common share (in dollars per share) | $ 5.78 | $ 3.76 | ||||

| Profit per common share - diluted (in dollars per share) | [2] | $ 5.75 | $ 3.74 | |||

| Weighted-average common shares outstanding (millions) | ||||||

| Basic (in shares) | 493.9 | 516.2 | ||||

| Diluted (in shares) | [2] | 496.9 | 519.4 | |||

| Machinery, Energy & Transportation | ||||||

| Sales and revenues: | ||||||

| Total sales and revenues | $ 14,960 | $ 15,099 | ||||

| Financial Products | ||||||

| Sales and revenues: | ||||||

| Total sales and revenues | 839 | 763 | ||||

| Operating costs: | ||||||

| Interest expense of Financial Products | 298 | 217 | ||||

| All other excluding Financial Products | ||||||

| Operating costs: | ||||||

| Interest expense excluding Financial Products | $ 143 | $ 129 | ||||

| ||||||

CAT Balance Sheet

2024-03-31Consolidated Statement of Financial Position - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 4,959 | $ 6,978 |

| Receivables – trade and other | 9,296 | 9,310 |

| Receivables – finance | 9,446 | 9,510 |

| Prepaid expenses and other current assets | 3,010 | 4,586 |

| Inventories | 16,953 | 16,565 |

| Total current assets | 43,664 | 46,949 |

| Property, plant and equipment – net | 12,538 | 12,680 |

| Long-term receivables – trade and other | 1,200 | 1,238 |

| Long-term receivables – finance | 12,531 | 12,664 |

| Noncurrent deferred and refundable income taxes | 2,860 | 2,816 |

| Intangible assets | 516 | 564 |

| Goodwill | 5,277 | 5,308 |

| Other assets | 5,155 | 5,257 |

| Total assets | 83,741 | 87,476 |

| Short-term borrowings: | ||

| Accounts payable | 7,778 | 7,906 |

| Accrued expenses | 4,821 | 4,958 |

| Accrued wages, salaries and employee benefits | 1,291 | 2,757 |

| Customer advances | 2,194 | 1,929 |

| Dividends payable | 0 | 649 |

| Other current liabilities | 3,265 | 3,123 |

| Long-term debt due within one year: | ||

| Total current liabilities | 32,371 | 34,728 |

| Long-term debt due after one year: | ||

| Liability for postemployment benefits | 4,068 | 4,098 |

| Other liabilities | 4,826 | 4,675 |

| Total liabilities | 66,096 | 67,973 |

| Commitments and contingencies (Notes 11 and 14) | ||

| Shareholders’ equity | ||

| Common stock, authorized and issued | 5,663 | 6,403 |

| Treasury stock: (3/31/24 – 325,621,704 shares; 12/31/23 – 315,517,355 shares) at cost | (40,039) | (36,339) |

| Profit employed in the business | 54,108 | 51,250 |

| Accumulated other comprehensive income (loss) | (2,093) | (1,820) |

| Noncontrolling interests | 6 | 9 |

| Total shareholders’ equity | 17,645 | 19,503 |

| Total liabilities and shareholders’ equity | 83,741 | 87,476 |

| Financial Products | ||

| Short-term borrowings: | ||

| Short-term borrowings | 3,568 | 4,643 |

| Long-term debt due within one year: | ||

| Long-term debt due within one year | 8,409 | 7,719 |

| Long-term debt due after one year: | ||

| Long-term debt due after one year | 16,292 | 15,893 |

| Machinery, Energy & Transportation | ||

| Long-term debt due within one year: | ||

| Long-term debt due within one year | 1,045 | 1,044 |

| Long-term debt due after one year: | ||

| Long-term debt due after one year | $ 8,539 | $ 8,579 |

| WEBSITE | caterpillar.com |

|---|---|

| INDUSTRY | Apparel Manufacturing |