Market Summary

DD Alerts

DD Stock Price

DD RSI Chart

DD Valuation

DD Price/Sales (Trailing)

DD Profitability

DD Fundamentals

DD Revenue

DD Earnings

Breaking Down DD Revenue

52 Week Range

Last 7 days

1.4%

Last 30 days

2.0%

Last 90 days

16.4%

Trailing 12 Months

22.9%

How does DD drawdown profile look like?

DD Financial Health

DD Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 12.0B | 0 | 0 | 0 |

| 2023 | 12.8B | 12.5B | 12.3B | 12.1B |

| 2022 | 12.8B | 13.0B | 13.2B | 13.0B |

| 2021 | 13.7B | 13.5B | 13.1B | 12.6B |

| 2020 | 15.2B | 14.6B | 14.3B | 14.3B |

| 2019 | 20.9B | 18.9B | 17.1B | 15.4B |

| 2018 | 39.7B | 31.7B | 22.0B | 22.6B |

| 2017 | 50.7B | 52.6B | 55.4B | 47.3B |

| 2016 | 48.6B | 48.5B | 48.3B | 48.2B |

| 2015 | 0 | 0 | 0 | 48.8B |

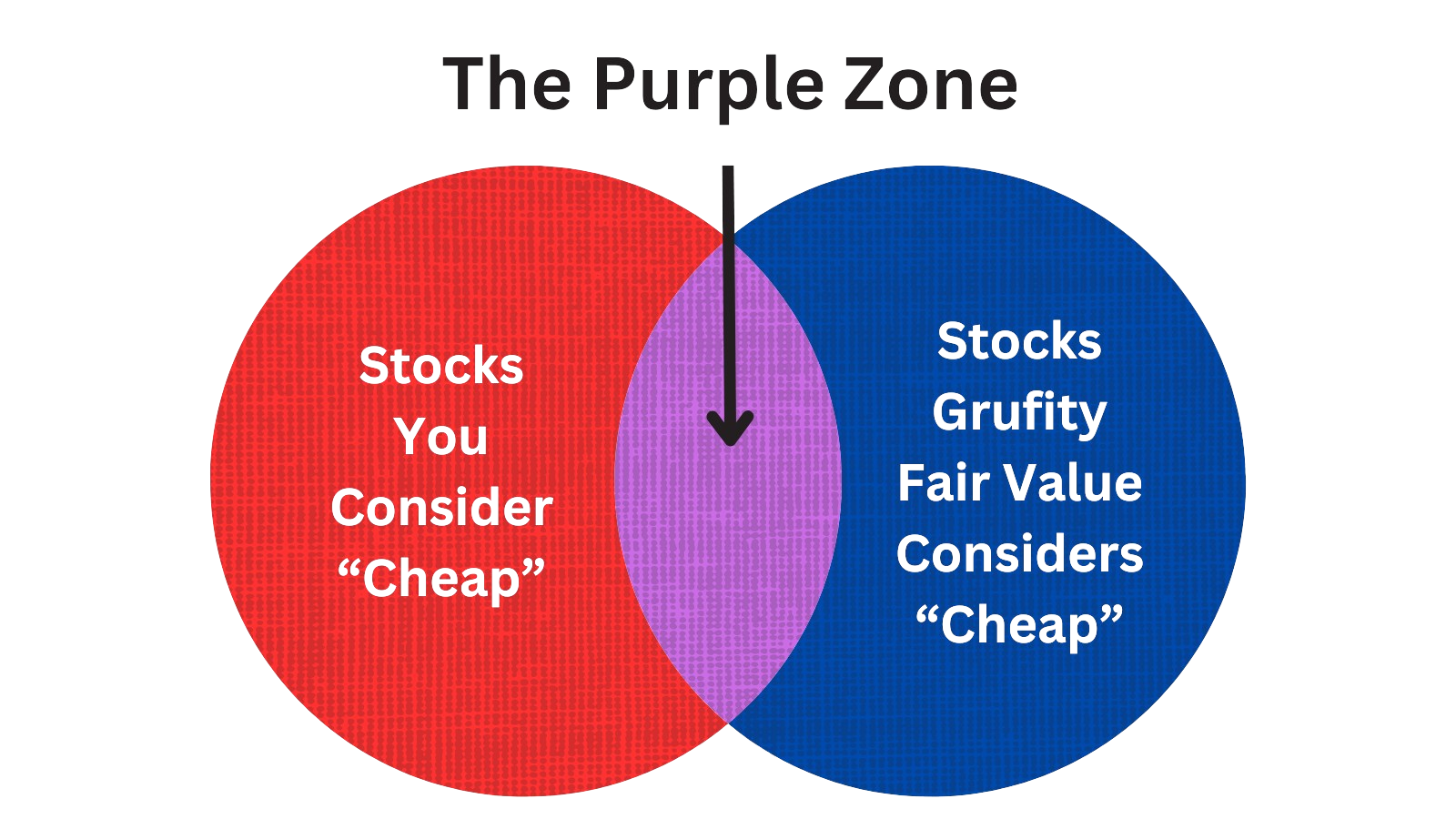

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of DuPont de Nemours Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 09, 2024 | goss michael g. | sold | -104,884 | 78.33 | -1,339 | controller |

| May 06, 2024 | weaver leland | sold | -1,450,400 | 78.4 | -18,500 | president, water & protection |

| May 04, 2024 | koch lori | sold (taxes) | -227,681 | 77.76 | -2,928 | evp & cfo |

| May 04, 2024 | breen edward d | sold (taxes) | -881,798 | 77.76 | -11,340 | chief executive officer |

| May 04, 2024 | raia christopher | sold (taxes) | -94,945 | 77.76 | -1,221 | senior vice president & chro |

| May 04, 2024 | hoover erik t. | sold (taxes) | -113,918 | 77.76 | -1,465 | svp & general counsel |

| May 04, 2024 | larrabee steven p. | sold (taxes) | -43,467 | 77.76 | -559 | svp & cio |

| May 04, 2024 | weaver leland | sold (taxes) | -113,918 | 77.76 | -1,465 | president, water & protection |

| May 04, 2024 | kemp jon d. | sold (taxes) | -128,071 | 77.76 | -1,647 | president, electronics & indus |

| May 04, 2024 | goss michael g. | sold (taxes) | -20,528 | 77.76 | -264 | controller |

Which funds bought or sold DD recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 08, 2024 | DEARBORN PARTNERS LLC | sold off | -100 | -289,175 | - | -% |

| May 08, 2024 | ROGCO, LP | unchanged | - | -14.00 | 4,140 | -% |

| May 08, 2024 | EVERENCE CAPITAL MANAGEMENT INC | unchanged | - | -2,000 | 624,000 | 0.04% |

| May 08, 2024 | TD Asset Management Inc | reduced | -4.48 | -689,530 | 13,681,300 | 0.01% |

| May 08, 2024 | GW&K Investment Management, LLC | reduced | -13.61 | -2,000 | 13,000 | -% |

| May 08, 2024 | GREAT LAKES ADVISORS, LLC | added | 0.25 | -51,873 | 56,719,700 | 0.48% |

| May 08, 2024 | Achmea Investment Management B.V. | sold off | -100 | -710,000 | - | -% |

| May 08, 2024 | Ruffer LLP | unchanged | - | -6,820 | 1,686,190 | 0.06% |

| May 08, 2024 | PROFUND ADVISORS LLC | reduced | -5.3 | -50,982 | 855,561 | 0.03% |

| May 08, 2024 | COMMONWEALTH OF PENNSYLVANIA PUBLIC SCHOOL EMPLS RETRMT SYS | added | 0.26 | -5,471 | 7,239,340 | 0.05% |

Are Funds Buying or Selling DD?

DD Alerts

Unveiling DuPont de Nemours Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 11.17% | 48,043,862 | SC 13G/A | |

| Feb 09, 2024 | massachusetts financial services co /ma/ | 5.2% | 22,155,892 | SC 13G | |

| Jan 26, 2024 | blackrock inc. | 7.1% | 30,389,248 | SC 13G/A | |

| Dec 08, 2023 | vanguard group inc | 10.46% | 44,973,793 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 8.27% | 41,097,386 | SC 13G/A | |

| Feb 07, 2023 | blackrock inc. | 6.9% | 34,048,779 | SC 13G/A | |

| Feb 03, 2023 | state street corp | 4.03% | 20,033,500 | SC 13G/A | |

| Feb 09, 2022 | vanguard group inc | 8.21% | 42,557,331 | SC 13G/A | |

| Feb 03, 2022 | blackrock inc. | 7.0% | 36,179,121 | SC 13G/A | |

| Feb 16, 2021 | state street corp | 4.96% | 36,400,924 | SC 13G/A |

Recent SEC filings of DuPont de Nemours Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 10, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 144 | Notice of Insider Sale Intent | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to DuPont de Nemours Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

APD | 55.8B | 12.2B | 4.58% | -10.79% | 22.58 | 4.59 | -7.47% | 13.44% |

DOW | 41.9B | 43.5B | -0.68% | 11.24% | 33.01 | 0.96 | -18.61% | -57.39% |

CE | 17.6B | 10.7B | -2.89% | 56.87% | 8.86 | 1.65 | 7.11% | 34.19% |

AVTR | 16.8B | 6.9B | -4.22% | 20.36% | 64.71 | 2.45 | -6.48% | -57.90% |

ALB | 15.7B | 8.4B | 3.41% | -31.33% | 46.53 | 1.87 | -4.27% | -90.82% |

EMN | 11.9B | 9.1B | -0.88% | 27.35% | 12.85 | 1.31 | -11.38% | 33.67% |

| MID-CAP | ||||||||

CBT | 5.6B | 3.9B | 3.70% | 47.94% | 12.61 | 1.44 | -8.19% | 39.97% |

BCPC | 5.0B | 929.6M | 0.94% | 23.83% | 43.78 | 5.41 | -1.74% | 15.81% |

AVNT | 4.2B | 3.1B | 5.12% | 17.67% | 39.61 | 1.33 | -6.69% | -83.56% |

ARCH | 2.9B | 3.0B | 3.58% | 25.10% | 9.16 | 0.99 | -20.68% | -74.38% |

| SMALL-CAP | ||||||||

CCF | 1.2B | 404.0M | 0.11% | 32.60% | 36.59 | 3 | 24.06% | -25.72% |

ASIX | 658.4M | 1.5B | -16.99% | -29.19% | 289.66 | 0.45 | -21.27% | -97.94% |

CMT | 178.5M | 336.4M | 7.61% | -4.59% | 9.79 | 0.53 | -12.92% | 28.47% |

AREC | 104.5M | 16.7M | -7.09% | -18.63% | -8.83 | 6.24 | -57.58% | -718.66% |

AMRS | 3.7M | - | -80.00% | -99.58% | -0.01 | 0.01 | - | - |

DuPont de Nemours Inc News

DuPont de Nemours Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 1.1% | 2,931 | 2,898 | 3,058 | 3,094 | 3,018 | 3,104 | 3,317 | 3,322 | 3,274 | 3,246 | 3,199 | 3,104 | 3,017 | 3,750 | 3,629 | 3,289 | 3,670 | 3,746 | 3,901 | 3,910 | 3,879 |

| S&GA Expenses | 9.7% | 384 | 350 | 360 | 358 | 340 | 337 | 356 | 385 | 389 | 401 | 411 | 395 | 395 | 193 | 403 | 414 | 482 | 44.00 | 645 | 642 | 726 |

| R&D Expenses | -2.3% | 125 | 128 | 128 | 125 | 127 | 123 | 129 | 141 | 143 | 148 | 137 | 133 | 139 | 99.00 | 140 | 153 | 173 | -35.00 | 225 | 232 | 267 |

| EBITDA Margin | -3.8% | 0.13* | 0.14* | 0.24* | 0.24* | 0.24* | 0.24* | 0.22* | 0.21* | 0.23* | 0.24* | 0.42* | 0.43* | - | - | - | - | - | - | - | - | - |

| Income Taxes | 126.6% | 84.00 | -316 | 117 | 87.00 | 83.00 | 88.00 | 139 | 113 | 47.00 | 65.00 | 80.00 | 93.00 | -1.00 | -134 | 122 | 8.00 | 94.00 | -144 | 78.00 | 155 | -91.00 |

| Earnings Before Taxes | 143.3% | 267 | -616 | 408 | 356 | 356 | 193 | 498 | 478 | 279 | 232 | 339 | 488 | 385 | 1,370 | 208 | -2,381 | -456 | 537 | 450 | -948 | -165 |

| EBT Margin | -17.1% | 0.03* | 0.04* | 0.11* | 0.11* | 0.12* | 0.11* | 0.11* | 0.10* | 0.10* | 0.11* | 0.20* | 0.18* | - | - | - | - | - | - | - | - | - |

| Net Income | 959.1% | 189 | -22.00 | 319 | -131 | 257 | 4,226 | 367 | 787 | 488 | 204 | 391 | 478 | 5,394 | 222 | -79.00 | -2,478 | -616 | 176 | 372 | -571 | 521 |

| Net Income Margin | -15.5% | 0.03* | 0.04* | 0.38* | 0.38* | 0.44* | 0.45* | 0.14* | 0.14* | 0.12* | 0.51* | 0.50* | 0.45* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -23.7% | 493 | 646 | 740 | 462 | 343 | 185 | 578 | 277 | 209 | 186 | 842 | 440 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -2.2% | 37,717 | 38,552 | 39,133 | 40,797 | 41,208 | 41,355 | 44,099 | 44,440 | 45,393 | 45,707 | 46,015 | 45,839 | 47,804 | 70,903 | 72,141 | 66,753 | 67,987 | 69,349 | 70,119 | 70,843 | 189,785 |

| Current Assets | -5.9% | 7,067 | 7,514 | 7,935 | 11,127 | 11,200 | 11,270 | 14,350 | 14,006 | 14,443 | 14,303 | 8,497 | 10,492 | 12,540 | 29,008 | 12,606 | 11,986 | 10,392 | 9,999 | 10,688 | 10,623 | 49,248 |

| Cash Equivalents | -1.9% | 2,347 | 2,392 | 1,338 | 4,885 | 3,525 | 3,662 | 1,896 | 1,500 | 1,734 | 2,037 | 1,700 | 3,942 | 4,364 | 8,733 | 10,233 | 3,762 | 1,776 | 1,522 | 2,147 | 1,701 | 12,066 |

| Inventory | 1.3% | 2,175 | 2,147 | 2,279 | 2,341 | 2,443 | 2,329 | 2,359 | 2,356 | 2,238 | 2,086 | 2,844 | 2,642 | 2,499 | 2,393 | 3,902 | 4,307 | 4,410 | 2,897 | 4,306 | 4,390 | 16,604 |

| Net PPE | - | - | - | - | - | - | - | 5,477 | 5,564 | 5,668 | 5,753 | 6,921 | 6,856 | 6,744 | 6,867 | 9,686 | 9,909 | 9,912 | 7,100 | 9,699 | 9,806 | 35,575 |

| Goodwill | -0.6% | 16,613 | 16,720 | 17,251 | 16,643 | 16,703 | 16,663 | 16,302 | 16,610 | 16,878 | 16,981 | 19,688 | 1,213 | 18,511 | 16,040 | 29,690 | 30,018 | 32,317 | 22,139 | 32,935 | 33,330 | 58,948 |

| Liabilities | -0.9% | 13,705 | 13,827 | 14,506 | 14,244 | 14,047 | 14,338 | 18,596 | 18,303 | 18,602 | 18,657 | 18,776 | 18,375 | 20,099 | 31,834 | 34,023 | 29,176 | 27,870 | 27,793 | 28,207 | 28,267 | - |

| Current Liabilities | -2.1% | 3,032 | 3,098 | 3,688 | 3,739 | 3,406 | 3,733 | 6,014 | 5,494 | 5,122 | 4,931 | 4,221 | 3,940 | 5,667 | 12,226 | 6,984 | 8,010 | 8,545 | 8,345 | 6,616 | 6,457 | 28,580 |

| Short Term Borrowings | - | - | - | - | - | - | - | 1,287 | 661 | 405 | 150 | - | - | - | - | - | - | - | - | - | - | - |

| Long Term Debt | -0.3% | 7,776 | 7,800 | 7,740 | 7,775 | 7,807 | 7,774 | 10,564 | 10,625 | 10,634 | 10,632 | 10,629 | 10,627 | 10,625 | 15,611 | 21,802 | 15,608 | 13,618 | 13,611 | 15,610 | 15,608 | 34,966 |

| Shareholder's Equity | -1.1% | 24,012 | 24,279 | 24,192 | 26,553 | 27,161 | 26,569 | 25,503 | 26,137 | 26,791 | 27,050 | 27,239 | 27,464 | 27,705 | 39,070 | 38,118 | 37,577 | 40,117 | 41,556 | 41,912 | 42,576 | 93,820 |

| Retained Earnings | -2.8% | -23,519 | -22,874 | -22,854 | -20,938 | -20,807 | -21,065 | -22,692 | -22,808 | -23,096 | -23,187 | -22,892 | -22,783 | -22,618 | -11,586 | -11,808 | -11,728 | -9,251 | -8,400 | -8,289 | -8,299 | 29,764 |

| Additional Paid-In Capital | 0.4% | 48,238 | 48,059 | 48,190 | 47,946 | 48,256 | 48,420 | 49,199 | 49,176 | 49,487 | 49,574 | 49,702 | 49,681 | 49,964 | 50,039 | 50,219 | 50,191 | 50,605 | 50,796 | 51,155 | 51,129 | 82,125 |

| Accumulated Depreciation | 2.2% | 4,949 | 4,841 | 4,711 | 4,663 | 4,574 | 4,448 | 4,227 | 4,253 | 4,215 | 4,142 | 4,599 | 4,528 | 4,359 | 4,256 | 5,757 | 5,466 | 5,189 | 3,522 | 4,822 | 4,667 | 40,383 |

| Shares Outstanding | -6.0% | 423 | 450 | 452 | 459 | 459 | 499 | 499 | 509 | 512 | 543 | 522 | 567 | - | - | - | - | - | - | - | - | - |

| Minority Interest | -4.0% | 428 | 446 | 435 | 430 | 424 | 448 | 594 | 609 | 615 | 617 | 606 | 587 | 517 | 566 | 559 | 572 | 566 | 569 | 568 | 570 | 1,654 |

| Float | - | - | - | - | 33,000 | - | - | - | 28,000 | - | - | - | 41,000 | - | - | - | 39,000 | - | - | - | 56.10* | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -23.7% | 493 | 646 | 740 | 462 | 343 | 185 | 578 | 277 | 209 | 186 | 842 | 440 | 378 | 1,301 | 1,274 | 802 | 718 | 578 | 882 | -77.00 | 26.00 |

| Cashflow From Investing | -118.5% | -202 | 1,091 | -1,870 | 1,210 | -259 | 9,133 | -78.00 | 178 | -229 | 429 | -2,398 | 1,931 | -2,260 | -237 | 383 | -224 | -124 | -506 | -150 | -657 | -1,000 |

| Cashflow From Financing | -9.7% | -691 | -630 | -1,982 | -164 | -213 | -7,185 | 197 | -400 | -258 | -1,668 | -665 | -2,798 | -2,458 | -2,592 | 4,780 | 1,394 | -344 | -653 | -236 | -9,629 | -1,032 |

| Dividend Payments | -100.0% | - | 156 | 165 | 165 | 165 | 152 | 165 | 166 | 169 | 154 | 157 | 158 | 161 | 220 | 220 | 220 | 222 | 222 | 224 | 314 | 851 |

| Buy Backs | - | - | - | 2,000 | - | - | - | - | - | 375 | 1,072 | - | - | 500 | - | - | - | 232 | -3,211 | 359 | 7,102 | 1,579 |

DD Income Statement

2024-03-31Consolidated Statements of Operations - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Income Statement [Abstract] | ||

| Net sales | $ 2,931 | $ 3,018 |

| Cost of sales | 1,918 | 1,983 |

| Research and development expenses | 125 | 127 |

| Selling, general and administrative expenses | 384 | 340 |

| Amortization of intangibles | 149 | 147 |

| Restructuring and asset related charges - net | 39 | 14 |

| Acquisition, integration and separation costs | 3 | 0 |

| Equity in earnings of nonconsolidated affiliates | 12 | 15 |

| Sundry income (expense) - net | 38 | 29 |

| Interest expense | 96 | 95 |

| Income from continuing operations before income taxes | 267 | 356 |

| Provision for income taxes on continuing operations | 84 | 83 |

| Income from continuing operations, net of tax | 183 | 273 |

| Income (loss) from discontinued operations, net of tax | 14 | (8) |

| Net income | 197 | 265 |

| Net income attributable to noncontrolling interests | 8 | 8 |

| Net income available for DuPont common stockholders | $ 189 | $ 257 |

| Per common share data: | ||

| Earnings per common share from continuing operations - basic (in usd per share) | $ 0.41 | $ 0.58 |

| Earnings (loss) per common share from discontinued operations - basic (in usd per share) | 0.03 | (0.02) |

| Earnings per common share - basic (in usd per share) | 0.45 | 0.56 |

| Earnings per common share from continuing operations - diluted (in usd per share) | 0.41 | 0.58 |

| Earnings (loss) per common share from discontinued operations - diluted (in usd per share) | 0.03 | (0.02) |

| Earnings per common share - diluted (in usd per share) | $ 0.45 | $ 0.56 |

| Weighted-average common shares outstanding - basic (in shares) | 422.8 | 458.8 |

| Weighted-average common shares outstanding - diluted (in shares) | 424.3 | 460.2 |

DD Balance Sheet

2024-03-31Condensed Consolidated Balance Sheets - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current Assets | ||

| Cash and cash equivalents | $ 1,934 | $ 2,392 |

| Restricted cash and cash equivalents | 413 | 411 |

| Accounts and notes receivable - net | 2,365 | 2,370 |

| Inventories | 2,175 | 2,147 |

| Prepaid and other current assets | 180 | 194 |

| Total current assets | 7,067 | 7,514 |

| Property, plant and equipment - net of accumulated depreciation (March 31, 2024 - $4,949; December 31, 2023 - $4,841) | 5,772 | 5,884 |

| Other Assets | ||

| Goodwill | 16,613 | 16,720 |

| Other intangible assets | 5,640 | 5,814 |

| Investments and noncurrent receivables | 1,086 | 1,071 |

| Deferred income tax assets | 288 | 312 |

| Deferred charges and other assets | 1,251 | 1,237 |

| Total other assets | 24,878 | 25,154 |

| Total Assets | 37,717 | 38,552 |

| Current Liabilities | ||

| Accounts payable | 1,624 | 1,675 |

| Income taxes payable | 153 | 154 |

| Accrued and other current liabilities | 1,255 | 1,269 |

| Total current liabilities | 3,032 | 3,098 |

| Long-Term Debt | 7,776 | 7,800 |

| Other Noncurrent Liabilities | ||

| Deferred income tax liabilities | 1,098 | 1,130 |

| Pension and other post-employment benefits - noncurrent | 549 | 565 |

| Other noncurrent obligations | 1,250 | 1,234 |

| Total other noncurrent liabilities | 2,897 | 2,929 |

| Total Liabilities | 13,705 | 13,827 |

| Commitments and contingent liabilities | ||

| Stockholders' Equity | ||

| Common stock (authorized 1,666,666,667 shares of $0.01 par value each; issued 2024: 418,074,174 shares; 2023: 430,110,140 shares) | 4 | 4 |

| Additional paid-in capital | 48,238 | 48,059 |

| Accumulated deficit | (23,519) | (22,874) |

| Accumulated other comprehensive loss | (1,139) | (910) |

| Total DuPont stockholders' equity | 23,584 | 24,279 |

| Noncontrolling interests | 428 | 446 |

| Total equity | 24,012 | 24,725 |

| Total Liabilities and Equity | $ 37,717 | $ 38,552 |

| CEO | Mr. Edward D. Breen |

|---|---|

| WEBSITE | dupont.com |

| INDUSTRY | Chemicals |

| EMPLOYEES | 23000 |