Market Summary

GILD Stock Price

GILD RSI Chart

GILD Valuation

GILD Price/Sales (Trailing)

GILD Profitability

GILD Fundamentals

GILD Revenue

GILD Earnings

Breaking Down GILD Revenue

52 Week Range

Last 7 days

-1.1%

Last 30 days

-7.6%

Last 90 days

-12.3%

Trailing 12 Months

-17.3%

How does GILD drawdown profile look like?

GILD Financial Health

GILD Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 27.4B | 0 | 0 | 0 |

| 2023 | 27.0B | 27.4B | 27.4B | 27.1B |

| 2022 | 27.5B | 27.5B | 27.1B | 27.3B |

| 2021 | 25.6B | 26.6B | 27.5B | 27.3B |

| 2020 | 22.7B | 22.2B | 23.1B | 24.7B |

| 2019 | 22.3B | 22.4B | 22.4B | 22.4B |

| 2018 | 24.7B | 23.2B | 22.3B | 22.1B |

| 2017 | 29.1B | 28.5B | 27.5B | 26.1B |

| 2016 | 32.8B | 32.4B | 31.6B | 30.4B |

| 2015 | 27.5B | 29.2B | 31.4B | 32.6B |

| 2014 | 13.7B | 17.4B | 20.7B | 24.9B |

| 2013 | 10.0B | 10.3B | 10.7B | 11.2B |

| 2012 | 8.7B | 9.0B | 9.3B | 9.7B |

| 2011 | 7.8B | 8.0B | 8.2B | 8.4B |

| 2010 | 7.6B | 7.8B | 8.0B | 7.9B |

| 2009 | 5.6B | 6.0B | 6.4B | 7.0B |

| 2008 | 0 | 4.6B | 5.0B | 5.3B |

| 2007 | 0 | 0 | 0 | 4.2B |

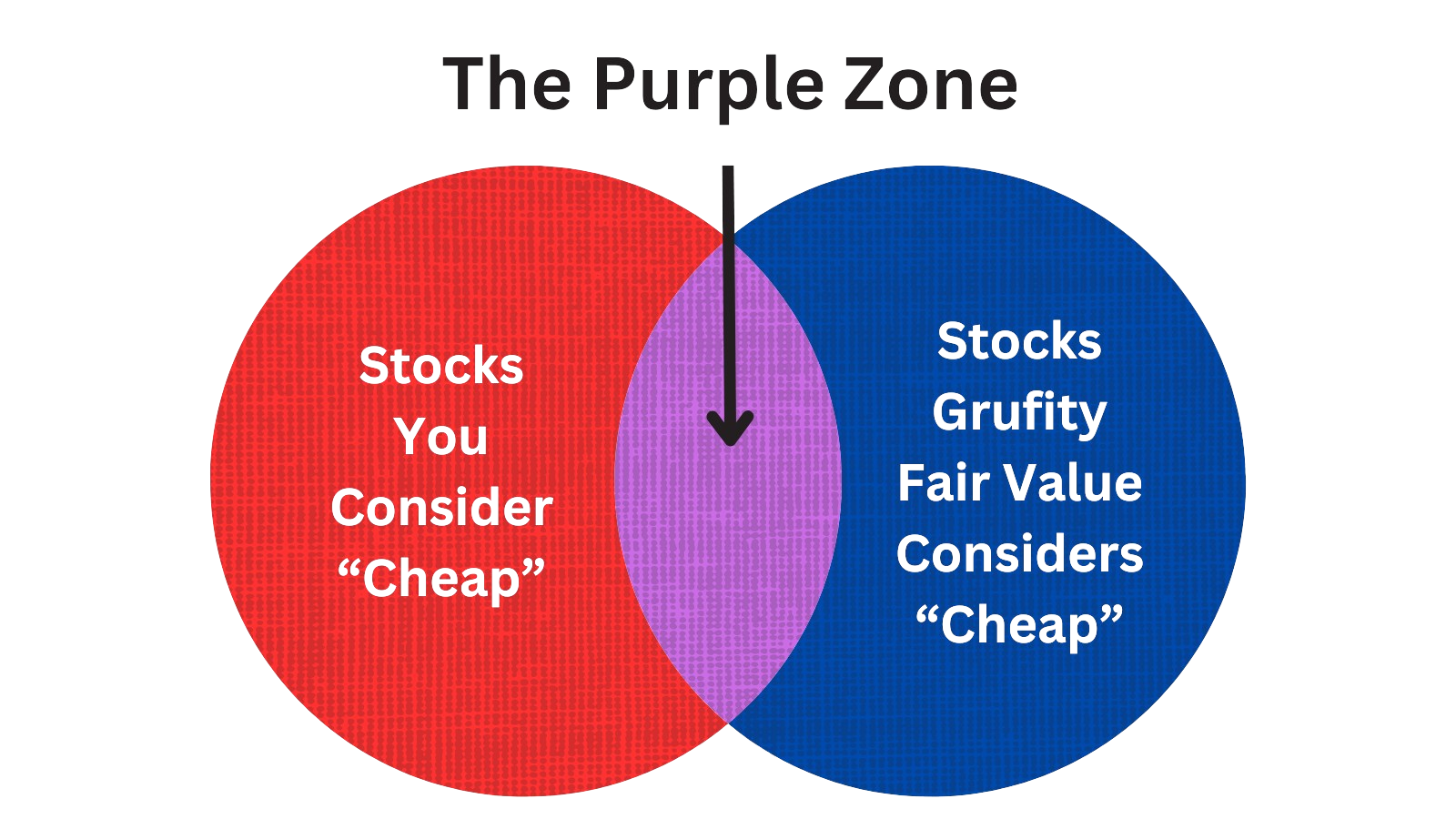

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Gilead Sciences Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 08, 2024 | welters anthony | acquired | - | - | 2,310 | - |

| May 08, 2024 | love ted w | acquired | - | - | 2,310 | - |

| May 08, 2024 | manwani harish | sold (taxes) | -29,278 | 64.92 | -451 | - |

| May 08, 2024 | manwani harish | acquired | - | - | 2,310 | - |

| May 08, 2024 | rodriguez javier | acquired | - | - | 2,310 | - |

| May 08, 2024 | barton jacqueline k | acquired | - | - | 2,310 | - |

| Apr 25, 2024 | telman deborah h | acquired | - | - | 515 | evp, corporate affairs & gc |

| Apr 25, 2024 | telman deborah h | sold (taxes) | -10,312 | 65.27 | -158 | evp, corporate affairs & gc |

| Apr 01, 2024 | parsey merdad | sold | -145,920 | 72.96 | -2,000 | chief medical officer |

| Mar 10, 2024 | parsey merdad | acquired | - | - | 10,401 | chief medical officer |

Which funds bought or sold GILD recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 08, 2024 | CIDEL ASSET MANAGEMENT INC | added | 4.85 | -35,773 | 652,731 | 0.05% |

| May 08, 2024 | Sandy Spring Bank | reduced | -17.93 | -73,297 | 210,887 | 0.01% |

| May 08, 2024 | KBC Group NV | added | 122 | 116,249,000 | 231,409,000 | 0.74% |

| May 08, 2024 | EDMOND DE ROTHSCHILD HOLDING S.A. | reduced | -0.83 | -1,871,010 | 16,238,200 | 0.27% |

| May 08, 2024 | LETKO, BROSSEAU & ASSOCIATES INC | added | 0.35 | -7,105,790 | 69,621,000 | 1.21% |

| May 08, 2024 | Belpointe Asset Management LLC | added | 5.34 | -40,182 | 806,232 | 0.06% |

| May 08, 2024 | PRIVATE MANAGEMENT GROUP INC | added | 0.07 | -3,476,190 | 33,062,600 | 1.25% |

| May 08, 2024 | Moors & Cabot, Inc. | added | 14.92 | 68,395 | 1,816,540 | 0.10% |

| May 08, 2024 | Focused Wealth Management, Inc | sold off | -100 | -90,280 | - | -% |

| May 08, 2024 | ProShare Advisors LLC | added | 21.66 | 9,865,420 | 108,482,000 | 0.29% |

Are Funds Buying or Selling GILD?

Unveiling Gilead Sciences Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 8.97% | 111,820,711 | SC 13G/A | |

| Feb 09, 2024 | capital world investors | 6.7% | 83,698,215 | SC 13G/A | |

| Jan 24, 2024 | blackrock inc. | 9.9% | 122,790,297 | SC 13G/A | |

| Feb 13, 2023 | capital world investors | 5.5% | 68,900,998 | SC 13G | |

| Feb 13, 2023 | capital research global investors | 4.4% | 54,602,952 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 8.93% | 112,038,324 | SC 13G/A | |

| Jan 31, 2023 | blackrock inc. | 10.5% | 131,555,769 | SC 13G/A | |

| Jul 08, 2022 | blackrock inc. | 10.1% | 126,932,693 | SC 13G | |

| Feb 11, 2022 | capital research global investors | 8.5% | 107,156,981 | SC 13G/A | |

| Feb 10, 2022 | vanguard group inc | 8.43% | 105,803,799 | SC 13G/A |

Recent SEC filings of Gilead Sciences Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 8-K | Current Report | |

| May 08, 2024 | 10-Q | Quarterly Report |

- …

Peers (Alternatives to Gilead Sciences Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

JNJ | 360.6B | 85.6B | -1.57% | -7.27% | 9.37 | 4.21 | 5.68% | 202.39% |

MRK | 329.8B | 61.4B | 2.75% | 10.43% | 143.04 | 5.37 | 6.11% | -82.30% |

AMGN | 167.8B | 29.5B | 15.72% | 33.63% | 44.6 | 5.68 | 12.76% | -52.47% |

PFE | 159.7B | 57.8B | 5.27% | -25.60% | 127.39 | 2.76 | 76.51% | -86.81% |

GILD | 80.5B | 27.4B | -7.64% | -17.30% | 166.06 | 2.93 | 1.51% | -91.32% |

TEVA | 18.1B | 16.0B | 14.60% | 91.74% | -36.65 | 1.13 | 7.23% | 71.10% |

| MID-CAP | ||||||||

PRGO | 4.2B | 4.6B | -3.76% | -14.95% | -549.18 | 0.93 | -0.06% | 94.55% |

ALKS | 4.1B | 1.7B | -9.20% | -22.63% | 9.45 | 2.38 | 54.01% | 364.56% |

BHC | 2.5B | 9.0B | -24.84% | 16.97% | -5.6 | 0.28 | 10.01% | -27.45% |

AMPH | 2.1B | 676.2M | 3.79% | 3.06% | 13.41 | 3.07 | 30.38% | 66.04% |

| SMALL-CAP | ||||||||

TLRY | 1.5B | 743.2M | -4.37% | -28.36% | -4.35 | 2.06 | 24.65% | 80.36% |

TXMD | 23.4M | 1.3M | -5.58% | -47.55% | -3.16 | 17.98 | -98.14% | -104.71% |

ACRX | 17.3M | - | -14.29% | 43.16% | -0.94 | 0.22 | 2882.68% | -138.52% |

AGRX | 2.5M | 19.6M | 5.41% | -93.33% | -0.17 | 0.13 | 80.00% | 43.08% |

ACOR | 807.4K | 117.6M | -57.29% | -90.96% | 0 | 0.01 | -0.79% | -283.60% |

Gilead Sciences Inc News

Gilead Sciences Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -6.0% | 6,686 | 7,114 | 7,051 | 6,599 | 6,352 | 7,389 | 7,042 | 6,260 | 6,590 | 7,244 | 7,421 | 6,217 | 6,423 | 7,421 | 6,577 | 5,143 | 5,548 | 5,879 | 5,604 | 5,685 | 5,281 |

| Costs and Expenses | 100.1% | 11,008 | 5,502 | 4,428 | 4,934 | 4,647 | 5,122 | 4,205 | 4,231 | 6,393 | 6,304 | 3,579 | 3,971 | 3,533 | 4,770 | 4,576 | 8,126 | 3,146 | 4,786 | 7,077 | 3,255 | 3,044 |

| S&GA Expenses | -14.5% | 1,375 | 1,608 | 1,315 | 1,849 | 1,319 | 2,020 | 1,213 | 1,357 | 1,083 | 1,650 | 1,190 | 1,351 | 1,055 | 1,730 | 1,106 | 1,239 | 1,076 | 1,204 | 1,052 | 1,095 | 1,030 |

| R&D Expenses | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 1,101 | 1,899 | 4,990 | 1,160 | 1,057 |

| EBITDA Margin | -71.0% | 0.09* | 0.30* | 0.31* | 0.31* | 0.32* | 0.26* | 0.21* | 0.25* | 0.26* | 0.35* | 0.39* | - | - | - | - | - | - | - | - | - | - |

| Interest Expenses | 0.8% | 254 | 252 | 232 | 230 | 230 | 226 | 229 | 242 | 238 | 238 | 250 | 256 | 257 | 267 | 236 | 240 | 241 | 243 | 250 | 248 | 254 |

| Income Taxes | -233.2% | -315 | 237 | 146 | 549 | 316 | 398 | 646 | 368 | -164 | 383 | 852 | 300 | 542 | 270 | 472 | 373 | 465 | -788 | -333 | 535 | 382 |

| Earnings Before Taxes | -371.4% | -4,486 | 1,653 | 2,318 | 1,588 | 1,300 | 2,031 | 2,432 | 1,503 | -152 | 759 | 3,438 | 1,817 | 2,264 | 1,814 | 825 | -2,973 | 2,003 | 1,901 | -1,501 | 2,410 | 2,350 |

| EBT Margin | -84.5% | 0.04* | 0.25* | 0.26* | 0.27* | 0.27* | 0.21* | 0.17* | 0.20* | 0.21* | 0.30* | 0.34* | - | - | - | - | - | - | - | - | - | - |

| Net Income | -391.7% | -4,170 | 1,430 | 2,180 | 1,045 | 1,010 | 1,640 | 1,789 | 1,144 | 19.00 | 382 | 2,592 | 1,522 | 1,729 | 1,551 | 360 | -3,339 | 1,551 | 2,696 | -1,165 | 1,880 | 1,975 |

| Net Income Margin | -91.6% | 0.02* | 0.21* | 0.21* | 0.20* | 0.21* | 0.17* | 0.12* | 0.15* | 0.16* | 0.23* | 0.27* | - | - | - | - | - | - | - | - | - | - |

| Free Cashflow | 8.2% | 2,114 | 1,954 | 1,633 | 2,199 | 1,635 | 2,386 | 2,706 | 1,659 | 1,593 | 3,049 | 3,114 | - | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -9.4% | 56,292 | 62,125 | 62,373 | 62,337 | 61,876 | 63,171 | 62,557 | 62,870 | 63,080 | 67,952 | 67,098 | 67,984 | 67,492 | 68,407 | 60,878 | 55,934 | 59,741 | 61,627 | 59,146 | 63,210 | 62,837 |

| Current Assets | -12.7% | 14,041 | 16,085 | 15,980 | 14,287 | 13,456 | 14,443 | 13,554 | 13,175 | 12,629 | 14,772 | 13,991 | 13,925 | 13,278 | 15,996 | 30,926 | 24,643 | 26,950 | 30,296 | 28,361 | 33,727 | 34,024 |

| Cash Equivalents | -22.5% | 4,718 | 6,085 | 5,705 | 5,704 | 4,936 | 5,412 | 4,699 | 4,739 | 4,296 | 5,338 | 4,362 | 4,893 | 4,065 | 5,997 | 12,886 | 6,746 | 10,051 | 11,631 | 9,474 | 11,240 | 16,927 |

| Inventory | 3.7% | 1,853 | 1,787 | 1,663 | 1,633 | 1,576 | 1,507 | 1,463 | 1,494 | 1,482 | 1,618 | 1,676 | 1,772 | 1,779 | 1,683 | 1,008 | 1,052 | 986 | 922 | 882 | 884 | 898 |

| Net PPE | 0.1% | 5,321 | 5,317 | 5,572 | 5,540 | 5,479 | 5,475 | 5,349 | 5,299 | 5,253 | 5,121 | 5,037 | 4,996 | 4,990 | 4,967 | 4,810 | 4,653 | 4,564 | 4,502 | 4,377 | 4,249 | 4,116 |

| Goodwill | 0% | 8,314 | 8,314 | 8,314 | 8,314 | 8,314 | 8,314 | 8,314 | 8,314 | 8,314 | 8,332 | 8,332 | 8,334 | 8,334 | 8,108 | 4,117 | 4,117 | 4,117 | 4,117 | 4,117 | 4,117 | 4,117 |

| Current Liabilities | 15.4% | 13,015 | 11,280 | 11,945 | 13,964 | 10,528 | 11,237 | 10,423 | 9,220 | 8,558 | 11,610 | 10,245 | 10,214 | 9,705 | 11,397 | 9,509 | 10,564 | 8,879 | 9,759 | 9,567 | 8,961 | 9,397 |

| Long Term Debt | -7.2% | 21,527 | 23,189 | 23,189 | 21,209 | 22,956 | 22,957 | 22,953 | 25,195 | 25,183 | 25,179 | 25,175 | 27,914 | 27,907 | 28,645 | 27,792 | 21,103 | 22,098 | 22,094 | 22,090 | 24,084 | 24,080 |

| LT Debt, Non Current | -100.0% | - | 23,189 | 23,189 | 21,209 | 22,956 | 22,957 | 22,953 | 25,195 | 25,183 | 25,179 | 25,175 | 27,914 | 27,907 | 28,645 | 27,792 | 21,103 | 22,098 | 22,094 | 22,090 | 24,084 | 24,080 |

| Shareholder's Equity | -23.6% | 17,455 | 22,833 | 22,314 | 21,094 | 20,939 | 21,240 | 21,057 | 20,215 | 19,915 | 21,064 | 21,471 | 19,710 | 18,964 | 18,221 | 17,471 | 18,142 | 22,179 | 22,650 | 20,736 | 22,751 | 22,091 |

| Retained Earnings | -34.6% | 10,656 | 16,304 | 16,002 | 15,138 | 15,223 | 15,687 | 15,756 | 15,117 | 14,986 | 16,324 | 16,903 | 15,392 | 14,821 | 14,381 | 13,709 | 14,445 | 18,709 | 19,388 | 17,616 | 19,829 | 19,326 |

| Additional Paid-In Capital | 4.8% | 6,813 | 6,500 | 6,279 | 6,008 | 5,793 | 5,550 | 5,226 | 5,031 | 4,867 | 4,661 | 4,492 | 4,271 | 4,092 | 3,880 | 3,712 | 3,511 | 3,311 | 3,051 | 2,870 | 2,684 | 2,494 |

| Shares Outstanding | 0% | 1,246 | 1,246 | 1,247 | 1,247 | 1,248 | 1,247 | 1,255 | 1,256 | 1,255 | 1,256 | 1,256 | 1,256 | - | - | - | - | - | - | - | - | - |

| Minority Interest | 0% | -84.00 | -84.00 | -72.00 | -64.00 | -58.00 | -31.00 | -24.00 | -21.00 | -12.00 | -5.00 | 1.00 | 7.00 | 12.00 | 19.00 | 26.00 | 115 | 112 | 125 | 132 | 135 | 140 |

| Float | - | - | - | - | 67,000 | - | - | - | 55,900 | - | - | - | 62,600 | - | - | - | 69,900 | - | - | - | 66,400 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | 2.3% | 2,219 | 2,169 | 1,755 | 2,338 | 1,744 | 2,567 | 2,863 | 1,802 | 1,840 | 3,205 | 3,253 | 2,316 | 2,610 | 1,916 | 2,250 | 2,566 | 1,436 | 2,580 | 2,645 | 2,342 | 1,577 |

| Share Based Compensation | -7.0% | 187 | 201 | 202 | 198 | 165 | 174 | 168 | 165 | 130 | 159 | 171 | 166 | 139 | 161 | 173 | 168 | 141 | 157 | 162 | 174 | 143 |

| Cashflow From Investing | -203.6% | -2,207 | -727 | -229 | -483 | -826 | -375 | -713 | -308 | -1,070 | -278 | -234 | -577 | -2,042 | -8,977 | -271 | -5,023 | -344 | 431 | -1,841 | -6,163 | -244 |

| Cashflow From Financing | -23.8% | -1,361 | -1,099 | -1,519 | -1,101 | -1,406 | -1,554 | -2,118 | -1,003 | -1,794 | -1,942 | -3,527 | -931 | -2,477 | 131 | 4,124 | -874 | -2,611 | -896 | -2,515 | -1,857 | -2,366 |

| Dividend Payments | -100.0% | - | 943 | 953 | 944 | 969 | 915 | 929 | 920 | 945 | 894 | 900 | 894 | 917 | 858 | 861 | 856 | 874 | 801 | 804 | 800 | 817 |

| Buy Backs | 166.7% | 400 | 150 | 300 | 150 | 400 | 792 | 182 | 70.00 | 352 | 27.00 | 183 | 49.00 | 309 | -22.50 | 238 | 62.00 | 1,328 | 88.00 | 252 | 593 | 834 |

GILD Income Statement

2024-03-31CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited) - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Revenues: | ||

| Total revenues | $ 6,686 | $ 6,352 |

| Costs and expenses: | ||

| Cost of goods sold | 1,552 | 1,401 |

| Research and development expenses | 1,520 | 1,447 |

| Acquired in-process research and development expenses | 4,131 | 481 |

| In-process research and development impairment | 2,430 | 0 |

| Selling, general and administrative expenses | 1,375 | 1,319 |

| Total costs and expenses | 11,008 | 4,647 |

| Operating (loss) income | (4,322) | 1,705 |

| Interest expense | 254 | 230 |

| Other (income) expense, net | (91) | 174 |

| (Loss) income before income taxes | (4,486) | 1,300 |

| Income tax (benefit) expense | (315) | 316 |

| Net (loss) income | (4,170) | 985 |

| Net loss attributable to noncontrolling interest | 0 | (26) |

| Net (loss) income attributable to Gilead | $ (4,170) | $ 1,010 |

| Basic (loss) earnings per share attributable to Gilead (in dollars per share) | $ (3.34) | $ 0.81 |

| Shares used in basic (loss) earnings per share attributable to Gilead calculation (in shares) | 1,247 | 1,248 |

| Diluted (loss) earnings per share attributable to Gilead (in dollars per share) | $ (3.34) | $ 0.80 |

| Shares used in diluted (loss) earnings per share attributable to Gilead calculation (in shares) | 1,247 | 1,261 |

| Product sales | ||

| Revenues: | ||

| Total revenues | $ 6,647 | $ 6,306 |

| Royalty, contract and other revenues | ||

| Revenues: | ||

| Total revenues | $ 39 | $ 46 |

GILD Balance Sheet

2024-03-31CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited) - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 4,718 | $ 6,085 |

| Short-term marketable debt securities | 0 | 1,179 |

| Accounts receivable, net | 4,669 | 4,660 |

| Inventories | 1,853 | 1,787 |

| Prepaid and other current assets | 2,800 | 2,374 |

| Total current assets | 14,041 | 16,085 |

| Property, plant and equipment, net | 5,321 | 5,317 |

| Long-term marketable debt securities | 0 | 1,163 |

| Intangible assets, net | 23,428 | 26,454 |

| Goodwill | 8,314 | 8,314 |

| Other long-term assets | 5,188 | 4,792 |

| Total assets | 56,292 | 62,125 |

| Current liabilities: | ||

| Accounts payable | 622 | 550 |

| Accrued rebates | 4,263 | 3,802 |

| Other current liabilities | 4,464 | 5,130 |

| Current portion of long-term debt and other obligations, net | 3,667 | 1,798 |

| Total current liabilities | 13,015 | 11,280 |

| Long-term debt, net | 21,527 | 23,189 |

| Long-term income taxes payable | 1,967 | 2,039 |

| Deferred tax liability | 933 | 1,588 |

| Other long-term obligations | 1,395 | 1,280 |

| Commitments and contingencies (Note 10) | ||

| Stockholders’ equity: | ||

| Preferred stock, par value $0.001 per share; 5 shares authorized; none outstanding | 0 | 0 |

| Common stock, par value $0.001 per share; 5,600 shares authorized; 1,246 shares issued and outstanding | 1 | 1 |

| Additional paid-in capital | 6,813 | 6,500 |

| Accumulated other comprehensive income | 69 | 28 |

| Retained earnings | 10,656 | 16,304 |

| Total Gilead stockholders’ equity | 17,539 | 22,833 |

| Noncontrolling interest | (84) | (84) |

| Total stockholders’ equity | 17,455 | 22,749 |

| Total liabilities and stockholders’ equity | $ 56,292 | $ 62,125 |

| CEO | Mr. Daniel P. O'Day |

|---|---|

| WEBSITE | gilead.com |

| INDUSTRY | Pharmaceuticals |

| EMPLOYEES | 17000 |