Market Summary

GL Stock Price

GL RSI Chart

GL Valuation

GL Price/Sales (Trailing)

GL Profitability

GL Fundamentals

GL Revenue

GL Earnings

Breaking Down GL Revenue

52 Week Range

Last 7 days

9.6%

Last 30 days

-19.2%

Last 90 days

-31.0%

Trailing 12 Months

-19.4%

How does GL drawdown profile look like?

GL Financial Health

GL Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 5.5B | 0 | 0 | 0 |

| 2023 | 5.2B | 5.3B | 5.4B | 5.4B |

| 2022 | 5.1B | 5.2B | 5.2B | 5.2B |

| 2021 | 4.9B | 5.0B | 5.0B | 5.1B |

| 2020 | 4.5B | 4.6B | 4.6B | 4.7B |

| 2019 | 4.4B | 4.4B | 4.5B | 4.5B |

| 2018 | 4.2B | 4.3B | 4.3B | 4.3B |

| 2017 | 4.0B | 4.0B | 4.1B | 4.2B |

| 2016 | 3.8B | 3.9B | 3.9B | 3.9B |

| 2015 | 3.6B | 3.7B | 3.7B | 3.8B |

| 2014 | 3.7B | 3.7B | 3.6B | 3.6B |

| 2013 | 3.6B | 3.7B | 3.8B | 3.8B |

| 2012 | 3.4B | 3.5B | 3.5B | 3.6B |

| 2011 | 3.4B | 3.4B | 3.4B | 3.4B |

| 2010 | 3.2B | 3.2B | 3.3B | 3.4B |

| 2009 | 0 | 3.1B | 3.0B | 3.1B |

| 2008 | 0 | 3.4B | 3.3B | 3.2B |

| 2007 | 0 | 0 | 0 | 3.5B |

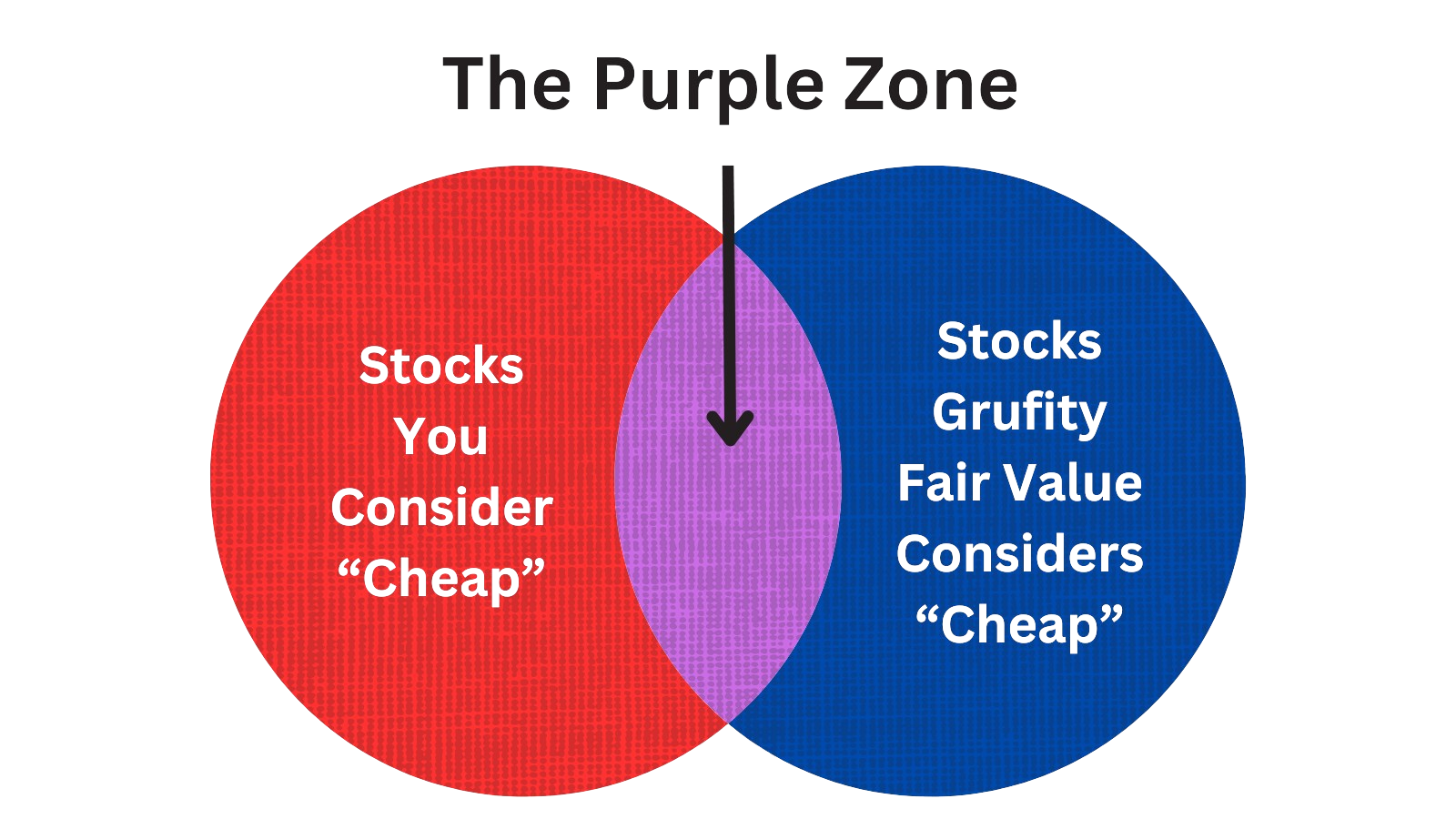

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Globe Life Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Apr 25, 2024 | zorn rebecca e | sold | -179,336 | 77.3 | -2,320 | evp & chief talent officer |

| Apr 25, 2024 | blinn mark a | bought | 153,540 | 76.77 | 2,000 | - |

| Apr 24, 2024 | rodriguez david a | bought | 119,585 | 79.7233 | 1,500 | - |

| Apr 24, 2024 | johnson steven paul | bought | 100,800 | 76.4214 | 1,319 | - |

| Apr 24, 2024 | brannen james | bought | 156,940 | 78.4702 | 2,000 | - |

| Feb 28, 2024 | mitchell robert brian | sold (taxes) | -270,667 | 128 | -2,108 | evp, general counsel and cro |

| Feb 28, 2024 | darden james matthew | sold (taxes) | -522,074 | 128 | -4,066 | co-chairman & ceo |

| Feb 28, 2024 | majors michael clay | acquired | - | - | 9,287 | evp - chief strategy officer |

| Feb 28, 2024 | mitchell robert brian | acquired | - | - | 8,635 | evp, general counsel and cro |

| Feb 28, 2024 | svoboda frank m | acquired | - | - | 16,082 | co-chairman & ceo |

Which funds bought or sold GL recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 10, 2024 | ONTARIO TEACHERS PENSION PLAN BOARD | reduced | -50.26 | -1,179,710 | 1,069,670 | 0.01% |

| May 10, 2024 | OSAIC HOLDINGS, INC. | reduced | -21.92 | -728,009 | 2,143,600 | -% |

| May 10, 2024 | ING GROEP NV | sold off | -100 | -4,820,480 | - | -% |

| May 10, 2024 | TRUSTMARK NATIONAL BANK TRUST DEPARTMENT | unchanged | - | -32,822 | 713,930 | 0.06% |

| May 10, 2024 | CREDIT SUISSE AG/ | added | 6.63 | 412,726 | 21,673,700 | 0.02% |

| May 10, 2024 | Pacer Advisors, Inc. | reduced | -18.41 | -900,081 | 3,192,140 | 0.01% |

| May 10, 2024 | Avestar Capital, LLC | reduced | -1.79 | -22,798 | 350,274 | 0.04% |

| May 10, 2024 | WELLS FARGO & COMPANY/MN | added | 13.17 | 1,811,680 | 23,904,500 | 0.01% |

| May 10, 2024 | CITIGROUP INC | added | 24.16 | 1,929,560 | 12,246,400 | 0.01% |

| May 10, 2024 | Legacy Capital Wealth Partners, LLC | sold off | -100 | -425,202 | - | -% |

Are Funds Buying or Selling GL?

Unveiling Globe Life Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 14, 2024 | berkshire hathaway inc | 0% | 10 | SC 13G/A | |

| Feb 13, 2024 | vanguard group inc | 11.51% | 10,828,866 | SC 13G/A | |

| Feb 08, 2024 | wellington management group llp | 4.98% | 4,685,657 | SC 13G/A | |

| Jan 26, 2024 | blackrock inc. | 7.1% | 6,695,570 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 11.08% | 10,780,683 | SC 13G/A | |

| Feb 06, 2023 | wellington management group llp | 6.14% | 5,970,777 | SC 13G/A | |

| Feb 01, 2023 | blackrock inc. | 6.6% | 6,410,977 | SC 13G/A | |

| Feb 10, 2022 | vanguard group inc | 10.65% | 10,757,918 | SC 13G/A | |

| Feb 04, 2022 | wellington management group llp | 5.28% | 5,334,828 | SC 13G | |

| Feb 01, 2022 | blackrock inc. | 6.4% | 6,462,907 | SC 13G/A |

Recent SEC filings of Globe Life Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 08, 2024 | 10-Q | Quarterly Report | |

| May 07, 2024 | 13F-HR | Fund Holdings Report | |

| Apr 30, 2024 | 4/A | Insider Trading | |

| Apr 29, 2024 | 8-K | Current Report | |

| Apr 26, 2024 | 4 | Insider Trading | |

| Apr 26, 2024 | 4 | Insider Trading | |

| Apr 26, 2024 | 4 | Insider Trading | |

| Apr 26, 2024 | 4 | Insider Trading | |

| Apr 26, 2024 | 4 | Insider Trading | |

| Apr 25, 2024 | 144 | Notice of Insider Sale Intent |

Peers (Alternatives to Globe Life Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

ARGO | 1.1T | 1.3B | -3.06% | 3129.10% | -5.3K | 847.07 | -10.27% | -34.69% |

AJG | 54.1B | 10.6B | 1.42% | 13.93% | 49.53 | 5.09 | 20.42% | -6.05% |

AIG | 53.0B | 48.4B | 5.79% | 51.85% | 10.98 | 1.1 | -4.15% | -20.63% |

TRV | 50.2B | 42.9B | -1.92% | 19.86% | 16.01 | 1.17 | 13.52% | 12.15% |

AFL | 48.5B | 19.3B | 2.66% | 27.97% | 9.07 | 2.51 | 3.03% | 17.35% |

ACGL | 37.4B | 14.4B | 9.22% | 29.02% | 7.72 | 2.6 | 32.92% | 143.01% |

AFG | 11.0B | 8.0B | 0.12% | 13.56% | 12.47 | 1.38 | 11.14% | 7.56% |

| MID-CAP | ||||||||

UNM | 10.0B | 12.6B | 2.05% | 19.37% | 7.55 | 0.79 | 4.24% | -13.40% |

AIZ | 9.3B | 11.4B | 0.24% | 38.71% | 12.18 | 0.82 | 9.81% | 217.29% |

LNC | 5.0B | 11.9B | -1.98% | 45.16% | 3.68 | 0.42 | -33.27% | 234.43% |

AEL | 3.9B | 3.2B | -0.20% | 45.14% | 5.55 | 1.23 | 64.05% | -35.60% |

| SMALL-CAP | ||||||||

BRP | 1.9B | 1.3B | 4.75% | 32.07% | -34.12 | 1.46 | 18.74% | 30.90% |

AMSF | 907.6M | 308.9M | -1.00% | -14.86% | 14.71 | 2.94 | 3.79% | 10.94% |

AMBC | 829.0M | 314.0M | 17.41% | 25.27% | 14.42 | 2.64 | -29.20% | -88.19% |

AAME | 38.2M | 186.8M | -11.37% | -15.00% | -223.11 | 0.2 | -0.56% | -111.21% |

Globe Life Inc News

Globe Life Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 0.0% | 1,416 | 1,416 | 1,384 | 1,326 | 1,321 | 1,335 | 1,297 | 1,292 | 1,303 | 1,297 | 1,278 | 1,271 | 1,267 | 1,229 | 1,195 | 1,181 | 1,133 | 1,137 | 1,141 | 1,130 | 1,119 |

| Gross Profit | 1.0% | 327 | 323 | 321 | 310 | 305 | 306 | 264 | 307 | 301 | 568 | 220 | 237 | 191 | 225 | 230 | 217 | 229 | 225 | 235 | 224 | 227 |

| S&GA Expenses | -100.0% | - | 78.00 | 75.00 | 75.00 | 74.00 | 80.00 | 76.00 | 79.00 | 73.00 | 75.00 | 68.00 | 68.00 | 71.00 | 63.00 | 64.00 | 62.00 | 67.00 | 64.00 | 61.00 | 65.00 | 60.00 |

| EBITDA Margin | 1.7% | 0.24* | 0.24* | 0.23* | 0.22* | 0.22* | 0.23* | 0.28* | 0.28* | 0.28* | 0.27* | 0.20* | 0.21* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | 11.5% | 29.00 | 26.00 | 26.00 | 26.00 | 25.00 | 25.00 | 24.00 | 22.00 | 20.00 | 20.00 | 21.00 | 22.00 | 21.00 | 21.00 | 22.00 | 23.00 | 21.00 | 21.00 | 21.00 | 21.00 | 21.00 |

| Income Taxes | -1.9% | 61.00 | 62.00 | 62.00 | 49.00 | 51.00 | 54.00 | 44.00 | 52.00 | 57.00 | 116 | 42.00 | 46.00 | 40.00 | 46.00 | 43.00 | 39.00 | 37.00 | 40.00 | 46.00 | 42.00 | 43.00 |

| Earnings Before Taxes | -6.5% | 315 | 337 | 319 | 265 | 274 | 297 | 235 | 276 | 294 | 580 | 231 | 245 | 219 | 250 | 232 | 212 | 203 | 227 | 247 | 229 | 228 |

| EBT Margin | 1.6% | 0.22* | 0.22* | 0.22* | 0.20* | 0.21* | 0.21* | 0.27* | 0.27* | 0.26* | 0.25* | 0.19* | 0.19* | - | - | - | - | - | - | - | - | - |

| Net Income | -7.5% | 254 | 275 | 257 | 215 | 224 | 242 | 191 | 224 | 237 | 604 | 189 | 925 | -826 | 204 | 189 | 1,339 | -613 | 187 | 202 | 187 | 185 |

| Net Income Margin | 1.4% | 0.18* | 0.18* | 0.17* | 0.17* | 0.17* | 0.17* | 0.24* | 0.24* | 0.38* | 0.17* | 0.10* | 0.10* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -9.7% | 342 | 378 | 276 | 309 | 469 | 364 | 351 | 290 | 390 | 370 | 351 | 322 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 1.9% | 28,571 | 28,051 | 26,223 | 26,770 | 26,922 | 25,987 | 25,249 | 26,424 | 28,216 | 29,768 | 29,497 | 29,580 | 28,113 | 29,047 | 28,042 | 27,534 | 25,352 | 25,977 | 25,792 | 24,855 | 24,133 |

| Cash Equivalents | -19.0% | 84.00 | 103 | 86.00 | 75.00 | 172 | 93.00 | 86.00 | 172 | 128 | 92.00 | 96.00 | 138 | 82.00 | 95.00 | 80.00 | 114 | 90.00 | 76.00 | 67.00 | 89.00 | 67.00 |

| Goodwill | 0% | 482 | 482 | 482 | 482 | 482 | 482 | 482 | 482 | 482 | 482 | 482 | 442 | 442 | 442 | 442 | 442 | 442 | 442 | 442 | 442 | 442 |

| Liabilities | -0.1% | 23,531 | 23,565 | 21,600 | 22,789 | 23,076 | 22,037 | 21,639 | 23,204 | 25,671 | 21,125 | 20,888 | 20,963 | 20,281 | 20,276 | 19,817 | 19,686 | 18,832 | 18,683 | 18,479 | 18,155 | 18,090 |

| Short Term Borrowings | 50.9% | 734 | 486 | 448 | 258 | 514 | 449 | 435 | 495 | 522 | 480 | 394 | 260 | 275 | 255 | 280 | 831 | 458 | 299 | 233 | 257 | 294 |

| Long Term Debt | 0.0% | 1,630 | 1,630 | 1,799 | 1,798 | 1,628 | 1,628 | 1,628 | 1,627 | 1,547 | 1,546 | 1,546 | 1,986 | 1,668 | 1,668 | 1,668 | 1,272 | 1,347 | 1,349 | 1,467 | 1,446 | 1,356 |

| LT Debt, Non Current | -100.0% | - | 1,630 | 1,799 | 1,798 | 1,628 | 1,628 | 1,628 | 1,627 | 1,547 | 1,546 | 1,546 | 1,986 | 1,668 | 1,668 | 1,668 | 1,272 | 1,347 | 1,349 | 1,351 | 1,353 | - |

| Shareholder's Equity | 12.3% | 5,039 | 4,487 | 4,623 | 3,980 | 3,846 | 3,950 | 3,610 | 3,220 | 2,544 | 2,004 | 8,608 | 8,617 | 7,832 | 8,771 | 8,225 | 7,848 | 6,520 | 7,294 | 7,313 | 6,700 | 6,043 |

| Retained Earnings | 2.8% | 7,707 | 7,500 | 7,520 | 7,286 | 7,093 | 6,895 | 6,633 | 6,470 | 6,316 | 6,182 | 6,353 | 6,186 | 6,021 | 5,874 | 6,002 | 5,839 | 5,686 | 5,551 | 5,687 | 5,515 | 5,365 |

| Additional Paid-In Capital | -1.1% | 527 | 532 | 544 | 536 | 529 | 530 | 541 | 532 | 523 | 521 | 534 | 525 | 516 | 527 | 537 | 528 | 519 | 532 | 538 | 527 | 519 |

| Shares Outstanding | 0% | 102 | 102 | 105 | 105 | 105 | 105 | 109 | 109 | 109 | 109 | 113 | 113 | - | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | 10,400 | - | - | - | 9,300 | - | - | - | 9,500 | - | - | - | 7,700 | - | - | - | 9,600 | - |

| Cashflow (Quarterly) | (In Thousands) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -10.4% | 350,806 | 391,397 | 286,887 | 326,811 | 477,330 | 371,807 | 356,997 | 296,257 | 397,133 | 377,658 | 357,983 | 330,209 | 371,830 | 397,818 | 309,314 | 425,748 | 343,554 | 333,699 | 343,538 | 263,352 | 423,285 |

| Share Based Compensation | -100.0% | - | 8,004 | 7,567 | 7,486 | 7,679 | 9,047 | 9,120 | 8,448 | 9,035 | 5,974 | 7,776 | 8,634 | 7,888 | 9,237 | 8,667 | 8,632 | 9,356 | 11,495 | 11,533 | 11,256 | 10,559 |

| Cashflow From Investing | -645.5% | -731,936 | -98,177 | -417,835 | -162,367 | -247,770 | -252,166 | -282,919 | -132,606 | -275,324 | -284,116 | 46,148 | -405,717 | -269,685 | -189,272 | -31,801 | -648,982 | -311,675 | -240,744 | -212,211 | -50,594 | -305,762 |

| Cashflow From Financing | 231.4% | 356,956 | -271,731 | 136,776 | -254,792 | -151,740 | -114,656 | -170,293 | -122,804 | -84,700 | -95,596 | -450,513 | 135,823 | -113,317 | -187,061 | -309,032 | 253,307 | -31,271 | -81,084 | -153,286 | -186,657 | -169,481 |

| Dividend Payments | -0.3% | 21,117 | 21,171 | 21,376 | 21,498 | 20,071 | 20,106 | 20,233 | 20,521 | 19,687 | 19,975 | 20,177 | 20,380 | 19,511 | 19,689 | 19,962 | 19,953 | 18,588 | 18,695 | 18,841 | 18,956 | 17,696 |

| Buy Backs | -83.8% | 23,469 | 145,171 | 96,898 | 89,755 | 179,276 | 119,186 | 72,031 | 143,939 | 119,482 | 148,055 | 97,796 | 162,864 | 132,720 | 147,218 | 129,919 | - | 166,729 | 125,100 | 104,372 | 119,201 | 110,896 |

GL Income Statement

2024-03-31Condensed Consolidated Statements of Operations - USD ($) $ in Thousands | 3 Months Ended | |||||

|---|---|---|---|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |||||

| Revenue: | ||||||

| Revenue | $ 1,145,284 | $ 1,095,090 | ||||

| Net investment income | 282,578 | 257,105 | ||||

| Realized gains (losses) | (11,799) | (30,927) | ||||

| Other income | 76 | 50 | ||||

| Total revenue | 1,416,139 | 1,321,318 | ||||

| Benefits and expenses: | ||||||

| Total policyholder benefits | 731,793 | 707,927 | ||||

| Amortization of deferred acquisition costs | 99,478 | 92,322 | ||||

| Commissions, premium taxes, and non-deferred acquisition costs | 148,110 | 137,797 | ||||

| Other operating expense | 93,214 | 84,171 | ||||

| Interest expense | 28,621 | 24,867 | ||||

| Total benefits and expenses | 1,101,216 | 1,047,084 | ||||

| Income before income taxes | 314,923 | 274,234 | ||||

| Income tax benefit (expense) | (60,706) | (50,624) | ||||

| Net income | $ 254,217 | $ 223,610 | ||||

| Basic net income per common share (in dollars per share) | $ 2.71 | $ 2.32 | ||||

| Diluted net income per common share (in dollars per share) | $ 2.67 | $ 2.28 | ||||

| Life premium | ||||||

| Revenue: | ||||||

| Revenue | $ 804,265 | $ 772,597 | ||||

| Benefits and expenses: | ||||||

| Total policyholder benefits | [1] | 519,871 | 507,977 | |||

| Health premium | ||||||

| Revenue: | ||||||

| Revenue | 341,019 | 322,493 | ||||

| Benefits and expenses: | ||||||

| Total policyholder benefits | [2] | 202,327 | 190,962 | |||

| Other premium | ||||||

| Revenue: | ||||||

| Revenue | 0 | 0 | ||||

| Benefits and expenses: | ||||||

| Total policyholder benefits | $ 9,595 | $ 8,988 | ||||

| ||||||

GL Balance Sheet

2024-03-31Condensed Consolidated Balance Sheets - USD ($) $ in Thousands | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Investments: | ||

| Fixed maturities—available for sale, at fair value (amortized cost: 2024—$19,504,784; 2023—$18,924,914, allowance for credit losses: 2024— $7,027; 2023— $7,115) | $ 18,144,353 | $ 17,870,206 |

| Mortgage loans | 329,033 | 279,199 |

| Policy loans | 664,641 | 657,020 |

| Other long-term investments (includes: 2024—$844,916; 2023—$795,583 under the fair value option) | 899,085 | 835,878 |

| Short-term investments | 58,413 | 81,740 |

| Total investments | 20,095,525 | 19,724,043 |

| Cash | 83,547 | 103,156 |

| Accrued investment income | 299,398 | 270,396 |

| Other receivables | 645,966 | 630,223 |

| Deferred acquisition costs | 6,131,237 | 6,009,477 |

| Goodwill | 481,791 | 481,791 |

| Other assets | 833,129 | 832,413 |

| Total assets | 28,570,593 | 28,051,499 |

| Liabilities: | ||

| Future policy benefits | 18,882,023 | 19,460,353 |

| Unearned and advance premium | 270,105 | 254,567 |

| Policy claims and other benefits payable | 520,094 | 514,875 |

| Other policyholders' funds | 401,269 | 236,958 |

| Total policy liabilities | 20,073,491 | 20,466,753 |

| Current and deferred income taxes | 630,268 | 494,639 |

| Short-term debt | 733,544 | 486,113 |

| Long-term debt (estimated fair value: 2024—$1,510,512; 2023—$1,491,229) | 1,629,978 | 1,629,559 |

| Other liabilities | 464,151 | 487,632 |

| Total liabilities | 23,531,432 | 23,564,696 |

| Commitments and Contingencies (Note 5) | ||

| Shareholders' equity: | ||

| Preferred stock, par value $1 per share—5,000,000 shares authorized; outstanding: 0 in 2024 and 2023 | 0 | 0 |

| Common stock, par value $1 per share—320,000,000 shares authorized; outstanding: (2024—102,218,183 issued; 2023—102,218,183 issued) | 102,218 | 102,218 |

| Additional paid-in-capital | 526,862 | 532,474 |

| Accumulated other comprehensive income (loss) | (2,467,236) | (2,772,419) |

| Retained earnings | 7,706,655 | 7,478,813 |

| Treasury stock, at cost: (2024—8,141,299 shares; 2023—8,426,854 shares) | (829,338) | (854,283) |

| Total shareholders' equity | 5,039,161 | 4,486,803 |

| Total liabilities and shareholders' equity | $ 28,570,593 | $ 28,051,499 |

| CEO | Mr. Frank Martin Svoboda |

|---|---|

| WEBSITE | globelifeinsurance.com |

| INDUSTRY | Insurance Property & Casualty |

| EMPLOYEES | 3543 |