Market Summary

LHX Stock Price

LHX RSI Chart

LHX Valuation

LHX Price/Sales (Trailing)

LHX Profitability

LHX Fundamentals

LHX Revenue

LHX Earnings

Breaking Down LHX Revenue

52 Week Range

Last 7 days

3.9%

Last 30 days

6.5%

Last 90 days

4.6%

Trailing 12 Months

16.1%

How does LHX drawdown profile look like?

LHX Financial Health

LHX Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 20.2B | 0 | 0 | 0 |

| 2023 | 17.4B | 18.0B | 18.7B | 19.4B |

| 2022 | 17.4B | 16.8B | 16.8B | 17.1B |

| 2021 | 18.1B | 18.4B | 18.1B | 17.8B |

| 2020 | 15.8B | 18.3B | 18.4B | 18.2B |

| 2019 | 6.6B | 6.8B | 9.7B | 12.9B |

| 2018 | 6.0B | 6.2B | 6.3B | 6.4B |

| 2017 | 5.6B | 5.9B | 5.9B | 6.0B |

| 2016 | 5.4B | 6.3B | 5.9B | 5.6B |

| 2015 | 4.9B | 3.9B | 4.5B | 5.1B |

| 2014 | 5.0B | 5.0B | 5.0B | 5.0B |

| 2013 | 5.2B | 5.1B | 5.0B | 5.0B |

| 2012 | 5.2B | 5.5B | 5.4B | 5.4B |

| 2011 | 5.7B | 5.4B | 5.3B | 5.2B |

| 2010 | 5.0B | 5.2B | 5.4B | 5.6B |

| 2009 | 4.9B | 5.0B | 5.0B | 4.9B |

| 2008 | 0 | 4.6B | 4.7B | 4.8B |

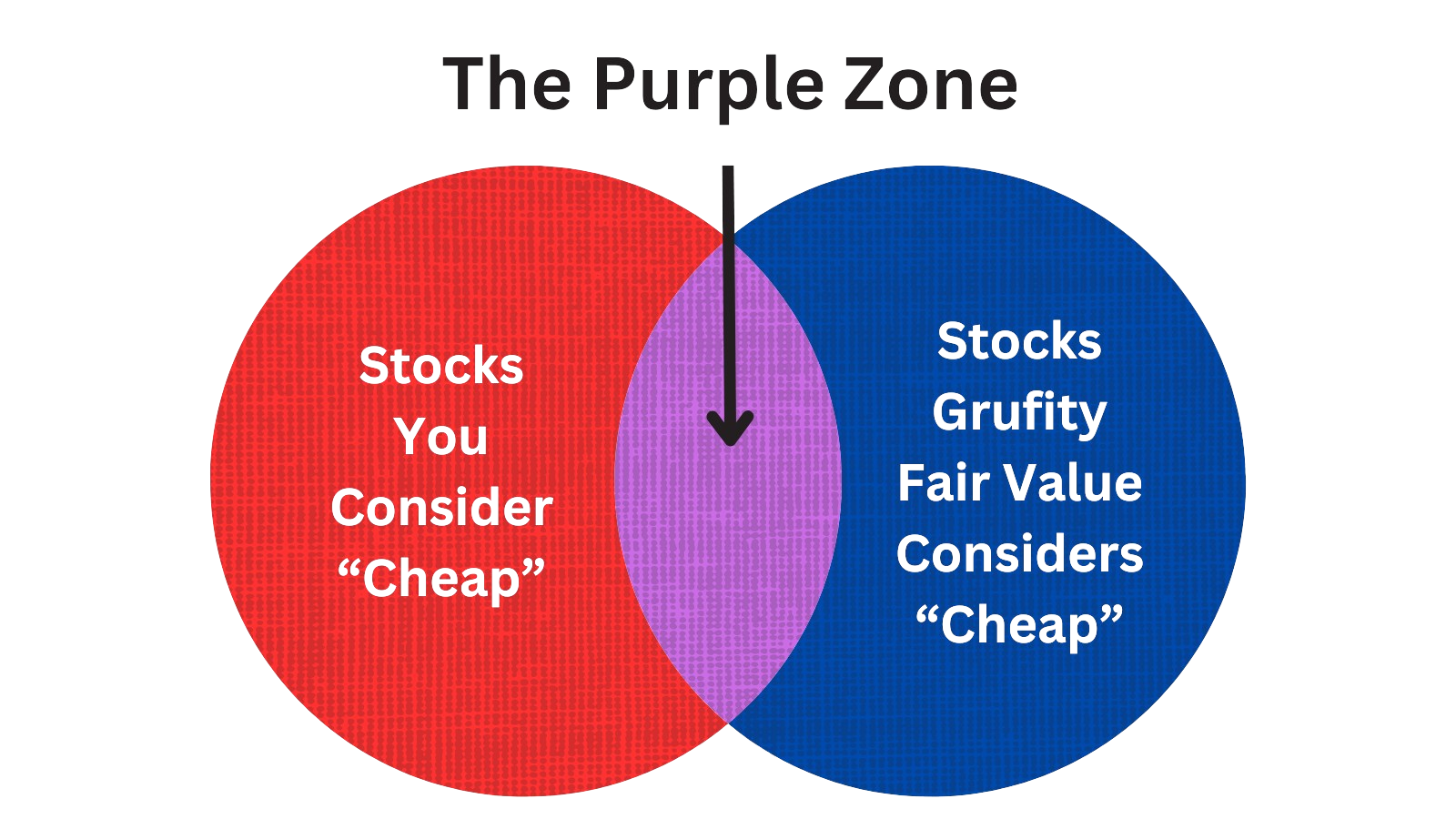

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of L3Harris Technologies Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Apr 19, 2024 | dattilo thomas a | acquired | - | - | 924 | - |

| Apr 19, 2024 | hay lewis iii | acquired | - | - | 924 | - |

| Apr 19, 2024 | zamarro christina l | acquired | - | - | 924 | - |

| Apr 19, 2024 | geraghty joanna | acquired | - | - | 924 | - |

| Apr 19, 2024 | fradin roger | acquired | - | - | 924 | - |

| Apr 19, 2024 | harris harry b. jr | acquired | - | - | 924 | - |

| Apr 19, 2024 | swanson william h | acquired | - | - | 924 | - |

| Apr 19, 2024 | chiarelli peter w | acquired | - | - | 924 | - |

| Apr 19, 2024 | hachigian kirk s | acquired | - | - | 924 | - |

| Apr 19, 2024 | lane rita s. | acquired | - | - | 924 | - |

Which funds bought or sold LHX recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 08, 2024 | Cassaday & Co Wealth Management LLC | reduced | -4.15 | -13,039 | 417,890 | 0.01% |

| May 08, 2024 | RKL Wealth Management LLC | added | 2.17 | 81,668 | 2,498,270 | 0.25% |

| May 08, 2024 | EMERALD ADVISERS, LLC | reduced | -1.61 | -3,595 | 795,076 | 0.03% |

| May 08, 2024 | Hudson Value Partners, LLC | reduced | -57.69 | -1,551,600 | 1,161,400 | 0.49% |

| May 08, 2024 | Jackson, Grant Investment Advisers, Inc. | unchanged | - | 206 | 17,687 | 0.01% |

| May 08, 2024 | Bell Investment Advisors, Inc | added | 8.77 | 1,207 | 13,213 | -% |

| May 08, 2024 | Cyrus J. Lawrence, LLC | new | - | 7,135,000 | 7,135,000 | 1.58% |

| May 08, 2024 | Sandy Spring Bank | added | 20.98 | 762,440 | 4,166,460 | 0.19% |

| May 08, 2024 | GREAT LAKES ADVISORS, LLC | added | 4.3 | 274,124 | 5,235,920 | 0.04% |

| May 08, 2024 | TrinityPoint Wealth, LLC | added | 0.07 | 7,818 | 627,018 | 0.10% |

Are Funds Buying or Selling LHX?

Unveiling L3Harris Technologies Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 14, 2024 | price t rowe associates inc /md/ | 5.1% | 9,584,760 | SC 13G | |

| Feb 09, 2024 | capital world investors | 8.5% | 16,152,117 | SC 13G/A | |

| Jan 25, 2024 | blackrock inc. | 9.2% | 17,403,276 | SC 13G/A | |

| Jan 10, 2024 | vanguard group inc | 10.65% | 20,186,424 | SC 13G/A | |

| Feb 14, 2023 | price t rowe associates inc /md/ | 5.4% | 10,364,874 | SC 13G | |

| Feb 13, 2023 | capital world investors | 7.1% | 13,483,165 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 9.30% | 17,699,032 | SC 13G/A | |

| Feb 03, 2023 | blackrock inc. | 7.9% | 15,019,303 | SC 13G/A | |

| Feb 11, 2022 | capital world investors | 7.6% | 14,871,240 | SC 13G | |

| Feb 10, 2022 | vanguard group inc | 8.55% | 16,782,733 | SC 13G/A |

Recent SEC filings of L3Harris Technologies Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 08, 2024 | 3 | Insider Trading | |

| May 01, 2024 | S-8 | Employee Benefits Plan | |

| Apr 26, 2024 | 10-Q | Quarterly Report | |

| Apr 25, 2024 | 8-K | Current Report | |

| Apr 23, 2024 | 4 | Insider Trading | |

| Apr 23, 2024 | 8-K | Current Report | |

| Apr 23, 2024 | 4 | Insider Trading | |

| Apr 23, 2024 | 4 | Insider Trading | |

| Apr 23, 2024 | 4 | Insider Trading | |

| Apr 23, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to L3Harris Technologies Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

BA | 111.3B | 76.4B | 1.76% | -9.75% | -51.73 | 1.46 | 8.37% | 47.92% |

GD | 81.2B | 43.1B | 2.47% | 39.91% | 24 | 1.88 | 8.09% | -0.18% |

LHX | 41.6B | 20.2B | 6.47% | 16.11% | 35.49 | 2.07 | 15.66% | 26.95% |

HWM | 33.5B | 6.9B | 24.57% | 85.34% | 38.93 | 4.88 | 15.47% | 76.95% |

HEI | 29.4B | 3.2B | 13.36% | 24.70% | 69.2 | 9.07 | 38.68% | 18.86% |

AXON | 23.3B | 1.7B | -0.70% | 60.37% | 88.93 | 13.88 | 31.69% | 90.90% |

HII | 9.9B | 11.6B | -8.92% | 26.52% | 14.04 | 0.85 | 7.53% | 24.12% |

| MID-CAP | ||||||||

CW | 10.6B | 2.9B | 8.88% | 69.02% | 28.36 | 3.62 | 11.39% | 20.50% |

BWXT | 8.1B | 2.5B | -8.34% | 32.77% | 32.11 | 3.21 | 11.52% | 5.39% |

AVAV | 5.3B | 705.8M | 25.01% | 76.89% | -49.33 | 7.47 | 44.89% | -1159.76% |

| SMALL-CAP | ||||||||

DCO | 841.6M | 766.6M | 0.46% | 16.90% | 47.97 | 1.1 | 4.98% | -32.31% |

SPCE | 423.7M | 8.4M | -12.82% | -75.54% | -0.95 | 50.48 | 194.12% | 21.45% |

ISSC | 111.9M | 37.6M | -10.22% | -2.29% | 17.52 | 2.98 | 36.42% | 25.49% |

CODA | 77.0M | 642.5K | 9.02% | -23.44% | 32.67 | 106.77 | -97.11% | -47.43% |

ASTC | 15.8M | 2.0M | -6.65% | -17.17% | -1.54 | 7.92 | 371.33% | -13.01% |

L3Harris Technologies Inc News

L3Harris Technologies Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -2.4% | 5,211 | 5,340 | 4,915 | 4,693 | 4,471 | 4,578 | 4,246 | 4,135 | 4,103 | 4,350 | 4,229 | 4,668 | 4,567 | 4,660 | 4,463 | 4,445 | 4,626 | 4,832 | 4,431 | 1,865 | 1,728 |

| Operating Expenses | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 928 | 999 | 349 | 310 |

| S&GA Expenses | 10.5% | 970 | 878 | 828 | 783 | 773 | 771 | 742 | 744 | 745 | 795 | 793 | 891 | 801 | 831 | 817 | 855 | 812 | 882 | 999 | 349 | 310 |

| EBITDA Margin | -16.2% | 0.05* | 0.05* | 0.09* | 0.05* | 0.07* | 0.08* | 0.08* | 0.14* | 0.14* | 0.13* | 0.11* | 0.10* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -2.9% | -176 | -171 | -159 | -111 | -102 | -74.00 | -70.00 | -67.00 | -68.00 | -67.00 | -67.00 | -65.00 | -66.00 | -129 | -62.00 | -65.00 | 68.00 | -353 | 67.00 | 39.00 | 43.00 |

| Income Taxes | 110.0% | 5.00 | -50.00 | 18.00 | 21.00 | 34.00 | 116 | -20.00 | 55.00 | 61.00 | 104 | 107 | 169 | 60.00 | 63.00 | 87.00 | 58.00 | 26.00 | 68.00 | 5.00 | 33.00 | 40.00 |

| Earnings Before Taxes | 281.6% | 290 | 76.00 | 400 | 372 | 373 | 533 | -321 | 525 | 536 | 588 | 586 | 582 | 527 | 247 | 518 | 336 | 221 | 468 | 440 | 302 | 283 |

| EBT Margin | -10.2% | 0.06* | 0.06* | 0.09* | 0.05* | 0.06* | 0.07* | 0.08* | 0.13* | 0.13* | 0.13* | 0.11* | 0.10* | - | - | - | - | - | - | - | - | - |

| Net Income | 79.1% | 283 | 158 | 383 | 349 | 337 | 416 | -300 | 471 | 475 | 484 | 481 | 413 | 468 | 193 | 426 | 283 | 217 | 393 | 429 | 268 | 243 |

| Net Income Margin | -7.9% | 0.06* | 0.06* | 0.08* | 0.04* | 0.05* | 0.06* | 0.07* | 0.11* | 0.11* | 0.10* | 0.09* | 0.08* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -133.6% | -219 | 652 | 395 | 321 | 279 | 711 | 524 | 687 | -16.00 | 687 | 405 | 659 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 0.3% | 41,816 | 41,687 | 42,293 | 35,362 | 35,507 | 33,524 | 33,381 | 34,138 | 34,444 | 34,709 | 35,018 | 36,064 | 36,590 | 36,960 | 37,145 | 37,852 | 38,105 | 38,336 | 38,947 | 10,117 | 9,792 |

| Current Assets | 2.6% | 8,266 | 8,055 | 7,501 | 6,850 | 7,000 | 6,754 | 6,431 | 6,188 | 6,249 | 6,359 | 6,626 | 7,589 | 7,538 | 6,667 | 6,393 | 6,926 | 7,211 | 6,312 | 7,027 | 2,578 | 2,285 |

| Cash Equivalents | -14.8% | 477 | 560 | 499 | 366 | 545 | 880 | 529 | 420 | 402 | 941 | 1,126 | 2,029 | 976 | 1,276 | 1,341 | 1,947 | 663 | 824 | 1,001 | 530 | 334 |

| Inventory | 0.3% | 1,476 | 1,472 | 1,638 | 1,555 | 1,541 | 1,291 | 1,339 | 1,241 | 1,090 | 982 | 1,024 | 872 | 904 | 973 | 894 | 859 | 990 | 1,219 | 1,339 | 360 | 433 |

| Net PPE | - | - | - | - | - | - | - | - | - | - | - | 2,044 | 2,026 | 2,136 | 2,102 | 2,047 | 2,015 | 2,032 | 2,117 | 2,073 | 894 | 904 |

| Goodwill | 0.5% | 20,070 | 19,979 | 20,736 | 18,417 | 18,291 | 17,283 | 17,260 | 18,143 | 18,194 | 18,189 | 18,207 | 18,234 | 18,252 | 18,876 | 18,992 | 14,582 | 19,265 | 20,001 | 15,423 | 5,340 | 5,371 |

| Liabilities | 1.0% | 23,086 | 22,858 | 23,577 | 16,831 | 17,099 | 14,900 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Current Liabilities | 5.4% | 8,437 | 8,004 | 8,482 | 6,309 | 6,151 | 5,776 | 5,853 | 4,884 | 4,737 | 4,551 | 4,313 | 4,464 | 4,231 | 4,240 | 4,666 | 4,587 | 5,123 | 4,009 | 4,718 | 2,268 | 1,606 |

| Short Term Borrowings | 37.5% | 2,203 | 1,602 | 2,033 | 582 | 2.00 | 2.00 | 2.00 | 2.00 | 3.00 | 2.00 | 2.00 | 3.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 3.00 | 3.00 | 103 | 103 |

| Long Term Debt | -0.2% | 11,140 | 11,160 | 11,140 | 7,867 | 8,220 | 6,225 | 5,967 | 6,782 | 6,795 | 7,048 | 7,053 | 7,061 | 7,066 | 6,943 | 6,261 | 6,273 | 6,294 | 6,694 | 6,307 | 2,763 | 3,412 |

| Shareholder's Equity | -0.5% | 18,666 | 18,765 | 18,616 | 18,531 | 18,408 | 18,624 | 18,439 | 19,190 | 19,366 | 19,319 | 19,594 | 19,976 | 20,482 | 20,841 | 21,439 | 22,226 | 22,027 | 22,744 | 22,925 | 3,363 | 3,607 |

| Retained Earnings | 0.6% | 3,239 | 3,220 | 3,278 | 3,111 | 2,998 | 2,943 | 2,768 | 3,312 | 3,128 | 2,917 | 2,743 | 2,633 | 2,529 | 2,347 | 2,383 | 2,250 | 2,151 | 2,183 | 2,019 | 2,173 | 1,986 |

| Additional Paid-In Capital | -0.5% | 15,472 | 15,553 | 15,470 | 15,391 | 15,407 | 15,677 | 15,744 | 15,814 | 16,089 | 16,248 | 16,847 | 17,863 | 18,487 | 19,008 | 19,310 | 20,260 | 20,182 | 20,694 | 21,288 | 1,778 | 1,720 |

| Shares Outstanding | -0.2% | 189 | 190 | 189 | 189 | 190 | 191 | 192 | 192 | 193 | 194 | 200 | 204 | - | - | - | - | - | - | - | - | - |

| Minority Interest | 0% | 64.00 | 64.00 | 100 | 103 | 102 | 101 | 102 | 104 | 106 | 106 | 110 | 113 | 115 | 117 | 126 | 124 | 129 | 157 | 152 | - | - |

| Float | - | - | - | - | 37,362 | - | - | - | 46,385 | - | - | - | 44,062 | - | - | - | 36,994 | - | - | - | 22,331 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -113.2% | -104 | 789 | 543 | 414 | 350 | 782 | 588 | 749 | 39.00 | 822 | 484 | 720 | 661 | 698 | 757 | 802 | 533 | 858 | 81.00 | 311 | 405 |

| Share Based Compensation | 18.2% | 26.00 | 22.00 | 22.00 | 22.00 | 23.00 | 17.00 | 23.00 | 41.00 | 28.00 | 29.00 | 33.00 | 34.00 | 33.00 | 23.00 | 31.00 | 24.00 | 16.00 | -18.00 | 143 | -28.50 | 37.00 |

| Cashflow From Investing | -39.8% | -116 | -83.00 | -4,864 | -26.00 | -2,048 | -62.00 | -67.00 | -57.00 | -64.00 | -6.00 | 93.00 | 1,368 | -61.00 | -47.00 | -47.00 | 903 | -58.00 | -94.00 | 1,414 | -55.00 | -37.00 |

| Cashflow From Financing | 121.8% | 144 | -660 | 4,460 | -567 | 1,361 | -385 | -392 | -661 | -513 | -1,000 | -1,476 | -1,037 | -900 | -739 | -1,331 | -430 | -612 | -957 | -1,014 | -59.00 | -380 |

| Dividend Payments | 3.7% | 224 | 216 | 216 | 216 | 220 | 214 | 215 | 217 | 218 | 199 | 202 | 207 | 209 | 179 | 179 | 184 | 183 | 160 | 177 | 81.00 | 81.00 |

| Buy Backs | - | 233 | - | - | 122 | 396 | 183 | 171 | 421 | 308 | 800 | 1,325 | 850 | 700 | 440 | 1,150 | - | 700 | 750 | 750 | -5.00 | 5.00 |

LHX Income Statement

2024-03-29CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (Unaudited) - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |||

|---|---|---|---|---|

Mar. 29, 2024 | Mar. 31, 2023 | |||

| Income Statement [Abstract] | ||||

| Revenue | $ 5,211 | $ 4,471 | ||

| Cost of revenue | (3,863) | (3,305) | ||

| General and administrative expenses | (970) | (773) | ||

| Operating income | 378 | 393 | ||

| Non-service FAS pension income and other, net | [1] | 88 | 82 | |

| Interest expense, net | (176) | (102) | ||

| Income from continuing operations before income taxes | 290 | 373 | ||

| Income taxes | (5) | (34) | ||

| Net income | 285 | 339 | ||

| Noncontrolling interests, net of income taxes | (2) | (2) | ||

| Net income attributable to L3Harris Technologies, Inc. | $ 283 | $ 337 | ||

| Net income per common share attributable to L3Harris Technologies, Inc. common shareholders | ||||

| Basic (in dollars per share) | $ 1.49 | $ 1.77 | ||

| Diluted (in dollars per share) | $ 1.48 | $ 1.76 | ||

| Basic weighted-average common shares outstanding (in shares) | 189.8 | 190.2 | ||

| Diluted weighted-average common shares outstanding (in shares) | 190.8 | 191.2 | ||

| ||||

LHX Balance Sheet

2024-03-29CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited) - USD ($) $ in Millions | Mar. 29, 2024 | Dec. 29, 2023 |

|---|---|---|

| Current assets | ||

| Cash and cash equivalents | $ 477 | $ 560 |

| Receivables, net of allowances for collection losses of $13 and $15, respectively | 1,209 | 1,230 |

| Contract assets | 3,502 | 3,196 |

| Inventories | 1,476 | 1,472 |

| Other current assets | 466 | 491 |

| Assets of business held for sale | 1,136 | 1,106 |

| Total current assets | 8,266 | 8,055 |

| Non-current assets | ||

| Property, plant and equipment, net | 2,836 | 2,862 |

| Goodwill | 20,070 | 19,979 |

| Other intangible assets, net | 8,340 | 8,540 |

| Deferred income taxes | 113 | 91 |

| Other non-current assets | 2,191 | 2,160 |

| Total assets | 41,816 | 41,687 |

| Current liabilities | ||

| Short-term debt | 2,203 | 1,602 |

| Current portion of long-term debt, net | 365 | 363 |

| Accounts payable | 2,112 | 2,106 |

| Contract liabilities | 1,777 | 1,900 |

| Compensation and benefits | 379 | 544 |

| Other accrued items | 1,174 | 1,129 |

| Income taxes payable | 182 | 88 |

| Liabilities of business held for sale | 245 | 272 |

| Total current liabilities | 8,437 | 8,004 |

| Non-current liabilities | ||

| Long-term debt, net | 11,140 | 11,160 |

| Deferred income taxes | 683 | 815 |

| Other long-term liabilities | 2,826 | 2,879 |

| Total liabilities | 23,086 | 22,858 |

| Shareholders’ Equity: | ||

| Preferred stock, without par value; 1,000,000 shares authorized; none issued | 0 | 0 |

| Common stock, $1.00 par value; 500,000,000 shares authorized; issued and outstanding 189,463,015 and 189,808,581 shares at March 29, 2024 and December 29, 2023, respectively | 189 | 190 |

| Paid-in capital | 15,472 | 15,553 |

| Retained earnings | 3,239 | 3,220 |

| Accumulated other comprehensive loss | (234) | (198) |

| Total shareholders’ equity | 18,666 | 18,765 |

| Noncontrolling interests | 64 | 64 |

| Total equity | 18,730 | 18,829 |

| Total liabilities and equity | $ 41,816 | $ 41,687 |

| CEO | Mr. Christopher E. Kubasik CPA, CPA |

|---|---|

| WEBSITE | l3harris.com |

| INDUSTRY | Aerospace & Defense |

| EMPLOYEES | 46000 |