Market Summary

PODD Alerts

PODD Stock Price

PODD RSI Chart

PODD Valuation

PODD Price/Sales (Trailing)

PODD Profitability

PODD Fundamentals

PODD Revenue

PODD Earnings

Breaking Down PODD Revenue

Last 7 days

12.9%

Last 30 days

12.6%

Last 90 days

-2.0%

Trailing 12 Months

-38.2%

How does PODD drawdown profile look like?

PODD Financial Health

PODD Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 1.8B | 0 | 0 | 0 |

| 2023 | 1.4B | 1.5B | 1.6B | 1.7B |

| 2022 | 1.1B | 1.2B | 1.2B | 1.3B |

| 2021 | 958.7M | 995.6M | 1.0B | 1.1B |

| 2020 | 776.6M | 825.8M | 867.7M | 904.4M |

| 2019 | 599.8M | 652.7M | 693.7M | 738.2M |

| 2018 | 485.7M | 500.1M | 529.4M | 563.8M |

| 2017 | 387.5M | 409.9M | 436.8M | 463.8M |

| 2016 | 297.0M | 323.7M | 347.2M | 367.0M |

| 2015 | 224.1M | 227.1M | 238.5M | 263.9M |

| 2014 | 245.1M | 242.6M | 241.5M | 231.3M |

| 2013 | 221.0M | 230.0M | 236.4M | 247.1M |

| 2012 | 171.8M | 190.6M | 200.7M | 211.4M |

| 2011 | 104.4M | 113.7M | 132.8M | 152.3M |

| 2010 | 73.8M | 81.5M | 89.2M | 97.0M |

| 2009 | 0 | 0 | 0 | 66.0M |

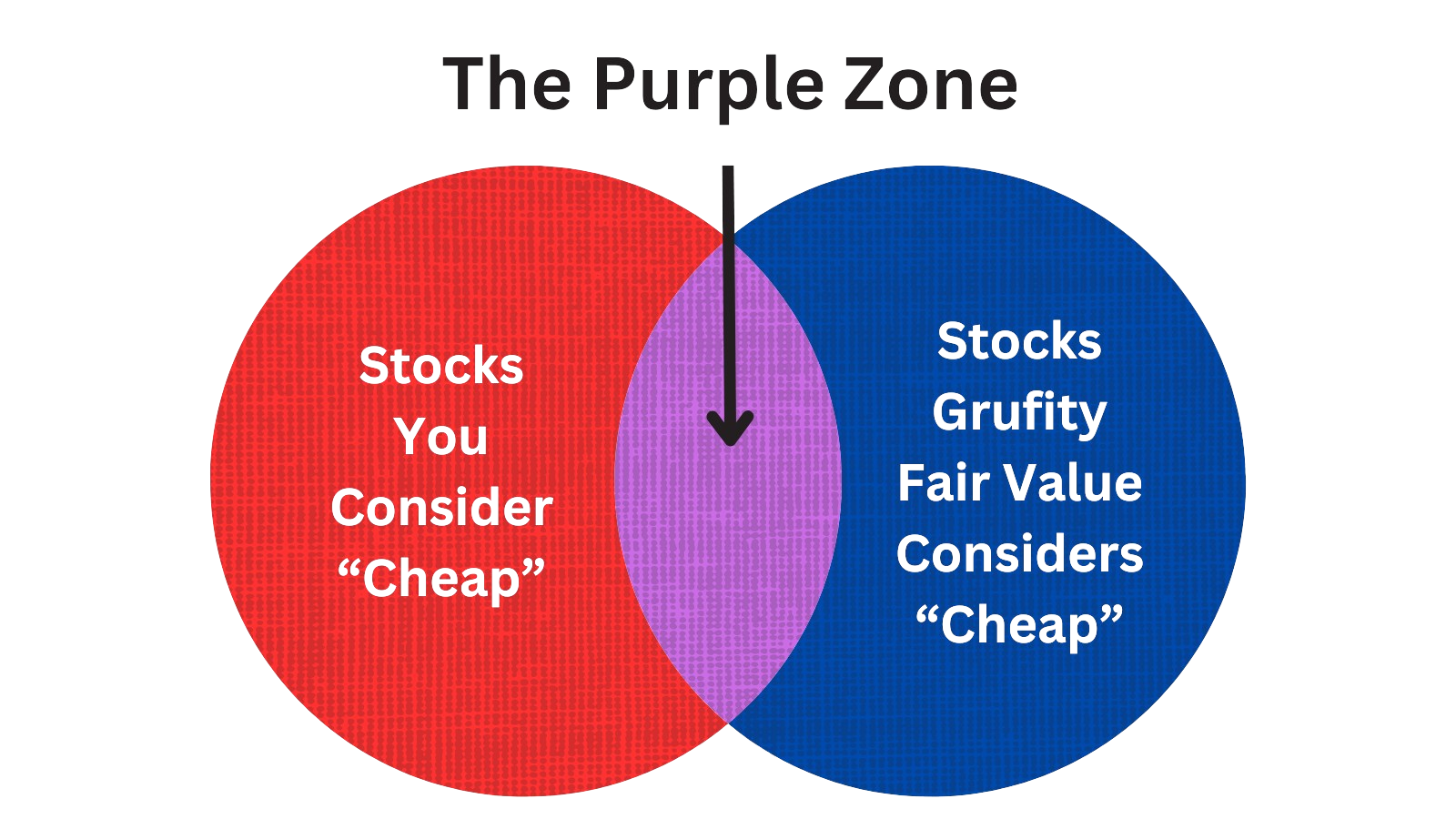

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Insulet Corp

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 01, 2024 | chadwick ana maria | acquired | - | - | 13,214 | evp, cfo & treasurer |

| Feb 28, 2024 | petrovic shacey | sold | -1,891,340 | 162 | -11,609 | - |

| Feb 28, 2024 | hollingshead james | sold (taxes) | -148,549 | 163 | -908 | president and ceo |

| Feb 28, 2024 | budden lauren | sold (taxes) | -38,118 | 163 | -233 | interim cfo and treasurer |

| Feb 28, 2024 | petrovic shacey | acquired | 1,069,300 | 92.11 | 11,609 | - |

| Feb 28, 2024 | manea dan | sold (taxes) | -27,484 | 163 | -168 | svp, chief hr officer |

| Feb 28, 2024 | kapples john w. | sold (taxes) | -43,026 | 163 | -263 | svp and general counsel |

| Feb 28, 2024 | cousin laetitia | sold (taxes) | -10,143 | 163 | -62.00 | svp, reg, quality & compliance |

| Feb 28, 2024 | field mark n | sold (taxes) | -21,922 | 163 | -134 | svp & chief technology officer |

| Feb 28, 2024 | singh prem | sold (taxes) | -14,724 | 163 | -90.00 | svp, global operations |

Which funds bought or sold PODD recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 17, 2024 | Plato Investment Management Ltd | added | 1,574 | 960,138 | 1,038,680 | 0.11% |

| May 17, 2024 | Kozak & Associates, Inc. | sold off | - | - | - | -% |

| May 16, 2024 | CALIFORNIA STATE TEACHERS RETIREMENT SYSTEM | reduced | -0.39 | -5,043,820 | 18,618,500 | 0.02% |

| May 16, 2024 | JANE STREET GROUP, LLC | reduced | -90.77 | -1,745,180 | 156,319 | -% |

| May 16, 2024 | Garner Asset Management Corp | sold off | -100 | -14,630 | - | -% |

| May 16, 2024 | Creekmur Asset Management LLC | new | - | 4,285 | 4,285 | -% |

| May 16, 2024 | Pineridge Advisors LLC | sold off | -100 | -5,208 | - | -% |

| May 16, 2024 | Motley Fool Asset Management LLC | added | 7.13 | -43,496 | 239,446 | 0.01% |

| May 16, 2024 | COMERICA BANK | reduced | -32.98 | -10,132,500 | 11,400,800 | 0.05% |

| May 16, 2024 | Grandeur Peak Global Advisors, LLC | added | 6.23 | -1,465,780 | 7,645,640 | 0.61% |

Are Funds Buying or Selling PODD?

PODD Alerts

Unveiling Insulet Corp's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 11.50% | 8,029,608 | SC 13G/A | |

| Feb 09, 2024 | capital world investors | 3.3% | 2,312,283 | SC 13G/A | |

| Feb 09, 2024 | capital research global investors | 13.6% | 9,476,623 | SC 13G/A | |

| Feb 09, 2024 | fmr llc | - | 0 | SC 13G/A | |

| Feb 08, 2024 | wellington management group llp | 4.87% | 3,401,606 | SC 13G/A | |

| Jan 25, 2024 | blackrock inc. | 8.7% | 6,102,546 | SC 13G/A | |

| Oct 13, 2023 | fmr llc | - | 0 | SC 13G/A | |

| Oct 10, 2023 | fil ltd | - | 0 | SC 13G/A | |

| Apr 10, 2023 | vanguard group inc | 11.36% | 7,903,404 | SC 13G/A | |

| Feb 13, 2023 | capital world investors | 5.9% | 4,097,334 | SC 13G/A |

Recent SEC filings of Insulet Corp

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 10, 2024 | 10-Q | Quarterly Report | |

| May 09, 2024 | 8-K | Current Report | |

| May 02, 2024 | 4 | Insider Trading | |

| Apr 25, 2024 | 3 | Insider Trading | |

| Apr 09, 2024 | DEF 14A | DEF 14A | |

| Apr 09, 2024 | DEFA14A | DEFA14A | |

| Mar 20, 2024 | 8-K | Current Report | |

| Mar 01, 2024 | 8-K | Current Report | |

| Feb 29, 2024 | 4 | Insider Trading | |

| Feb 29, 2024 | 4 | Insider Trading |

Peers (Alternatives to Insulet Corp)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

ABT | 181.0B | 40.3B | -1.75% | -4.07% | 32.18 | 4.49 | -2.84% | -3.08% |

BDX | 68.3B | 19.7B | 1.78% | -6.05% | 51.24 | 3.46 | 4.82% | -17.56% |

ALGN | 20.4B | 3.9B | -9.57% | -7.50% | 44.2 | 5.22 | 5.72% | 46.72% |

BAX | 18.0B | 14.9B | -10.73% | -18.01% | 6.79 | 1.21 | 2.98% | 207.68% |

| MID-CAP | ||||||||

ATR | 9.8B | 3.5B | 6.68% | 24.08% | 31.27 | 2.76 | 6.16% | 35.06% |

HSIC | 9.6B | 12.5B | 6.31% | -2.51% | 24.63 | 0.77 | -0.61% | -18.83% |

BIO | 8.4B | 2.6B | 1.13% | -22.65% | -26.02 | 3.22 | -6.25% | -68.62% |

XRAY | 5.9B | 3.9B | -6.79% | -30.12% | -62.84 | 1.49 | 0.23% | 91.03% |

AXNX | 3.4B | 387.1M | 0.52% | 31.17% | -216.3 | 8.9 | 30.82% | 65.57% |

PDCO | 2.3B | 6.6B | 0.19% | -5.50% | 11.93 | 0.35 | 2.78% | -0.87% |

| SMALL-CAP | ||||||||

AHCO | 1.3B | 3.2B | 5.94% | -10.00% | -1.91 | 0.41 | 7.94% | -1661.78% |

ANIK | 376.6M | 169.3M | -1.13% | -2.23% | -4.9 | 2.23 | 7.49% | -244.90% |

ANGO | 241.9M | 324.0M | -4.58% | -37.15% | -1.26 | 0.75 | -3.19% | -337.41% |

APYX | 56.1M | 50.5M | 22.73% | -73.49% | -2.46 | 1.11 | 14.25% | -10.06% |

AEMD | 1.0M | 3.7M | -71.83% | -87.10% | -0.09 | 0.28 | 5.77% | 8.23% |

Insulet Corp News

Insulet Corp Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -13.4% | 442 | 510 | 433 | 397 | 358 | 370 | 341 | 299 | 295 | 308 | 276 | 263 | 252 | 246 | 234 | 226 | 198 | 209 | 192 | 177 | 160 |

| Gross Profit | -15.1% | 307 | 361 | 293 | 265 | 241 | 217 | 188 | 190 | 210 | 213 | 189 | 183 | 168 | 161 | 152 | 143 | 127 | 134 | 123 | 116 | 107 |

| Operating Expenses | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 116 | 106 | 109 | 99.00 |

| S&GA Expenses | -6.2% | 200 | 213 | 181 | 179 | 163 | 144 | 140 | 174 | 129 | 122 | 118 | 116 | 111 | 130 | 89.00 | 81.00 | 84.00 | 81.00 | 75.00 | 76.00 | 67.00 |

| R&D Expenses | 19.5% | 50.00 | 42.00 | 58.00 | 55.00 | 50.00 | 50.00 | 45.00 | 43.00 | 43.00 | 42.00 | 38.00 | 40.00 | 41.00 | 38.00 | 39.00 | 34.00 | 36.00 | 36.00 | 31.00 | 33.00 | 33.00 |

| EBITDA Margin | 9.2% | 0.20* | 0.18* | 0.15* | 0.11* | 0.07* | 0.07* | 0.15* | 0.15* | 0.15* | 0.13* | -0.02* | -0.02* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -43.4% | 11.00 | 19.00 | 10.00 | -2.40 | -2.90 | 26.00 | 9.00 | -8.30 | -8.90 | 108 | -16.30 | -16.40 | -13.40 | -12.50 | -11.40 | -11.10 | -10.10 | -9.40 | -7.70 | -5.80 | -4.80 |

| Income Taxes | -24.4% | 3.00 | 5.00 | 2.00 | 1.00 | 1.00 | 5.00 | -0.50 | -1.10 | 2.00 | 4.00 | 3.00 | -3.40 | 0.00 | -1.40 | 2.00 | 3.00 | -0.50 | 2.00 | 0.00 | 1.00 | 0.00 |

| Earnings Before Taxes | -49.1% | 55.00 | 108 | 54.00 | 29.00 | 25.00 | 22.00 | -5.70 | -36.10 | 29.00 | 33.00 | 15.00 | -28.40 | 0.00 | -18.50 | 13.00 | 17.00 | -2.60 | 7.00 | 1.00 | 2.00 | 5.00 |

| EBT Margin | 8.8% | 0.14* | 0.13* | 0.08* | 0.05* | 0.00* | 0.01* | 0.02* | 0.04* | 0.04* | 0.02* | -0.03* | -0.03* | - | - | - | - | - | - | - | - | - |

| Net Income | -50.1% | 52.00 | 103 | 52.00 | 27.00 | 24.00 | 17.00 | -5.20 | -35.00 | 28.00 | 29.00 | 13.00 | -25.00 | - | -17.10 | 12.00 | 14.00 | -2.10 | 5.00 | 1.00 | 1.00 | 4.00 |

| Net Income Margin | 8.1% | 0.13* | 0.12* | 0.08* | 0.04* | 0.00* | 0.00* | 0.01* | 0.03* | 0.04* | 0.02* | -0.03* | -0.03* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | 311.9% | 66.00 | 16.00 | 36.00 | 28.00 | -10.00 | -13.70 | 26.00 | 11.00 | -26.50 | -57.30 | -53.10 | -1.60 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 1.4% | 2,624 | 2,588 | 2,468 | 2,386 | 2,289 | 2,251 | 2,166 | 2,114 | 2,069 | 2,049 | 1,999 | 1,924 | 1,840 | 1,873 | 1,711 | 1,627 | 1,108 | 1,143 | 1,268 | 978 | 953 |

| Current Assets | 2.2% | 1,618 | 1,583 | 1,471 | 1,422 | 1,330 | 1,314 | 1,329 | 1,309 | 1,285 | 1,330 | 1,307 | 1,253 | 1,192 | 1,249 | 1,160 | 1,086 | 541 | 591 | 794 | 499 | 496 |

| Cash Equivalents | 6.7% | 751 | 704 | 685 | 660 | 636 | 690 | 737 | 724 | 725 | 806 | 871 | 869 | 836 | 922 | 838 | 779 | 201 | 214 | 420 | 120 | 129 |

| Inventory | 7.0% | 431 | 403 | 411 | 411 | 386 | 347 | 328 | 320 | 315 | 303 | 259 | 198 | 170 | 154 | 125 | 104 | 96.00 | 101 | 90.00 | 85.00 | 74.00 |

| Net PPE | - | - | - | - | 602 | 597 | 600 | 553 | 536 | 538 | 537 | 515 | 506 | 498 | 479 | 449 | 423 | 412 | 399 | 356 | 334 | 300 |

| Goodwill | 0% | 52.00 | 52.00 | 52.00 | 52.00 | 52.00 | 52.00 | 52.00 | 52.00 | 52.00 | 40.00 | 40.00 | 40.00 | 40.00 | 40.00 | 40.00 | 40.00 | 40.00 | 40.00 | 40.00 | 40.00 | 40.00 |

| Liabilities | -1.2% | 1,833 | 1,856 | 1,860 | 1,832 | 1,786 | 1,775 | 1,738 | 1,691 | 1,623 | 1,493 | 1,501 | 1,465 | 1,255 | 1,269 | 1,116 | 1,063 | 1,049 | 1,067 | 1,118 | 728 | 729 |

| Current Liabilities | -4.2% | 432 | 451 | 451 | 425 | 383 | 365 | 334 | 279 | 215 | 229 | 229 | 213 | 186 | 208 | 175 | 134 | 130 | 158 | 113 | 106 | 114 |

| Long Term Debt | -0.3% | 1,363 | 1,366 | 1,371 | 1,369 | 1,369 | 1,374 | 1,380 | 1,385 | 1,391 | 1,249 | 1,257 | 1,235 | 1,052 | 1,044 | 922 | 910 | 899 | 888 | 986 | 607 | 600 |

| LT Debt, Current | -21.3% | 39.00 | 49.00 | 50.00 | 29.00 | 28.00 | 28.00 | 27.00 | 26.00 | 26.00 | 25.00 | 29.00 | 21.00 | 16.00 | 16.00 | - | - | - | - | - | - | - |

| LT Debt, Non Current | - | - | - | - | 1,369 | 1,369 | 1,374 | 1,380 | 1,385 | 1,391 | 1,249 | 1,257 | 1,235 | 1,052 | 1,044 | 922 | 910 | 899 | 888 | 986 | 607 | 600 |

| Shareholder's Equity | 7.9% | 791 | 733 | 608 | 554 | 503 | 476 | 428 | 422 | 447 | 556 | 498 | 459 | 585 | 604 | 595 | 563 | 59.00 | 76.00 | 151 | 250 | 224 |

| Retained Earnings | 13.6% | -326 | -378 | -481 | -533 | -560 | -584 | -601 | -596 | -561 | -649 | -678 | -691 | -666 | -666 | -649 | -660 | -675 | -672 | -676 | -677 | -679 |

| Additional Paid-In Capital | 1.4% | 1,118 | 1,103 | 1,081 | 1,071 | 1,047 | 1,041 | 1,022 | 1,011 | 996 | 1,208 | 1,180 | 1,150 | 1,248 | 1,264 | 1,245 | 1,228 | 738 | 749 | 832 | 930 | 906 |

| Shares Outstanding | 0.2% | 70.00 | 70.00 | 70.00 | 70.00 | 70.00 | 70.00 | 69.00 | 69.00 | 69.00 | 68.00 | 69.00 | 66.00 | - | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | 20,100 | - | - | - | 15,100 | - | - | - | 18,800 | - | - | - | 12,700 | - | - | - | 7,200 | - |

| Cashflow (Quarterly) | (In Thousands) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | 93.8% | 87,600 | 45,200 | 56,000 | 44,000 | 500 | 50,700 | 56,700 | 25,300 | -13,700 | -25,500 | -25,800 | 18,300 | -35,100 | 17,000 | 44,200 | 26,400 | -3,600 | 46,900 | 31,100 | 13,900 | 6,500 |

| Share Based Compensation | 12.7% | 14,200 | 12,600 | 10,500 | 13,100 | 12,100 | 11,200 | 9,000 | 11,200 | 9,500 | 8,600 | 8,200 | 9,000 | 8,600 | 15,600 | 6,600 | 5,800 | 7,900 | 8,000 | 6,600 | 8,300 | 5,800 |

| Cashflow From Investing | 24.1% | -24,000 | -31,600 | -22,600 | -23,100 | -42,100 | -88,400 | -33,900 | -21,900 | -46,900 | -36,400 | -12,200 | -11,400 | -22,700 | -69,300 | 2,700 | 67,200 | 13,400 | -54,000 | 12,200 | -39,400 | 7,600 |

| Cashflow From Financing | -740.9% | -14,100 | 2,200 | -6,900 | 3,200 | -12,100 | -14,500 | -3,900 | -1,600 | -20,300 | -1,500 | 42,200 | 28,400 | -28,400 | 130,100 | 10,500 | 483,900 | -19,000 | -202,400 | 258,200 | 16,200 | 1,500 |

| Buy Backs | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 300 |

PODD Income Statement

2024-03-31CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) - USD ($) shares in Thousands, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Revenue | $ 441.7 | $ 358.1 |

| Cost of revenue | 134.9 | 117.6 |

| Gross profit | 306.8 | 240.5 |

| Research and development expenses | 50.2 | 50.1 |

| Selling, general and administrative expenses | 199.7 | 162.7 |

| Operating income | 56.9 | 27.7 |

| Interest expense, net | (10.7) | (9.4) |

| Interest income | 9.4 | 6.5 |

| Other expense, net | (0.7) | (0.2) |

| Income before income taxes | 54.9 | 24.6 |

| Income tax expense | (3.4) | (0.8) |

| Net income | $ 51.5 | $ 23.8 |

| Earnings per share: | ||

| Basic (in dollars per share) | $ 0.74 | $ 0.34 |

| Diluted (in dollars per share) | $ 0.73 | $ 0.34 |

| Weighted-average number of common shares outstanding (in thousands): | ||

| Basic (in shares) | 69,957 | 69,583 |

| Diluted (in shares) | 73,741 | 70,096 |

| Nonrelated Party | ||

| Revenue | $ 329.9 | $ 261.3 |

| Related Party | ||

| Revenue | $ 111.8 | $ 96.8 |

PODD Balance Sheet

2024-03-31CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current Assets | ||

| Cash and cash equivalents | $ 751.2 | $ 704.2 |

| Inventories | 430.6 | 402.6 |

| Prepaid expenses and other current assets | 116.1 | 116.4 |

| Total current assets | 1,618.4 | 1,582.9 |

| Property, plant and equipment, net | 667.7 | 664.9 |

| Other intangible assets, net | 98.5 | 98.7 |

| Goodwill | 51.7 | 51.7 |

| Other assets (includes $29.4 and $31.3 at fair value) | 187.7 | 190.0 |

| Total assets | 2,624.0 | 2,588.2 |

| Current Liabilities | ||

| Accounts payable | 75.9 | 19.2 |

| Current portion of long-term debt | 38.9 | 49.4 |

| Total current liabilities | 432.4 | 451.2 |

| Long-term debt, net | 1,362.6 | 1,366.4 |

| Other liabilities | 38.3 | 37.9 |

| Total liabilities | 1,833.3 | 1,855.5 |

| Commitments and contingencies (Note 12) | ||

| Stockholders’ Equity | ||

| Preferred stock, $.001 par value, 5,000,000 authorized; none issued and outstanding | 0.0 | 0.0 |

| Common stock, $.001 par value, 100,000,000 authorized; 70,020,202 and 69,907,289 issued and outstanding | 0.1 | 0.1 |

| Additional paid-in capital | 1,117.6 | 1,102.6 |

| Accumulated deficit | (326.5) | (378.0) |

| Accumulated other comprehensive (loss) income | (0.5) | 8.0 |

| Total stockholders’ equity | 790.7 | 732.7 |

| Total liabilities and stockholders’ equity | 2,624.0 | 2,588.2 |

| Nonrelated Party | ||

| Current Assets | ||

| Accounts receivable, net | 234.1 | 240.2 |

| Current Liabilities | ||

| Accrued expenses and other current liabilities | 308.6 | 373.7 |

| Related Party | ||

| Current Assets | ||

| Accounts receivable, net | 86.4 | 119.5 |

| Current Liabilities | ||

| Accrued expenses and other current liabilities | $ 9.0 | $ 8.9 |

| CEO | Dr. James R. Hollingshead Ph.D. |

|---|---|

| WEBSITE | insulet.com |

| INDUSTRY | Medical Instruments & Supplies |

| EMPLOYEES | 2600 |