Market Summary

PTC Stock Price

PTC RSI Chart

PTC Valuation

PTC Price/Sales (Trailing)

PTC Profitability

PTC Fundamentals

PTC Revenue

PTC Earnings

Breaking Down PTC Revenue

52 Week Range

Last 7 days

5.5%

Last 30 days

-3.8%

Last 90 days

-1.7%

Trailing 12 Months

38.0%

How does PTC drawdown profile look like?

PTC Financial Health

PTC Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 2.2B | 0 | 0 | 0 |

| 2023 | 2.0B | 2.1B | 2.1B | 2.2B |

| 2022 | 1.9B | 1.9B | 1.9B | 1.9B |

| 2021 | 1.6B | 1.7B | 1.8B | 1.8B |

| 2020 | 1.3B | 1.4B | 1.5B | 1.5B |

| 2019 | 1.3B | 1.2B | 1.3B | 1.3B |

| 2018 | 1.2B | 1.2B | 1.2B | 1.3B |

| 2017 | 1.1B | 1.1B | 1.2B | 1.2B |

| 2016 | 1.2B | 1.2B | 1.1B | 1.1B |

| 2015 | 1.3B | 1.3B | 1.3B | 1.2B |

| 2014 | 1.3B | 1.3B | 1.4B | 1.4B |

| 2013 | 1.3B | 1.3B | 1.3B | 1.3B |

| 2012 | 1.3B | 1.3B | 1.3B | 1.3B |

| 2011 | 1.0B | 1.1B | 1.2B | 1.2B |

| 2010 | 974.1M | 992.1M | 1.0B | 1.0B |

| 2009 | 0 | 1.0B | 938.2M | 956.2M |

| 2008 | 0 | 0 | 1.1B | 0 |

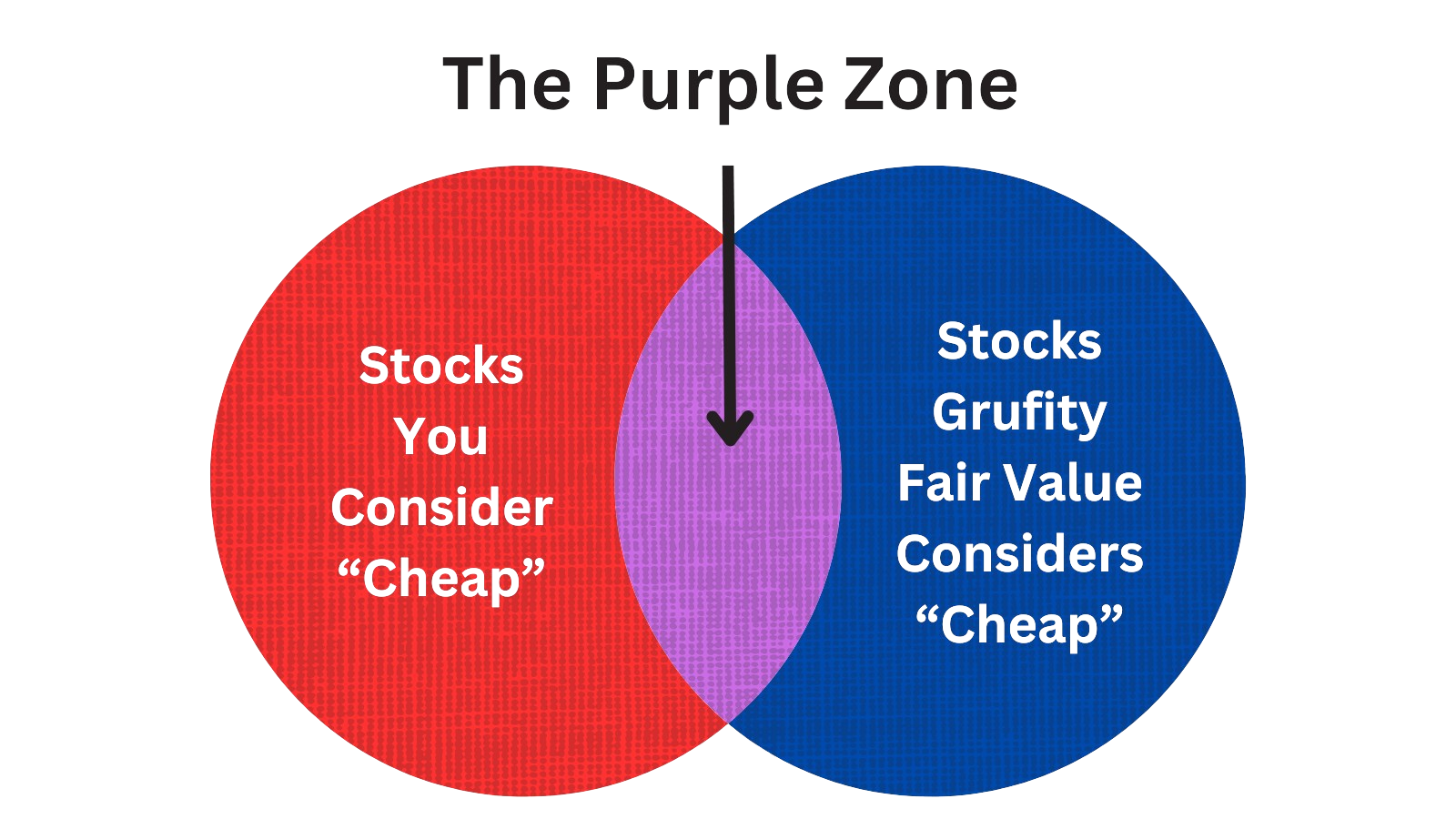

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of PTC Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 03, 2024 | katz michal | sold | -524,422 | 174 | -3,000 | - |

| May 01, 2024 | von staats aaron c | sold | -426,480 | 175 | -2,432 | evp, gc and secretary |

| Apr 01, 2024 | hanspal amarpreet | acquired | - | - | 1,756 | - |

| Mar 15, 2024 | kniker catherine | acquired | - | - | 710 | chief strategy officer |

| Mar 15, 2024 | kniker catherine | sold (taxes) | -41,270 | 181 | -227 | chief strategy officer |

| Mar 01, 2024 | lacy paul a | sold | -1,404,080 | 187 | -7,500 | - |

| Feb 15, 2024 | ditullio michael | acquired | - | - | 1,281 | president and coo |

| Feb 15, 2024 | ditullio michael | sold (taxes) | -72,796 | 181 | -400 | president and coo |

| Feb 15, 2024 | katz michal | acquired | - | - | 1,561 | - |

| Feb 14, 2024 | schechter robert | acquired | - | - | 2,282 | - |

Which funds bought or sold PTC recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 08, 2024 | Moors & Cabot, Inc. | added | 136 | 335,384 | 550,760 | 0.03% |

| May 08, 2024 | KBC Group NV | added | 4.39 | 4,763,000 | 42,164,000 | 0.13% |

| May 08, 2024 | PROFUND ADVISORS LLC | reduced | -3.63 | 17,233 | 440,986 | 0.02% |

| May 08, 2024 | EVERENCE CAPITAL MANAGEMENT INC | unchanged | - | 32,000 | 440,000 | 0.03% |

| May 08, 2024 | PATTON FUND MANAGEMENT, INC. | reduced | -11.69 | -236,418 | 4,863,320 | 0.88% |

| May 08, 2024 | Cyrus J. Lawrence, LLC | new | - | 74,000 | 74,000 | 0.02% |

| May 08, 2024 | Calamos Advisors LLC | reduced | -48.72 | -11,192,700 | 13,887,800 | 0.07% |

| May 08, 2024 | BNP PARIBAS ASSET MANAGEMENT Holding S.A. | reduced | -76.71 | -4,962,000 | 1,668,000 | -% |

| May 08, 2024 | Bell Investment Advisors, Inc | unchanged | - | 1,300 | 17,572 | -% |

| May 08, 2024 | GREAT LAKES ADVISORS, LLC | reduced | -18.88 | -30,336 | 214,258 | -% |

Are Funds Buying or Selling PTC?

Unveiling PTC Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Mar 07, 2024 | blackrock inc. | 10.1% | 12,119,848 | SC 13G/A | |

| Feb 14, 2024 | t. rowe price investment management, inc. | 8.1% | 9,655,805 | SC 13G | |

| Feb 13, 2024 | vanguard group inc | 11.35% | 13,535,231 | SC 13G/A | |

| Jan 24, 2024 | blackrock inc. | 9.4% | 11,180,248 | SC 13G/A | |

| Aug 01, 2023 | rockwell automation, inc | 4.99% | 5,910,905 | SC 13D/A | |

| Jun 20, 2023 | rockwell automation, inc | 5.13% | 6,070,905 | SC 13D/A | |

| May 18, 2023 | rockwell automation, inc | 5.44% | 6,448,905 | SC 13D/A | |

| Feb 14, 2023 | rockwell automation, inc | 6.45% | 7,622,238 | SC 13D/A | |

| Feb 09, 2023 | vanguard group inc | 10.36% | 12,246,328 | SC 13G/A | |

| Feb 03, 2023 | blackrock inc. | 8.1% | 8,972,641 | SC 13G/A |

Recent SEC filings of PTC Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 09, 2024 | 144 | Notice of Insider Sale Intent | |

| May 03, 2024 | 10-Q | Quarterly Report | |

| May 03, 2024 | 144 | Notice of Insider Sale Intent | |

| May 03, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 4 | Insider Trading | |

| May 01, 2024 | 144 | Notice of Insider Sale Intent | |

| May 01, 2024 | 8-K | Current Report | |

| Apr 02, 2024 | 4 | Insider Trading | |

| Mar 19, 2024 | 4 | Insider Trading | |

| Mar 07, 2024 | SC 13G/A | Major Ownership Report |

Peers (Alternatives to PTC Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

CRM | 266.9B | 34.9B | -9.02% | 34.30% | 64.52 | 7.66 | 11.18% | 1888.46% |

UBER | 141.9B | 38.6B | -9.61% | 75.10% | 102.1 | 3.68 | 14.01% | 141.26% |

ADSK | 46.8B | 5.3B | -11.80% | 11.39% | 51.01 | 8.75 | 9.15% | 48.14% |

ANSS | 28.6B | 2.2B | -4.95% | 10.69% | 65.78 | 12.84 | 3.59% | -21.47% |

ZM | 18.4B | 4.5B | -4.26% | -5.12% | 28.84 | 4.06 | 3.06% | 514.65% |

| MID-CAP | ||||||||

APPF | 8.9B | 671.8M | 5.51% | 71.97% | 115.75 | 13.18 | 33.64% | 185.98% |

LYFT | 6.9B | 4.7B | -6.92% | 94.47% | -37.56 | 1.48 | 10.90% | 88.31% |

ALRM | 3.4B | 881.7M | -2.86% | 43.34% | 42.76 | 3.9 | 4.64% | 44.42% |

AYX | 3.4B | 970.0M | 0.90% | -15.87% | -19.13 | 3.53 | 13.46% | 43.89% |

AI | 2.9B | 296.4M | -2.45% | 20.52% | -10.78 | 9.89 | 11.14% | -3.59% |

AGYS | 2.2B | 228.1M | -4.15% | 2.69% | 25.39 | 9.72 | 18.99% | 599.09% |

| SMALL-CAP | ||||||||

AVID | 1.2B | 413.5M | 0.63% | -1.64% | 92.02 | 2.88 | -1.65% | -71.35% |

APPS | 228.5M | 572.4M | 3.23% | -81.38% | -1.15 | 0.4 | -19.38% | -489.49% |

AEYE | 210.9M | 31.6M | 49.54% | 166.62% | -35.92 | 6.67 | 2.76% | 43.72% |

ASUR | 194.9M | 117.7M | -5.04% | -45.44% | -19.76 | 1.66 | 12.54% | 11.24% |

PTC Inc News

PTC Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 9.6% | 603 | 550 | 547 | 542 | 542 | 466 | 508 | 462 | 505 | 493 | 481 | 436 | 462 | 429 | 391 | 352 | 360 | 356 | 335 | 295 | 290 |

| Gross Profit | 12.0% | 493 | 440 | 431 | 426 | 429 | 370 | 412 | 360 | 412 | 363 | 381 | 341 | 372 | 342 | 306 | 272 | 277 | 269 | 250 | 213 | 211 |

| Operating Expenses | -2.5% | 313 | 321 | 310 | 317 | 306 | 265 | 266 | 281 | 253 | 300 | 266 | 267 | 271 | 252 | 239 | 209 | 227 | 238 | 203 | 203 | 233 |

| S&GA Expenses | -1.8% | 135 | 137 | 137 | 145 | 129 | 118 | 119 | 124 | 116 | 125 | 129 | 134 | 129 | 125 | 116 | 105 | 107 | 108 | 101 | 108 | 104 |

| R&D Expenses | 1.1% | 107 | 106 | 102 | 104 | 100 | 88.00 | 88.00 | 88.00 | 82.00 | 81.00 | 78.00 | 78.00 | 73.00 | 71.00 | 70.00 | 61.00 | 60.00 | 65.00 | 64.00 | 61.00 | 61.00 |

| EBITDA Margin | 6.2% | 0.29* | 0.27* | 0.27* | 0.29* | 0.30* | 0.29* | 0.28* | 0.30* | 0.28* | 0.28* | 0.29* | 0.24* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -10.6% | 32.00 | 35.00 | 36.00 | 36.00 | 42.00 | 16.00 | 15.00 | 14.00 | 12.00 | 13.00 | 13.00 | 13.00 | 13.00 | 12.00 | 12.00 | 20.00 | 33.00 | 12.00 | 11.00 | 11.00 | 11.00 |

| Income Taxes | 62.9% | 31.00 | 19.00 | 43.00 | 15.00 | 18.00 | 11.00 | 31.00 | 30.00 | 14.00 | 9.00 | -123 | 7.00 | -22.90 | 54.00 | 2.00 | 10.00 | 9.00 | -16.42 | 24.00 | 14.00 | 10.00 |

| Earnings Before Taxes | 70.3% | 146 | 86.00 | 89.00 | 77.00 | 81.00 | 86.00 | 137 | 101 | 104 | 55.00 | 170 | 58.00 | 86.00 | 77.00 | 55.00 | 45.00 | 16.00 | 19.00 | 34.00 | -0.48 | -33.42 |

| EBT Margin | 16.3% | 0.18* | 0.15* | 0.16* | 0.19* | 0.21* | 0.22* | 0.21* | 0.23* | 0.21* | 0.20* | 0.22* | 0.16* | - | - | - | - | - | - | - | - | - |

| Net Income | 72.4% | 114 | 66.00 | 46.00 | 61.00 | 64.00 | 75.00 | 107 | 70.00 | 90.00 | 46.00 | 69.00 | 51.00 | 109 | 24.00 | 53.00 | 35.00 | 7.00 | 35.00 | 10.00 | -14.76 | -43.51 |

| Net Income Margin | 18.2% | 0.13* | 0.11* | 0.12* | 0.15* | 0.16* | 0.18* | 0.16* | 0.14* | 0.14* | 0.15* | 0.14* | 0.14* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | 35.2% | 247 | 183 | 44.00 | 164 | 207 | 172 | 29.00 | 112 | 140 | 134 | 32.00 | 85.00 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -1.1% | 6,205 | 6,271 | 6,289 | 6,208 | 6,300 | 4,796 | 4,687 | 4,606 | 4,379 | 4,421 | 4,508 | 4,206 | 4,181 | 3,449 | 3,383 | 3,376 | 3,866 | 3,280 | 2,665 | 2,649 | 2,716 |

| Current Assets | 1.6% | 1,153 | 1,134 | 1,277 | 1,103 | 1,166 | 1,127 | 1,069 | 948 | 967 | 1,009 | 1,073 | 918 | 902 | 936 | 833 | 847 | 1,341 | 739 | 783 | 753 | 791 |

| Cash Equivalents | -5.9% | 249 | 265 | 288 | 282 | 320 | 388 | 273 | 323 | 307 | 297 | 327 | 366 | 327 | 399 | 276 | 378 | 828 | 238 | 271 | 269 | 295 |

| Net PPE | -4.2% | 82.00 | 85.00 | 88.00 | 89.00 | 92.00 | 95.00 | 98.00 | 91.00 | 93.00 | 97.00 | 100 | 94.00 | 97.00 | 98.00 | 101 | 102 | 104 | 105 | 106 | 108 | 107 |

| Goodwill | -0.3% | 3,446 | 3,458 | 3,359 | 3,377 | 3,369 | 975 | 2,354 | 2,383 | 2,186 | 2,190 | 2,192 | 2,197 | 2,194 | 563 | 1,626 | 1,605 | 1,603 | 1,606 | 1,238 | 1,245 | 1,230 |

| Liabilities | -5.8% | 3,262 | 3,465 | 3,612 | 3,609 | 3,781 | 2,395 | 2,391 | 2,448 | 2,295 | 2,467 | 2,469 | 2,481 | 2,531 | 1,954 | 1,944 | 2,049 | 2,592 | 2,032 | 1,463 | 1,433 | 1,468 |

| Current Liabilities | 59.4% | 1,515 | 950 | 1,671 | 1,612 | 1,593 | 787 | 792 | 770 | 782 | 780 | 779 | 746 | 767 | 712 | 681 | 666 | 1,192 | 632 | 638 | 601 | 598 |

| Long Term Debt | -33.7% | 1,491 | 2,248 | 1,686 | 1,738 | 1,918 | 1,351 | 1,351 | 1,425 | 1,266 | 1,440 | 1,439 | 1,479 | 1,508 | 988 | 1,005 | 1,125 | 1,134 | 1,124 | 669 | 699 | - |

| LT Debt, Current | 4017.4% | 515 | 13.00 | 9.00 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Shareholder's Equity | 4.9% | 2,943 | 2,807 | 2,677 | 2,599 | 2,519 | 2,401 | 2,296 | 2,157 | 2,084 | 1,954 | 2,038 | 1,725 | 1,651 | 1,495 | 1,438 | 1,328 | 1,274 | 1,248 | 1,202 | 1,216 | 1,248 |

| Retained Earnings | 11.0% | 1,154 | 1,040 | 973 | 928 | 866 | 803 | 728 | 621 | 550 | 461 | 415 | 122 | 71.00 | -38.75 | -62.27 | -115 | -150 | -157 | -191 | -197 | -182 |

| Additional Paid-In Capital | 2.2% | 1,901 | 1,861 | 1,821 | 1,767 | 1,750 | 1,702 | 1,721 | 1,669 | 1,638 | 1,590 | 1,719 | 1,695 | 1,677 | 1,623 | 1,603 | 1,552 | 1,537 | 1,508 | 1,503 | 1,505 | 1,524 |

| Shares Outstanding | 0.2% | 120 | 119 | 119 | 119 | 118 | 118 | 117 | 117 | 117 | 117 | 117 | 117 | - | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | - | 14,078 | - | - | - | 11,336 | - | - | - | 14,487 | - | - | - | 6,145 | - | - | - | 10,785 |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | 33.8% | 251 | 187 | 50.00 | 169 | 211 | 181 | 38.00 | 117 | 142 | 138 | 45.00 | 88.00 | 122 | 114 | 34.00 | 105 | 88.00 | 8.00 | 55.00 | 68.00 | 141 |

| Share Based Compensation | -8.2% | 54.00 | 59.00 | 59.00 | 54.00 | 52.00 | 42.00 | 42.00 | 49.00 | 38.00 | 46.00 | 43.00 | 43.00 | 45.00 | 46.00 | 42.00 | 25.00 | 20.00 | 28.00 | 15.00 | 15.00 | 27.00 |

| Cashflow From Investing | 101.4% | 1.00 | -105 | 0.00 | -6.40 | -839 | -20.13 | -8.26 | -236 | 41.00 | 3.00 | -13.05 | -4.49 | -717 | 47.00 | -28.97 | -20.26 | -3.32 | -473 | -2.44 | -19.24 | -27.13 |

| Cashflow From Financing | -134.3% | -262 | -111 | -39.22 | -199 | 561 | -53.99 | -70.84 | 147 | -170 | -169 | -69.73 | -44.97 | 528 | -42.78 | -111 | -535 | 513 | 431 | -46.36 | -74.70 | -96.90 |

| Buy Backs | - | - | - | - | - | - | - | - | 3.00 | 0.00 | 120 | 30.00 | - | - | - | - | - | - | - | 25.00 | 25.00 | 65.00 |

PTC Income Statement

2024-03-31Consolidated Statements Of Operations (Unaudited) - USD ($) shares in Thousands, $ in Thousands | 3 Months Ended | 6 Months Ended | ||

|---|---|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | Mar. 31, 2024 | Mar. 31, 2023 | |

| Revenue: | ||||

| Total revenue | $ 603,072 | $ 542,181 | $ 1,153,286 | $ 1,008,091 |

| Cost of revenue: | ||||

| Total cost of revenue | 110,055 | 113,506 | 220,075 | 209,296 |

| Gross margin | 493,017 | 428,675 | 933,211 | 798,795 |

| Operating expenses: | ||||

| Sales and marketing | 134,521 | 129,207 | 271,445 | 247,590 |

| Research and development | 106,998 | 100,349 | 212,781 | 188,526 |

| General and administrative | 61,526 | 65,923 | 130,732 | 116,894 |

| Amortization of acquired intangible assets | 10,424 | 10,656 | 20,787 | 18,682 |

| Restructuring and other charges (credits), net | (7) | 1 | (802) | (337) |

| Total operating expenses | 313,462 | 306,136 | 634,943 | 571,355 |

| Operating income | 179,555 | 122,539 | 298,268 | 227,440 |

| Interest and debt premium expense | (31,586) | (41,525) | (66,920) | (57,883) |

| Other income (expense), net | (2,224) | 55 | (4) | (2,064) |

| Income before income taxes | 145,745 | 81,069 | 231,344 | 167,493 |

| Provision for income taxes | 31,300 | 17,565 | 50,512 | 28,954 |

| Net income | $ 114,445 | $ 63,504 | $ 180,832 | $ 138,539 |

| Earnings per share—Basic | $ 0.96 | $ 0.54 | $ 1.52 | $ 1.17 |

| Earnings per share—Diluted | $ 0.95 | $ 0.53 | $ 1.5 | $ 1.17 |

| Weighted-average shares outstanding—Basic | 119,587 | 118,260 | 119,354 | 118,037 |

| Weighted-average shares outstanding—Diluted | 120,712 | 119,041 | 120,480 | 118,912 |

| License | ||||

| Revenue: | ||||

| License | $ 234,321 | $ 196,993 | $ 418,319 | $ 369,691 |

| Cost of revenue: | ||||

| Cost of license revenue | 10,602 | 17,039 | 20,931 | 29,792 |

| Support and cloud services | ||||

| Revenue: | ||||

| Support and cloud services | 336,446 | 304,071 | 666,915 | 561,727 |

| Cost of revenue: | ||||

| Cost of support and cloud services revenue | 67,414 | 59,137 | 134,437 | 109,362 |

| Software | ||||

| Revenue: | ||||

| Total software revenue | 570,767 | 501,064 | 1,085,234 | 931,418 |

| Cost of revenue: | ||||

| Total cost of software revenue | 78,016 | 76,176 | 155,368 | 139,154 |

| Professional services | ||||

| Revenue: | ||||

| Professional services | 32,305 | 41,117 | 68,052 | 76,673 |

| Cost of revenue: | ||||

| Cost of professional services revenue | $ 32,039 | $ 37,330 | $ 64,707 | $ 70,142 |

PTC Balance Sheet

2024-03-31Consolidated Balance Sheets (Unaudited) - USD ($) $ in Thousands | Mar. 31, 2024 | Sep. 30, 2023 |

|---|---|---|

| ASSETS | ||

| Cash and cash equivalents | $ 248,971 | $ 288,103 |

| Accounts receivable, net of allowance for doubtful accounts of $1,269 and $429 at March 31, 2024 and September 30, 2023, respectively | 705,493 | 811,398 |

| Prepaid expenses | 137,393 | 96,016 |

| Other current assets | 60,951 | 81,849 |

| Total current assets | 1,152,808 | 1,277,366 |

| Property and equipment, net | 81,811 | 88,391 |

| Goodwill | 3,446,373 | 3,358,511 |

| Acquired intangible assets, net | 931,471 | 941,249 |

| Deferred tax assets | 109,204 | 123,319 |

| Operating right-of-use lease assets | 135,262 | 143,028 |

| Other assets | 348,334 | 356,978 |

| Total assets | 6,205,263 | 6,288,842 |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||

| Accounts payable | 19,637 | 43,480 |

| Accrued expenses and other current liabilities | 110,353 | 132,841 |

| Accrued compensation and benefits | 119,326 | 160,431 |

| Accrued income taxes | 19,348 | 14,919 |

| Current portion of long-term debt | 514,677 | 9,375 |

| Deferred acquisition payments | 0 | 620,040 |

| Deferred revenue | 708,839 | 665,362 |

| Short-term lease obligations | 22,836 | 24,737 |

| Total current liabilities | 1,515,016 | 1,671,185 |

| Long-term debt | 1,491,064 | 1,686,410 |

| Deferred tax liabilities | 37,568 | 29,508 |

| Long-term deferred revenue | 15,732 | 16,188 |

| Long-term lease obligations | 160,953 | 168,455 |

| Other liabilities | 41,798 | 39,806 |

| Total liabilities | 3,262,131 | 3,611,552 |

| Commitments and contingencies (Note 11) | ||

| Stockholders’ equity: | ||

| Preferred stock, $0.01 par value; 5,000 shares authorized; none issued | 0 | 0 |

| Common stock, $0.01 par value; 500,000 shares authorized; 119,717 and 118,846 shares issued and outstanding at March 31, 2024 and September 30, 2023, respectively | 1,197 | 1,188 |

| Additional paid-in capital | 1,901,109 | 1,820,905 |

| Retained earnings | 1,154,109 | 973,277 |

| Accumulated other comprehensive loss | (113,283) | (118,080) |

| Total stockholders’ equity | 2,943,132 | 2,677,290 |

| Total liabilities and stockholders’ equity | $ 6,205,263 | $ 6,288,842 |

| CEO | Mr. James E. Heppelmann |

|---|---|

| WEBSITE | ptc.com |

| INDUSTRY | Software - Apps |

| EMPLOYEES | 7165 |