Market Summary

SNCY Stock Price

SNCY RSI Chart

SNCY Valuation

SNCY Price/Sales (Trailing)

SNCY Profitability

SNCY Fundamentals

SNCY Revenue

SNCY Earnings

Breaking Down SNCY Revenue

52 Week Range

Last 7 days

-17.3%

Last 30 days

-24.5%

Last 90 days

-24.8%

Trailing 12 Months

-37.0%

How does SNCY drawdown profile look like?

SNCY Financial Health

SNCY Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 1.1B | 0 | 0 | 0 |

| 2023 | 962.0M | 1.0B | 1.0B | 1.0B |

| 2022 | 721.9M | 791.8M | 839.8M | 894.4M |

| 2021 | 348.8M | 462.6M | 558.3M | 623.0M |

| 2020 | 685.0M | 551.0M | 457.5M | 401.5M |

| 2019 | 0 | 0 | 0 | 701.4M |

| 2018 | 0 | 0 | 0 | 0 |

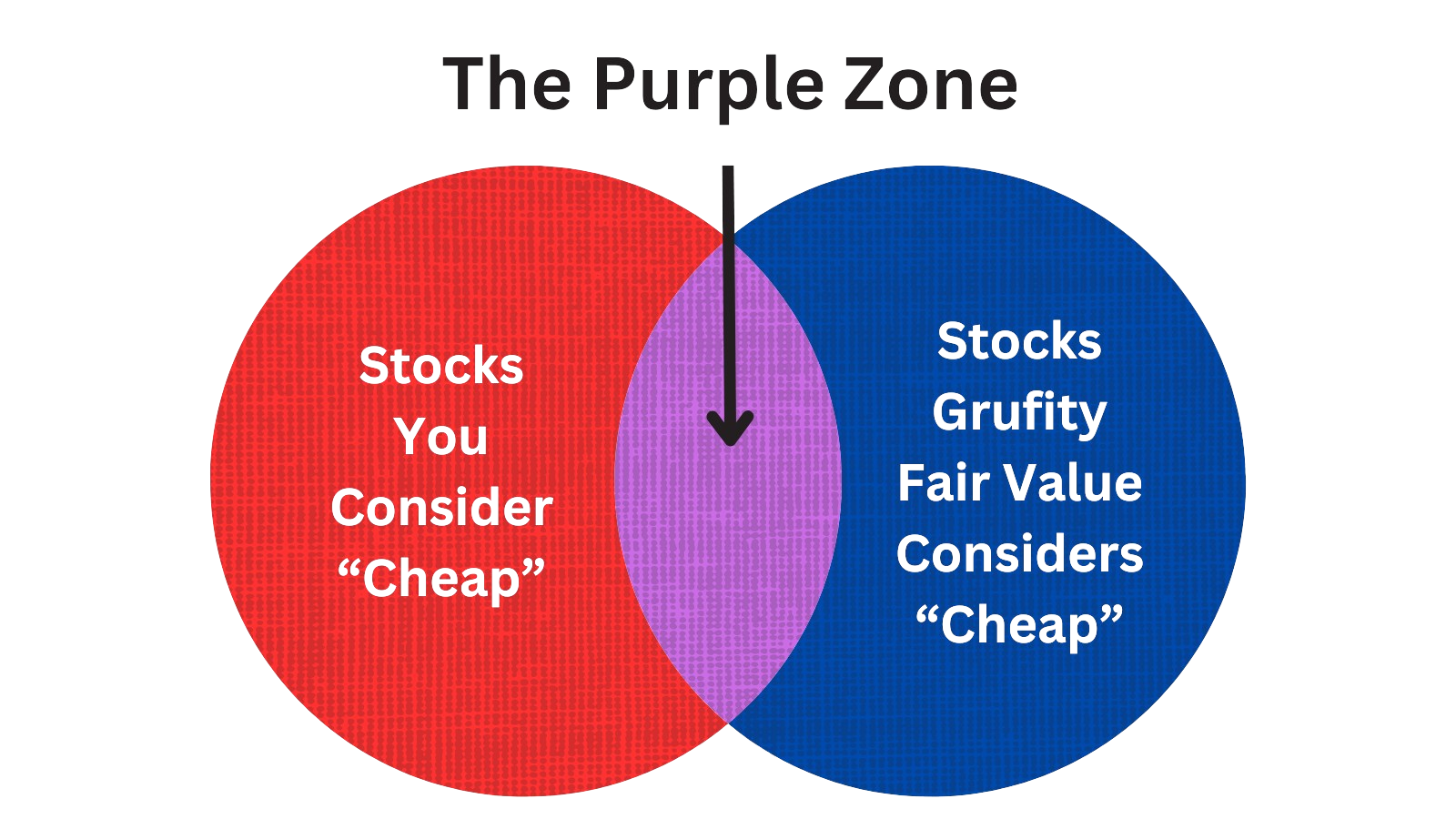

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed Russell 2000 Index

Small Caps and Mid Caps are mostly overlooked by investors as all the focus goes to Magnificent 7. These stocks that are not part of the beauty contest require a deeper look. However, all large cap stocks were once small caps. Grufity's Fair Value model opens up this unverse as it separates high-performing, rewarding stocks from low-performing risky stocks. <b>Russell 2000 stocks that were marked 'Very Cheap' by the model doubled in three years while the index was flat.</b>

Returns of $10,000 invested in:

Very Cheap Stocks: $21,859

Russell 2000 Index: $10,334

Very Expensive Stocks: $8,224

Russell 2000 stocks considered 'Very Cheap' by the model greatly outperformed Russell 2000 index and the 'Very Expensive' bucket over past three years.

Tracking the Latest Insider Buys and Sells of Sun Country Airlines Holdings, Inc.

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Apr 03, 2024 | neale erin rose | sold | -25,361 | 14.41 | -1,760 | svp, gc, and secretary |

| Apr 02, 2024 | davis david m | sold | -13,775 | 14.3791 | -958 | president & cfo |

| Apr 02, 2024 | mays gregory a. | sold | -12,571 | 14.4169 | -872 | chief operating officer & evp |

| Apr 02, 2024 | neale erin rose | sold | -11,329 | 14.4146 | -786 | svp, gc, and secretary |

| Apr 02, 2024 | whitney grant | sold | -5,745 | 14.3631 | -400 | chief revenue officer & svp |

| Apr 02, 2024 | gyurci john | sold | -4,485 | 14.3757 | -312 | chief acct. off. & vp, finance |

| Apr 02, 2024 | bricker jude | sold | -30,782 | 14.351 | -2,145 | chief executive officer |

| Feb 28, 2024 | davis david m | sold | -31,247 | 16.2495 | -1,923 | president & cfo |

| Jan 11, 2024 | sca horus holdings, llc | sold | -3,702,270 | 16.00 | -231,392 | - |

| Jan 09, 2024 | davis david m | acquired | - | - | 23,465 | president & cfo |

Which funds bought or sold SNCY recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 08, 2024 | Russell Investments Group, Ltd. | reduced | -45.29 | -1,834,560 | 2,026,490 | -% |

| May 08, 2024 | STATE BOARD OF ADMINISTRATION OF FLORIDA RETIREMENT SYSTEM | sold off | -100 | -169,255 | - | -% |

| May 08, 2024 | US BANCORP \DE\ | unchanged | - | -156 | 3,682 | -% |

| May 08, 2024 | EVERENCE CAPITAL MANAGEMENT INC | unchanged | - | -9,000 | 220,000 | 0.01% |

| May 08, 2024 | EMERALD ADVISERS, LLC | added | 0.4 | -546,776 | 14,278,000 | 0.57% |

| May 08, 2024 | EMERALD MUTUAL FUND ADVISERS TRUST | unchanged | - | -492,638 | 11,615,500 | 0.60% |

| May 07, 2024 | Swiss National Bank | unchanged | - | -17,664 | 416,484 | -% |

| May 07, 2024 | NEW YORK STATE COMMON RETIREMENT FUND | reduced | -0.16 | -9,000 | 213,000 | -% |

| May 07, 2024 | Empowered Funds, LLC | added | 322 | 4,275,560 | 5,674,170 | 0.05% |

| May 07, 2024 | ASSETMARK, INC | reduced | -97.74 | -50,997 | 1,132 | -% |

Are Funds Buying or Selling SNCY?

Unveiling Sun Country Airlines Holdings, Inc.'s Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 14, 2024 | macquarie group ltd | 6.99% | 3,788,897 | SC 13G | |

| Feb 13, 2024 | vanguard group inc | 8.50% | 4,601,829 | SC 13G/A | |

| Feb 13, 2024 | sca horus holdings, llc | 21.2% | 11,392,497 | SC 13G/A | |

| Feb 09, 2024 | capital international investors | 6.1% | 3,280,677 | SC 13G/A | |

| Feb 08, 2024 | etf series solutions | 2657% | 2,850,525 | SC 13G | |

| Jan 24, 2024 | blackrock inc. | 11.2% | 6,067,439 | SC 13G/A | |

| Nov 24, 2023 | par investment partners lp | 5.1% | 2,767,000 | SC 13G | |

| Oct 06, 2023 | blackrock inc. | 10.5% | 5,865,705 | SC 13G/A | |

| Feb 14, 2023 | sca horus holdings, llc | 42.8% | 24,869,997 | SC 13G/A | |

| Feb 13, 2023 | capital international investors | 5.5% | 3,173,836 | SC 13G |

Recent SEC filings of Sun Country Airlines Holdings, Inc.

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 07, 2024 | 10-Q | Quarterly Report | |

| May 07, 2024 | 8-K | Current Report | |

| Apr 29, 2024 | DEF 14A | DEF 14A | |

| Apr 29, 2024 | DEFA14A | DEFA14A | |

| Apr 04, 2024 | 4 | Insider Trading | |

| Apr 04, 2024 | 4 | Insider Trading | |

| Apr 04, 2024 | 4 | Insider Trading | |

| Apr 04, 2024 | 4 | Insider Trading | |

| Apr 04, 2024 | 4 | Insider Trading | |

| Apr 04, 2024 | 4 | Insider Trading |

Peers (Alternatives to Sun Country Airlines Holdings, Inc.)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

DAL | 34.0B | 59.0B | 11.50% | 56.09% | 6.8 | 0.58 | 9.34% | 164.26% |

UAL | 17.3B | 54.8B | 21.18% | 15.64% | 6.44 | 0.32 | 12.31% | 40.00% |

LUV | 16.3B | 26.7B | -6.09% | -6.70% | 50.47 | 0.61 | 7.60% | -43.44% |

| MID-CAP | ||||||||

AAL | 9.5B | 53.2B | 3.66% | 0.84% | 18.97 | 0.18 | 1.74% | -71.78% |

ALK | 5.6B | 10.5B | 2.00% | 1.76% | 22.72 | 0.53 | 2.96% | 315.25% |

JBLU | 2.0B | 9.5B | -19.04% | -17.29% | -2.34 | 0.21 | -2.60% | -178.93% |

| SMALL-CAP | ||||||||

ALGT | 980.5M | 2.5B | -18.61% | -47.79% | 16.2 | 0.39 | 2.66% | -9.01% |

ATSG | 974.0M | 2.1B | 12.77% | -5.24% | 19.96 | 0.47 | -0.28% | -71.11% |

HA | 677.7M | 2.7B | -0.98% | 63.99% | -2.26 | 0.25 | -0.99% | -46.20% |

SAVE | 419.4M | 5.3B | -22.00% | -75.54% | -0.86 | 0.08 | -3.17% | -4.93% |

MESA | 38.5M | 498.1M | 10.59% | -37.33% | -0.27 | 0.07 | -6.20% | 34.25% |

Sun Country Airlines Holdings, Inc. News

Sun Country Airlines Holdings, Inc. Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Thousands) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 26.9% | 311 | 246 | 249 | 261 | 294 | 227 | 222 | 219 | 227 | 173 | 174 | 149 | 128 | 108 | 78.00 | 35.00 | 180 | 164 | 171 | 169 | 197 |

| Costs and Expenses | 12.2% | 256 | 228 | 230 | 225 | 238 | 212 | 206 | 216 | 205 | 162 | 152 | 99.00 | 103 | 112 | 69.00 | 38.00 | 165 | - | - | - | - |

| S&GA Expenses | 31.8% | 11.00 | 8.00 | 8.00 | 9.00 | 10.00 | 8.00 | 7.00 | 8.00 | 9.00 | 6.00 | 5.00 | 6.00 | 5.00 | 3.00 | 3.00 | 2.00 | 9.00 | - | - | - | - |

| EBITDA Margin | 0.0% | 0.21* | 0.21* | 0.21* | 0.21* | 0.18* | 0.14* | 0.13* | 0.14* | 0.24* | 0.29* | 0.29* | 0.32* | 0.22* | 0.16* | 0.25* | 0.20* | 0.16* | 0.16* | - | - | - |

| Interest Expenses | -2.2% | 11.00 | 11.00 | 11.00 | 11.00 | 9.00 | 8.00 | 7.00 | 7.00 | 9.00 | 7.00 | 6.00 | 6.00 | 7.00 | 6.00 | 5.00 | 5.00 | 6.00 | - | - | - | - |

| Income Taxes | 458.1% | 11.00 | 2.00 | 2.00 | 6.00 | 11.00 | 2.00 | 2.00 | -0.92 | 3.00 | 1.00 | 2.00 | 10.00 | 5.00 | -2.25 | 1.00 | -1.90 | 2.00 | - | - | - | - |

| Earnings Before Taxes | 507.8% | 47.00 | 8.00 | 10.00 | 27.00 | 50.00 | 9.00 | 13.00 | -4.84 | 6.00 | 2.00 | 16.00 | 62.00 | 18.00 | -10.29 | 4.00 | -7.94 | 10.00 | - | - | - | - |

| EBT Margin | -4.9% | 0.09* | 0.09* | 0.09* | 0.10* | 0.07* | 0.03* | 0.02* | 0.02* | 0.12* | 0.16* | 0.15* | 0.16* | 0.01* | -0.01* | 0.13* | 0.11* | 0.09* | 0.09* | - | - | - |

| Net Income | 525.6% | 35.00 | 6.00 | 8.00 | 21.00 | 38.00 | 7.00 | 11.00 | -3.92 | 4.00 | -0.60 | 13.00 | 52.00 | 17.00 | -8.04 | 3.00 | -6.04 | 7.00 | 5.00 | 4.00 | 4.00 | 33.00 |

| Net Income Margin | -5.7% | 0.06* | 0.07* | 0.07* | 0.08* | 0.05* | 0.02* | 0.01* | 0.02* | 0.10* | 0.13* | 0.13* | 0.14* | 0.02* | -0.01* | 0.02* | 0.02* | 0.03* | 0.07* | - | - | - |

| Free Cashflow | -98.4% | 1.00 | 64.00 | -11.33 | -39.54 | -57.12 | 46.00 | -5.40 | -69.12 | -31.47 | 37.00 | -24.76 | 62.00 | -38.56 | -5.17 | 16.00 | -45.18 | -61.39 | 2.00 | 2.00 | 2.00 | 2.00 |

| Balance Sheet | (In Millions) | |||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2019Q4 |

| Assets | 1.0% | 1,639 | 1,624 | 1,601 | 1,635 | 1,582 | 1,524 | 1,521 | 1,507 | 1,420 | 1,380 | 1,342 | 1,310 | 1,244 | 1,053 | 1,008 |

| Current Assets | -13.4% | 235 | 271 | 260 | 302 | 326 | 345 | 338 | 363 | 349 | 375 | 346 | 371 | 328 | 127 | 113 |

| Cash Equivalents | -14.4% | 40.00 | 46.00 | 27.00 | 87.00 | 72.00 | 92.00 | 132 | 213 | 272 | 309 | 291 | 311 | 270 | 70.00 | 64.00 |

| Inventory | 10.1% | 9.00 | 8.00 | 8.00 | 7.00 | 7.00 | 8.00 | 7.00 | 6.00 | 6.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 |

| Net PPE | - | - | - | - | - | - | - | - | - | - | - | 561 | 500 | 457 | 415 | 345 |

| Goodwill | 0% | 222 | 222 | 222 | 222 | 222 | 222 | 222 | 222 | 222 | 222 | 222 | 222 | 222 | 222 | 222 |

| Liabilities | -1.0% | 1,098 | 1,109 | 1,082 | 1,094 | 1,061 | 1,032 | 1,013 | 1,011 | 926 | 890 | 859 | 846 | 834 | 769 | 724 |

| Current Liabilities | -8.4% | 384 | 419 | 371 | 383 | 366 | 377 | 321 | 331 | 301 | 282 | 242 | 251 | 238 | 254 | 354 |

| Long Term Debt | -4.2% | 314 | 327 | 352 | 365 | 346 | 295 | 325 | 320 | 243 | 248 | 267 | 268 | 274 | 256 | 74.00 |

| LT Debt, Current | 0.3% | 74.00 | 74.00 | 83.00 | 83.00 | 66.00 | 58.00 | 46.00 | 44.00 | 35.00 | 29.00 | 20.00 | 20.00 | 29.00 | 26.00 | 13.00 |

| LT Debt, Non Current | -100.0% | - | 327 | 352 | 365 | 346 | 295 | 325 | 320 | 243 | 248 | 267 | 268 | 274 | 256 | 74.00 |

| Shareholder's Equity | 5.2% | 541 | 514 | 519 | 541 | 521 | 493 | 508 | 496 | 497 | 491 | 487 | 469 | 414 | 284 | 284 |

| Retained Earnings | 37.5% | 130 | 94.00 | 89.00 | 81.00 | 60.00 | 22.00 | 15.00 | 4.00 | 4.00 | 4.00 | 1.00 | -12.71 | -64.46 | 38.00 | 42.00 |

| Additional Paid-In Capital | 0.6% | 517 | 514 | 511 | 508 | 501 | 488 | 493 | 491 | 488 | 486 | 481 | 476 | 474 | 249 | 6.00 |

| Accumulated Depreciation | - | - | - | - | - | - | - | - | - | - | 117 | 101 | 89.00 | 76.00 | 65.00 | 28.00 |

| Shares Outstanding | -1.3% | 53.00 | 53.00 | 54.00 | 56.00 | 56.00 | 57.00 | 58.00 | 58.00 | 58.00 | 55.00 | 57.00 | 57.00 | 48.00 | 47.00 | 47.00 |

| Float | - | - | - | - | 911 | - | - | - | 602 | - | - | - | 861 | - | - | - |

| Cashflow (Quarterly) | (In Thousands) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -57.0% | 30,721 | 71,469 | 6,958 | 47,832 | 47,861 | 55,769 | 34,611 | 18,847 | 18,213 | 42,618 | 19,554 | 80,965 | 15,839 | -3,179 | 16,448 | -26,753 | 13,858 | - | - | - | - |

| Share Based Compensation | - | - | - | - | - | - | 793 | 486 | 575 | 920 | 985 | 964 | 743 | 2,870 | 857 | 496 | 388 | 369 | - | - | - | - |

| Cashflow From Investing | -388.2% | -20,307 | 7,047 | -10,237 | -72,804 | -95,237 | -51,720 | -98,649 | -149,333 | -49,628 | -5,546 | -44,239 | -19,599 | -54,552 | -1,817 | -571 | -18,592 | -75,048 | - | - | - | - |

| Cashflow From Financing | 34.6% | -34,494 | -52,756 | -53,012 | 24,820 | 38,811 | -47,196 | -6,877 | 66,989 | -5,883 | -10,312 | 225 | -21,499 | 243,968 | 24,826 | 4.00 | 21,854 | 54,855 | - | - | - | - |

| Buy Backs | -15.1% | 11,493 | 13,534 | 32,802 | 7,437 | 14,812 | 25,054 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

SNCY Income Statement

2024-03-31CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS - USD ($) $ in Thousands | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Operating Revenues: | ||

| Total Operating Revenues | $ 311,483 | $ 294,115 |

| Operating Expenses: | ||

| Aircraft Fuel | 70,304 | 72,290 |

| Salaries, Wages, and Benefits | 82,238 | 75,430 |

| Aircraft Rent | 0 | 1,480 |

| Maintenance | 16,817 | 13,039 |

| Sales and Marketing | 10,679 | 9,929 |

| Depreciation and Amortization | 23,809 | 19,460 |

| Ground Handling | 9,154 | 9,170 |

| Landing Fees and Airport Rent | 14,729 | 10,945 |

| Other Operating, net | 28,577 | 26,589 |

| Total Operating Expenses | 256,307 | 238,332 |

| Operating Income | 55,176 | 55,783 |

| Non-operating Income (Expense): | ||

| Interest Income | 2,448 | 2,741 |

| Interest Expense | (11,112) | (8,630) |

| Other, net | 46 | (212) |

| Total Non-operating Expense, net | (8,618) | (6,101) |

| Income Before Income Tax | 46,558 | 49,682 |

| Income Tax Expense | 11,245 | 11,354 |

| Net Income | $ 35,313 | $ 38,328 |

| Net Income per share to common stockholders: | ||

| Basic (in dollars per share) | $ 0.67 | $ 0.68 |

| Diluted (in dollars per share) | $ 0.64 | $ 0.64 |

| Shares used for computation: | ||

| Basic (in shares) | 53,034,538 | 56,630,656 |

| Diluted (in shares) | 55,397,685 | 59,535,045 |

| Passenger | ||

| Operating Revenues: | ||

| Total Operating Revenues | $ 274,664 | $ 267,269 |

| Cargo | ||

| Operating Revenues: | ||

| Total Operating Revenues | 23,948 | 23,361 |

| Other | ||

| Operating Revenues: | ||

| Total Operating Revenues | $ 12,871 | $ 3,485 |

SNCY Balance Sheet

2024-03-31CONDENSED CONSOLIDATED BALANCE SHEETS - USD ($) $ in Thousands | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current Assets: | ||

| Cash and Cash Equivalents | $ 28,427 | $ 46,279 |

| Restricted Cash | 11,173 | 17,401 |

| Investments | 132,779 | 141,127 |

| Accounts Receivable, net of an allowance for credit losses of $39 and $17, respectively | 37,525 | 38,166 |

| Short-term Lessor Maintenance Deposits | 1,816 | 1,046 |

| Inventory, net of a reserve for obsolescence of $753 and $977, respectively | 8,583 | 7,793 |

| Prepaid Expenses | 12,604 | 15,823 |

| Other Current Assets | 2,062 | 3,716 |

| Total Current Assets | 234,969 | 271,351 |

| Property & Equipment, net: | ||

| Finance Lease Assets | 344,500 | 304,384 |

| Total Property & Equipment | 1,290,917 | 1,221,698 |

| Accumulated Depreciation & Amortization | (272,590) | (252,717) |

| Total Property & Equipment, net | 1,018,327 | 968,981 |

| Other Assets: | ||

| Goodwill | 222,223 | 222,223 |

| Other Intangible Assets, net of accumulated amortization of $25,622 and $24,190, respectively | 82,119 | 83,551 |

| Operating Lease Right-of-use Assets | 14,252 | 14,917 |

| Aircraft Deposits | 9,564 | 9,564 |

| Long-term Lessor Maintenance Deposits | 48,181 | 44,675 |

| Other Assets | 9,444 | 8,365 |

| Total Other Assets | 385,783 | 383,295 |

| Total Assets | 1,639,079 | 1,623,627 |

| Current Liabilities: | ||

| Accounts Payable | 59,929 | 59,011 |

| Accrued Salaries, Wages, and Benefits | 31,787 | 33,305 |

| Accrued Transportation Taxes | 16,459 | 18,097 |

| Air Traffic Liabilities | 119,938 | 157,996 |

| Finance Lease Obligations | 45,083 | 44,756 |

| Loyalty Program Liabilities | 9,404 | 9,898 |

| Operating Lease Obligations | 2,233 | 2,219 |

| Current Maturities of Long-term Debt, net | 74,398 | 74,177 |

| Income Tax Receivable Agreement Liability | 10,611 | 3,250 |

| Other Current Liabilities | 13,725 | 15,873 |

| Total Current Liabilities | 383,567 | 418,582 |

| Long-term Liabilities: | ||

| Finance Lease Obligations | 268,687 | 232,546 |

| Loyalty Program Liabilities | 3,664 | 3,839 |

| Operating Lease Obligations | 15,904 | 16,611 |

| Long-term Debt, net | 313,733 | 327,468 |

| Deferred Tax Liability | 18,080 | 9,148 |

| Income Tax Receivable Agreement Liability | 87,083 | 97,794 |

| Other Long-term Liabilities | 7,355 | 3,236 |

| Total Long-term Liabilities | 714,506 | 690,642 |

| Total Liabilities | 1,098,073 | 1,109,224 |

| Commitments and Contingencies (see Note 10) | ||

| Common Stock, Number of Shares, Par Value and Other Disclosure [Abstract] | ||

| Common stock, with $0.01 par value, 995,000,000 shares authorized, 58,954,329 and 58,878,723 issued and 52,611,323 and 53,291,001 outstanding at March 31, 2024 and December 31, 2023, respectively | 590 | 589 |

| Preferred Stock, Number of Shares, Par Value and Other Disclosure [Abstract] | ||

| Preferred stock, with $0.01 par value, 5,000,000 shares authorized, no shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | 0 | 0 |

| Treasury stock, at cost, 6,343,006 and 5,587,722 shares held at March 31, 2024 and December 31, 2023, respectively | (105,937) | (94,341) |

| Additional Paid-In Capital | 517,012 | 513,988 |

| Retained Earnings | 129,542 | 94,229 |

| Accumulated Other Comprehensive Loss | (201) | (62) |

| Total Stockholders' Equity | 541,006 | 514,403 |

| Total Liabilities and Stockholders' Equity | 1,639,079 | 1,623,627 |

| Aircraft and Flight Equipment | ||

| Property & Equipment, net: | ||

| Property & Equipment, net: | 703,222 | 685,559 |

| Aircraft and Flight Equipment Held for Operating Lease | ||

| Property & Equipment, net: | ||

| Property & Equipment, net: | 154,399 | 154,185 |

| Ground Equipment and Leasehold Improvements | ||

| Property & Equipment, net: | ||

| Property & Equipment, net: | 44,379 | 39,847 |

| Computer Hardware and Software | ||

| Property & Equipment, net: | ||

| Property & Equipment, net: | 19,430 | 17,875 |

| Rotable Parts | ||

| Property & Equipment, net: | ||

| Property & Equipment, net: | $ 24,987 | $ 19,848 |

| CEO | Mr. Jude I. Bricker |

|---|---|

| WEBSITE | suncountry.com |

| INDUSTRY | Airlines |

| EMPLOYEES | 2749 |