Market Summary

UHS Alerts

UHS Stock Price

UHS RSI Chart

UHS Valuation

UHS Price/Sales (Trailing)

UHS Profitability

UHS Fundamentals

UHS Revenue

UHS Earnings

Breaking Down UHS Revenue

Last 7 days

4.2%

Last 30 days

3.2%

Last 90 days

9.0%

Trailing 12 Months

25.1%

How does UHS drawdown profile look like?

UHS Financial Health

UHS Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 14.7B | 0 | 0 | 0 |

| 2023 | 13.6B | 13.8B | 14.0B | 14.3B |

| 2022 | 12.9B | 13.0B | 13.2B | 13.4B |

| 2021 | 11.7B | 12.2B | 12.5B | 12.6B |

| 2020 | 11.4B | 11.3B | 11.4B | 11.6B |

| 2019 | 10.9B | 11.1B | 11.2B | 11.4B |

| 2018 | 10.5B | 10.6B | 10.7B | 10.8B |

| 2017 | 9.8B | 9.7B | 9.7B | 10.4B |

| 2016 | 10.1B | 10.3B | 10.5B | 9.8B |

| 2015 | 9.0B | 9.4B | 9.6B | 9.7B |

| 2014 | 7.6B | 7.6B | 8.0B | 8.7B |

| 2013 | 7.0B | 7.4B | 7.5B | 7.5B |

| 2012 | 6.7B | 6.5B | 6.4B | 7.0B |

| 2011 | 6.0B | 6.5B | 7.0B | 6.8B |

| 2010 | 5.2B | 5.3B | 5.3B | 5.4B |

| 2009 | 0 | 5.1B | 5.1B | 5.2B |

| 2008 | 0 | 0 | 0 | 5.0B |

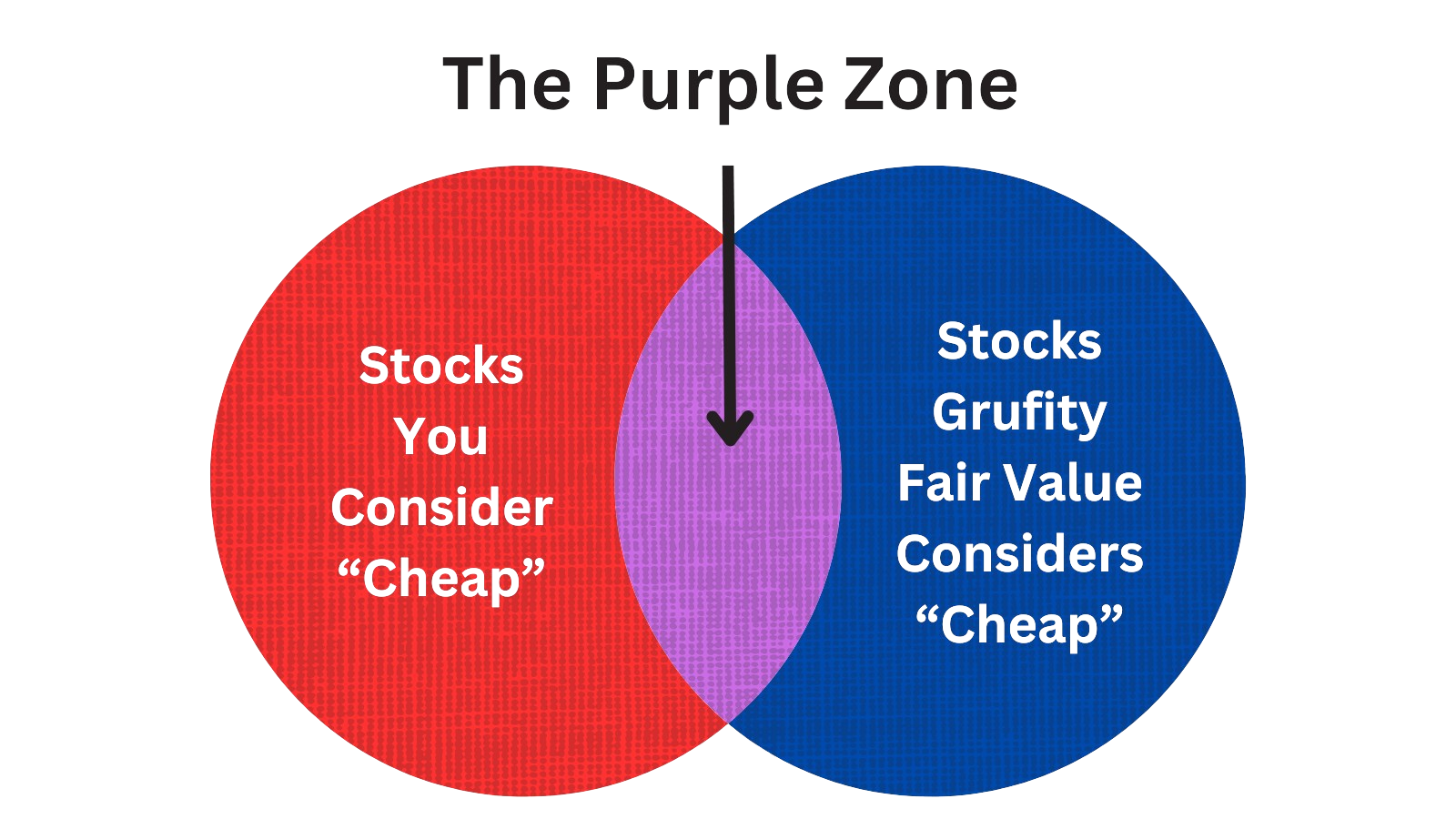

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Universal Health Services Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Mar 21, 2024 | peterson matthew jay | acquired | - | - | 4,758 | executive vice president, uhs |

| Mar 21, 2024 | miller marc d | acquired | - | - | 22,755 | president and ceo |

| Mar 21, 2024 | miller alan b | acquired | - | - | 11,966 | executive chairman |

| Mar 21, 2024 | filton steve | acquired | - | - | 5,792 | executive vice president & cfo |

| Mar 21, 2024 | sim edward h | acquired | - | - | 5,415 | executive vice president |

| Mar 14, 2024 | miller alan b | acquired | 8,711,300 | 134 | 65,000 | executive chairman |

| Mar 14, 2024 | miller alan b | sold (taxes) | -9,777,760 | 172 | -56,640 | executive chairman |

| Mar 13, 2024 | miller alan b | sold (taxes) | -9,835,510 | 174 | -56,293 | executive chairman |

| Mar 13, 2024 | miller alan b | acquired | 8,711,300 | 134 | 65,000 | executive chairman |

| Mar 13, 2024 | miller marc d | acquired | 3,926,050 | 71.3827 | 55,000 | president and ceo |

Which funds bought or sold UHS recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 08, 2024 | TD Asset Management Inc | reduced | -1.32 | 460,082 | 3,000,190 | -% |

| May 08, 2024 | Heritage Wealth Advisors | sold off | -100 | -610 | - | -% |

| May 08, 2024 | STEVENS CAPITAL MANAGEMENT LP | reduced | -61.69 | -283,000 | 239,000 | 0.05% |

| May 08, 2024 | STATE BOARD OF ADMINISTRATION OF FLORIDA RETIREMENT SYSTEM | added | 16.54 | -326,795 | 11,209,000 | 0.03% |

| May 08, 2024 | GW&K Investment Management, LLC | unchanged | - | - | - | -% |

| May 08, 2024 | Achmea Investment Management B.V. | unchanged | - | 240,000 | 1,456,000 | 0.03% |

| May 08, 2024 | GREAT LAKES ADVISORS, LLC | new | - | 8,937,800 | 8,937,800 | 0.08% |

| May 08, 2024 | Russell Investments Group, Ltd. | added | 1.19 | 2,388,970 | 13,706,200 | 0.02% |

| May 08, 2024 | COMMONWEALTH OF PENNSYLVANIA PUBLIC SCHOOL EMPLS RETRMT SYS | added | 0.25 | 407,089 | 2,443,690 | 0.02% |

| May 08, 2024 | BNP PARIBAS ASSET MANAGEMENT Holding S.A. | reduced | -10.61 | 178,000 | 2,729,000 | 0.01% |

Are Funds Buying or Selling UHS?

UHS Alerts

Unveiling Universal Health Services Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 11.54% | 7,042,246 | SC 13G/A | |

| Feb 09, 2024 | invesco ltd. | 5.6% | 3,435,912 | SC 13G/A | |

| Feb 09, 2024 | fmr llc | - | 0 | SC 13G/A | |

| Feb 08, 2024 | first eagle investment management, llc | 7.59% | 4,630,429 | SC 13G/A | |

| Jan 26, 2024 | blackrock inc. | 7.2% | 4,398,787 | SC 13G/A | |

| Feb 09, 2023 | fmr llc | - | 0 | SC 13G/A | |

| Feb 09, 2023 | first eagle investment management, llc | 7.38% | 4,733,178 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 11.37% | 7,294,009 | SC 13G/A | |

| Feb 08, 2023 | invesco ltd. | 7.6% | 4,898,383 | SC 13G/A | |

| Jan 31, 2023 | blackrock inc. | 7.2% | 4,625,635 | SC 13G/A |

Recent SEC filings of Universal Health Services Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 08, 2024 | 10-Q | Quarterly Report | |

| Apr 25, 2024 | 8-K | Current Report | |

| Apr 04, 2024 | ARS | ARS | |

| Apr 04, 2024 | DEF 14A | DEF 14A | |

| Apr 04, 2024 | DEFA14A | DEFA14A | |

| Apr 01, 2024 | 8-K | Current Report | |

| Mar 25, 2024 | 4 | Insider Trading | |

| Mar 25, 2024 | 4 | Insider Trading | |

| Mar 25, 2024 | 4 | Insider Trading | |

| Mar 25, 2024 | 4 | Insider Trading |

Peers (Alternatives to Universal Health Services Inc)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

UNH | 466.7B | 379.5B | 10.30% | 3.46% | 30.38 | 1.23 | 12.96% | -25.81% |

CI | 99.7B | 206.0B | -1.82% | 33.22% | 25.87 | 0.48 | 12.55% | -43.95% |

HCA | 84.3B | 66.7B | -2.18% | 15.50% | 15.4 | 1.26 | 9.59% | -4.59% |

CVS | 69.9B | 360.9B | -24.11% | -20.14% | 9.54 | 0.19 | 9.07% | 78.49% |

CNC | 41.4B | 155.5B | 6.79% | 16.14% | 15.15 | 0.27 | 6.34% | 84.42% |

DVA | 12.1B | 12.3B | 2.88% | 38.95% | 14.83 | 0.98 | 5.77% | 58.74% |

UHS | 11.9B | 14.7B | 3.23% | 25.09% | 14.57 | 0.81 | 7.99% | 19.23% |

| MID-CAP | ||||||||

CHE | 8.7B | 2.3B | -8.08% | 4.15% | 30.66 | 3.79 | 5.96% | 18.29% |

ACHC | 6.5B | 3.0B | -7.64% | 1.03% | -579.28 | 2.19 | 10.92% | -104.06% |

AMN | 2.3B | 3.8B | 0.76% | -34.62% | 10.95 | 0.61 | -27.73% | -52.50% |

AMEH | 2.2B | 1.5B | -8.15% | 19.83% | 35.09 | 1.51 | 19.34% | 40.15% |

| SMALL-CAP | ||||||||

ADUS | 1.7B | 1.1B | 7.65% | 29.55% | 26.45 | 1.6 | 11.45% | 30.74% |

BKD | 1.4B | 3.0B | 4.67% | 77.04% | -7.95 | 0.45 | 4.98% | 4.88% |

BEAT | 53.2M | - | -5.61% | -9.82% | -3.52 | - | - | -1.05% |

AMS | 19.4M | 21.3M | 3.03% | 6.99% | 36.34 | 0.91 | 8.00% | -62.25% |

Universal Health Services Inc News

Universal Health Services Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 3.8% | 3,844 | 3,704 | 3,563 | 3,548 | 3,468 | 3,447 | 3,336 | 3,323 | 3,293 | 3,275 | 3,156 | 3,198 | 3,013 | 3,087 | 2,913 | 2,730 | 2,830 | 2,896 | 2,822 | 2,855 | 2,804 |

| Operating Expenses | 2.4% | 3,455 | 3,372 | 3,277 | 3,268 | 3,189 | 3,186 | 3,060 | 3,090 | 3,060 | 2,962 | 2,841 | 2,759 | 2,717 | 2,673 | 2,563 | 2,372 | 2,593 | 2,555 | 2,634 | 2,510 | 2,464 |

| EBITDA Margin | 4.4% | 0.13* | 0.12* | 0.12* | 0.12* | 0.12* | 0.12* | 0.12* | 0.13* | 0.14* | 0.15* | 0.16* | 0.17* | 0.17* | 0.16* | 0.16* | 0.14* | 0.14* | 0.15* | 0.14* | 0.15* | 0.15* |

| Interest Expenses | -1.4% | 53.00 | 54.00 | 53.00 | 49.00 | 51.00 | 44.00 | 36.00 | 26.00 | 22.00 | 19.00 | 21.00 | 21.00 | 22.00 | 20.00 | 25.00 | 25.00 | 36.00 | 39.00 | 41.00 | 42.00 | 40.00 |

| Income Taxes | 14.2% | 70.00 | 62.00 | 52.00 | 55.00 | 52.00 | 52.00 | 57.00 | 51.00 | 49.00 | 73.00 | 68.00 | 102 | 64.00 | 95.00 | 79.00 | 79.00 | 46.00 | 73.00 | 37.00 | 70.00 | 59.00 |

| Earnings Before Taxes | 19.6% | 336 | 281 | 221 | 225 | 214 | 222 | 234 | 210 | 200 | 307 | 287 | 427 | 273 | 402 | 323 | 336 | 191 | 321 | 138 | 311 | 296 |

| EBT Margin | 10.1% | 0.07* | 0.07* | 0.06* | 0.06* | 0.06* | 0.06* | 0.07* | 0.08* | 0.09* | 0.10* | 0.11* | 0.12* | 0.11* | 0.11* | 0.10* | 0.09* | 0.08* | 0.09* | 0.08* | 0.09* | 0.10* |

| Net Income | 21.0% | 262 | 216 | 167 | 171 | 163 | 175 | 183 | 164 | 154 | 239 | 218 | 325 | 209 | 309 | 241 | 252 | 142 | 245 | 97.00 | 238 | 234 |

| Net Income Margin | 10.8% | 0.06* | 0.05* | 0.05* | 0.05* | 0.05* | 0.05* | 0.06* | 0.06* | 0.07* | 0.08* | 0.09* | 0.09* | 0.09* | 0.08* | 0.08* | 0.07* | 0.06* | 0.07* | 0.06* | 0.07* | 0.07* |

| Free Cashflow | -23.6% | 188 | 246 | -38.34 | 195 | 122 | 133 | 59.00 | -175 | 245 | 132 | 258 | -187 | -175 | -42.64 | 575 | 779 | 318 | 180 | 276 | 87.00 | 262 |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 0.6% | 14,046 | 13,968 | 13,873 | 13,732 | 13,556 | 13,494 | 13,379 | 13,296 | 13,144 | 13,094 | 12,847 | 12,813 | 13,096 | 13,477 | 12,976 | 12,148 | 11,620 | 11,668 | 11,594 | 11,753 | 11,721 |

| Current Assets | 2.1% | 2,871 | 2,811 | 2,753 | 2,625 | 2,559 | 2,537 | 2,457 | 2,436 | 2,302 | 2,264 | 2,343 | 2,365 | 2,784 | 3,282 | 2,961 | 2,297 | 1,834 | 1,916 | 1,931 | 1,965 | 1,960 |

| Cash Equivalents | 73.1% | 207 | 119 | 81.00 | 79.00 | 110 | 103 | 75.00 | 133 | 106 | 115 | 190 | 199 | 765 | 1,224 | 1,101 | 540 | 55.00 | 61.00 | 59.00 | 61.00 | 63.00 |

| Net PPE | 1.0% | 6,185 | 6,125 | 6,087 | 6,028 | 5,954 | 5,918 | 5,936 | 5,971 | 5,918 | 5,874 | 5,688 | 5,630 | 5,496 | 5,373 | 5,249 | 5,105 | 5,042 | 5,017 | 4,958 | 4,945 | 4,915 |

| Goodwill | -0.1% | 3,928 | 3,932 | 3,912 | 3,930 | 3,914 | 3,909 | 3,874 | 3,912 | 3,950 | 3,963 | 3,889 | 3,903 | 3,887 | 3,883 | 3,854 | 3,836 | 3,837 | 3,870 | 3,828 | 3,843 | 3,857 |

| Current Liabilities | 3.1% | 2,075 | 2,013 | 1,990 | 2,035 | 1,863 | 1,914 | 1,939 | 1,992 | 2,146 | 1,984 | 1,969 | 1,969 | 2,239 | 2,481 | 2,634 | 2,259 | 1,690 | 1,563 | 1,622 | 1,544 | 1,657 |

| Long Term Debt | -1.1% | 4,734 | 4,786 | 4,796 | 4,605 | 4,707 | 4,727 | 4,638 | 4,599 | 4,251 | 4,142 | 3,709 | 3,486 | 3,506 | 3,524 | 3,515 | 3,450 | 3,736 | 3,897 | 3,870 | 4,057 | 3,822 |

| LT Debt, Current | 0.6% | 127 | 127 | 127 | 111 | 96.00 | 81.00 | 66.00 | 66.00 | 48.00 | 48.00 | 45.00 | 107 | 107 | 332 | 95.00 | 82.00 | 70.00 | 88.00 | 78.00 | 92.00 | 72.00 |

| LT Debt, Non Current | -100.0% | - | 4,786 | 4,796 | 4,605 | 4,707 | 4,727 | 4,638 | 4,599 | 4,251 | 4,142 | 3,709 | 3,486 | 3,506 | 3,524 | 3,515 | 3,450 | 3,736 | 3,897 | 3,870 | 4,057 | 3,822 |

| Shareholder's Equity | 2.6% | 6,306 | 6,149 | 6,065 | 6,129 | 6,052 | 5,921 | 5,904 | 5,904 | 5,963 | 6,193 | 6,368 | 6,572 | 6,602 | 6,402 | 6,035 | 5,762 | 5,485 | 5,579 | 5,464 | 5,464 | 5,552 |

| Retained Earnings | -100.0% | - | 6,799 | - | - | - | 6,534 | - | - | - | 6,604 | - | - | - | 6,748 | - | - | - | 5,934 | - | - | - |

| Accumulated Depreciation | 2.1% | 5,770 | 5,653 | 5,523 | 5,414 | 5,297 | 5,167 | 5,167 | 5,087 | 5,011 | 4,896 | 4,828 | 4,732 | 4,623 | 4,513 | 4,404 | 4,294 | 4,191 | 4,090 | 4,009 | 3,914 | 3,819 |

| Shares Outstanding | -3.1% | 67.00 | 69.00 | 69.00 | 70.00 | 71.00 | 73.00 | 74.00 | 74.00 | 75.00 | 83.00 | 82.00 | 85.00 | 85.00 | 85.00 | 85.00 | 85.00 | 86.00 | 89.00 | 88.00 | 89.00 | 91.00 |

| Minority Interest | 3.0% | 49.00 | 48.00 | 42.00 | 42.00 | 40.00 | 45.00 | 49.00 | 89.00 | 95.00 | 103 | 94.00 | 92.00 | 88.00 | 85.00 | 72.00 | 73.00 | 72.00 | 75.00 | 75.00 | 71.00 | 70.00 |

| Float | - | - | - | - | 9,500 | - | - | - | 6,400 | - | - | - | 10,800 | - | - | - | 7,000 | - | - | - | 10,300 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -12.4% | 396 | 452 | 162 | 363 | 291 | 297 | 221 | 33.00 | 445 | 322 | 442 | 48.00 | 72.00 | 142 | 767 | 949 | 502 | 333 | 433 | 241 | 432 |

| Share Based Compensation | -10.8% | 20.00 | 22.00 | 23.00 | 22.00 | 21.00 | 23.00 | 21.00 | 23.00 | 19.00 | 18.00 | 19.00 | 19.00 | 18.00 | 16.00 | 16.00 | 16.00 | 18.00 | 17.00 | 18.00 | 17.00 | 18.00 |

| Cashflow From Investing | 18.5% | -194 | -238 | -176 | -169 | -178 | -248 | -73.33 | -156 | -168 | -254 | -176 | -221 | -262 | -227 | -277 | -161 | -135 | -219 | -123 | -136 | -208 |

| Cashflow From Financing | -14.6% | -208 | -182 | 18.00 | -223 | -105 | -15.37 | -178 | 154 | -278 | -132 | -274 | -392 | -269 | 218 | 72.00 | -302 | -371 | -164 | -309 | -104 | -266 |

| Dividend Payments | -100.0% | - | 14.00 | 14.00 | 14.00 | 14.00 | 14.00 | 15.00 | 15.00 | 15.00 | 16.00 | 16.00 | 17.00 | 17.00 | - | - | - | 17.00 | 17.00 | 18.00 | 9.00 | 9.00 |

| Buy Backs | 0.9% | 162 | 161 | 177 | 126 | 85.00 | 110 | 158 | 200 | 366 | 441 | 420 | 361 | 7.00 | 20.00 | 0.00 | 1.00 | 172 | 188 | 93.00 | 341 | 144 |

UHS Income Statement

2024-03-31Condensed Consolidated Statements of Income - USD ($) shares in Thousands, $ in Thousands | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Income Statement [Abstract] | ||

| Net revenues | $ 3,843,582 | $ 3,467,518 |

| Operating charges: | ||

| Salaries, wages and benefits | 1,842,624 | 1,753,335 |

| Other operating expenses | 1,032,170 | 878,951 |

| Supplies expense | 403,573 | 379,989 |

| Depreciation and amortization | 141,003 | 141,621 |

| Lease and rental expense | 35,450 | 34,922 |

| Operating Expenses, Total | 3,454,820 | 3,188,818 |

| Income from operations | 388,762 | 278,700 |

| Interest expense, net | 52,826 | 50,876 |

| Other (income) expense, net | (150) | 13,723 |

| Income before income taxes | 336,086 | 214,101 |

| Provision for income taxes | 70,264 | 51,726 |

| Net income | 265,822 | 162,375 |

| Less: Net income (loss) attributable to noncontrolling interests | 3,988 | (740) |

| Net income attributable to UHS | $ 261,834 | $ 163,115 |

| Basic earnings per share attributable to UHS | $ 3.90 | $ 2.31 |

| Diluted earnings per share attributable to UHS | $ 3.82 | $ 2.28 |

| Weighted average number of common shares - basic | 67,204 | 70,535 |

| Add: Other share equivalents | 1,278 | 952 |

| Weighted average number of common shares and equivalents - diluted | 68,482 | 71,487 |

UHS Balance Sheet

2024-03-31Condensed Consolidated Balance Sheets - USD ($) $ in Thousands | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 112,093 | $ 119,439 |

| Accounts receivable, net | 2,299,425 | 2,238,265 |

| Supplies | 216,058 | 216,988 |

| Other current assets | 243,352 | 236,658 |

| Total current assets | 2,870,928 | 2,811,350 |

| Property and equipment | 11,955,109 | 11,777,047 |

| Less: accumulated depreciation | (5,770,371) | (5,652,518) |

| Property, plant and equipment, net, Total | 6,184,738 | 6,124,529 |

| Other assets: | ||

| Goodwill | 3,928,120 | 3,932,407 |

| Deferred income taxes | 94,853 | 85,626 |

| Right of use assets-operating leases | 422,268 | 433,962 |

| Deferred charges | 6,871 | 6,974 |

| Other | 538,354 | 572,754 |

| Total Assets | 14,046,132 | 13,967,602 |

| Current liabilities: | ||

| Current maturities of long-term debt | 127,477 | 126,686 |

| Accounts payable and other liabilities | 1,830,178 | 1,813,015 |

| Operating lease liabilities | 71,014 | 71,600 |

| Federal and state taxes | 46,667 | 2,046 |

| Total current liabilities | 2,075,336 | 2,013,347 |

| Other noncurrent liabilities | 551,257 | 584,007 |

| Operating lease liabilities noncurrent | 374,380 | 382,559 |

| Long-term debt | 4,734,328 | 4,785,783 |

| Redeemable noncontrolling interests | 4,987 | 5,191 |

| Equity: | ||

| UHS common stockholders’ equity | 6,256,697 | 6,149,001 |

| Noncontrolling interest | 49,147 | 47,714 |

| Total equity | 6,305,844 | 6,196,715 |

| Total Liabilities and Stockholders’ Equity | $ 14,046,132 | $ 13,967,602 |

| CEO | Mr. Marc D. Miller |

|---|---|

| WEBSITE | https://uhs.com |

| INDUSTRY | Healthcare Plans |

| EMPLOYEES | 65535 |