Market Summary

UPS Alerts

UPS Stock Price

UPS RSI Chart

UPS Valuation

UPS Price/Sales (Trailing)

UPS Profitability

UPS Fundamentals

UPS Revenue

UPS Earnings

Breaking Down UPS Revenue

52 Week Range

Last 7 days

0.6%

Last 30 days

-1.7%

Last 90 days

1.2%

Trailing 12 Months

-12.9%

How does UPS drawdown profile look like?

UPS Financial Health

UPS Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 89.7B | 0 | 0 | 0 |

| 2023 | 98.9B | 96.2B | 93.1B | 91.0B |

| 2022 | 98.8B | 100.1B | 101.1B | 100.3B |

| 2021 | 89.5B | 92.5B | 94.4B | 97.3B |

| 2020 | 75.0B | 77.4B | 80.3B | 84.6B |

| 2019 | 71.9B | 72.5B | 73.4B | 74.1B |

| 2018 | 68.2B | 69.7B | 71.0B | 71.9B |

| 2017 | 62.0B | 63.3B | 64.5B | 66.6B |

| 2016 | 58.8B | 59.3B | 60.0B | 60.9B |

| 2015 | 58.4B | 58.3B | 58.2B | 58.4B |

| 2014 | 55.8B | 56.5B | 57.3B | 58.2B |

| 2013 | 54.4B | 54.6B | 55.0B | 55.4B |

| 2012 | 53.7B | 53.8B | 53.7B | 54.1B |

| 2011 | 50.4B | 51.4B | 52.4B | 53.1B |

| 2010 | 46.1B | 47.5B | 48.5B | 49.5B |

| 2009 | 49.7B | 47.6B | 45.6B | 45.3B |

| 2008 | 0 | 50.3B | 50.9B | 51.5B |

| 2007 | 0 | 0 | 0 | 49.7B |

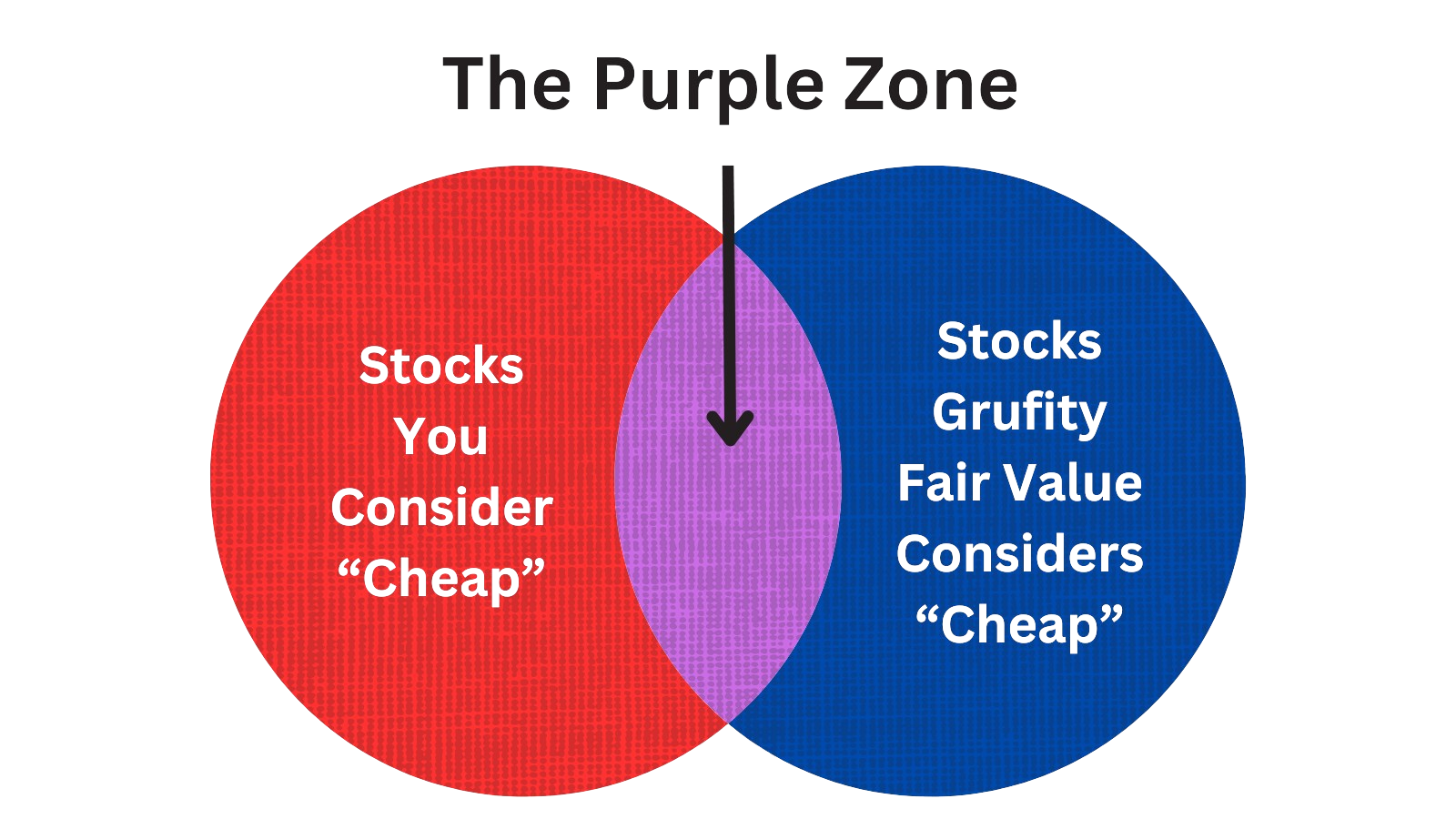

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of United Parcel Service Inc

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Mar 25, 2024 | gutmann kathleen m. | acquired | - | - | 591 | pres intl, healthcare and scs |

| Mar 25, 2024 | gutmann kathleen m. | sold (taxes) | -45,854 | 156 | -292 | pres intl, healthcare and scs |

| Mar 20, 2024 | guffey matthew | acquired | - | - | 1,136 | chf commercial & strategy off |

| Mar 20, 2024 | guffey matthew | sold (taxes) | -78,519 | 153 | -510 | chf commercial & strategy off |

| Feb 16, 2024 | gutmann kathleen m. | acquired | - | - | 20,508 | pres intl, healthcare and scs |

| Feb 16, 2024 | lane laura j | acquired | - | - | 14,037 | chf crp aff, com & sustain off |

| Feb 16, 2024 | subramanian bala | sold (taxes) | -355,969 | 157 | -2,264 | chief digital & tech officer |

| Feb 16, 2024 | cesarone nando | sold (taxes) | -1,574,680 | 155 | -10,123 | president, us operations |

| Feb 16, 2024 | gutmann kathleen m. | sold (taxes) | -1,433,960 | 155 | -9,228 | pres intl, healthcare and scs |

| Feb 16, 2024 | guffey matthew | sold (taxes) | -270,436 | 157 | -1,720 | chf commercial & strategy off |

Which funds bought or sold UPS recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 08, 2024 | Summit X, LLC | added | 8.29 | 33,765 | 1,466,610 | 0.38% |

| May 08, 2024 | W.G. Shaheen & Associates DBA Whitney & Co | unchanged | - | -35,294 | 609,978 | 0.07% |

| May 08, 2024 | Addison Capital Co | added | 7.9 | 44,013 | 2,247,430 | 1.12% |

| May 08, 2024 | Independent Advisor Alliance | reduced | -5.34 | -1,109,430 | 9,437,980 | 0.34% |

| May 08, 2024 | GREAT LAKES ADVISORS, LLC | added | 2.33 | -98,766 | 2,925,810 | 0.03% |

| May 08, 2024 | ProShare Advisors LLC | reduced | -3.33 | -1,298,920 | 13,772,200 | 0.04% |

| May 08, 2024 | Loudon Investment Management, LLC | unchanged | - | -96,363 | 1,665,400 | 0.96% |

| May 08, 2024 | Cypress Capital Group | added | 6.79 | 25,023 | 2,659,890 | 0.32% |

| May 08, 2024 | TD Asset Management Inc | added | 0.97 | -2,077,920 | 43,531,200 | 0.04% |

| May 08, 2024 | Cornerstone Advisory, LLC | reduced | -16.36 | -108,039 | 407,990 | 0.06% |

Are Funds Buying or Selling UPS?

UPS Alerts

Unveiling United Parcel Service Inc's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 9.29% | 67,218,177 | SC 13G/A | |

| Jan 26, 2024 | blackrock inc. | 7.5% | 54,283,579 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 9.26% | 67,566,426 | SC 13G/A | |

| Feb 03, 2023 | blackrock inc. | 7.9% | 57,900,388 | SC 13G/A | |

| Feb 03, 2022 | blackrock inc. | 7.1% | 52,091,461 | SC 13G | |

| Feb 10, 2021 | vanguard group inc | 8.06% | 57,634,689 | SC 13G/A | |

| Feb 05, 2021 | blackrock inc. | 7.4% | 52,600,820 | SC 13G/A | |

| Feb 12, 2020 | vanguard group inc | 8.07% | 56,561,755 | SC 13G/A | |

| Feb 06, 2020 | blackrock inc. | 6.3% | 44,176,915 | SC 13G/A |

Recent SEC filings of United Parcel Service Inc

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 06, 2024 | 8-K | Current Report | |

| May 03, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 4 | Insider Trading |

- …

United Parcel Service Inc News

United Parcel Service Inc Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -12.9% | 21,706 | 24,917 | 21,061 | 22,055 | 22,925 | 27,033 | 24,161 | 24,766 | 24,378 | 27,771 | 23,184 | 23,424 | 22,908 | 24,896 | 21,238 | 20,459 | 18,035 | 20,568 | 18,318 | 18,048 | 17,160 |

| Costs and Expenses | -10.5% | 20,093 | 22,440 | 19,718 | 19,275 | 20,384 | 23,838 | 21,048 | 21,231 | 21,127 | 23,880 | 20,288 | 20,166 | 20,143 | 22,859 | 18,875 | 18,247 | 16,963 | 18,435 | 16,190 | 15,905 | 15,766 |

| EBITDA Margin | -5.9% | 0.13* | 0.14* | 0.16* | 0.18* | 0.18* | 0.19* | 0.18* | 0.18* | 0.18* | 0.21* | 0.13* | 0.12* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -5.8% | 195 | 207 | 199 | 191 | 188 | 182 | 177 | 171 | 174 | 173 | 177 | 167 | 177 | 175 | 176 | 183 | 167 | 166 | 159 | 159 | 169 |

| Income Taxes | -7.6% | 423 | 458 | 141 | 639 | 627 | 1,014 | 685 | 848 | 730 | 869 | 664 | 760 | 1,412 | -941 | 568 | 589 | 285 | -92.00 | 456 | 519 | 329 |

| Earnings Before Taxes | -25.5% | 1,536 | 2,063 | 1,268 | 2,720 | 2,522 | 4,467 | 3,269 | 3,697 | 3,392 | 3,962 | 2,993 | 3,436 | 6,204 | -4,288 | 2,525 | 2,357 | 1,250 | -198 | 2,206 | 2,204 | 1,440 |

| EBT Margin | -10.3% | 0.08* | 0.09* | 0.12* | 0.13* | 0.14* | 0.15* | 0.14* | 0.14* | 0.14* | 0.17* | 0.09* | 0.09* | - | - | - | - | - | - | - | - | - |

| Net Income | -30.7% | 1,113 | 1,605 | 1,127 | 2,081 | 1,895 | 3,453 | 2,584 | 2,849 | 2,662 | 3,093 | 2,329 | 2,676 | 4,792 | -3,347 | 1,957 | 1,768 | 965 | -106 | 1,750 | 1,685 | 1,111 |

| Net Income Margin | -10.5% | 0.07* | 0.07* | 0.09* | 0.10* | 0.11* | 0.12* | 0.11* | 0.11* | 0.11* | 0.13* | 0.07* | 0.07* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | 530.1% | 2,281 | 362 | 944 | 2,026 | 1,748 | 841 | 1,589 | 2,973 | 3,932 | 1,622 | 2,407 | 3,087 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | -4.6% | 67,628 | 70,857 | 70,281 | 70,347 | 72,189 | 71,124 | 69,544 | 70,089 | 70,113 | 69,405 | 65,739 | 64,869 | 63,312 | 62,408 | 62,406 | 62,057 | 60,895 | 57,857 | 53,282 | 52,787 | 52,061 |

| Current Assets | -16.7% | 16,177 | 19,413 | 19,251 | 19,439 | 21,725 | 22,217 | 24,598 | 25,571 | 25,601 | 24,934 | 22,843 | 21,988 | 20,985 | 20,216 | 19,930 | 20,226 | 19,389 | 17,103 | 14,184 | 14,843 | 14,904 |

| Cash Equivalents | 36.4% | 4,374 | 3,206 | 4,311 | 4,812 | 6,190 | 5,602 | 11,045 | 11,735 | 12,208 | 10,255 | 10,212 | 9,608 | 7,731 | 5,910 | 8,839 | 8,813 | 8,955 | 5,238 | 4,040 | 4,072 | 4,399 |

| Net PPE | - | - | - | - | - | - | - | - | - | - | - | 32,859 | 32,631 | 32,455 | 32,254 | 32,164 | 31,439 | 30,908 | 30,482 | 29,071 | 28,095 | 27,247 |

| Goodwill | -0.5% | 4,846 | 4,872 | 4,097 | 4,250 | 4,249 | 4,223 | 3,624 | 3,675 | 3,668 | 3,692 | 375 | 3,357 | 3,346 | 3,367 | 3,816 | 3,787 | 3,776 | 3,813 | 3,783 | 3,811 | 3,813 |

| Current Liabilities | -16.9% | 14,696 | 17,676 | 15,817 | 14,686 | 16,262 | 18,140 | 17,679 | 17,337 | 16,842 | 17,569 | 15,472 | 15,770 | 16,306 | 17,016 | 15,456 | 16,271 | 15,846 | 15,413 | 12,835 | 13,633 | 13,209 |

| Short Term Borrowings | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 2,382 | 3,749 | 4,405 | 3,420 | - | - | - |

| Long Term Debt | -0.4% | 18,849 | 18,916 | 18,882 | 19,351 | 19,856 | 17,321 | 17,769 | 17,997 | 19,740 | 19,784 | 20,838 | 21,027 | 21,916 | 22,031 | 23,336 | 23,199 | 24,196 | 21,818 | 21,740 | 20,427 | 20,377 |

| LT Debt, Non Current | - | - | - | - | 19,351 | 19,856 | 17,321 | 17,769 | 17,997 | 19,740 | 19,784 | 20,838 | 21,027 | 21,916 | 22,031 | 23,336 | 23,199 | 24,196 | 21,818 | 21,740 | 20,427 | 20,377 |

| Shareholder's Equity | -2.3% | 16,909 | 17,306 | 19,168 | 20,019 | 21,510 | 19,786 | 16,968 | 573 | 1,231 | 16,179 | 12,041 | 1,329 | 15.00 | 865 | 5,592 | 255 | 19.00 | 9,105 | 10,037 | 9,109 | 8,249 |

| Retained Earnings | -1.8% | 20,681 | 21,055 | 20,699 | 21,584 | 21,510 | 21,326 | 20,177 | 18,958 | 17,433 | 16,179 | 13,973 | 12,531 | 10,748 | 6,896 | 11,115 | 10,032 | 9,137 | 9,105 | 10,037 | 9,109 | 8,249 |

| Additional Paid-In Capital | - | - | - | - | - | - | - | - | 573 | 1,231 | 1,343 | 1,088 | 1,329 | 1,049 | 865 | 490 | 255 | 29.00 | 150 | 129 | 102 | 27.00 |

| Minority Interest | 200.0% | 24.00 | 8.00 | 12.00 | 18.00 | 15.00 | 17.00 | 20.00 | 21.00 | 18.00 | 16.00 | 16.00 | 17.00 | 12.00 | 12.00 | 14.00 | 13.00 | 14.00 | 16.00 | 16.00 | 18.00 | 18.00 |

| Float | - | - | - | - | 129,730 | - | - | - | 133,554 | - | - | - | 151,320 | - | - | - | 78,510 | - | - | - | 72,097 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | 37.5% | 3,316 | 2,411 | 2,233 | 3,237 | 2,357 | 3,332 | 2,479 | 3,813 | 4,480 | 3,246 | 3,307 | 3,923 | 4,531 | 1,176 | 3,336 | 3,397 | 2,550 | 2,946 | 1,486 | 1,930 | 2,277 |

| Share Based Compensation | -292.9% | -27.00 | 14.00 | 21.00 | 39.00 | 126 | 718 | 233 | 231 | 386 | 200 | 179 | 206 | 315 | 288 | 140 | 137 | 231 | 199 | 203 | 205 | 308 |

| Cashflow From Investing | 148.9% | 1,566 | -3,204 | -1,070 | -1,046 | -1,813 | -5,064 | -909 | -927 | -572 | -2,218 | -866 | 32.00 | -766 | -2,177 | -1,163 | -1,009 | -934 | -2,034 | -1,180 | -1,431 | -1,416 |

| Cashflow From Financing | -950.4% | -3,666 | -349 | -1,603 | -3,586 | 4.00 | -3,710 | -2,189 | -3,316 | -1,970 | -967 | -1,818 | -2,093 | -1,945 | -1,961 | -2,157 | -2,566 | 2,167 | 127 | -320 | -839 | -695 |

| Dividend Payments | -100.0% | - | 1,338 | 1,341 | 1,345 | 1,348 | 1,272 | 1,275 | 1,283 | 1,284 | 859 | 860 | 860 | 858 | 846 | 845 | 843 | 840 | 797 | 798 | 800 | 799 |

| Buy Backs | - | - | - | 752 | 747 | 751 | 1,306 | 952 | 988 | 254 | - | 500 | - | - | - | -7.00 | 11.00 | 220 | 253 | 248 | 257 | 246 |

UPS Income Statement

2024-03-31STATEMENTS OF CONSOLIDATED INCOME - USD ($) $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Income Statement [Abstract] | ||

| Revenue | $ 21,706 | $ 22,925 |

| Operating Expenses: | ||

| Compensation and benefits | 11,639 | 11,464 |

| Repairs and maintenance | 718 | 725 |

| Depreciation and amortization | 898 | 834 |

| Purchased transportation | 3,246 | 3,541 |

| Fuel | 1,060 | 1,271 |

| Other occupancy | 564 | 551 |

| Other expenses | 1,968 | 1,998 |

| Total Operating Expenses | 20,093 | 20,384 |

| Operating Profit | 1,613 | 2,541 |

| Other Income (Expense): | ||

| Investment income and other | 118 | 169 |

| Interest expense | (195) | (188) |

| Total Other Income (Expense) | (77) | (19) |

| Income Before Income Taxes | 1,536 | 2,522 |

| Income Tax Expense | 423 | 627 |

| Net Income | $ 1,113 | $ 1,895 |

| Basic Earnings Per Share (in dollars per share) | $ 1.30 | $ 2.20 |

| Diluted Earnings Per Share (in dollars per share) | $ 1.30 | $ 2.19 |

UPS Balance Sheet

2024-03-31CONSOLIDATED BALANCE SHEETS - USD ($) shares in Millions, $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current Assets: | ||

| Cash and cash equivalents | $ 4,281 | $ 3,206 |

| Marketable securities | 232 | 2,866 |

| Accounts receivable | 9,698 | 11,342 |

| Less: Allowance for credit losses | (144) | (126) |

| Accounts receivable, net | 9,554 | 11,216 |

| Materials and supplies | 898 | 935 |

| Other current assets | 1,212 | 1,190 |

| Total Current Assets | 16,177 | 19,413 |

| Property, Plant and Equipment, Net | 37,168 | 36,945 |

| Operating Lease Right-Of-Use Assets | 4,223 | 4,308 |

| Goodwill | 4,846 | 4,872 |

| Intangible Assets, Net | 3,308 | 3,305 |

| Deferred Income Tax Assets | 126 | 126 |

| Other Non-Current Assets | 1,780 | 1,888 |

| Total Assets | 67,628 | 70,857 |

| Current Liabilities: | ||

| Current maturities of long-term debt, commercial paper and finance leases | 1,164 | 3,348 |

| Current maturities of operating leases | 694 | 709 |

| Accounts payable | 5,397 | 6,340 |

| Accrued wages and withholdings | 3,217 | 3,224 |

| Self-insurance reserves | 1,325 | 1,320 |

| Accrued group welfare and retirement plan contributions | 1,573 | 1,479 |

| Other current liabilities | 1,326 | 1,256 |

| Total Current Liabilities | 14,696 | 17,676 |

| Long-Term Debt and Finance Leases | 18,849 | 18,916 |

| Non-Current Operating Leases | 3,690 | 3,756 |

| Pension and Postretirement Benefit Obligations | 6,323 | 6,159 |

| Deferred Income Tax Liabilities | 3,825 | 3,772 |

| Other Non-Current Liabilities | 3,312 | 3,264 |

| Shareowners’ Equity: | ||

| Additional paid-in capital | 0 | 0 |

| Retained earnings | 20,681 | 21,055 |

| Accumulated other comprehensive loss | (3,781) | (3,758) |

| Deferred compensation obligations | 6 | 9 |

| Less: Treasury stock (0.1 and $0.2 shares in 2024 and 2023, respectively) | (6) | (9) |

| Total Equity for Controlling Interests | 16,909 | 17,306 |

| Noncontrolling interests | 24 | 8 |

| Total Shareowners’ Equity | 16,933 | 17,314 |

| Total Liabilities and Shareowners’ Equity | $ 67,628 | $ 70,857 |

| Treasury stock (in shares) | 0.1 | 0.2 |

| Class A common stock | ||

| Shareowners’ Equity: | ||

| Common stock | $ 2 | $ 2 |

| Class B common stock | ||

| Shareowners’ Equity: | ||

| Common stock | $ 7 | $ 7 |

| CEO | Ms. Carol B. Tome |

|---|---|

| WEBSITE | ups.com |

| INDUSTRY | Integrated Freight & Logistics |

| EMPLOYEES | 65535 |