Market Summary

ATO Stock Price

ATO RSI Chart

ATO Valuation

ATO Price/Sales (Trailing)

ATO Profitability

ATO Fundamentals

ATO Revenue

ATO Earnings

Breaking Down ATO Revenue

Last 7 days

0.5%

Last 30 days

2.6%

Last 90 days

5.8%

Trailing 12 Months

0.3%

How does ATO drawdown profile look like?

ATO Financial Health

ATO Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 4.1B | 0 | 0 | 0 |

| 2023 | 4.6B | 4.4B | 4.3B | 3.9B |

| 2022 | 3.8B | 4.0B | 4.2B | 4.7B |

| 2021 | 3.2B | 3.3B | 3.4B | 3.5B |

| 2020 | 2.8B | 2.8B | 2.8B | 2.9B |

| 2019 | 3.0B | 2.9B | 2.9B | 2.9B |

| 2018 | 3.1B | 3.1B | 3.1B | 3.1B |

| 2017 | 2.7B | 2.7B | 2.8B | 2.9B |

| 2016 | 2.4B | 2.4B | 2.5B | 2.6B |

| 2015 | 3.8B | 3.3B | 2.9B | 2.7B |

| 2014 | 4.7B | 4.8B | 4.9B | 4.6B |

| 2013 | 3.5B | 3.8B | 3.9B | 4.1B |

| 2012 | 3.9B | 3.7B | 3.4B | 3.4B |

| 2011 | 4.2B | 4.2B | 4.3B | 4.3B |

| 2010 | 4.8B | 4.7B | 4.7B | 4.5B |

| 2009 | 0 | 6.0B | 4.9B | 0 |

| 2008 | 0 | 0 | 7.2B | 0 |

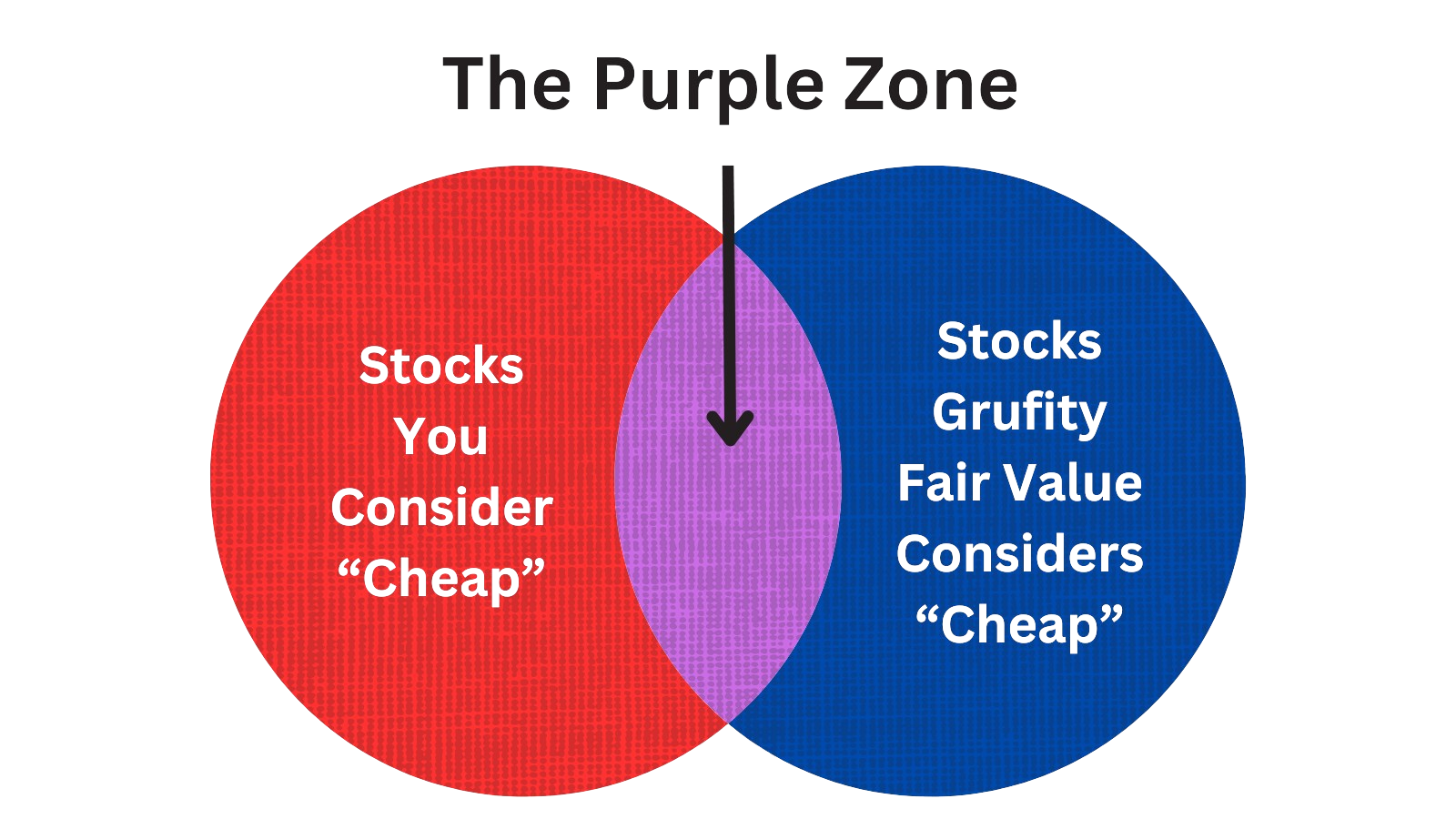

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Atmos Energy Corp

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 03, 2024 | robbins j matt | sold (taxes) | -151,959 | 119 | -1,276 | sr vp, human resources |

| May 03, 2024 | mcdill john s | acquired | 190,544 | 119 | 1,600 | sr vp, utility operations |

| May 03, 2024 | thomas richard m | acquired | 101,822 | 119 | 855 | vice president & controller |

| May 03, 2024 | akers john k | acquired | 1,701,800 | 119 | 14,290 | president & ceo |

| May 03, 2024 | mcdill john s | sold (taxes) | -70,501 | 119 | -592 | sr vp, utility operations |

| May 03, 2024 | robbins j matt | acquired | 382,874 | 119 | 3,215 | sr vp, human resources |

| May 03, 2024 | thomas richard m | sold (taxes) | -43,825 | 119 | -368 | vice president & controller |

| May 03, 2024 | akers john k | sold (taxes) | -629,748 | 119 | -5,288 | president & ceo |

| May 03, 2024 | forsythe christopher t | sold (taxes) | -206,264 | 119 | -1,732 | sr vice president & cfo |

| May 03, 2024 | forsythe christopher t | acquired | 523,996 | 119 | 4,400 | sr vice president & cfo |

Which funds bought or sold ATO recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 08, 2024 | COMMONWEALTH OF PENNSYLVANIA PUBLIC SCHOOL EMPLS RETRMT SYS | added | 8.43 | 3,618,820 | 35,902,200 | 0.25% |

| May 08, 2024 | Unigestion Holding SA | new | - | 3,522,240 | 3,522,240 | 0.17% |

| May 08, 2024 | INSTITUTIONAL & FAMILY ASSET MANAGEMENT, LLC | unchanged | - | 59.00 | 2,377 | -% |

| May 08, 2024 | US BANCORP \DE\ | reduced | -16.05 | -146,922 | 910,435 | -% |

| May 08, 2024 | GREAT LAKES ADVISORS, LLC | unchanged | - | 7,046 | 281,058 | -% |

| May 08, 2024 | Independent Advisor Alliance | added | 17.02 | 137,657 | 825,293 | 0.03% |

| May 08, 2024 | KBC Group NV | added | 119 | 5,224,000 | 9,414,000 | 0.03% |

| May 08, 2024 | Texas Yale Capital Corp. | added | 0.32 | 114,958 | 4,090,790 | 0.18% |

| May 08, 2024 | ProShare Advisors LLC | added | 5.61 | 14,374,600 | 187,243,000 | 0.50% |

| May 08, 2024 | Focused Wealth Management, Inc | sold off | -100 | -78,348 | - | -% |

Are Funds Buying or Selling ATO?

Unveiling Atmos Energy Corp's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 14, 2024 | aristotle capital management, llc | 5.80% | 8,750,234 | SC 13G/A | |

| Feb 13, 2024 | vanguard group inc | 13.03% | 19,344,837 | SC 13G/A | |

| Feb 08, 2024 | wellington management group llp | 6.65% | 10,032,021 | SC 13G/A | |

| Jan 25, 2024 | state street corp | 7.36% | 11,101,980 | SC 13G/A | |

| Jan 25, 2024 | blackrock inc. | 8.5% | 12,840,023 | SC 13G/A | |

| Jun 08, 2023 | blackrock inc. | 12.4% | 17,940,381 | SC 13G/A | |

| Feb 14, 2023 | aristotle capital management, llc | 6.76% | 9,519,883 | SC 13G | |

| Feb 09, 2023 | vanguard group inc | 13.07% | 18,430,637 | SC 13G/A | |

| Feb 06, 2023 | wellington management group llp | 6.02% | 8,485,905 | SC 13G | |

| Feb 06, 2023 | state street corp | 7.64% | 10,774,109 | SC 13G/A |

Recent SEC filings of Atmos Energy Corp

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 09, 2024 | 4 | Insider Trading | |

| May 08, 2024 | 8-K | Current Report | |

| May 08, 2024 | 8-K | Current Report | |

| May 08, 2024 | 424B5 | Prospectus Filed | |

| May 08, 2024 | 10-Q | Quarterly Report |

Peers (Alternatives to Atmos Energy Corp)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

CPK | 2.5T | 698.2M | 6.09% | -13.01% | 25.5K | 3.5K | 3.29% | 8.78% |

AEP | 47.9B | 19.3B | 6.91% | -0.83% | 17.02 | 2.48 | -2.13% | 41.75% |

AWK | 26.2B | 4.3B | 10.31% | -10.24% | 27.31 | 6.08 | 10.78% | 15.26% |

AEE | 19.9B | 7.3B | 1.03% | -16.76% | 17.27 | 2.75 | -10.88% | 5.77% |

ATO | 18.0B | 4.1B | 2.56% | 0.27% | 18.06 | 4.45 | -11.13% | 20.48% |

NRG | 17.0B | 28.5B | 12.38% | 154.37% | 10.37 | 0.6 | -9.05% | 188.86% |

AGR | 14.3B | 8.3B | 2.76% | -10.06% | 15.98 | 1.73 | 0.05% | 30.98% |

AES | 14.2B | 12.5B | 9.35% | -10.98% | -2.2K | 1.14 | -3.77% | 98.49% |

| MID-CAP | ||||||||

PNW | 8.8B | 4.7B | 3.73% | -4.04% | 16.31 | 1.87 | 4.84% | 12.15% |

ALE | 3.6B | 1.9B | 3.67% | 1.23% | 14.67 | 1.93 | 19.68% | 30.53% |

AVA | 3.0B | 1.9B | 8.21% | -14.02% | 15.91 | 1.59 | 9.47% | 35.66% |

| SMALL-CAP | ||||||||

CWCO | 446.1M | 180.2M | 10.10% | 63.84% | 15 | 2.48 | 91.50% | 388.02% |

CDZI | 157.6M | 2.0M | -7.48% | -47.89% | -5.01 | 78.41 | 33.96% | -26.84% |

VIA | 35.3M | 415.8M | 0.65% | -9.01% | 1.49 | 0.08 | -11.16% | 525.10% |

CREG | 8.6M | - | -21.17% | -37.26% | -11.52 | 12.3 | -88.45% | 83.25% |

Atmos Energy Corp News

Atmos Energy Corp Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 42.2% | 1,647 | 1,158 | 588 | 663 | 1,541 | 1,484 | 723 | 816 | 1,650 | 1,013 | 568 | 606 | 1,319 | 914 | 475 | 493 | 978 | 876 | 444 | 486 | 1,095 |

| Cost Of Revenue | 84.2% | 624 | 339 | 3.00 | 45.00 | 666 | 738 | 191 | 249 | 871 | 371 | 84.00 | 87.00 | 574 | 288 | 18.00 | 26.00 | 318 | 297 | 14.00 | 31.00 | 472 |

| EBITDA Margin | 5.0% | 0.49* | 0.46* | 0.41* | 0.38* | 0.36* | 0.34* | 0.35* | 0.36* | 0.36* | 0.39* | 0.41* | 0.45* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | 6.9% | 55.00 | 52.00 | 32.00 | 31.00 | 37.00 | 37.00 | 28.00 | 26.00 | 29.00 | 20.00 | 14.00 | 21.00 | 26.00 | 22.00 | 126 | -19.58 | -22.17 | 27.00 | 29.00 | 20.00 | 27.00 |

| Income Taxes | 49.0% | 80.00 | 54.00 | 19.00 | 16.00 | 45.00 | 34.00 | 12.00 | 13.00 | 36.00 | 16.00 | 11.00 | 16.00 | 62.00 | 65.00 | 18.00 | 9.00 | 67.00 | 52.00 | 12.00 | 24.00 | 60.00 |

| Earnings Before Taxes | 40.3% | 512 | 365 | 137 | 154 | 403 | 306 | 84.00 | 142 | 361 | 265 | 60.00 | 118 | 359 | 283 | 83.00 | 127 | 306 | 230 | 70.00 | 104 | 275 |

| EBT Margin | 7.5% | 0.29* | 0.27* | 0.23* | 0.21* | 0.20* | 0.19* | 0.20* | 0.20* | 0.21* | 0.23* | 0.24* | 0.25* | - | - | - | - | - | - | - | - | - |

| Net Income | 38.8% | 432 | 311 | 119 | 138 | 358 | 272 | 72.00 | 129 | 325 | 249 | 49.00 | 102 | 297 | 218 | 65.00 | 118 | 240 | 179 | 58.00 | 80.00 | 215 |

| Net Income Margin | 5.2% | 0.25* | 0.23* | 0.21* | 0.19* | 0.18* | 0.17* | 0.18* | 0.19* | 0.19* | 0.20* | 0.20* | 0.21* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | 204.4% | 747 | 245 | 238 | 329 | 2,704 | 189 | 48.00 | 289 | 579 | 62.00 | 74.00 | 244 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 1.4% | 24,005 | 23,684 | 22,517 | 21,772 | 21,312 | 23,366 | 22,193 | 21,655 | 21,271 | 20,546 | 19,609 | 19,315 | 19,409 | 16,476 | 15,359 | 14,871 | 14,716 | 14,388 | 13,368 | 12,881 | 12,675 |

| Current Assets | -14.7% | 1,432 | 1,680 | 886 | 889 | 1,073 | 3,628 | 3,048 | 3,282 | 3,529 | 3,274 | 2,839 | 1,115 | 1,620 | 1,192 | 471 | 602 | 830 | 812 | 458 | 504 | 671 |

| Cash Equivalents | -5.2% | 264 | 278 | 15.00 | 56.00 | 95.00 | 172 | 52.00 | 328 | 582 | 264 | 117 | 525 | 865 | 458 | 21.00 | 208 | 320 | 189 | 25.00 | 46.00 | 108 |

| Goodwill | 0% | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 731 | 730 | 730 |

| Current Liabilities | -9.9% | 1,055 | 1,170 | 1,353 | 1,034 | 1,113 | 3,532 | 3,603 | 3,259 | 3,208 | 3,426 | 3,510 | 1,063 | 871 | 798 | 782 | 703 | 933 | 845 | 1,209 | 901 | 864 |

| Short Term Borrowings | - | - | - | 242 | - | - | - | 185 | - | - | - | - | - | - | - | - | - | 200 | - | 465 | 75.00 | - |

| Long Term Debt | 0.0% | 7,445 | 7,444 | 6,554 | 6,554 | 6,553 | 6,552 | 5,761 | 5,759 | 5,758 | 5,555 | 4,930 | 7,129 | 7,316 | 5,125 | 4,532 | 4,531 | 4,329 | 4,324 | 3,529 | 3,529 | 3,529 |

| LT Debt, Current | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 125 | 125 |

| LT Debt, Non Current | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 3,529 | 3,529 | 3,529 |

| Shareholder's Equity | 3.1% | 11,619 | 11,273 | 10,870 | 10,602 | 10,205 | 9,836 | 9,419 | 9,268 | 8,983 | 8,290 | 7,907 | 7,774 | 7,821 | 7,213 | 6,791 | 6,461 | 6,304 | 6,128 | 5,750 | 5,642 | 5,508 |

| Retained Earnings | 8.0% | 4,168 | 3,858 | 3,667 | 3,659 | 3,630 | 3,378 | 3,211 | 3,236 | 3,203 | 2,971 | 2,813 | 2,847 | 2,826 | 2,610 | 2,471 | 2,477 | 2,430 | 2,261 | 2,152 | 2,157 | 2,139 |

| Additional Paid-In Capital | 0.1% | 6,954 | 6,946 | 6,684 | 6,538 | 6,214 | 6,066 | 5,838 | 5,726 | 5,634 | 5,294 | 5,024 | 4,865 | 4,854 | 4,600 | 4,377 | 4,100 | 3,986 | 3,980 | 3,712 | 3,600 | 3,486 |

| Shares Outstanding | 0.0% | 151 | 151 | 148 | 147 | 144 | 142 | 141 | 140 | 137 | 134 | 130 | 131 | - | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | - | 16,117 | - | - | - | 16,491 | - | - | - | 12,737 | - | - | - | 11,938 | - | - | - | 11,827 |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | 204.4% | 747 | 245 | 238 | 329 | 2,704 | 189 | 48.00 | 289 | 579 | 62.00 | 74.00 | 244 | -1,559 | 157 | 143 | 262 | 461 | 172 | 160 | 248 | 396 |

| Cashflow From Investing | 15.6% | -644 | -764 | -717 | -666 | -617 | -792 | -715 | -532 | -502 | -679 | -611 | -506 | -392 | -453 | -525 | -409 | -463 | -528 | -488 | -426 | -353 |

| Cashflow From Financing | -115.7% | -123 | 785 | 441 | 301 | -2,162 | 724 | 391 | -10.65 | 242 | 765 | 129 | -78.21 | 2,359 | 733 | 195 | 35.00 | 132 | 521 | 307 | 117 | -152 |

| Dividend Payments | -100.0% | - | 120 | 111 | 108 | 106 | 105 | 97.00 | 95.00 | 94.00 | 90.00 | 83.00 | 82.00 | 80.00 | 79.00 | 72.00 | 71.00 | 71.00 | 70.00 | 64.00 | 62.00 | 62.00 |

ATO Income Statement

2024-03-31CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME - USD ($) shares in Thousands, $ in Thousands | 3 Months Ended | 6 Months Ended | ||

|---|---|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | Mar. 31, 2024 | Mar. 31, 2023 | |

| Operating revenues | $ 1,647,227 | $ 1,540,973 | $ 2,805,694 | $ 3,024,982 |

| Purchased gas cost | 624,295 | 666,211 | 963,164 | 1,404,460 |

| Operation and maintenance expense | 199,899 | 194,716 | 366,244 | 379,732 |

| Depreciation and amortization expense | 165,087 | 148,317 | 329,695 | 294,337 |

| Taxes, other than income | 106,956 | 109,091 | 196,496 | 202,629 |

| Operating income | 550,990 | 422,638 | 950,095 | 743,824 |

| Other non-operating income | 16,687 | 17,406 | 34,573 | 38,597 |

| Interest charges | 55,442 | 37,370 | 107,317 | 74,130 |

| Income before income taxes | 512,235 | 402,674 | 877,351 | 708,291 |

| Income tax expense | 80,212 | 45,003 | 134,036 | 78,760 |

| Net income | $ 432,023 | $ 357,671 | $ 743,315 | $ 629,531 |

| Basic net income per share (USD per share) | $ 2.85 | $ 2.48 | $ 4.93 | $ 4.40 |

| Diluted net income per share (USD per share) | 2.85 | 2.48 | 4.93 | 4.40 |

| Cash dividends per share (USD per share) | $ 0.805 | $ 0.740 | $ 1.61 | $ 1.48 |

| Basic weighted average shares outstanding (in shares) | 151,271 | 143,941 | 150,534 | 142,881 |

| Diluted weighted average shares outstanding (in shares) | 151,297 | 143,987 | 150,547 | 142,963 |

| Other comprehensive income (loss), net of tax | ||||

| Net unrealized holding gains (losses) on available-for-sale securities, net of tax | $ (50) | $ 134 | $ 246 | $ 221 |

| Cash flow hedges: | ||||

| Amortization and unrealized gains (losses) on interest rate agreements, net of tax | 27,158 | (30,467) | (23,074) | (8,336) |

| Total other comprehensive income (loss) | 27,108 | (30,333) | (22,828) | (8,115) |

| Total comprehensive income | 459,131 | 327,338 | 720,487 | 621,416 |

| Distribution segment | ||||

| Operating revenues | 1,588,394 | 1,499,437 | 2,693,013 | 2,939,130 |

| Pipeline and storage segment | ||||

| Operating revenues | 58,833 | 41,536 | 112,681 | 85,852 |

| Operating Segments | Distribution segment | ||||

| Operating revenues | 1,589,181 | 1,500,210 | 2,694,519 | 2,940,636 |

| Purchased gas cost | 788,643 | 809,023 | 1,285,305 | 1,690,938 |

| Operation and maintenance expense | 154,956 | 151,353 | 282,571 | 287,822 |

| Depreciation and amortization expense | 121,384 | 106,310 | 241,069 | 211,974 |

| Taxes, other than income | 98,008 | 98,200 | 178,903 | 182,822 |

| Operating income | 426,190 | 335,324 | 706,671 | 567,080 |

| Other non-operating income | 9,359 | 7,465 | 15,198 | 14,239 |

| Interest charges | 36,784 | 21,420 | 71,365 | 44,259 |

| Income before income taxes | 398,765 | 321,369 | 650,504 | 537,060 |

| Income tax expense | 56,073 | 32,895 | 86,375 | 54,118 |

| Net income | 342,692 | 288,474 | 564,129 | 482,942 |

| Operating Segments | Pipeline and storage segment | ||||

| Operating revenues | 223,487 | 184,424 | 434,656 | 371,053 |

| Purchased gas cost | 840 | 621 | 844 | (237) |

| Operation and maintenance expense | 45,196 | 43,591 | 84,169 | 92,376 |

| Depreciation and amortization expense | 43,703 | 42,007 | 88,626 | 82,363 |

| Taxes, other than income | 8,948 | 10,891 | 17,593 | 19,807 |

| Operating income | 124,800 | 87,314 | 243,424 | 176,744 |

| Other non-operating income | 7,328 | 9,941 | 19,375 | 24,358 |

| Interest charges | 18,658 | 15,950 | 35,952 | 29,871 |

| Income before income taxes | 113,470 | 81,305 | 226,847 | 171,231 |

| Income tax expense | 24,139 | 12,108 | 47,661 | 24,642 |

| Net income | 89,331 | 69,197 | 179,186 | 146,589 |

| Intersegment eliminations | ||||

| Operating revenues | (165,441) | (143,661) | (323,481) | (286,707) |

| Purchased gas cost | (165,188) | (143,433) | (322,985) | (286,241) |

| Operation and maintenance expense | (253) | (228) | (496) | (466) |

| Depreciation and amortization expense | 0 | 0 | 0 | 0 |

| Taxes, other than income | 0 | 0 | 0 | 0 |

| Operating income | 0 | 0 | 0 | 0 |

| Other non-operating income | 0 | 0 | 0 | 0 |

| Interest charges | 0 | 0 | 0 | 0 |

| Income before income taxes | 0 | 0 | 0 | 0 |

| Income tax expense | 0 | 0 | 0 | 0 |

| Net income | 0 | 0 | 0 | 0 |

| Intersegment eliminations | Distribution segment | ||||

| Operating revenues | 787 | 773 | 1,506 | 1,506 |

| Intersegment eliminations | Pipeline and storage segment | ||||

| Operating revenues | $ 164,654 | $ 142,888 | $ 321,975 | $ 285,201 |

ATO Balance Sheet

2024-03-31CONDENSED CONSOLIDATED BALANCE SHEETS - USD ($) $ in Thousands | Mar. 31, 2024 | Sep. 30, 2023 |

|---|---|---|

| ASSETS | ||

| Property, plant and equipment | $ 24,283,917 | $ 22,898,374 |

| Less accumulated depreciation and amortization | 3,469,354 | 3,291,791 |

| Net property, plant and equipment | 20,814,563 | 19,606,583 |

| Current assets | ||

| Cash and cash equivalents | 262,497 | 15,404 |

| Restricted cash and cash equivalents | 1,272 | 3,844 |

| Cash and cash equivalents and restricted cash and cash equivalents | 263,769 | 19,248 |

| Accounts receivable, net | 596,433 | 328,654 |

| Gas stored underground | 144,128 | 245,830 |

| Other current assets | 428,105 | 292,036 |

| Total current assets | 1,432,435 | 885,768 |

| Securitized intangible asset, net (See Note 9) | 87,279 | 92,202 |

| Goodwill | 731,257 | 731,257 |

| Deferred charges and other assets | 939,106 | 1,201,158 |

| Total assets | 24,004,640 | 22,516,968 |

| Shareholders’ equity | ||

| Common stock, no par value (stated at $0.005 per share); 200,000,000 shares authorized; issued and outstanding: March 31, 2024 — 150,874,552 shares; September 30, 2023 — 148,492,783 shares | 754 | 742 |

| Additional paid-in capital | 6,953,761 | 6,684,120 |

| Accumulated other comprehensive income | 495,700 | 518,528 |

| Retained earnings | 4,168,424 | 3,666,674 |

| Shareholders’ equity | 11,618,639 | 10,870,064 |

| Long-term debt, net | 7,444,855 | 6,554,133 |

| Securitized long-term debt (See Note 9) | 81,261 | 85,078 |

| Total capitalization | 19,144,755 | 17,509,275 |

| Current liabilities | ||

| Accounts payable and accrued liabilities | 367,887 | 336,083 |

| Other current liabilities | 677,706 | 763,086 |

| Short-term debt | 0 | 241,933 |

| Current maturities of long-term debt | 1,591 | 1,568 |

| Current maturities of securitized long-term debt (See Note 9) | 8,001 | 9,922 |

| Total current liabilities | 1,055,185 | 1,352,592 |

| Deferred income taxes | 2,486,024 | 2,304,974 |

| Regulatory excess deferred taxes | 216,284 | 253,212 |

| Regulatory cost of removal obligation | 506,860 | 497,017 |

| Deferred credits and other liabilities | 595,532 | 599,898 |

| Total capitalization and liabilities | $ 24,004,640 | $ 22,516,968 |

| CEO | Mr. John Kevin Akers |

|---|---|

| WEBSITE | atmosenergy.com |

| INDUSTRY | Utilities Regulated Electric |

| EMPLOYEES | 4791 |