Market Summary

BATL Stock Price

BATL RSI Chart

BATL Valuation

BATL Price/Sales (Trailing)

BATL Profitability

BATL Fundamentals

BATL Revenue

BATL Earnings

Breaking Down BATL Revenue

Last 7 days

2.5%

Last 30 days

5.9%

Last 90 days

-4.5%

Trailing 12 Months

5.7%

How does BATL drawdown profile look like?

BATL Financial Health

BATL Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 205.5M | 0 | 0 | 0 |

| 2023 | 342.6M | 295.4M | 250.3M | 220.8M |

| 2022 | 311.3M | 348.4M | 366.8M | 359.1M |

| 2021 | 156.4M | 202.3M | 243.3M | 285.2M |

| 2020 | 220.2M | 182.3M | 171.3M | 148.3M |

| 2019 | 229.4M | 230.3M | 219.5M | 224.7M |

| 2018 | 291.5M | 226.7M | 191.4M | 226.5M |

| 2017 | 477.1M | 491.6M | 506.1M | 378.0M |

| 2016 | 495.4M | 433.6M | 448.1M | 462.6M |

| 2015 | 1.0B | 850.2M | 673.6M | 550.3M |

| 2014 | 1.1B | 1.2B | 1.2B | 1.1B |

| 2013 | 412.3M | 603.3M | 835.0M | 999.5M |

| 2012 | 105.7M | 100.9M | 150.0M | 248.3M |

| 2011 | 106.0M | 105.2M | 102.3M | 104.6M |

| 2010 | 0 | 95.1M | 103.1M | 111.1M |

| 2009 | 0 | 0 | 0 | 87.1M |

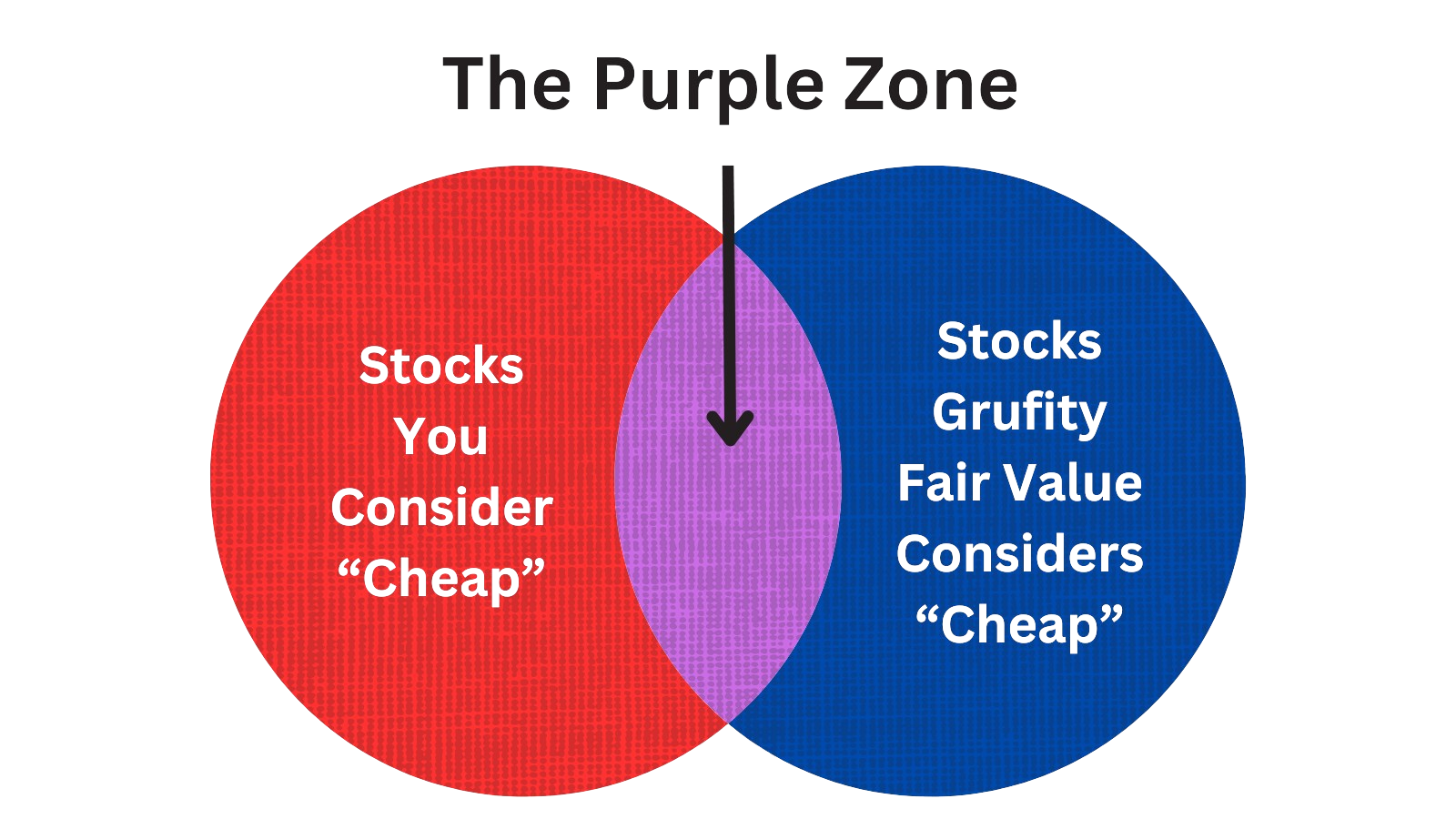

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed Russell 2000 Index

Small Caps and Mid Caps are mostly overlooked by investors as all the focus goes to Magnificent 7. These stocks that are not part of the beauty contest require a deeper look. However, all large cap stocks were once small caps. Grufity's Fair Value model opens up this unverse as it separates high-performing, rewarding stocks from low-performing risky stocks. <b>Russell 2000 stocks that were marked 'Very Cheap' by the model doubled in three years while the index was flat.</b>

Returns of $10,000 invested in:

Very Cheap Stocks: $21,859

Russell 2000 Index: $10,334

Very Expensive Stocks: $8,224

Russell 2000 stocks considered 'Very Cheap' by the model greatly outperformed Russell 2000 index and the 'Very Expensive' bucket over past three years.

Tracking the Latest Insider Buys and Sells of Battalion Oil Corp

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Feb 20, 2023 | mayer walter r | sold (taxes) | -6,409 | 9.77 | -656 | svp, general counsel |

| Feb 20, 2023 | mayer walter r | acquired | - | - | 2,214 | svp, general counsel |

| Feb 20, 2023 | evans grant r | sold (taxes) | -12,818 | 9.77 | -1,312 | vp, exploration & geosciences |

| Feb 20, 2023 | evans grant r | acquired | - | - | 4,427 | vp, exploration & geosciences |

| Feb 20, 2023 | rohling daniel p | sold (taxes) | -19,237 | 9.77 | -1,969 | chief operating officer |

| Feb 20, 2023 | rohling daniel p | acquired | - | - | 6,641 | chief operating officer |

| Feb 20, 2023 | little richard h | sold (taxes) | -43,066 | 9.77 | -4,408 | chief executive officer |

| Feb 20, 2023 | little richard h | acquired | - | - | 17,709 | chief executive officer |

| Feb 20, 2023 | kasparek leah r. | sold (taxes) | -6,409 | 9.77 | -656 | svp, hr & corporate secretary |

| Feb 20, 2023 | kasparek leah r. | acquired | - | - | 2,214 | svp, hr & corporate secretary |

Which funds bought or sold BATL recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 16, 2024 | JANE STREET GROUP, LLC | sold off | -100 | -134,117 | - | -% |

| May 15, 2024 | Beryl Capital Management LLC | sold off | -100 | -3,608,060 | - | -% |

| May 15, 2024 | STATE STREET CORP | new | - | 69,120 | 69,120 | -% |

| May 15, 2024 | Steward Partners Investment Advisory, LLC | unchanged | - | -39.00 | 57.00 | -% |

| May 15, 2024 | LSP Investment Advisors, LLC | unchanged | - | -9,360,590 | 13,412,900 | 7.23% |

| May 15, 2024 | EHP Funds Inc. | added | 6.01 | -287,778 | 478,389 | 0.20% |

| May 15, 2024 | BANK OF AMERICA CORP /DE/ | reduced | -94.9 | -15,342 | 476 | -% |

| May 15, 2024 | MORGAN STANLEY | added | - | -521,398 | 747,132 | -% |

| May 15, 2024 | GOLDMAN SACHS GROUP INC | reduced | -85.93 | -5,442,820 | 491,826 | -% |

| May 15, 2024 | Royal Bank of Canada | added | 0.03 | -13,000 | 19,000 | -% |

Are Funds Buying or Selling BATL?

Unveiling Battalion Oil Corp's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| May 15, 2024 | brookfield oaktree holdings, llc | 44.67% | 10,065,897 | SC 13D/A | |

| May 15, 2024 | gen iv investment opportunities, llc | 28.1% | 6,419,006 | SC 13D/A | |

| May 15, 2024 | luminus management llc | 50.3% | 16,661,693 | SC 13D/A | |

| Mar 29, 2024 | brookfield oaktree holdings, llc | 41.68% | 8,911,940 | SC 13D/A | |

| Mar 29, 2024 | gen iv investment opportunities, llc | 28.9% | 5,716,474 | SC 13D/A | |

| Mar 29, 2024 | luminus management llc | 59.0% | 14,838,161 | SC 13D/A | |

| Feb 02, 2024 | goldman sachs group inc | 4.0% | 652,470 | SC 13G/A | |

| Dec 19, 2023 | gen iv investment opportunities, llc | 26.5% | 5,088,092 | SC 13D/A | |

| Dec 19, 2023 | oaktree capital group, llc | 38.7% | 7,881,798 | SC 13D/A | |

| Dec 19, 2023 | luminus management llc | 56.2% | 13,207,104 | SC 13D/A |

Recent SEC filings of Battalion Oil Corp

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 16, 2024 | 4/A | Insider Trading | |

| May 15, 2024 | SC 13D/A | 13D - Major Acquisition | |

| May 15, 2024 | SC 13D/A | 13D - Major Acquisition | |

| May 15, 2024 | SC 13D/A | 13D - Major Acquisition | |

| May 15, 2024 | DEFA14A | DEFA14A | |

| May 15, 2024 | 8-K | Current Report | |

| May 15, 2024 | 4 | Insider Trading | |

| May 15, 2024 | 4 | Insider Trading | |

| May 15, 2024 | 4 | Insider Trading | |

| May 15, 2024 | 10-Q | Quarterly Report |

Peers (Alternatives to Battalion Oil Corp)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

XOM | 471.7B | 341.1B | 0.85% | 13.11% | 14.38 | 1.38 | -16.75% | -46.83% |

CVX | 300.5B | 198.9B | 4.03% | 5.64% | 14.81 | 1.51 | -18.05% | -43.28% |

OXY | 56.3B | 27.7B | -3.83% | 8.93% | 13.02 | 2.03 | -22.75% | -55.41% |

MRO | 14.8B | 6.6B | -5.31% | 13.71% | 10.31 | 2.23 | -15.57% | -47.38% |

CHK | 12.0B | 6.4B | 5.21% | 11.50% | 11.38 | 1.87 | -54.63% | -85.10% |

| MID-CAP | ||||||||

RRC | 9.2B | 2.2B | 8.87% | 28.18% | 19.03 | 4.18 | -62.59% | -77.29% |

HP | 3.8B | 2.7B | -5.78% | 17.60% | 10.77 | 1.38 | 2.93% | 8.77% |

CNX | 3.7B | 2.5B | 1.93% | 51.75% | 3.66 | 1.46 | -6.59% | -31.79% |

KOS | 2.8B | 1.7B | -2.31% | -5.73% | 12.58 | 1.62 | -15.13% | -28.06% |

CPE | 2.4B | 2.1B | 12.10% | 1.07% | 5.93 | 1.13 | -35.04% | -60.65% |

| SMALL-CAP | ||||||||

AMPY | 249.2M | 304.0M | -7.64% | -11.90% | 8.14 | 0.82 | -28.78% | -93.34% |

AMTX | 170.5M | 257.2M | 1.32% | 57.38% | -3.85 | 0.66 | 7.59% | 61.82% |

BATL | 94.5M | 205.5M | 5.90% | 5.71% | -1.66 | 0.46 | -40.02% | -142.55% |

AE | 70.6M | 2.8B | -3.81% | -20.17% | 41.23 | 0.03 | -15.01% | 137.22% |

BRN | 26.1M | 24.4M | -6.81% | 2.77% | -8.02 | 1.07 | -16.16% | -245.04% |

Battalion Oil Corp News

Battalion Oil Corp Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | ||||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 5.6% | 49,870,000 | 47,242,000 | 54,106,000 | 54,272,000 | 65,142,000 | 76,802,000 | 99,149,000 | 101,511,000 | 81,602,000 | 84,505,000 | 80,816,000 | 64,366,000 | 55,518,000 | 42,566,000 | 39,830,000 | 18,494,000 | 47,399,000 | 65,582,000 | 50,809,000 | 56,378,000 | 51,923,000 |

| Costs and Expenses | 4.0% | 49,847,000 | 47,910,000 | 47,289,000 | 53,963,000 | 54,018,000 | 52,193,000 | 55,213,000 | 51,722,000 | 47,800,000 | 49,199,000 | 47,361,000 | 43,459,000 | 41,812,000 | 75,642,000 | 175,420,000 | 109,481,000 | 49,578,000 | 54,777,000 | 115,245,000 | 750,068,000 | 356,572,000 |

| S&GA Expenses | -100.0% | - | 5,453,000 | 3,192,000 | 5,243,000 | 5,137,000 | 3,564,000 | 4,498,000 | 4,588,000 | 4,985,000 | 3,165,000 | 4,491,000 | 4,031,000 | 4,827,000 | 5,219,000 | 4,111,000 | 5,270,000 | 3,856,000 | 5,111,000 | 19,423,000 | 12,519,000 | 4,608,000 |

| EBITDA Margin | -218.7% | -0.14 | 0.12 | 0.06 | 0.59 | 0.56 | 0.22 | 0.27 | 0.02 | -0.13 | 0.06 | -0.29 | -1.17 | -2.12 | - | - | - | - | - | - | - | - |

| Interest Expenses | - | 6,571,000 | - | - | - | 7,265,000 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Income Taxes | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 95,791,000 | - | -50,306,000 | -45,485,000 |

| Earnings Before Taxes | -195.5% | -31,203,000 | 32,688,000 | -53,799,000 | -4,748,000 | 22,811,000 | -7,652,000 | 105,888,000 | 13,047,000 | -92,744,000 | 25,935,000 | 13,052,000 | -33,929,000 | -33,375,000 | -63,757,000 | -153,125,000 | -127,316,000 | 114,491,000 | -10,460,000 | -63,284,000 | -691,150,000 | -382,044,000 |

| EBT Margin | -1911.2% | -0.28 | -0.01 | -0.17 | 0.39 | 0.39 | 0.05 | 0.14 | -0.12 | -0.28 | -0.10 | -0.49 | -1.40 | -2.41 | - | - | - | - | - | - | - | - |

| Net Income | -195.5% | -31,203,000 | 32,688,000 | -53,799,000 | -4,748,000 | 22,811,000 | -7,652,000 | 105,888,000 | 13,047,000 | -92,744,000 | 25,935,000 | 13,052,000 | -33,929,000 | -33,375,000 | -63,757,000 | -153,125,000 | -127,316,000 | 114,491,000 | -10,460,000 | -63,284,000 | -640,844,000 | -336,559,000 |

| Net Income Margin | -1911.2% | -0.28 | -0.01 | -0.17 | 0.39 | 0.39 | 0.05 | 0.14 | -0.12 | -0.28 | -0.10 | -0.49 | -1.40 | -2.41 | - | - | - | - | - | - | - | - |

| Free Cashflow | -40.0% | 3,916,000 | 6,524,000 | -1,929,000 | 4,993,000 | -5,034,000 | 20,642,000 | 21,136,000 | 11,941,000 | 7,702,000 | 17,095,000 | 13,687,000 | 11,397,000 | 9,013,000 | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 0.7% | 489 | 485 | 457 | 433 | 464 | 485 | 478 | 449 | 411 | 390 | 349 | 352 | 351 | 346 | 413 | 579 | 712 | 585 | 594 | 1,155 | 1,799 |

| Current Assets | -7.7% | 84.00 | 91.00 | 75.00 | 53.00 | 72.00 | 88.00 | 93.00 | 104 | 92.00 | 88.00 | 44.00 | 42.00 | 44.00 | 48.00 | 49.00 | 55.00 | 109 | 71.00 | 85.00 | 59.00 | 61.00 |

| Cash Equivalents | -14.8% | 49.00 | 58.00 | 43.00 | 19.00 | 23.00 | 33.00 | 34.00 | 44.00 | 44.00 | 48.00 | 2.00 | 1.00 | 2.00 | 4.00 | 2.00 | 0.00 | 1.00 | 10.00 | 16.00 | 2.00 | 0.00 |

| Net PPE | -5.5% | 3.00 | 3.00 | 3.00 | 3.00 | 3.00 | 3.00 | 3.00 | 3.00 | 3.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 3.00 | 3.00 | 3.00 | 4.00 | 179 | 148 |

| Current Liabilities | 9.8% | 148 | 134 | 141 | 107 | 117 | 165 | 167 | 205 | 190 | 122 | 135 | 139 | 119 | 83.00 | 67.00 | 77.00 | 98.00 | 106 | 379 | 927 | 264 |

| Long Term Debt | -9.6% | 127 | 140 | 153 | 164 | 175 | 183 | 179 | 188 | 177 | 182 | 155 | 163 | 155 | 158 | 179 | 180 | 170 | 144 | 130 | - | 613 |

| LT Debt, Current | 10.0% | 55.00 | 50.00 | 45.00 | 43.00 | 40.00 | 35.00 | 25.00 | 15.00 | 5.00 | 0.00 | 0.00 | 2.00 | 2.00 | 2.00 | 1.00 | 1.00 | - | - | 258 | 802 | 105 |

| LT Debt, Non Current | -100.0% | - | 140 | 153 | 164 | 175 | 183 | 179 | 188 | 177 | 182 | 155 | 163 | 155 | 158 | 179 | 180 | 170 | 144 | 130 | - | 613 |

| Shareholder's Equity | -54.0% | 31.00 | 68.00 | 41.00 | 99.00 | 106 | 85.00 | 91.00 | - | - | 64.00 | 37.00 | 24.00 | 57.00 | 90.00 | 153 | 305 | 432 | 317 | 148 | 214 | 854 |

| Retained Earnings | -12.3% | -284 | -252 | -285 | -231 | -227 | -249 | -242 | -348 | -361 | -268 | -294 | -307 | -273 | -240 | -176 | -23.28 | 104 | -10.46 | -939 | -875 | -234 |

| Additional Paid-In Capital | -1.7% | 316 | 321 | 327 | 331 | 333 | 335 | 334 | 333 | 332 | 332 | 332 | 331 | 331 | 330 | 329 | 328 | 328 | 327 | 1,087 | 1,090 | 1,089 |

| Accumulated Depreciation | 8.9% | 2.00 | 2.00 | 2.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.00 | 14.00 | 12.00 | 10.00 |

| Shares Outstanding | 0% | 16.00 | 16.00 | 16.00 | 16.00 | 16.00 | 16.00 | 16.00 | 16.00 | 16.00 | 16.00 | 16.00 | 16.00 | 16.00 | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | 22.00 | - | - | - | 32.00 | - | - | - | 50.00 | - | - | - | 24.00 | - | - | - | 25.00 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -40.0% | 4.00 | 7.00 | 2.00 | 9.00 | -0.69 | 25.00 | 25.00 | 16.00 | 12.00 | 21.00 | 18.00 | 16.00 | 13.00 | 2.00 | 5.00 | 31.00 | 12.00 | 14.00 | -12.83 | 10.00 | -36.83 |

| Share Based Compensation | -38.5% | 0.00 | 0.00 | -0.69 | -0.77 | 0.00 | 1.00 | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.00 | - | -2.28 | 1.00 | -6.78 |

| Cashflow From Investing | -116.1% | -31.85 | -14.74 | -5.37 | -4.04 | -27.70 | -38.35 | -35.79 | -36.14 | -15.84 | -5.66 | -9.58 | -23.95 | -12.72 | 20.00 | -2.35 | -42.51 | -47.65 | -42.79 | -49.11 | -90.87 | -114 |

| Cashflow From Financing | -16.5% | 19.00 | 23.00 | 27.00 | -10.03 | 19.00 | 13.00 | 0.00 | 20.00 | -0.92 | 31.00 | -8.04 | 8.00 | -3.26 | -20.00 | -1.00 | 11.00 | 26.00 | 10.00 | 89.00 | 83.00 | 105 |

BATL Income Statement

2024-03-31CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) - USD ($) shares in Thousands, $ in Thousands | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Oil, natural gas and natural gas liquids sales: | ||

| Total oil, natural gas and natural gas liquids sales | $ 49,532 | $ 64,273 |

| Other | 338 | 869 |

| Total operating revenues | 49,870 | 65,142 |

| Production: | ||

| Lease operating | 11,586 | 11,691 |

| Workover and other | 888 | 1,335 |

| Taxes other than income | 2,991 | 3,190 |

| Gathering and other | 17,286 | 16,517 |

| General and administrative | 4,071 | 5,137 |

| Depletion, depreciation and accretion | 13,025 | 16,148 |

| Total operating expenses | 49,847 | 54,018 |

| Income from operations | 23 | 11,124 |

| Other income (expenses): | ||

| Net (loss) gain on derivative contracts | (24,187) | 19,473 |

| Interest expense and other | (7,039) | (7,786) |

| Total other (expenses) income | (31,226) | 11,687 |

| (Loss) income before income taxes | (31,203) | 22,811 |

| Income tax benefit (provision) | 0 | 0 |

| Net (loss) income | (31,203) | 22,811 |

| Series A preferred dividends | (5,632) | (1,492) |

| Net (loss) income available to common stockholders | $ (36,835) | $ 21,319 |

| Net (loss) income per share of common stock available to common stockholders: | ||

| Basic (in dollars per share) | $ (2.24) | $ 1.29 |

| Diluted (in dollars per share) | $ (2.24) | $ 1.28 |

| Weighted average common shares outstanding: | ||

| Basic (in shares) | 16,457 | 16,393 |

| Diluted (in shares) | 16,457 | 16,535 |

| Oil | ||

| Oil, natural gas and natural gas liquids sales: | ||

| Total oil, natural gas and natural gas liquids sales | $ 42,429 | $ 54,215 |

| Natural gas | ||

| Oil, natural gas and natural gas liquids sales: | ||

| Total oil, natural gas and natural gas liquids sales | 2,047 | 2,900 |

| Natural gas liquids | ||

| Oil, natural gas and natural gas liquids sales: | ||

| Total oil, natural gas and natural gas liquids sales | $ 5,056 | $ 7,158 |

BATL Balance Sheet

2024-03-31CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) - USD ($) $ in Thousands | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current assets: | ||

| Cash and cash equivalents | $ 48,941 | $ 57,529 |

| Accounts receivable, net | 25,987 | 23,021 |

| Assets from derivative contracts | 7,633 | 8,992 |

| Restricted cash | 91 | 90 |

| Prepaids and other | 919 | 907 |

| Total current assets | 83,571 | 90,539 |

| Oil and natural gas properties (full cost method): | ||

| Evaluated | 776,504 | 755,482 |

| Unevaluated | 58,909 | 58,909 |

| Gross oil and natural gas properties | 835,413 | 814,391 |

| Less: accumulated depletion | (458,604) | (445,975) |

| Net oil and natural gas properties | 376,809 | 368,416 |

| Other operating property and equipment: | ||

| Other operating property and equipment | 4,648 | 4,640 |

| Less: accumulated depreciation | (1,979) | (1,817) |

| Net other operating property and equipment | 2,669 | 2,823 |

| Other noncurrent assets: | ||

| Assets from derivative contracts | 3,898 | 4,877 |

| Operating lease right of use assets | 890 | 1,027 |

| Other assets | 20,780 | 17,656 |

| Total assets | 488,617 | 485,338 |

| Current liabilities: | ||

| Accounts payable and accrued liabilities | 63,117 | 66,525 |

| Liabilities from derivative contracts | 28,764 | 17,191 |

| Current portion of long-term debt | 55,106 | 50,106 |

| Operating lease liabilities | 614 | 594 |

| Total current liabilities | 147,601 | 134,416 |

| Long-term debt, net | 126,821 | 140,276 |

| Other noncurrent liabilities: | ||

| Liabilities from derivative contracts | 21,907 | 16,058 |

| Asset retirement obligations | 17,866 | 17,458 |

| Operating lease liabilities | 329 | 490 |

| Other | 11,156 | 2,084 |

| Commitments and contingencies (Note 8) | ||

| Temporary equity: | ||

| Series A redeemable convertible preferred stock: 118,000 shares and 98,000 shares of $0.0001 par value authorized, issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | 131,624 | 106,535 |

| Stockholders' equity: | ||

| Common stock: 100,000,000 shares of $0.0001 par value authorized; 16,456,563 shares issued and outstanding as of March 31, 2024 and December 31, 2023 | 2 | 2 |

| Additional paid-in capital | 315,507 | 321,012 |

| Retained earnings (accumulated deficit) | (284,196) | (252,993) |

| Total stockholders' equity | 31,313 | 68,021 |

| Total liabilities, temporary equity and stockholders' equity | $ 488,617 | $ 485,338 |

| CEO | Mr. Matthew B. Steele |

|---|---|

| WEBSITE | https://battalionoil.com |

| INDUSTRY | Oil - E&P |

| EMPLOYEES | 63 |