Market Summary

OXY Alerts

OXY Stock Price

OXY RSI Chart

OXY Valuation

OXY Price/Sales (Trailing)

OXY Profitability

OXY Fundamentals

OXY Revenue

OXY Earnings

Breaking Down OXY Revenue

Last 7 days

-1.2%

Last 30 days

-7.4%

Last 90 days

9.7%

Trailing 12 Months

8.0%

How does OXY drawdown profile look like?

OXY Financial Health

OXY Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 27.7B | 0 | 0 | 0 |

| 2023 | 35.8B | 31.8B | 29.7B | 28.9B |

| 2022 | 29.4B | 34.1B | 36.8B | 37.1B |

| 2021 | 15.1B | 18.1B | 21.7B | 26.3B |

| 2020 | 24.3B | 22.8B | 20.1B | 16.3B |

| 2019 | 19.2B | 19.5B | 19.4B | 21.8B |

| 2018 | 14.1B | 14.6B | 17.7B | 18.9B |

| 2017 | 11.1B | 12.1B | 12.5B | 13.3B |

| 2016 | 11.9B | 10.9B | 10.4B | 10.4B |

| 2015 | 20.0B | 17.9B | 16.2B | 12.7B |

| 2014 | 20.5B | 20.1B | 18.6B | 21.9B |

| 2013 | 19.8B | 20.1B | 20.6B | 21.5B |

| 2012 | 24.6B | 24.2B | 24.1B | 20.2B |

| 2011 | 20.3B | 21.9B | 23.1B | 24.1B |

| 2010 | 16.5B | 17.4B | 18.1B | 19.2B |

| 2009 | 21.0B | 17.5B | 14.5B | 14.9B |

| 2008 | 0 | 21.3B | 22.7B | 24.0B |

| 2007 | 0 | 0 | 0 | 20.0B |

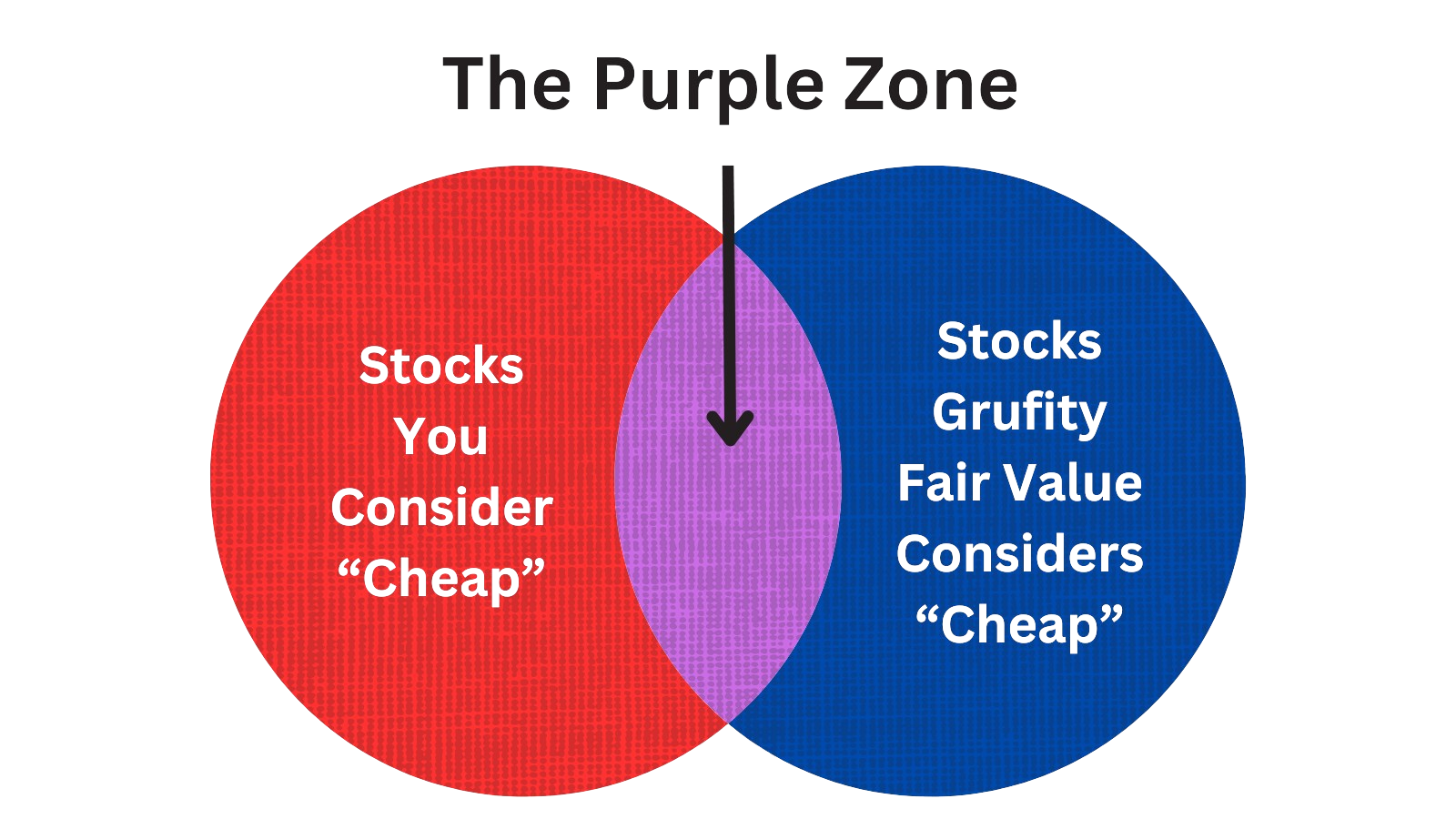

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Occidental Petroleum Corp

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 03, 2024 | poladian avedick baruyr | acquired | - | - | 3,883 | - |

| May 03, 2024 | oneill claire | acquired | - | - | 3,495 | - |

| May 03, 2024 | robinson kenneth b. | sold (taxes) | -49,515 | 64.39 | -769 | - |

| May 03, 2024 | bailey vicky a | acquired | - | - | 3,495 | - |

| May 03, 2024 | moore jack b | sold (taxes) | -94,653 | 64.39 | -1,470 | - |

| May 03, 2024 | robinson kenneth b. | acquired | - | - | 3,495 | - |

| May 03, 2024 | shearer bob | acquired | - | - | 3,883 | - |

| May 03, 2024 | gutierrez carlos m | acquired | - | - | 3,495 | - |

| May 03, 2024 | moore jack b | acquired | - | - | 6,679 | - |

| May 03, 2024 | gould andrew | sold (taxes) | -75,014 | 64.39 | -1,165 | - |

Which funds bought or sold OXY recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 07, 2024 | Moss Adams Wealth Advisors LLC | new | - | 441,625 | 441,625 | 0.07% |

| May 07, 2024 | ASSETMARK, INC | unchanged | - | 16.00 | 172 | -% |

| May 07, 2024 | Avalon Trust Co | unchanged | - | 10,560 | 129,980 | 0.01% |

| May 07, 2024 | VERUS CAPITAL PARTNERS, LLC | new | - | 256,553 | 256,553 | 0.03% |

| May 07, 2024 | OPPENHEIMER & CO INC | added | 27.34 | 3,161,260 | 11,350,200 | 0.19% |

| May 07, 2024 | SUSQUEHANNA INTERNATIONAL GROUP, LLP | reduced | -58.22 | -29,640,900 | 24,720,800 | -% |

| May 07, 2024 | Williams Jones Wealth Management, LLC. | reduced | -50.3 | -1,181,590 | 1,392,150 | 0.02% |

| May 07, 2024 | Inspire Investing, LLC | reduced | -8.56 | -2,153 | 449,016 | 0.05% |

| May 07, 2024 | ANTIPODES PARTNERS Ltd | reduced | -0.88 | 11,019,000 | 150,768,000 | 4.77% |

| May 07, 2024 | Illinois Municipal Retirement Fund | added | 6.75 | 1,322,000 | 9,489,000 | 0.14% |

Are Funds Buying or Selling OXY?

OXY Alerts

Unveiling Occidental Petroleum Corp's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | dodge & cox | 10.7% | 95,267,578 | SC 13G/A | |

| Feb 13, 2024 | vanguard group inc | 6.47% | 56,822,431 | SC 13G/A | |

| Jan 25, 2024 | state street corp | 4.57% | 40,141,797 | SC 13G/A | |

| Jan 10, 2024 | berkshire hathaway inc | 34.0% | 327,574,652 | SC 13G/A | |

| Jul 07, 2023 | blackrock inc. | 4.7% | 42,296,047 | SC 13G/A | |

| Feb 14, 2023 | dodge & cox | 11.6% | 107,355,862 | SC 13G/A | |

| Feb 14, 2023 | berkshire hathaway inc | 28.0% | 278,210,498 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 6.73% | 61,149,817 | SC 13G/A | |

| Feb 08, 2023 | blackrock inc. | 5.5% | 50,272,936 | SC 13G/A | |

| Feb 07, 2023 | state street corp | 5.36% | 48,735,391 | SC 13G/A |

Recent SEC filings of Occidental Petroleum Corp

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 07, 2024 | 10-Q | Quarterly Report | |

| May 07, 2024 | 8-K | Current Report | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading |

Peers (Alternatives to Occidental Petroleum Corp)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

XOM | 458.0B | 341.1B | -3.65% | 6.42% | 13.96 | 1.34 | -16.75% | -46.83% |

CVX | 300.2B | 198.9B | 0.78% | 2.14% | 14.79 | 1.51 | -18.05% | -43.28% |

OXY | 56.4B | 27.7B | -7.39% | 7.95% | 13.06 | 2.04 | -22.75% | -55.41% |

MRO | 15.2B | 6.6B | -8.51% | 17.82% | 10.61 | 2.3 | -15.57% | -47.38% |

CHK | 11.6B | 6.4B | -2.01% | 13.18% | 10.97 | 1.8 | -54.63% | -85.10% |

| MID-CAP | ||||||||

RRC | 9.0B | 2.2B | 3.10% | 44.71% | 18.61 | 4.08 | -62.59% | -77.29% |

HP | 3.8B | 2.7B | -11.14% | 20.77% | 10.75 | 1.38 | 2.93% | 8.77% |

CNX | 3.6B | 2.5B | -2.36% | 51.35% | 3.55 | 1.42 | -6.59% | -31.79% |

KOS | 2.8B | 1.7B | 1.69% | -5.21% | 12.77 | 1.64 | -15.13% | -28.06% |

CPE | 2.4B | 2.1B | 12.10% | 1.07% | 5.93 | 1.13 | -35.04% | -60.65% |

| SMALL-CAP | ||||||||

AMPY | 283.6M | 304.0M | 2.58% | 1.42% | 9.27 | 0.93 | -28.78% | -93.34% |

AMTX | 176.4M | 186.7M | -21.14% | 114.51% | -3.8 | 0.94 | -27.21% | 56.92% |

BATL | 93.1M | 220.8M | -14.63% | -12.52% | -30.56 | 0.42 | -38.52% | -116.44% |

AE | 71.6M | 2.8B | -6.97% | -25.60% | 41.81 | 0.03 | -15.01% | 137.22% |

BRN | 28.7M | 23.9M | 12.16% | 5.54% | -10.57 | 1.2 | -21.86% | -149.09% |

Occidental Petroleum Corp News

Occidental Petroleum Corp Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -20.2% | 6,010 | 7,529 | 7,400 | 6,731 | 7,258 | 8,326 | 9,501 | 10,735 | 8,533 | 8,010 | 6,815 | 6,010 | 5,479 | 3,348 | 3,283 | 2,976 | 6,654 | 7,142 | 6,043 | 4,476 | 4,089 |

| S&GA Expenses | -15.6% | 259 | 307 | 258 | 277 | 241 | 258 | 247 | 244 | 196 | 280 | 240 | 177 | 166 | 209 | 166 | 225 | 264 | 345 | 245 | 163 | 140 |

| EBITDA Margin | -1.4% | 0.45* | 0.46* | 0.48* | 0.51* | 0.55* | 0.57* | 0.57* | 0.54* | 0.49* | 0.46* | 0.39* | 0.18* | -0.36* | -0.47* | -0.32* | -0.14* | 0.20* | - | - | - | - |

| Income Taxes | -15.8% | 304 | 361 | 434 | 467 | 471 | 473 | 902 | 1,231 | -1,793 | 469 | 387 | 43.00 | 16.00 | -276 | -403 | -1,468 | -25.00 | 167 | 163 | 306 | 225 |

| Earnings Before Taxes | -35.2% | 1,010 | 1,559 | 1,809 | 1,327 | 1,734 | 2,400 | 3,648 | 4,986 | 3,083 | 2,030 | 1,217 | 143 | 315 | -1,425 | -4,058 | -8,184 | -2,038 | -869 | -574 | 941 | 856 |

| EBT Margin | -7.3% | 0.21* | 0.22* | 0.24* | 0.29* | 0.36* | 0.38* | 0.37* | 0.33* | 0.22* | 0.14* | 0.01* | -0.28* | -0.89* | -0.97* | -0.76* | -0.51* | -0.10* | - | - | - | - |

| Net Income | -25.9% | 888 | 1,198 | 1,375 | 860 | 1,263 | 1,927 | 2,746 | 3,755 | 4,876 | 1,537 | 828 | 103 | -146 | -1,112 | -3,575 | -8,131 | -2,013 | -1,036 | -752 | 635 | 631 |

| Net Income Margin | -3.8% | 0.16* | 0.16* | 0.18* | 0.21* | 0.27* | 0.36* | 0.35* | 0.32* | 0.25* | 0.09* | -0.02* | -0.26* | -0.86* | -0.91* | -0.74* | -0.52* | -0.13* | - | - | - | - |

| Free Cashflow | -86.8% | 224 | 1,695 | 1,510 | 1,424 | 1,409 | 2,455 | 3,120 | 4,357 | 2,381 | 2,155 | 2,462 | 2,616 | 331 | 790 | 606 | -15.00 | 39.00 | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 0.4% | 74,277 | 74,008 | 71,827 | 71,199 | 71,600 | 72,609 | 72,144 | 74,221 | 74,222 | 75,036 | 75,758 | 79,937 | 79,355 | 80,064 | 84,434 | 89,452 | 101,643 | 107,190 | 125,443 | 44,770 | 44,380 |

| Current Assets | -0.4% | 8,345 | 8,375 | 8,266 | 7,454 | 8,142 | 8,886 | 8,749 | 10,408 | 10,058 | 3,387 | 9,899 | 12,844 | 10,074 | 1,419 | 10,694 | 8,437 | 14,109 | 1,130 | 20,944 | 9,425 | 9,270 |

| Cash Equivalents | -6.5% | 1,333 | 1,426 | 611 | 486 | 1,165 | 984 | 1,233 | 1,362 | 1,909 | 2,803 | 2,059 | 4,569 | 2,270 | 2,194 | 1,896 | 1,011 | 2,021 | 3,574 | 4,840 | 1,751 | 1,752 |

| Inventory | 5.4% | 2,131 | 2,022 | 1,975 | 2,021 | 2,311 | 2,059 | 1,937 | 1,564 | 1,406 | 1,846 | 1,773 | 1,837 | 2,173 | 1,898 | 1,660 | 1,477 | 1,436 | 1,581 | 1,601 | 1,582 | 1,484 |

| Net PPE | - | - | - | - | - | - | - | - | - | - | - | 60,644 | 61,846 | 64,073 | 65,889 | 68,421 | 72,604 | 79,073 | 82,230 | 90,121 | 32,115 | 31,900 |

| Current Liabilities | -3.7% | 8,812 | 9,148 | 8,941 | 7,456 | 7,440 | 7,757 | 7,935 | 9,730 | 8,700 | 1,976 | 9,126 | 9,586 | 8,631 | 1,549 | 10,500 | 9,919 | 11,963 | 785 | 15,697 | 7,880 | 7,537 |

| Long Term Debt | 0.0% | 18,545 | 18,536 | 18,597 | 19,669 | 19,645 | 19,670 | 20,478 | 21,743 | 25,865 | 9,464 | 30,915 | 35,352 | 35,466 | 7,860 | 35,899 | 36,034 | 36,058 | 8,673 | 47,583 | 10,155 | 10,203 |

| LT Debt, Current | - | - | - | - | - | - | - | 546 | 459 | 507 | 186 | - | 651 | 559 | 440 | 2,558 | 2,460 | 2,464 | 51.00 | 31.00 | 116 | 116 |

| LT Debt, Non Current | - | - | - | - | - | - | - | 20,478 | 21,743 | 25,865 | 29,431 | - | 35,352 | 35,466 | 35,745 | 35,899 | 36,034 | 36,058 | 38,537 | 47,583 | 10,155 | 10,203 |

| Shareholder's Equity | 2.4% | 30,967 | 30,250 | 29,312 | 29,111 | 29,559 | 30,085 | 28,720 | 27,830 | 24,907 | 20,327 | 18,873 | 18,244 | 18,300 | 18,573 | 19,860 | 23,346 | 31,295 | 34,232 | 41,005 | 21,347 | 21,236 |

| Retained Earnings | 2.7% | 20,147 | 19,626 | 18,758 | 17,762 | 17,318 | 16,499 | 14,888 | 12,462 | 9,032 | 4,480 | 3,152 | 2,533 | 2,639 | 2,996 | 4,317 | 8,105 | 17,229 | 20,180 | 22,227 | 23,848 | 23,795 |

| Additional Paid-In Capital | 0.2% | 17,456 | 17,422 | 17,326 | 17,218 | 17,159 | 17,181 | 17,129 | 16,914 | 16,785 | 16,749 | 16,692 | 16,638 | 16,585 | 16,552 | 16,505 | 16,235 | 15,081 | 14,955 | 14,867 | 8,157 | 8,083 |

| Accumulated Depreciation | - | - | - | - | - | - | - | - | - | - | - | 56,548 | 54,720 | 55,205 | 53,075 | 52,038 | 52,919 | 44,389 | 42,037 | 46,804 | 44,889 | 43,913 |

| Shares Outstanding | 0.8% | 887 | 879 | 880 | 885 | - | - | 909 | 931 | 937 | - | 1,083 | - | - | - | - | - | - | - | - | - | - |

| Minority Interest | 57.6% | 156 | 99.00 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 4,925 | - | - |

| Float | - | - | - | - | 51,700 | - | - | - | 53,000 | - | - | - | 29,200 | - | - | - | 17,000 | - | - | - | 45,000 | - |

| Cashflow (Quarterly) | (In Thousands) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -38.0% | 2,007,000 | 3,239,000 | 3,129,000 | 3,070,000 | 2,870,000 | 3,975,000 | 4,267,000 | 5,329,000 | 3,239,000 | 3,092,000 | 3,118,000 | 3,314,000 | 910,000 | 1,404,000 | 852,000 | 360,000 | 1,339,000 | 2,009,000 | 2,405,000 | 2,013,000 | 948,000 |

| Cashflow From Investing | 8.1% | -1,810,000 | -1,969,000 | -1,474,000 | -1,939,000 | -1,598,000 | -1,898,000 | -1,019,000 | -1,293,000 | -662,000 | -51,000 | -166,000 | -754,000 | -282,000 | 1,579,000 | -292,000 | -576,000 | -1,530,000 | -1,301,000 | -25,023,000 | -1,288,000 | -1,415,000 |

| Cashflow From Financing | 27.9% | -328,000 | -455,000 | -1,539,000 | -1,816,000 | -1,080,000 | -2,330,000 | -3,370,000 | -4,586,000 | -3,429,000 | -2,532,000 | -5,424,000 | -262,000 | -354,000 | -2,863,000 | 301,000 | -935,000 | -1,019,000 | -2,499,000 | 26,232,000 | -726,000 | -814,000 |

| Dividend Payments | - | - | - | - | - | - | 321,000 | 324,000 | 323,000 | 216,000 | 209,000 | 210,000 | 209,000 | 211,000 | 211,000 | 7,000 | 714,000 | 913,000 | 858,000 | 588,000 | 587,000 | 591,000 |

| Buy Backs | -100.0% | - | 187,000 | 434,000 | 445,000 | 732,000 | 632,000 | 1,899,000 | 532,000 | 36,000 | 8,000 | -3,000 | - | 3,000 | 8,000 | - | 4,000 | - | - | - | - | 237,000 |

OXY Income Statement

2024-03-31Consolidated Condensed Statements of Operations - USD ($) $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| REVENUES AND OTHER INCOME | ||

| Net sales | $ 5,975 | $ 7,225 |

| Interest, dividends and other income | 36 | 29 |

| Gains (losses) on sales of assets and other, net | (1) | 4 |

| Total | 6,010 | 7,258 |

| COSTS AND OTHER DEDUCTIONS | ||

| Oil and gas operating expense | 1,161 | 1,081 |

| Transportation and gathering expense | 353 | 384 |

| Chemical and midstream cost of sales | 742 | 745 |

| Purchased commodities | 86 | 498 |

| Selling, general and administrative expenses | 259 | 241 |

| Other operating and non-operating expense | 410 | 308 |

| Taxes other than on income | 235 | 306 |

| Depreciation, depletion and amortization | 1,693 | 1,721 |

| Acquisition-related costs | 12 | 0 |

| Exploration expense | 66 | 102 |

| Interest and debt expense, net | 284 | 238 |

| Total | 5,301 | 5,624 |

| Income before income taxes and other items | 709 | 1,634 |

| OTHER ITEMS | ||

| Income from equity investments and other | 301 | 100 |

| Total | 301 | 100 |

| Income before income taxes | 1,010 | 1,734 |

| Income tax expense | (304) | (471) |

| Income from continuing operations | 706 | 1,263 |

| Discontinued operations, net of taxes | 182 | 0 |

| NET INCOME | 888 | 1,263 |

| Less: Preferred stock dividends and redemption premiums | (170) | (280) |

| NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ 718 | $ 983 |

| PER COMMON SHARE | ||

| Income from continuing operations—basic (in dollars per share) | $ 0.60 | $ 1.08 |

| Discontinued operations—basic (in dollars per share) | 0.21 | 0 |

| Net income attributable to common stockholders—basic (in dollars per share) | 0.81 | 1.08 |

| PER COMMON SHARE, DILUTED | ||

| Income from continuing operations—diluted (in dollars per share) | 0.56 | 1.00 |

| Discontinued operations—diluted (in dollars per share) | 0.19 | 0 |

| Net income attributable to common stockholders—diluted (in dollars per share) | $ 0.75 | $ 1.00 |

OXY Balance Sheet

2024-03-31Consolidated Condensed Balance Sheets - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| CURRENT ASSETS | ||

| Cash and cash equivalents | $ 1,272 | $ 1,426 |

| Trade receivables, net of reserves of $29 in 2024 and $29 in 2023 | 3,271 | 3,195 |

| Inventories | 2,131 | 2,022 |

| Other current assets | 1,671 | 1,732 |

| Total current assets | 8,345 | 8,375 |

| INVESTMENTS IN UNCONSOLIDATED ENTITIES | 3,400 | 3,224 |

| PROPERTY, PLANT AND EQUIPMENT | ||

| Gross property, plant and equipment | 128,542 | 126,811 |

| Accumulated depreciation, depletion and amortization | (69,779) | (68,282) |

| Net property, plant and equipment | 58,763 | 58,529 |

| OPERATING LEASE ASSETS | 1,038 | 1,130 |

| OTHER LONG-TERM ASSETS | 2,731 | 2,750 |

| TOTAL ASSETS | 74,277 | 74,008 |

| CURRENT LIABILITIES | ||

| Current maturities of long-term debt | 1,203 | 1,202 |

| Current operating lease liabilities | 424 | 446 |

| Accounts payable | 3,827 | 3,646 |

| Accrued liabilities | 3,358 | 3,854 |

| Total current liabilities | 8,812 | 9,148 |

| LONG-TERM DEBT, NET | ||

| Long-term debt, net | 18,545 | 18,536 |

| DEFERRED CREDITS AND OTHER LIABILITIES | ||

| Deferred income taxes, net | 5,728 | 5,764 |

| Asset retirement obligations | 3,867 | 3,882 |

| Pension and postretirement obligations | 933 | 931 |

| Environmental remediation liabilities | 870 | 889 |

| Operating lease liabilities | 664 | 727 |

| Other | 3,891 | 3,782 |

| Total deferred credits and other liabilities | 15,953 | 15,975 |

| EQUITY | ||

| Preferred stock, at $1.00 per share par value: 2024 — $84,897 shares and 2023 —$84,897 shares | 8,287 | 8,287 |

| Common stock, at $0.20 per share par value, authorized shares: 1.5 billion, issued shares: 2024 — 1,114,773,127 shares and 2023 — 1,107,516,500 shares | 223 | 222 |

| Treasury stock: 2024 — $228,053,397 shares and 2023 — $228,053,397 shares | (15,582) | (15,582) |

| Additional paid-in capital | 17,456 | 17,422 |

| Retained earnings | 20,147 | 19,626 |

| Accumulated other comprehensive income | 280 | 275 |

| Total stockholders' equity | 30,811 | 30,250 |

| Non-controlling interest | 156 | 99 |

| Total equity | 30,967 | 30,349 |

| TOTAL LIABILITIES AND EQUITY | 74,277 | 74,008 |

| Corporate | ||

| PROPERTY, PLANT AND EQUIPMENT | ||

| Gross property, plant and equipment | 1,060 | 1,039 |

| Oil and gas | Operating segments | ||

| PROPERTY, PLANT AND EQUIPMENT | ||

| Gross property, plant and equipment | 110,680 | 109,214 |

| Chemical | Operating segments | ||

| PROPERTY, PLANT AND EQUIPMENT | ||

| Gross property, plant and equipment | 8,315 | 8,279 |

| Midstream and marketing | Operating segments | ||

| PROPERTY, PLANT AND EQUIPMENT | ||

| Gross property, plant and equipment | $ 8,487 | $ 8,279 |

| CEO | Ms. Vicki A. Hollub |

|---|---|

| WEBSITE | oxy.com |

| INDUSTRY | Oil - E&P |

| EMPLOYEES | 11973 |