Market Summary

RF Stock Price

RF RSI Chart

RF Valuation

RF Price/Sales (Trailing)

RF Profitability

RF Fundamentals

RF Revenue

RF Earnings

Breaking Down RF Revenue

Last 7 days

1.8%

Last 30 days

7.0%

Last 90 days

9.3%

Trailing 12 Months

18.8%

How does RF drawdown profile look like?

RF Financial Health

RF Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 7.0B | 0 | 0 | 0 |

| 2023 | 5.7B | 6.3B | 6.7B | 6.9B |

| 2022 | 4.1B | 4.3B | 4.6B | 5.1B |

| 2021 | 4.2B | 4.1B | 4.1B | 4.1B |

| 2020 | 4.5B | 4.4B | 4.3B | 4.3B |

| 2019 | 4.5B | 4.6B | 4.6B | 4.6B |

| 2018 | 4.1B | 4.2B | 4.3B | 4.3B |

| 2017 | 3.8B | 3.9B | 3.9B | 4.0B |

| 2016 | 3.7B | 3.7B | 3.8B | 3.8B |

| 2015 | 3.6B | 3.6B | 3.6B | 3.6B |

| 2014 | 3.6B | 3.6B | 3.6B | 3.6B |

| 2013 | 3.8B | 3.8B | 3.7B | 3.6B |

| 2012 | 4.1B | 0 | 0 | 3.9B |

| 2011 | 4.6B | 4.5B | 4.4B | 4.3B |

| 2010 | 5.2B | 5.0B | 4.8B | 4.7B |

| 2009 | 6.2B | 5.9B | 5.6B | 5.3B |

| 2008 | 0 | 7.6B | 7.1B | 6.6B |

| 2007 | 0 | 0 | 0 | 8.1B |

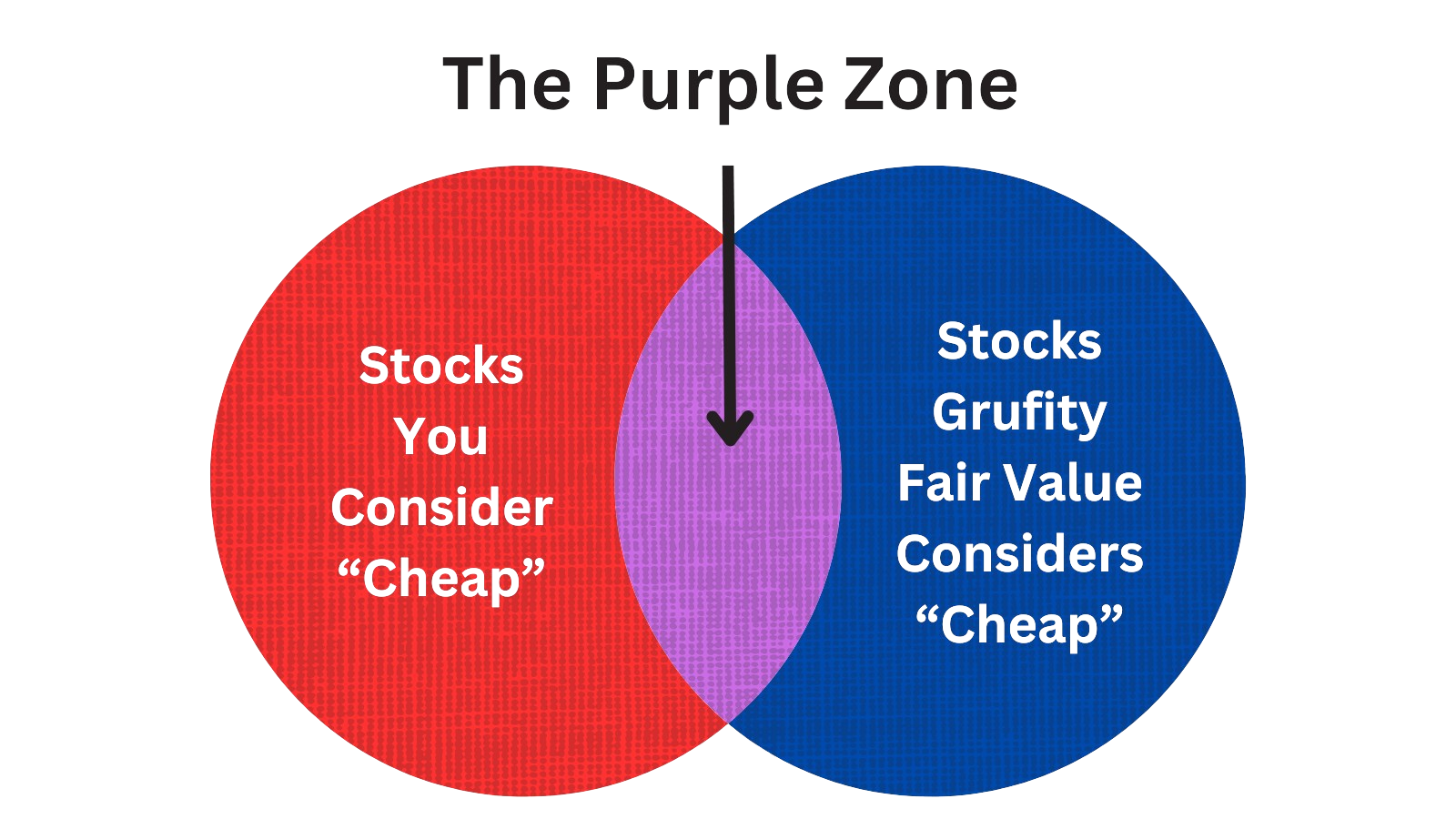

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Regions Financial Corp

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 03, 2024 | ritter william d. | sold | -458,742 | 19.9453 | -23,000 | sevp |

| Apr 29, 2024 | smith ronald g. | gifted | - | - | -5,000 | sevp |

| Apr 23, 2024 | rhodes william c iii | bought | 968,500 | 19.37 | 50,000 | - |

| Apr 17, 2024 | mccrary charles d | acquired | - | - | 79,111 | - |

| Apr 17, 2024 | hill j thomas | acquired | - | - | 7,460 | - |

| Apr 17, 2024 | rand alison s. | acquired | - | - | 4,700 | - |

| Apr 17, 2024 | rhodes william c iii | acquired | - | - | 1,179 | - |

| Apr 17, 2024 | johns john d | acquired | - | - | 43,883 | - |

| Apr 17, 2024 | johnson joia m | acquired | - | - | 7,460 | - |

Which funds bought or sold RF recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 17, 2024 | Heartland Bank & Trust Co | new | - | 210,421 | 210,421 | 0.12% |

| May 17, 2024 | Plato Investment Management Ltd | unchanged | - | 90.00 | 1,136 | -% |

| May 17, 2024 | VIMA LLC | sold off | -100 | -3,876 | - | -% |

| May 16, 2024 | Beacon Capital Management, LLC | reduced | -14.5 | 10,774 | 245,640 | 0.05% |

| May 16, 2024 | HANCOCK WHITNEY CORP | reduced | -37.61 | -839,963 | 1,762,980 | 0.06% |

| May 16, 2024 | B. Riley Wealth Advisors, Inc. | reduced | -7.94 | -62,863 | 283,243 | 0.01% |

| May 16, 2024 | Tidal Investments LLC | added | 7.62 | 316,918 | 2,203,540 | 0.04% |

| May 16, 2024 | Global Financial Private Client, LLC | new | - | 1,460 | 1,460 | -% |

| May 16, 2024 | LBP AM SA | new | - | 3,643,120 | 3,643,120 | 0.14% |

| May 16, 2024 | JANE STREET GROUP, LLC | reduced | -2.5 | 567,621 | 10,265,600 | -% |

Are Funds Buying or Selling RF?

Unveiling Regions Financial Corp's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 12.65% | 117,699,356 | SC 13G/A | |

| Feb 08, 2024 | wellington management group llp | 6.00% | 55,775,416 | SC 13G | |

| Jan 30, 2024 | state street corp | 6.19% | 57,570,108 | SC 13G/A | |

| Jan 24, 2024 | blackrock inc. | 9.5% | 88,029,893 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 11.74% | 109,685,449 | SC 13G/A | |

| Feb 03, 2023 | state street corp | 5.38% | 50,287,929 | SC 13G/A | |

| Jan 23, 2023 | blackrock inc. | 10.1% | 94,712,764 | SC 13G/A | |

| Feb 11, 2022 | state street corp | 7.07% | 67,417,692 | SC 13G/A | |

| Jan 10, 2022 | blackrock inc. | 10.1% | 96,711,569 | SC 13G/A | |

| Feb 10, 2021 | state street corp | 5.83% | 55,967,406 | SC 13G |

Recent SEC filings of Regions Financial Corp

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 07, 2024 | 10-Q | Quarterly Report | |

| May 07, 2024 | 4 | Insider Trading | |

| May 03, 2024 | 144 | Notice of Insider Sale Intent | |

| May 01, 2024 | 4 | Insider Trading | |

| Apr 25, 2024 | 8-K | Current Report | |

| Apr 24, 2024 | 4 | Insider Trading | |

| Apr 24, 2024 | 4 | Insider Trading | |

| Apr 24, 2024 | 4 | Insider Trading | |

| Apr 24, 2024 | 4 | Insider Trading | |

| Apr 24, 2024 | 4 | Insider Trading |

- …

Peers (Alternatives to Regions Financial Corp)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

JPM | 588.1B | 174.7B | 13.73% | 46.82% | 11.68 | 3.37 | 53.11% | 19.83% |

BAC | 307.4B | 137.9B | 11.58% | 38.08% | 12.28 | 2.23 | 56.12% | -12.56% |

WFC | 213.0B | 85.8B | 6.86% | 51.95% | 11.35 | 2.48 | 35.02% | 26.14% |

C | 122.2B | 125.0B | 10.16% | 38.13% | 15.29 | 0.98 | 37.85% | - |

CFG | 16.9B | 10.4B | 12.51% | 41.04% | 11.81 | 1.62 | 26.22% | -33.87% |

KEY | 14.5B | 8.1B | 6.72% | 53.23% | 16.61 | 1.78 | 32.15% | -50.93% |

| MID-CAP | ||||||||

CMA | 7.3B | 4.2B | 10.08% | 41.38% | 10.46 | 1.71 | 34.68% | -45.96% |

ZION | 6.6B | 4.1B | 14.23% | 65.05% | 10.55 | 1.63 | 32.93% | -30.73% |

ABCB | 3.5B | 1.3B | 13.35% | 57.95% | 12.32 | 2.65 | 30.60% | -12.99% |

ASB | 3.4B | 2.0B | 11.57% | 43.03% | 20.88 | 1.65 | 47.11% | -59.32% |

| SMALL-CAP | ||||||||

AMNB | 497.6M | 120.2M | 6.68% | 49.76% | 19.02 | 4.14 | 45.65% | -13.98% |

AROW | 417.1M | 173.1M | 15.06% | 27.00% | 14.3 | 2.41 | 26.54% | -34.86% |

ALRS | 390.4M | 152.4M | -0.90% | 32.84% | 39.27 | 2.56 | 16.94% | -73.84% |

ACNB | 295.5M | 98.7M | 10.19% | 20.01% | 10.04 | 2.99 | 6.27% | -22.90% |

ASRV | 48.0M | 62.5M | 8.95% | -1.75% | -16.24 | 0.77 | 18.83% | -145.18% |

Regions Financial Corp News

Regions Financial Corp Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | -1.5% | 1,724 | 1,751 | 1,766 | 1,739 | 1,641 | 1,552 | 1,343 | 1,155 | 1,052 | 1,056 | 1,006 | 1,006 | 1,013 | 1,061 | 1,059 | 1,063 | 1,079 | 1,098 | 1,150 | 1,177 | 1,171 |

| EBITDA Margin | -4.2% | 1.13* | 1.18* | 1.29* | 1.37* | 1.47* | 1.57* | 1.73* | 1.80* | 1.83* | 1.84* | 1.36* | 1.36* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -3.8% | 1,184 | 1,231 | 1,291 | 1,381 | 1,417 | 1,401 | 1,262 | 1,108 | 1,015 | 1,019 | 965 | 963 | 967 | 1,006 | 988 | 972 | 928 | 918 | 937 | 942 | 948 |

| Income Taxes | 20.0% | 96.00 | 80.00 | 129 | 147 | 177 | 187 | 133 | 157 | 154 | 103 | 180 | 231 | 180 | 121 | 104 | -47.00 | 42.00 | 98.00 | 107 | 93.00 | 105 |

| Earnings Before Taxes | - | 464 | - | - | - | 789 | - | - | - | - | - | - | - | - | - | - | - | - | 487 | 516 | 483 | 499 |

| EBT Margin | -1.2% | 0.37* | 0.38* | 0.43* | 0.46* | 0.51* | 0.56* | 0.70* | 0.75* | 0.78* | 0.79* | 0.32* | 0.32* | - | - | - | - | - | - | - | - | - |

| Net Income | -5.9% | 368 | 391 | 490 | 581 | 612 | 685 | 429 | 583 | 548 | 438 | 651 | 790 | 642 | 616 | 530 | -214 | 162 | 389 | 409 | 390 | 394 |

| Net Income Margin | -12.8% | 0.26* | 0.30* | 0.35* | 0.37* | 0.41* | 0.44* | 0.43* | 0.52* | 0.59* | 0.62* | 0.66* | 0.62* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -53.7% | 396 | 855 | 860 | 397 | 196 | 1,276 | 321 | 921 | 584 | 761 | 841 | 709 | 719 | -1.00 | 681 | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 1.8% | 154,909 | 152,194 | 153,624 | 155,656 | 154,135 | 155,220 | 157,798 | 160,908 | 164,082 | 162,938 | 156,153 | 155,610 | 153,331 | 147,389 | 145,180 | 144,070 | 133,542 | 126,240 | 128,147 | 127,518 | 128,802 |

| Cash Equivalents | 65.4% | 11,250 | 6,801 | 9,016 | 9,886 | 8,833 | 11,227 | 15,666 | 20,500 | 27,945 | 29,411 | 27,507 | 25,594 | 24,920 | 17,956 | 13,473 | 13,198 | 5,255 | 4,114 | 5,067 | 4,488 | 3,807 |

| Net PPE | -0.4% | 1,635 | 1,642 | 1,616 | 1,622 | 1,705 | 1,718 | 1,744 | 1,768 | 1,794 | 1,814 | 1,805 | 1,825 | 1,852 | 1,897 | 1,896 | 1,929 | 1,935 | 1,960 | 1,944 | 1,950 | 2,026 |

| Goodwill | 0% | 5,733 | 5,733 | 5,733 | 5,733 | 5,733 | 5,733 | 5,739 | 5,749 | 5,748 | 5,744 | 5,181 | 5,181 | 5,181 | 5,190 | 5,187 | 5,193 | 4,845 | 4,845 | 4,845 | 4,829 | 4,829 |

| Liabilities | 2.3% | 137,831 | 134,701 | 137,499 | 138,995 | 137,233 | 139,269 | 142,625 | 144,401 | 147,100 | 144,612 | 137,530 | 137,358 | 135,469 | 129,278 | 127,276 | 126,442 | 116,210 | 109,945 | 111,566 | 110,910 | 113,279 |

| Short Term Borrowings | - | 1,000 | - | 2,000 | 3,000 | 2,000 | - | - | - | - | - | - | - | - | - | - | - | 3,150 | 2,050 | 5,401 | 4,250 | 1,600 |

| Long Term Debt | 42.8% | 3,327 | 2,330 | 4,290 | 4,293 | 2,307 | 2,284 | 2,274 | 2,319 | 2,343 | 2,407 | 2,451 | 2,870 | 2,916 | 3,569 | 4,919 | 6,408 | 10,105 | 7,879 | 9,128 | 9,213 | 12,957 |

| Shareholder's Equity | -2.2% | 17,044 | 17,429 | 16,100 | 16,639 | 16,883 | 15,947 | 15,173 | 16,507 | 16,982 | 18,326 | 18,605 | 18,252 | 17,862 | 18,111 | 17,904 | 17,602 | 17,332 | 16,295 | 16,581 | 16,608 | 15,512 |

| Retained Earnings | 1.4% | 8,304 | 8,186 | 8,042 | 7,802 | 7,433 | 7,004 | 6,531 | 6,314 | 5,915 | 5,550 | 5,296 | 4,836 | 4,235 | -377 | 3,330 | 2,978 | 375 | 2.00 | 3,534 | 3,299 | 3,066 |

| Additional Paid-In Capital | -0.8% | 11,666 | 11,757 | 11,996 | 11,979 | 11,996 | 11,988 | 11,976 | 11,962 | 11,983 | 12,189 | 12,479 | 12,467 | 12,740 | 12,731 | 12,714 | 12,703 | 12,695 | 12,685 | 12,803 | 13,380 | 13,584 |

| Shares Outstanding | -1.6% | 921 | 936 | 938 | 939 | 935 | 935 | 934 | 936 | 938 | 956 | 955 | 958 | - | - | - | - | - | - | - | - | - |

| Minority Interest | -46.9% | 34.00 | 64.00 | 25.00 | 22.00 | 19.00 | 4.00 | - | - | - | - | 18.00 | - | - | - | - | 26.00 | - | - | - | - | 11.00 |

| Float | - | - | - | - | 16,320 | - | - | - | 17,101 | - | - | - | 18,795 | - | - | - | 10,382 | - | - | - | 9,976 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -53.7% | 396 | 855 | 860 | 397 | 196 | 1,276 | 321 | 921 | 584 | 761 | 841 | 709 | 719 | -1.00 | 681 | 857 | 787 | 497 | 763 | 743 | 578 |

| Cashflow From Investing | 875.0% | 1,209 | -156 | 243 | -598 | -1,096 | -1,869 | -2,085 | -5,388 | -3,599 | -2,513 | 1,127 | -1,412 | -67.00 | 1,977 | -414 | -1,136 | -5,280 | 287 | 187 | 1,723 | -1,688 |

| Cashflow From Financing | 197.6% | 2,844 | -2,914 | -1,973 | 1,254 | -1,494 | -3,846 | -3,070 | -2,978 | 1,549 | 3,656 | -55.00 | 1,377 | 6,312 | 2,507 | 8.00 | 8,222 | 5,634 | -1,737 | -371 | -1,785 | 1,379 |

| Dividend Payments | -100.0% | - | 226 | 187 | 187 | 187 | 185 | 159 | 158 | 161 | 162 | 148 | 149 | 149 | 149 | 148 | 149 | 149 | 151 | 140 | 143 | 143 |

| Buy Backs | -59.5% | 102 | 252 | - | - | - | - | - | 15.00 | 215 | 300 | - | 167 | - | - | - | - | - | 132 | 589 | 190 | 190 |

RF Income Statement

2024-03-31CONSOLIDATED STATEMENTS OF INCOME - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Interest income on: | ||

| Loans, including fees | $ 1,421 | $ 1,360 |

| Debt securities | 209 | 187 |

| Loans held for sale | 8 | 7 |

| Other earning assets | 86 | 87 |

| Total interest income | 1,724 | 1,641 |

| Interest expense on: | ||

| Deposits | 495 | 179 |

| Short-term borrowings | 1 | 5 |

| Long-term borrowings | 44 | 40 |

| Total interest expense | 540 | 224 |

| Net interest income | 1,184 | 1,417 |

| Provision (credit) for credit losses | 152 | 135 |

| Net interest income after provision for credit losses | 1,032 | 1,282 |

| Non-interest income: | ||

| Total Noninterest Income | 563 | 534 |

| Non-interest expense: | ||

| Salaries and employee benefits | 658 | 616 |

| Equipment and Software Expense | 101 | 102 |

| Net occupancy expense | $ 74 | 73 |

| Defined Benefit Plan, Net Periodic Benefit Cost (Credit) Excluding Service Cost, Statement of Income or Comprehensive Income [Extensible Enumeration] | Other | |

| Other | $ 298 | 236 |

| Total non-interest expense | 1,131 | 1,027 |

| Income before income taxes | 464 | 789 |

| Income tax expense | 96 | 177 |

| Net income | 368 | 612 |

| Net income available to common shareholders | $ 343 | $ 588 |

| Weighted Average Number of Shares Outstanding, Diluted [Abstract] | ||

| Basic | 921 | 935 |

| Diluted | 923 | 942 |

| Earnings Per Share [Abstract] | ||

| Basic | $ 0.37 | $ 0.63 |

| Diluted | $ 0.37 | $ 0.62 |

| Service charges on deposit accounts | ||

| Non-interest income: | ||

| Total Noninterest Income | $ 148 | $ 155 |

| Card and ATM fees | ||

| Non-interest income: | ||

| Total Noninterest Income | 116 | 121 |

| Investment management and trust fee income | ||

| Non-interest income: | ||

| Total Noninterest Income | 81 | 76 |

| Capital Markets [Member] | ||

| Non-interest income: | ||

| Total Noninterest Income | 91 | 42 |

| Mortgage income | ||

| Non-interest income: | ||

| Total Noninterest Income | 41 | 24 |

| Securities gains, net [Member] | ||

| Non-interest income: | ||

| Total Noninterest Income | (50) | (2) |

| Other [Member] | ||

| Non-interest income: | ||

| Total Noninterest Income | $ 136 | $ 118 |

RF Balance Sheet

2024-03-31CONSOLIDATED BALANCE SHEETS - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Assets | ||

| Cash and due from banks | $ 2,527 | $ 2,635 |

| Interest-bearing deposits in other banks | 8,723 | 4,166 |

| Debt Securities held to maturity | 743 | 754 |

| Debt securities available for sale | 27,881 | 28,104 |

| Loans held for sale | 417 | 400 |

| Loans, net of unearned income | 96,862 | 98,379 |

| Allowance for loan losses | (1,617) | (1,576) |

| Net loans | 95,245 | 96,803 |

| Other earning assets | 1,478 | 1,417 |

| Premises, equipment and software, net | 1,635 | 1,642 |

| Interest receivable | 588 | 614 |

| Goodwill | 5,733 | 5,733 |

| Servicing Asset at Fair Value, Amount | 1,026 | 906 |

| Other identifiable intangible assets, net | $ 196 | 205 |

| Derivative Asset, Statement of Financial Position [Extensible Enumeration] | Other assets | |

| Other assets | $ 8,717 | 8,815 |

| Total assets | 154,909 | 152,194 |

| Deposits: | ||

| Noninterest-bearing Deposit Liabilities | 41,824 | 42,368 |

| Interest-bearing | 87,158 | 85,420 |

| Total deposits | 128,982 | 127,788 |

| Borrowed funds: | ||

| Short-term borrowings | 1,000 | 0 |

| Long-term borrowings | 3,327 | 2,330 |

| Total borrowed funds | $ 4,327 | 2,330 |

| Derivative Liability, Statement of Financial Position [Extensible Enumeration] | Other liabilities | |

| Other liabilities | $ 4,522 | 4,583 |

| Total liabilities | 137,831 | 134,701 |

| Equity: | ||

| Preferred stock | 1,659 | 1,659 |

| Common stock | 10 | 10 |

| Additional paid-in capital | 11,666 | 11,757 |

| Retained earnings | 8,304 | 8,186 |

| Treasury stock, at cost | (1,371) | (1,371) |

| Accumulated other comprehensive income (loss), net | (3,224) | (2,812) |

| Total shareholders’ equity | 17,044 | 17,429 |

| Equity, Attributable to Noncontrolling Interest | 34 | 64 |

| Equity, Including Portion Attributable to Noncontrolling Interest, Total | 17,078 | 17,493 |

| Total liabilities and equity | $ 154,909 | $ 152,194 |

| CEO | Mr. John M. Turner Jr. |

|---|---|

| WEBSITE | regions.com |

| INDUSTRY | Banks Diversified |

| EMPLOYEES | 20349 |