Market Summary

DUK Alerts

DUK Stock Price

DUK RSI Chart

DUK Valuation

DUK Price/Sales (Trailing)

DUK Profitability

DUK Fundamentals

DUK Revenue

DUK Earnings

Breaking Down DUK Revenue

52 Week Range

Last 7 days

3.7%

Last 30 days

5.9%

Last 90 days

12.4%

Trailing 12 Months

5.0%

How does DUK drawdown profile look like?

DUK Financial Health

DUK Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 29.5B | 0 | 0 | 0 |

| 2023 | 29.0B | 29.0B | 29.2B | 29.1B |

| 2022 | 25.6B | 26.5B | 27.5B | 28.8B |

| 2021 | 23.4B | 23.7B | 23.8B | 24.6B |

| 2020 | 24.9B | 24.4B | 24.2B | 23.4B |

| 2019 | 24.5B | 24.8B | 25.1B | 25.1B |

| 2018 | 24.0B | 24.1B | 24.2B | 24.5B |

| 2017 | 22.9B | 23.2B | 23.4B | 23.6B |

| 2016 | 19.3B | 13.3B | 7.2B | 1.1B |

| 2015 | 23.5B | 23.0B | 22.9B | 1.4B |

| 2014 | 23.5B | 23.8B | 24.0B | 23.9B |

| 2013 | 21.5B | 23.3B | 22.8B | 22.8B |

| 2012 | 14.5B | 14.5B | 17.3B | 19.6B |

| 2011 | 14.3B | 14.6B | 14.6B | 14.5B |

| 2010 | 13.0B | 13.4B | 13.9B | 14.3B |

| 2009 | 13.2B | 12.9B | 12.8B | 12.7B |

| 2008 | 0 | 12.9B | 13.0B | 13.2B |

| 2007 | 0 | 0 | 0 | 12.7B |

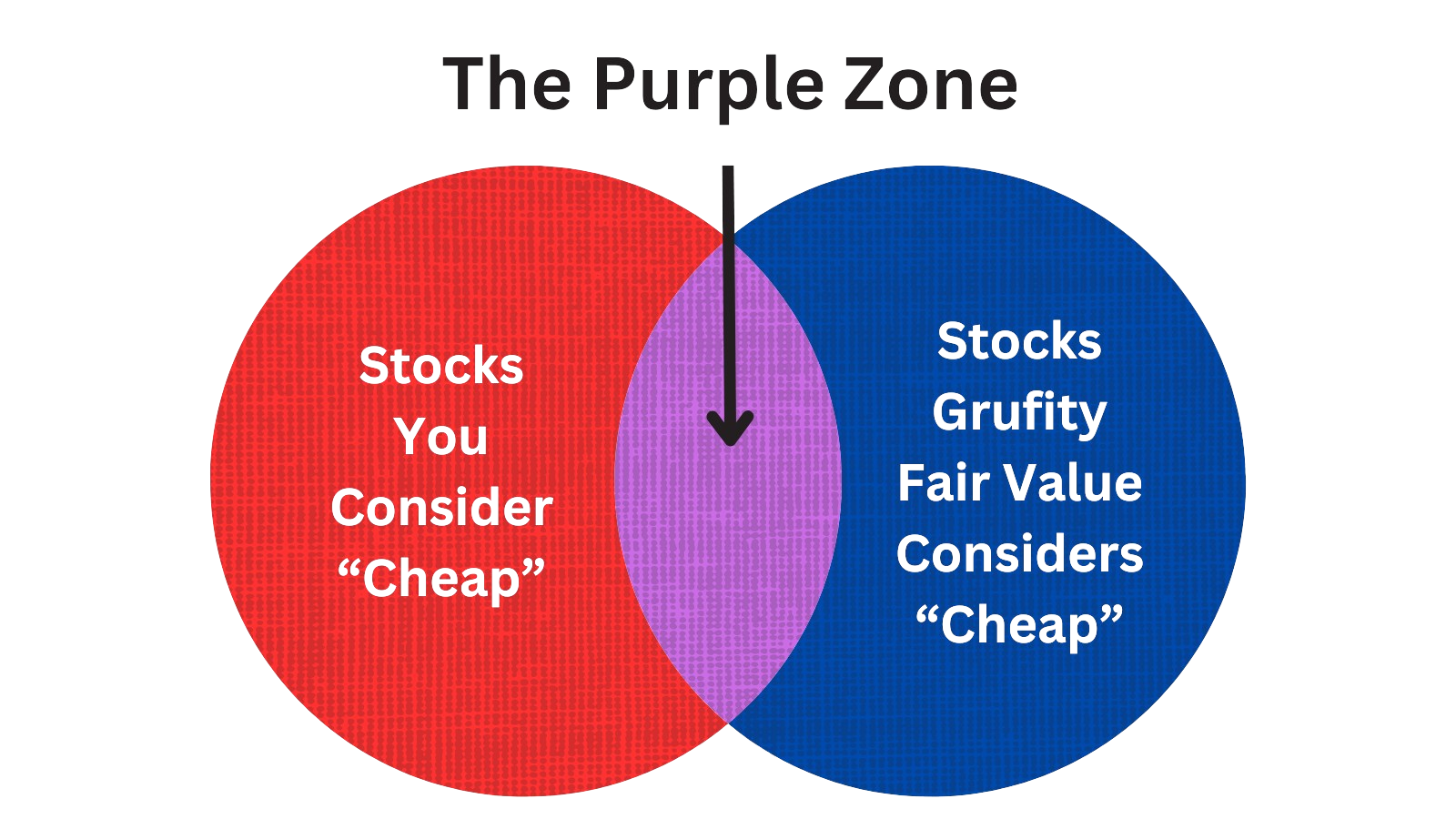

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Duke Energy Corp

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| May 05, 2024 | glenn robert alexander | sold (taxes) | -12,933 | 100 | -129 | evp & ceo def & midwest |

| May 05, 2024 | renjel louis e. | sold (taxes) | -10,026 | 100 | -100 | evp, chief corporate affairs |

| Mar 11, 2024 | janson julia s | acquired | - | - | 10,257 | evp extaffairs&prescarolinas |

| Mar 11, 2024 | sideris harry k. | acquired | - | - | 13,921 | evp, cust exp, soln & svcs |

| Mar 11, 2024 | gillespie thomas preston jr. | acquired | - | - | 6,922 | evp-chf gen off-entrp op excel |

| Mar 11, 2024 | glenn robert alexander | acquired | - | - | 5,499 | evp & ceo def & midwest |

| Feb 24, 2024 | janson julia s | sold (taxes) | -105,156 | 92.73 | -1,134 | evp extaffairs&prescarolinas |

| Feb 24, 2024 | ghartey-tagoe kodwo | sold (taxes) | -77,707 | 92.73 | -838 | evp, clo & corp sec |

| Feb 24, 2024 | savoy brian d | sold (taxes) | -59,625 | 92.73 | -643 | evp & cfo |

| Feb 24, 2024 | lee cynthia s. | sold (taxes) | -7,047 | 92.73 | -76.00 | vp, chf acct off & controller |

Which funds bought or sold DUK recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 08, 2024 | Texas Yale Capital Corp. | unchanged | - | -9,160 | 2,684,370 | 0.12% |

| May 08, 2024 | BIP Wealth, LLC | reduced | -23.09 | -77,489 | 254,494 | 0.02% |

| May 08, 2024 | BNP PARIBAS ASSET MANAGEMENT Holding S.A. | reduced | -27.13 | -4,466,000 | 11,842,000 | 0.03% |

| May 08, 2024 | Foundry Partners, LLC | added | 11.09 | 2,827,890 | 29,221,700 | 1.56% |

| May 08, 2024 | DEARBORN PARTNERS LLC | reduced | -28.85 | -253,699 | 618,601 | 0.03% |

| May 08, 2024 | Cypress Capital Group | reduced | -5.77 | -199,714 | 3,077,230 | 0.37% |

| May 08, 2024 | Souders Financial Advisors | reduced | -7.44 | -100,829 | 1,198,940 | 0.19% |

| May 08, 2024 | COMMONWEALTH OF PENNSYLVANIA PUBLIC SCHOOL EMPLS RETRMT SYS | added | 6.63 | 8,820,040 | 149,536,000 | 1.02% |

| May 08, 2024 | KBC Group NV | unchanged | - | -16,000 | 4,604,000 | 0.01% |

| May 08, 2024 | Columbia Asset Management | unchanged | - | - | 1,330,000 | 0.27% |

Are Funds Buying or Selling DUK?

DUK Alerts

Unveiling Duke Energy Corp's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 9.12% | 70,350,859 | SC 13G/A | |

| Jan 29, 2024 | state street corp | 5.42% | 41,821,025 | SC 13G/A | |

| Jan 26, 2024 | blackrock inc. | 7.5% | 58,022,212 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 9.16% | 70,510,251 | SC 13G/A | |

| Feb 07, 2023 | blackrock inc. | 7.8% | 59,699,444 | SC 13G/A | |

| Feb 06, 2023 | state street corp | 5.72% | 44,043,833 | SC 13G/A | |

| Feb 11, 2022 | state street corp | 5.13% | 39,413,653 | SC 13G/A | |

| Feb 09, 2022 | vanguard group inc | 8.68% | 66,738,560 | SC 13G/A | |

| Feb 03, 2022 | blackrock inc. | 6.9% | 53,412,420 | SC 13G/A | |

| Feb 10, 2021 | vanguard group inc | 8.37% | 61,598,521 | SC 13G/A |

Recent SEC filings of Duke Energy Corp

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 09, 2024 | 144 | Notice of Insider Sale Intent | |

| May 09, 2024 | 144 | Notice of Insider Sale Intent | |

| May 07, 2024 | 10-Q | Quarterly Report | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 4 | Insider Trading | |

| May 07, 2024 | 8-K | Current Report | |

| Apr 12, 2024 | 8-A12B | 8-A12B | |

| Apr 12, 2024 | 8-K | Current Report | |

| Apr 12, 2024 | CERT | CERT | |

| Apr 10, 2024 | 424B5 | Prospectus Filed |

- …

Peers (Alternatives to Duke Energy Corp)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

CPK | 2.5T | 698.2M | 6.09% | -13.01% | 25.6K | 3.6K | 3.29% | 8.78% |

AEP | 47.9B | 19.3B | 6.91% | -0.83% | 17.01 | 2.48 | -2.13% | 41.75% |

AWK | 26.2B | 4.3B | 10.31% | -10.24% | 27.3 | 6.08 | 10.78% | 15.26% |

AEE | 19.9B | 7.3B | 1.03% | -16.76% | 17.28 | 2.75 | -10.88% | 5.77% |

ATO | 18.1B | 4.1B | 2.56% | 0.27% | 18.06 | 4.45 | -11.13% | 20.48% |

NRG | 17.0B | 28.5B | 12.38% | 154.37% | 10.37 | 0.6 | -9.05% | 188.86% |

AGR | 14.3B | 8.3B | 2.76% | -10.06% | 15.98 | 1.73 | 0.05% | 30.98% |

AES | 14.2B | 12.5B | 9.35% | -10.98% | -2.2K | 1.14 | -3.77% | 98.49% |

| MID-CAP | ||||||||

PNW | 8.8B | 4.7B | 3.73% | -4.04% | 16.31 | 1.87 | 4.84% | 12.15% |

ALE | 3.6B | 1.7B | 3.67% | 1.23% | 15.15 | 2.11 | -1.93% | 32.23% |

AVA | 3.0B | 1.9B | 8.21% | -14.02% | 15.9 | 1.59 | 9.47% | 35.66% |

| SMALL-CAP | ||||||||

CWCO | 445.6M | 180.2M | 10.10% | 63.84% | 14.99 | 2.47 | 91.50% | 388.02% |

CDZI | 158.9M | 2.0M | -7.48% | -47.89% | -5.05 | 79.07 | 33.96% | -26.84% |

VIA | 35.3M | 415.8M | 0.65% | -9.01% | 1.49 | 0.08 | -11.16% | 525.10% |

CREG | 8.6M | - | -21.17% | -37.26% | -11.52 | 12.3 | -88.45% | 83.25% |

Duke Energy Corp News

Duke Energy Corp Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 6.4% | 7,671 | 7,212 | 7,994 | 6,578 | 7,276 | 7,351 | 7,842 | 6,564 | 7,011 | 6,117 | 6,834 | 5,638 | 6,032 | 5,275 | 6,721 | 5,421 | 5,949 | 6,103 | 6,940 | 5,873 | 6,163 |

| Costs and Expenses | 6.7% | 5,720 | 5,363 | 5,891 | 5,179 | 5,609 | 6,162 | 5,792 | 5,124 | 5,700 | 4,569 | 5,273 | 4,591 | 4,700 | 5,184 | 4,909 | 4,251 | 4,462 | 4,990 | 5,011 | 4,578 | 4,787 |

| EBITDA Margin | 2.2% | 0.49* | 0.48* | 0.45* | 0.44* | 0.44* | 0.43* | 0.45* | 0.46* | 0.46* | 0.48* | 0.45* | 0.45* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | 3.0% | 817 | 793 | 774 | 727 | 720 | 679 | 603 | 588 | 569 | 519 | 581 | 572 | 535 | 470 | 522 | 554 | 551 | 547 | 572 | 542 | 543 |

| Income Taxes | 45.9% | 178 | 122 | 42.00 | 119 | 155 | 3.00 | 158 | 114 | 25.00 | 58.00 | 90.00 | 36.00 | 84.00 | -95.00 | 105 | -316 | 137 | 95.00 | 188 | 141 | 95.00 |

| Earnings Before Taxes | 6.0% | 1,332 | 1,257 | 1,515 | 870 | 1,125 | 638 | 1,568 | 1,012 | 860 | 866 | 1,366 | 734 | 1,025 | -238 | 1,339 | -1,208 | 1,027 | 709 | 1,511 | 889 | 988 |

| EBT Margin | 2.9% | 0.17* | 0.16* | 0.14* | 0.14* | 0.15* | 0.14* | 0.16* | 0.15* | 0.15* | 0.16* | 0.12* | 0.12* | - | - | - | - | - | - | - | - | - |

| Net Income | 15.6% | 1,151 | 996 | 1,321 | -204 | 761 | -658 | 1,413 | 880 | 820 | 664 | 1,276 | 698 | 941 | -63.00 | 1,304 | -802 | 938 | 607 | 1,342 | 832 | 900 |

| Net Income Margin | 12.0% | 0.11* | 0.10* | 0.04* | 0.05* | 0.08* | 0.09* | 0.14* | 0.14* | 0.14* | 0.15* | 0.12* | 0.12* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | -1.2% | -734 | -725 | 479 | -817 | -1,663 | -2,480 | -1,878 | -326 | -756 | -1,563 | 901 | -636 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 1.0% | 178,670 | 176,893 | 181,160 | 180,076 | 178,833 | 178,086 | 176,340 | 172,383 | 171,220 | 169,587 | 167,007 | 165,385 | 163,465 | 162,388 | 161,409 | 160,049 | 160,072 | 158,838 | 155,917 | 153,449 | 151,136 |

| Current Assets | -5.3% | 12,091 | 12,769 | 13,048 | 13,088 | 12,314 | 13,222 | 12,972 | 11,561 | 11,042 | 9,940 | 9,436 | 8,985 | 8,508 | 8,682 | 8,679 | 9,237 | 10,181 | 9,163 | 9,619 | 9,509 | 9,168 |

| Cash Equivalents | 104.7% | 518 | 253 | 324 | 567 | 624 | 409 | 629 | 639 | 1,020 | 520 | 743 | 565 | 692 | 556 | 600 | 641 | 1,698 | 573 | 582 | 481 | 550 |

| Goodwill | 0% | 19,303 | 19,303 | 19,300 | 19,303 | 19,303 | 19,300 | 19,303 | 19,303 | 19,303 | 19,300 | 19,303 | 19,303 | 19,303 | 19,303 | 19,303 | 19,303 | 19,303 | 19,303 | 19,303 | 19,303 | 19,303 |

| Current Liabilities | -10.1% | 15,546 | 17,283 | 17,160 | 17,375 | 16,015 | 18,873 | 16,912 | 16,544 | 15,425 | 15,931 | 15,556 | 16,211 | 17,333 | 16,305 | 16,693 | 16,690 | 15,170 | 14,752 | 13,390 | 13,447 | 12,282 |

| Short Term Borrowings | -3.1% | 4,155 | 4,288 | 3,154 | 3,455 | 3,731 | 3,952 | 3,606 | 3,875 | 3,262 | 3,304 | 2,098 | 3,296 | 4,064 | 2,873 | 3,425 | 4,785 | 3,033 | 3,135 | 2,469 | 3,793 | 3,029 |

| Long Term Debt | 3.5% | 74,979 | 72,452 | 71,353 | 69,914 | 69,107 | 65,873 | 66,060 | 63,147 | 62,196 | 60,448 | 57,929 | 57,410 | 54,768 | 55,625 | 56,049 | 56,143 | 56,311 | 54,985 | 54,818 | 54,342 | 53,681 |

| LT Debt, Current | -18.8% | 2,274 | 2,800 | 4,034 | 4,609 | 3,330 | 3,878 | 3,249 | 3,171 | 3,884 | 3,387 | 4,873 | 4,976 | 5,586 | 4,238 | 500 | 3,756 | 5,077 | 3,141 | 500 | 2,698 | 2,501 |

| LT Debt, Non Current | -100.0% | - | 72,452 | 71,353 | 69,914 | 69,107 | 65,873 | 66,060 | 63,147 | 62,196 | 60,448 | 57,929 | 57,410 | 54,768 | 55,625 | 56,049 | 56,143 | 56,311 | 54,985 | 54,818 | 54,342 | 53,681 |

| Shareholder's Equity | 3.1% | 50,638 | 49,112 | 49,006 | 51,071 | 51,951 | 49,322 | 52,169 | 51,584 | 51,252 | 51,136 | 51,240 | 49,545 | 49,658 | 49,184 | 47,295 | 46,611 | 48,083 | 47,951 | 47,407 | 45,332 | 45,045 |

| Retained Earnings | 13.7% | 2,542 | 2,235 | 2,036 | 1,615 | 2,626 | 2,637 | 4,063 | 3,457 | 3,323 | 3,265 | 3,293 | 2,687 | 2,680 | 2,471 | 3,260 | 2,707 | 4,221 | 4,108 | 4,139 | 3,502 | 3,360 |

| Additional Paid-In Capital | 0.0% | 44,937 | 44,920 | 44,886 | 44,866 | 44,837 | 44,862 | 44,397 | 44,373 | 44,364 | 44,371 | 44,348 | 43,788 | 43,761 | 43,767 | 41,046 | 40,997 | 40,930 | 40,881 | 40,488 | 40,885 | 40,823 |

| Shares Outstanding | 0.1% | 772 | 771 | 771 | 771 | 771 | 770 | 770 | 770 | 770 | 769 | 769 | 769 | - | - | - | - | - | - | - | - | - |

| Minority Interest | 1.1% | 1,087 | 1,075 | 2,820 | 2,738 | 1.00 | 2,531 | 1,824 | 1,864 | - | 1,840 | 1,933 | 1,413 | 1,472 | 1,220 | 1,289 | 1,127 | 1,162 | 1,129 | 969 | 119 | 15.00 |

| Float | - | - | - | - | 69,081 | - | - | - | 82.00 | - | - | - | 75,871 | - | - | - | 58,688 | - | - | - | 64,231 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | -3.7% | 2,474 | 2,569 | 3,524 | 2,302 | 1,483 | 739 | 1,153 | 2,240 | 1,795 | 1,063 | 3,354 | 1,785 | 2,088 | 2,090 | 3,409 | 1,803 | 1,554 | 2,572 | 2,581 | 1,817 | 1,239 |

| Cashflow From Investing | -22.7% | -3,342 | -2,724 | -3,243 | -3,299 | -3,209 | -3,343 | -3,138 | -2,793 | -2,699 | -2,735 | -2,586 | -2,477 | -3,137 | -2,640 | -2,493 | -2,449 | -3,022 | -3,324 | -2,845 | -3,075 | -2,713 |

| Cashflow From Financing | 1759.7% | 1,029 | -62.00 | -274 | 940 | 1,747 | 2,578 | 1,975 | 172 | 1,404 | 1,449 | -590 | 565 | 1,185 | 506 | -957 | -411 | 2,593 | 743 | 365 | 1,189 | 1,433 |

| Dividend Payments | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 649 |

DUK Income Statement

2024-03-31Condensed Consolidated Statements of Operations - USD ($) shares in Millions, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| Operating Revenues | ||

| Regulated electric | $ 6,732 | $ 6,324 |

| Regulated natural gas | 866 | 882 |

| Nonregulated electric and other | 73 | 70 |

| Total operating revenues | 7,671 | 7,276 |

| Operating Expenses | ||

| Operation, maintenance and other | 1,379 | 1,310 |

| Depreciation and amortization | 1,387 | 1,227 |

| Property and other taxes | 386 | 389 |

| Impairment of assets and other charges | 1 | 8 |

| Total operating expenses | 5,720 | 5,609 |

| Gains on Sales of Other Assets and Other, net | 12 | 7 |

| Operating Income | 1,963 | 1,674 |

| Other Income and Expenses | ||

| Equity in earnings of unconsolidated affiliates | 17 | 20 |

| Other income and expenses, net | 169 | 151 |

| Total other income and expenses | 186 | 171 |

| Interest Expense | 817 | 720 |

| Income From Continuing Operations Before Income Taxes | 1,332 | 1,125 |

| Income Tax Expense From Continuing Operations | 178 | 155 |

| Income From Continuing Operations | 1,154 | 970 |

| Loss From Discontinued Operations, net of tax | (3) | (209) |

| Net Income | 1,151 | 761 |

| Add: Net (Income) Loss Attributable to Noncontrolling Interests | (13) | 43 |

| Net Income Attributable to Duke Energy Corporation | 1,138 | 804 |

| Less: Preferred Dividends | 39 | 39 |

| Net Income Available to Duke Energy Corporation Common Stockholders | $ 1,099 | $ 765 |

| Income from continuing operations available to Duke Energy Corporation common stockholders | ||

| Basic (in usd per share) | $ 1.44 | $ 1.20 |

| Diluted (in usd per share) | 1.44 | 1.20 |

| Loss from discontinued operations attributable to Duke Energy Corporation common stockholders | ||

| Basic (in usd per share) | 0 | (0.19) |

| Diluted (in usd per share) | 0 | (0.19) |

| Net income available to Duke Energy Corporation common stockholders | ||

| Basic (in usd per share) | 1.44 | 1.01 |

| Diluted (in usd per share) | $ 1.44 | $ 1.01 |

| Weighted Average Shares Outstanding | ||

| Basic (in shares) | 771 | 770 |

| Diluted (in shares) | 771 | 770 |

| Fuel used in electric generation and purchased power | ||

| Operating Expenses | ||

| Cost of sales | $ 2,335 | $ 2,377 |

| Cost of natural gas | ||

| Operating Expenses | ||

| Cost of sales | $ 232 | $ 298 |

DUK Balance Sheet

2024-03-31Condensed Consolidated Balance Sheets - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 |

|---|---|---|

| Current Assets | ||

| Cash and cash equivalents | $ 459 | $ 253 |

| Receivables (net of allowance for doubtful accounts) | 1,646 | 1,112 |

| Receivables of VIEs (net of allowance for doubtful accounts) | 2,253 | 3,019 |

| Inventory | 4,281 | 4,292 |

| Regulatory assets | 3,082 | 3,648 |

| Assets held for sale | 11 | 14 |

| Other (includes amounts related to VIEs) | 359 | 431 |

| Total current assets | 12,091 | 12,769 |

| Property, Plant and Equipment | ||

| Cost | 173,926 | 171,353 |

| Accumulated depreciation and amortization | (57,035) | (56,038) |

| Net property, plant and equipment | 116,891 | 115,315 |

| Other Noncurrent Assets | ||

| Goodwill | 19,303 | 19,303 |

| Regulatory assets | 13,636 | 13,618 |

| Nuclear decommissioning trust funds | 10,775 | 10,143 |

| Operating lease right-of-use assets, net | 1,092 | 1,092 |

| Investments in equity method unconsolidated affiliates | 502 | 492 |

| Assets held for sale | 308 | 197 |

| Other | 4,072 | 3,964 |

| Total other noncurrent assets | 49,688 | 48,809 |

| Total Assets | 178,670 | 176,893 |

| Current Liabilities | ||

| Accounts payable | 3,364 | 4,228 |

| Notes payable and commercial paper | 4,155 | 4,288 |

| Taxes accrued | 708 | 816 |

| Interest accrued | 798 | 745 |

| Current maturities of long-term debt | 2,274 | 2,800 |

| Asset retirement obligations | 603 | 596 |

| Regulatory liabilities | 1,309 | 1,369 |

| Liabilities associated with assets held for sale | 251 | 122 |

| Other | 2,084 | 2,319 |

| Total current liabilities | 15,546 | 17,283 |

| Long-Term Debt (includes amounts related to VIEs) | 74,979 | 72,452 |

| Other Noncurrent Liabilities | ||

| Deferred income taxes | 10,721 | 10,556 |

| Asset retirement obligations | 8,487 | 8,560 |

| Regulatory liabilities | 14,571 | 14,039 |

| Operating lease liabilities | 915 | 917 |

| Accrued pension and other post-retirement benefit costs | 473 | 485 |

| Investment tax credits | 862 | 864 |

| Liabilities associated with assets held for sale | 126 | 157 |

| Other (includes $19 at 2024 and $17 at 2023 related to VIEs) | 1,352 | 1,393 |

| Total other noncurrent liabilities | 37,507 | 36,971 |

| Commitments and Contingencies | ||

| Equity | ||

| Common stock | 1 | 1 |

| Additional paid-in capital | 44,937 | 44,920 |

| Retained earnings | 2,542 | 2,235 |

| Accumulated other comprehensive income (loss) | 109 | (6) |

| Total Duke Energy Corporation stockholders' equity | 49,551 | 49,112 |

| Noncontrolling interests | 1,087 | 1,075 |

| Total equity | 50,638 | 50,187 |

| Total Liabilities and Equity | 178,670 | 176,893 |

| Preferred stock, Series A | ||

| Equity | ||

| Preferred stock | 973 | 973 |

| Preferred stock, Series B | ||

| Equity | ||

| Preferred stock | $ 989 | $ 989 |

| CEO | Ms. Lynn J. Good |

|---|---|

| WEBSITE | duke-energy.com |

| INDUSTRY | Utilities Regulated Electric |

| EMPLOYEES | 27859 |