Market Summary

SRE Alerts

SRE Stock Price

SRE RSI Chart

SRE Valuation

SRE Price/Sales (Trailing)

SRE Profitability

SRE Fundamentals

SRE Revenue

SRE Earnings

Breaking Down SRE Revenue

52 Week Range

Last 7 days

4.5%

Last 30 days

6.3%

Last 90 days

9.3%

Trailing 12 Months

-2.1%

How does SRE drawdown profile look like?

SRE Financial Health

SRE Investor Care

Historical Charts for Stock Metrics

| Year | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| 2024 | 13.8B | 0 | 0 | 0 |

| 2023 | 17.2B | 17.0B | 16.7B | 16.7B |

| 2022 | 13.4B | 14.2B | 14.8B | 14.4B |

| 2021 | 11.6B | 11.8B | 12.2B | 12.9B |

| 2020 | 11.0B | 11.3B | 11.1B | 11.4B |

| 2019 | 10.5B | 10.5B | 10.7B | 10.8B |

| 2018 | 10.7B | 10.4B | 10.2B | 10.1B |

| 2017 | 10.6B | 11.0B | 11.1B | 11.2B |

| 2016 | 10.2B | 10.0B | 10.0B | 10.2B |

| 2015 | 10.9B | 10.6B | 10.3B | 10.2B |

| 2014 | 10.7B | 10.7B | 11.0B | 11.0B |

| 2013 | 9.9B | 10.5B | 10.5B | 10.6B |

| 2012 | 10.0B | 9.7B | 9.6B | 9.6B |

| 2011 | 8.9B | 9.3B | 9.8B | 10.0B |

| 2010 | 8.3B | 8.6B | 8.8B | 9.0B |

| 2009 | 0 | 0 | 0 | 8.1B |

| 2008 | 0 | 0 | 0 | 10.8B |

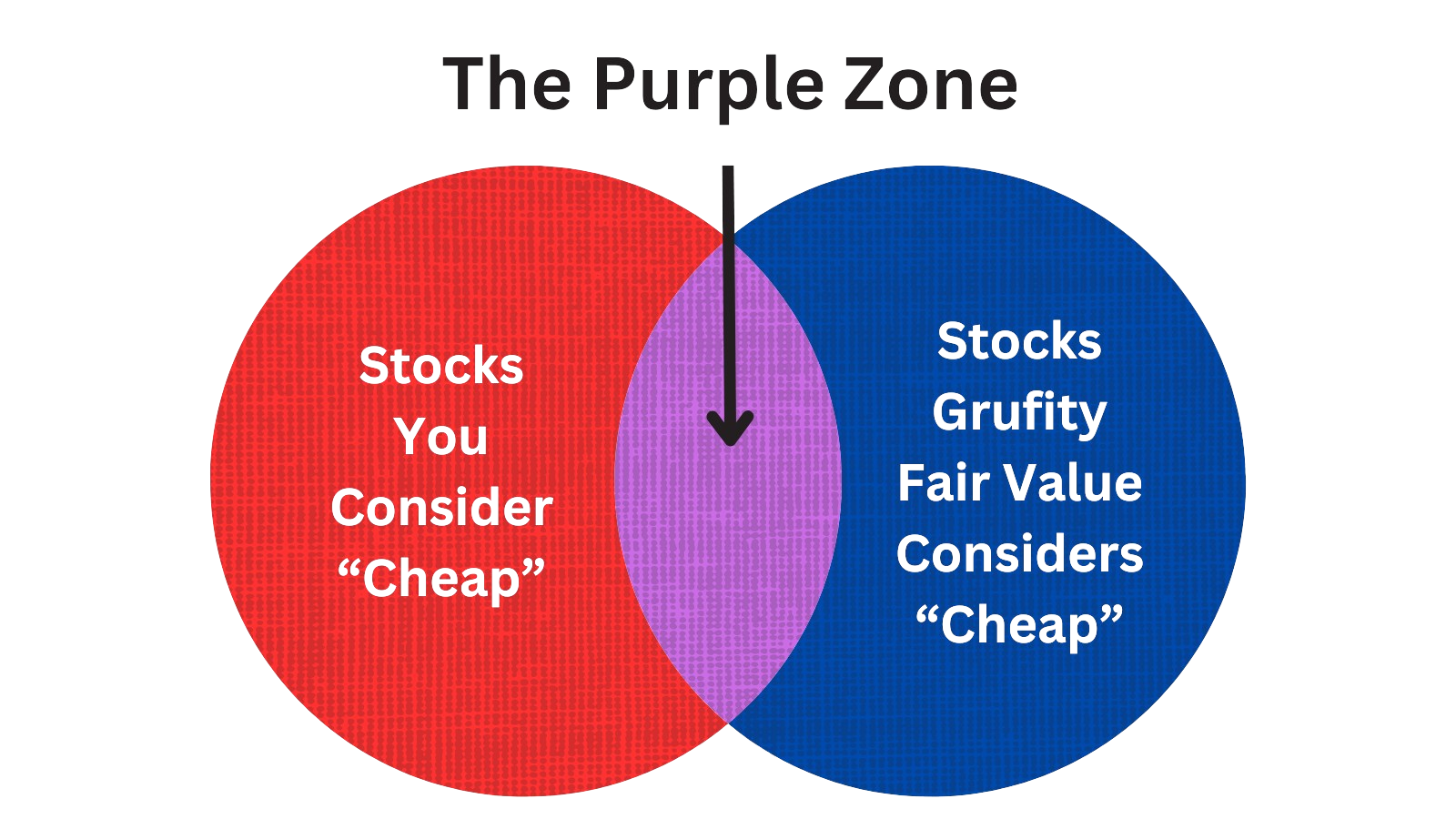

Stocks Marked 'Very Cheap' by Grufity's Fair Value Model Have Outperformed S&P 500 Index

Grufity's Fair Value model takes all the S&P 500 stocks and divides them into separate buckets based on their attractiveness. The 'Very Cheap' bucket of S&P 500 has greatly outperformed S&P 500 Index. Conversely, S&P500 stocks considered 'Very Expensive' by the model underperformed the S&P500 index in the past three years. Grufity Fair Value is available for 2300+ stocks, including 90% of S&P 500 stocks. Grufity's Fair Value Model separates high-return stocks from low-return stocks.

Returns of $10,000 invested in:

Very Cheap Stocks: $17,289

S&P 500 Index: $12,922

Very Expensive Stocks: $11,022

Grufity's Fair Value model does a great job in separating High Performing Stocks from Low Performing ones in the S&P 500 list.

Tracking the Latest Insider Buys and Sells of Sempra Energy

Filter Transactions| Datesorted ascending | Name | Buy/Sell | $ Value | Avg. Price | # Shares | Title |

|---|---|---|---|---|---|---|

| Mar 08, 2024 | sedgwick karen l | sold | -255,818 | 70.59 | -3,624 | executive vp and cfo |

| Mar 08, 2024 | day diana l | sold | -240,532 | 70.62 | -3,406 | chief legal counsel |

| Mar 08, 2024 | bird justin christopher | sold | -443,227 | 70.6 | -6,278 | executive vice president |

| Mar 07, 2024 | sedgwick karen l | sold | -367,301 | 71.21 | -5,158 | executive vp and cfo |

| Mar 07, 2024 | bird justin christopher | sold | -360,587 | 71.22 | -5,063 | executive vice president |

| Mar 07, 2024 | day diana l | sold | -280,354 | 71.21 | -3,937 | chief legal counsel |

| Mar 06, 2024 | mihalik trevor i | sold | -4,063,940 | 70.59 | -57,571 | executive vp and group pres |

| Feb 28, 2024 | martin jeffrey w | sold | -3,595,860 | 70.92 | -50,703 | chairman, ceo and president |

| Feb 21, 2024 | day diana l | sold (taxes) | -129,577 | 71.96 | -1,800 | chief legal counsel |

| Feb 21, 2024 | day diana l | acquired | - | - | 5,206 | chief legal counsel |

Which funds bought or sold SRE recently?

View All Details| Datesorted ascending | Fund Name | Type | % Chg | $ Change | $ Held | % Portfolio |

|---|---|---|---|---|---|---|

| May 08, 2024 | ProShare Advisors LLC | added | 1.58 | -256,747 | 10,616,500 | 0.03% |

| May 08, 2024 | US BANCORP \DE\ | added | 1.85 | -236,904 | 11,042,200 | 0.01% |

| May 08, 2024 | KBC Group NV | reduced | -7.34 | -2,606,000 | 21,225,000 | 0.07% |

| May 08, 2024 | BNP PARIBAS ASSET MANAGEMENT Holding S.A. | reduced | -42.64 | -4,126,000 | 5,070,000 | 0.01% |

| May 08, 2024 | Texas Yale Capital Corp. | unchanged | - | -72,401 | 1,793,310 | 0.08% |

| May 08, 2024 | MAI Capital Management | reduced | -4.92 | -46,961 | 498,213 | -% |

| May 08, 2024 | Heritage Wealth Advisors | reduced | -97.64 | -156,292 | 1,837 | -% |

| May 08, 2024 | INSTITUTIONAL & FAMILY ASSET MANAGEMENT, LLC | added | 2.76 | -685 | 56,277 | 0.01% |

| May 08, 2024 | Eagle Bay Advisors LLC | new | - | 6,810 | 6,810 | -% |

| May 08, 2024 | PROFUND ADVISORS LLC | reduced | -7.7 | -214,431 | 1,687,000 | 0.07% |

Are Funds Buying or Selling SRE?

SRE Alerts

Unveiling Sempra Energy's Major ShareHolders

| Date Filed | Name of Filer | Percent of Class | No. of Shares | Form Type | |

|---|---|---|---|---|---|

| Feb 13, 2024 | vanguard group inc | 9.72% | 61,166,858 | SC 13G/A | |

| Feb 09, 2024 | capital international investors | 8.9% | 56,098,217 | SC 13G/A | |

| Jan 30, 2024 | state street corp | 5.44% | 34,247,325 | SC 13G/A | |

| Jan 24, 2024 | blackrock inc. | 10.1% | 63,318,735 | SC 13G/A | |

| Dec 06, 2023 | blackrock inc. | 10.0% | 63,221,605 | SC 13G/A | |

| Feb 14, 2023 | price t rowe associates inc /md/ | 4.1% | 12,775,619 | SC 13G/A | |

| Feb 14, 2023 | price t rowe associates inc /md/ | 4.1% | 12,775,619 | SC 13G/A | |

| Feb 13, 2023 | capital international investors | 7.5% | 23,557,402 | SC 13G/A | |

| Feb 09, 2023 | vanguard group inc | 9.03% | 28,388,731 | SC 13G/A | |

| Feb 07, 2023 | state street corp | 5.73% | 18,020,979 | SC 13G/A |

Recent SEC filings of Sempra Energy

View All Filings| Date Filed | Form Type | Document | |

|---|---|---|---|

| May 07, 2024 | 10-Q | Quarterly Report | |

| May 07, 2024 | 8-K | Current Report | |

| Apr 29, 2024 | 424B2 | Prospectus Filed | |

| Apr 17, 2024 | DEFA14A | DEFA14A | |

| Apr 02, 2024 | 4 | Insider Trading | |

| Apr 02, 2024 | 4 | Insider Trading | |

| Apr 02, 2024 | 4 | Insider Trading | |

| Apr 02, 2024 | 4 | Insider Trading | |

| Apr 02, 2024 | 4 | Insider Trading | |

| Apr 02, 2024 | 4 | Insider Trading |

Peers (Alternatives to Sempra Energy)

| Name | Mkt Capsorted ascending | Revenue | Price %, 1M | Returns, 1Y | P/E | P/S | Rev 1-Yr | Inc 1-Yr |

|---|---|---|---|---|---|---|---|---|

| LARGE-CAP | ||||||||

CPK | 2.5T | 698.2M | 6.09% | -13.01% | 25.5K | 3.5K | 3.29% | 8.78% |

AEP | 47.9B | 19.3B | 6.91% | -0.83% | 17.02 | 2.48 | -2.13% | 41.75% |

AWK | 26.2B | 4.3B | 10.31% | -10.24% | 27.31 | 6.08 | 10.78% | 15.26% |

AEE | 19.9B | 7.3B | 1.03% | -16.76% | 17.27 | 2.75 | -10.88% | 5.77% |

ATO | 18.0B | 4.1B | 2.56% | 0.27% | 18.06 | 4.45 | -11.13% | 20.48% |

NRG | 17.0B | 28.5B | 12.38% | 154.37% | 10.37 | 0.6 | -9.05% | 188.86% |

AGR | 14.3B | 8.3B | 2.76% | -10.06% | 15.98 | 1.73 | 0.05% | 30.98% |

AES | 14.2B | 12.5B | 9.35% | -10.98% | -2.2K | 1.14 | -3.77% | 98.49% |

| MID-CAP | ||||||||

PNW | 8.8B | 4.7B | 3.73% | -4.04% | 16.31 | 1.87 | 4.84% | 12.15% |

ALE | 3.6B | 1.7B | 3.67% | 1.23% | 15.15 | 2.11 | -1.93% | 32.23% |

AVA | 3.0B | 1.9B | 8.21% | -14.02% | 15.91 | 1.59 | 9.47% | 35.66% |

| SMALL-CAP | ||||||||

CWCO | 445.6M | 180.2M | 10.10% | 63.84% | 14.99 | 2.47 | 91.50% | 388.02% |

CDZI | 158.9M | 2.0M | -7.48% | -47.89% | -5.05 | 79.07 | 33.96% | -26.84% |

VIA | 35.3M | 415.8M | 0.65% | -9.01% | 1.49 | 0.08 | -11.16% | 525.10% |

CREG | 8.6M | - | -21.17% | -37.26% | -11.52 | 12.3 | -88.45% | 83.25% |

Sempra Energy News

Sempra Energy Earnings Report: Key Takeaways & Analysis

| Income Statement (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Revenue | 4.3% | 3,640 | 3,491 | 3,334 | 3,335 | 6,560 | 3,455 | 3,617 | 3,547 | 3,820 | 3,844 | 3,013 | 2,741 | 3,259 | 3,171 | 2,644 | 2,526 | 3,029 | 2,943 | 2,758 | 2,230 | 2,898 |

| EBITDA Margin | 8.8% | 0.40* | 0.37* | 0.34* | 0.32* | 0.31* | 0.31* | 0.32* | 0.22* | 0.24* | 0.27* | 0.27* | 0.41* | - | - | - | - | - | - | - | - | - |

| Interest Expenses | -2.9% | 305 | 314 | 312 | 317 | 366 | 258 | 282 | 271 | 243 | 422 | 259 | 258 | 259 | 263 | 264 | 274 | 280 | 280 | 279 | 258 | 260 |

| Income Taxes | 2011.1% | 172 | -9.00 | -52.00 | 175 | 376 | 121 | 21.00 | 80.00 | 334 | - | -342 | 139 | 158 | 189 | 99.00 | 168 | -207 | 165 | 61.00 | 47.00 | 42.00 |

| Earnings Before Taxes | 56.0% | 705 | 452 | 323 | 523 | 1,329 | 149 | 165 | 364 | 665 | 375 | -1,365 | 466 | 903 | 428 | 201 | 463 | 397 | 499 | 448 | 286 | 501 |

| EBT Margin | -7.6% | 0.15* | 0.16* | 0.14* | 0.13* | 0.12* | 0.09* | 0.11* | 0.00* | 0.01* | 0.03* | 0.04* | 0.17* | - | - | - | - | - | - | - | - | - |

| Net Income | 159.4% | 812 | 313 | 854 | 736 | 1,172 | 262 | 561 | 659 | 657 | 567 | -632 | 455 | 928 | 414 | 421 | 2,305 | 947 | 447 | 813 | 354 | 441 |

| Net Income Margin | 7.0% | 0.20* | 0.18* | 0.18* | 0.16* | 0.15* | 0.15* | 0.16* | 0.09* | 0.08* | 0.10* | 0.10* | 0.19* | - | - | - | - | - | - | - | - | - |

| Free Cashflow | 70.0% | 1,851 | 1,089 | 1,392 | 1,757 | 1,980 | -313 | -909 | 757 | 1,607 | 861 | 726 | 753 | - | - | - | - | - | - | - | - | - |

| Balance Sheet | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Assets | 2.8% | 89,604 | 87,181 | 85,735 | 82,727 | 80,549 | 78,574 | 75,563 | 75,582 | 74,922 | 72,045 | 70,472 | 68,608 | 67,821 | 66,623 | 67,222 | 68,385 | 68,293 | 65,665 | 64,585 | 62,727 | 61,618 |

| Current Assets | 3.1% | 5,640 | 5,470 | 5,310 | 4,847 | 5,204 | 5,912 | 4,465 | 5,902 | 6,501 | 4,375 | 4,593 | 3,760 | 4,200 | 4,511 | 6,394 | 7,640 | 5,424 | 3,339 | 3,666 | 2,783 | 3,262 |

| Cash Equivalents | 253.4% | 834 | 236 | 1,149 | 1,077 | 534 | 370 | 786 | 2,093 | 2,536 | 581 | 907 | 371 | 778 | 985 | 3,515 | 4,894 | 2,247 | 10.00 | 106 | 168 | 78.00 |

| Inventory | -5.0% | 458 | 482 | 451 | 383 | 315 | 403 | 506 | 377 | 352 | 389 | 371 | 339 | 274 | 308 | 309 | 267 | 217 | 277 | 270 | 214 | 189 |

| Net PPE | - | - | - | - | - | - | 47,782 | - | - | - | 43,894 | - | - | - | 40,003 | 38,784 | 37,945 | 37,067 | 36,452 | 35,520 | 35,282 | 34,698 |

| Goodwill | 0% | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 | 1,602 |

| Current Liabilities | -10.2% | 9,064 | 10,090 | 8,765 | 8,451 | 9,630 | 9,899 | 7,836 | 7,550 | 9,000 | 10,035 | 12,944 | 7,312 | 6,875 | 6,839 | 7,635 | 9,595 | 12,177 | 9,150 | 9,498 | 8,177 | 8,612 |

| Short Term Borrowings | -29.2% | 1,659 | 2,342 | 1,977 | 2,512 | 3,037 | 3,352 | 1,750 | 955 | 2,181 | 3,471 | 3,068 | 2,266 | 1,817 | 885 | 772 | 3,143 | 5,742 | 3,505 | 3,588 | 2,395 | 2,523 |

| Long Term Debt | 6.3% | 29,519 | 27,759 | 27,703 | 27,521 | 25,206 | 24,548 | 23,830 | 24,661 | 24,416 | 21,068 | 20,042 | 22,090 | 22,023 | 21,781 | 21,770 | 20,535 | 20,198 | 20,785 | 20,995 | 21,199 | 19,738 |

| Shareholder's Equity | 20.9% | 34,661 | 28,675 | 28,238 | 31,014 | 30,245 | 27,115 | 29,289 | 29,053 | 27,560 | 27,419 | 24,604 | 25,692 | 25,608 | 24,934 | 24,856 | 25,386 | 22,115 | 21,805 | 20,551 | 19,434 | 19,470 |

| Retained Earnings | 2.6% | 16,141 | 15,732 | 15,371 | 15,024 | 14,796 | 14,201 | 14,123 | 13,998 | 13,798 | 13,548 | 13,292 | 14,291 | 14,214 | 13,673 | 13,560 | 13,511 | 11,577 | 11,130 | 10,966 | 10,425 | 10,337 |

| Accumulated Depreciation | - | - | - | - | - | - | 16,111 | - | - | - | 15,046 | - | - | - | 13,925 | 13,645 | 13,401 | 13,118 | 12,877 | 12,619 | 12,625 | 12,407 |

| Shares Outstanding | 0.2% | 633 | 631 | 629 | 630 | 630 | 629 | 629 | 631 | 633 | 634 | 619 | 616 | - | - | - | - | - | - | - | - | - |

| Float | - | - | - | - | 45,800 | - | - | - | 47,200 | - | - | - | 41,700 | - | - | - | 34,300 | - | - | - | 37,700 | - |

| Cashflow (Quarterly) | (In Millions) | |||||||||||||||||||||

| Description | (%) Q/Q | 2024Q1 | 2023Q4 | 2023Q3 | 2023Q2 | 2023Q1 | 2022Q4 | 2022Q3 | 2022Q2 | 2022Q1 | 2021Q4 | 2021Q3 | 2021Q2 | 2021Q1 | 2020Q4 | 2020Q3 | 2020Q2 | 2020Q1 | 2019Q4 | 2019Q3 | 2019Q2 | 2019Q1 |

| Cashflow From Operations | 70.0% | 1,851 | 1,089 | 1,392 | 1,757 | 1,980 | -313 | -909 | 757 | 1,607 | 861 | 726 | 753 | 1,502 | 962 | 602 | -291 | 1,318 | 970 | 414 | 753 | 951 |

| Share Based Compensation | -22.2% | 21.00 | 27.00 | 22.00 | 14.00 | 17.00 | 22.00 | 17.00 | 15.00 | 17.00 | 15.00 | 14.00 | 17.00 | 17.00 | 14.00 | 21.00 | 14.00 | 22.00 | 19.00 | 17.00 | 18.00 | 21.00 |

| Cashflow From Investing | 12.6% | -2,107 | -2,412 | -1,883 | -2,526 | -1,895 | -1,856 | -648 | -1,245 | -1,290 | -2,052 | -868 | -1,287 | -1,301 | -1,862 | -439 | 4,035 | -1,181 | -1,154 | -1,172 | -1,657 | -610 |

| Cashflow From Financing | 216.7% | 700 | 221 | 741 | 1,306 | 151 | 1,843 | 251 | 47.00 | 1,638 | 863 | 679 | 125 | -407 | -1,663 | -1,552 | -1,272 | 2,114 | -100 | 964 | 992 | -381 |

| Dividend Payments | -100.0% | - | 374 | 375 | 374 | 360 | 360 | 359 | 362 | 349 | 350 | 347 | 333 | 301 | 302 | 305 | 298 | 269 | 259 | 251 | 251 | 232 |

| Buy Backs | - | 40.00 | - | 1.00 | - | 31.00 | - | 2.00 | 250 | 226 | 300 | 1.00 | 1.00 | 37.00 | 1.00 | 501 | 7.00 | 57.00 | 3.00 | 5.00 | 4.00 | 14.00 |

SRE Income Statement

2024-03-31CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS - USD ($) shares in Thousands, $ in Millions | 3 Months Ended | |

|---|---|---|

Mar. 31, 2024 | Mar. 31, 2023 | |

| REVENUES | ||

| Natural gas | $ 2,109 | $ 4,412 |

| Electric | 1,056 | 1,027 |

| Energy-related businesses | 475 | 1,121 |

| Total revenues | 3,640 | 6,560 |

| Operating expenses: | ||

| Operation and maintenance | (1,212) | (1,209) |

| Depreciation and amortization | (594) | (539) |

| Franchise fees and other taxes | (184) | (192) |

| Other income, net | 99 | 41 |

| Interest income | 13 | 24 |

| Interest expense | (305) | (366) |

| Income before income taxes and equity earnings | 705 | 1,329 |

| Income tax expense | (172) | (376) |

| Equity earnings | 348 | 219 |

| Net income | 881 | 1,172 |

| Earnings attributable to noncontrolling interests | (69) | (192) |

| Preferred dividends | (11) | (11) |

| Earnings attributable to common shares | $ 801 | $ 969 |

| Basic EPS: | ||

| Earnings (in dollars per share) | $ 1.27 | $ 1.54 |

| Weighted-average common shares outstanding (in shares) | 632,821 | 629,838 |

| Diluted EPS: | ||

| Earnings (in dollars per share) | $ 1.26 | $ 1.53 |

| Weighted-average common shares outstanding (in shares) | 635,354 | 632,248 |

| Natural gas | ||

| Operating expenses: | ||

| Operating expenses | $ (554) | $ (2,683) |

| Electric fuel and purchased power | ||

| Operating expenses: | ||

| Operating expenses | (89) | (114) |

| Energy-related businesses | ||

| Operating expenses: | ||

| Operating expenses | $ (109) | $ (193) |

SRE Balance Sheet

2024-03-31CONDENSED CONSOLIDATED BALANCE SHEETS - USD ($) $ in Millions | Mar. 31, 2024 | Dec. 31, 2023 | |||

|---|---|---|---|---|---|

| Current assets: | |||||

| Cash and cash equivalents | $ 606 | $ 236 | [1] | ||

| Restricted cash | 121 | 49 | [1] | ||

| Accounts receivable – trade, net | 2,075 | 2,151 | [1] | ||

| Accounts receivable – other, net | 552 | 561 | [1] | ||

| Due from unconsolidated affiliates | 46 | 31 | [1] | ||

| Income taxes receivable | 79 | 94 | [1] | ||

| Inventories | 458 | 482 | [1] | ||

| Prepaid expenses | 286 | 273 | [1] | ||

| Regulatory assets | 52 | 226 | [1] | ||

| Fixed-price contracts and other derivatives | 124 | 122 | [1] | ||

| Greenhouse gas allowances | 1,176 | 1,189 | [1] | ||

| Other current assets | 65 | 56 | [1] | ||

| Total current assets | 5,640 | 5,470 | [1] | ||

| Other assets: | |||||

| Restricted cash | 107 | 104 | [1] | ||

| Regulatory assets | 3,982 | 3,771 | [1] | ||

| Greenhouse gas allowances | 532 | 301 | [1] | ||

| Nuclear decommissioning trusts | 886 | 872 | [1] | ||

| Dedicated assets in support of certain benefit plans | 559 | 549 | [1] | ||

| Deferred income taxes | 134 | 129 | [1] | ||

| Right-of-use assets – operating leases | 715 | 723 | [1] | ||

| Investment in Oncor Holdings | 14,545 | 14,266 | [1] | ||

| Other investments | 2,235 | 2,244 | [1] | ||

| Goodwill | 1,602 | 1,602 | [1] | ||

| Other intangible assets | 311 | 318 | [1] | ||

| Wildfire fund | 262 | 269 | [1] | ||

| Other long-term assets | 1,776 | 1,603 | [1] | ||

| Total other assets | 27,646 | 26,751 | [1] | ||

| Property, plant and equipment: | |||||

| Property, plant and equipment | 74,226 | 72,495 | [1] | ||

| Less accumulated depreciation and amortization | (17,908) | (17,535) | [1] | ||

| Property, plant and equipment, net | 56,318 | 54,960 | [1] | ||

| Total assets | 89,604 | 87,181 | [1] | ||

| Current liabilities: | |||||

| Short-term debt | 1,659 | 2,342 | [1] | ||

| Accounts payable – trade | 1,955 | 2,211 | [1] | ||

| Accounts payable – other | 234 | 224 | [1] | ||

| Dividends and interest payable | 737 | 691 | [1] | ||

| Accrued compensation and benefits | 376 | 526 | [1] | ||

| Regulatory liabilities | 952 | 553 | [1] | ||

| Current portion of long-term debt and finance leases | 593 | 975 | [1] | ||

| Greenhouse gas obligations | 1,176 | 1,189 | [1] | ||

| Total current liabilities | 9,064 | 10,090 | [1] | ||

| Long-term debt and finance leases | 29,519 | 27,759 | [1] | ||

| Deferred credits and other liabilities: | |||||

| Due to unconsolidated affiliates | 298 | 307 | [1] | ||

| Regulatory liabilities | 3,887 | 3,739 | [1] | ||

| Greenhouse gas obligations | 146 | 0 | [1] | ||

| Pension and other postretirement benefit plan obligations, net of plan assets | 431 | 407 | [1] | ||

| Deferred income taxes | 5,588 | 5,254 | [1] | ||

| Asset retirement obligations | 3,663 | 3,642 | [1] | ||

| Deferred credits and other | 2,347 | 2,329 | [1] | ||

| Total deferred credits and other liabilities | 16,360 | 15,678 | [1] | ||

| Commitments and contingencies | [1] | ||||

| Equity: | |||||

| Common stock | 12,209 | 12,204 | [1] | ||

| Retained earnings | 16,141 | 15,732 | [1] | ||

| Accumulated other comprehensive income (loss) | (104) | (150) | [1] | ||

| Total shareholders’ equity | 29,135 | 28,675 | [1] | ||

| Preferred stock of subsidiary | 20 | 20 | [1] | ||

| Other noncontrolling interests | 5,506 | 4,959 | [1] | ||

| Total equity | 34,661 | 33,654 | [1] | ||

| Total liabilities and equity | 89,604 | 87,181 | [1] | ||

| Related Party | |||||

| Current assets: | |||||

| Due from unconsolidated affiliates | 46 | 31 | |||

| Current liabilities: | |||||

| Other current liabilities | 0 | 5 | [1] | ||

| Deferred credits and other liabilities: | |||||

| Due to unconsolidated affiliates | 298 | 307 | |||

| Nonrelated Party | |||||

| Current liabilities: | |||||

| Other current liabilities | 1,382 | 1,374 | [1] | ||

| Series C Preferred Stock | |||||

| Equity: | |||||

| Preferred stock | $ 889 | $ 889 | [1] | ||

| |||||

| CEO | Mr. Jeffrey Walker Martin |

|---|---|

| WEBSITE | sempra.com |

| INDUSTRY | Utilities Regulated Electric |

| EMPLOYEES | 15785 |